Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Dear Friends,

Good things take time. This must mean that I’m getting old, because there are a lot of good things in my life right now. One thing I’ve particularly enjoyed is trying new fitness challenges. It keeps me feeling younger than I am, and there is nothing like the anxiousness of starting something new, combined with the rush of accomplishing the challenge. When I signed up for the BSF Community Skate Ski race in early February, I wasn’t sure if I hadn’t gone too far. Our nordic community is a national juggernaut. And weekend warriors with ill-fitting tights a limbs askew can stick out pretty easily. That was me. But post race, when the phlem had cleared, in came the exhilaration of having done it the best I could. Thank you BSF!

McCormick Financial Advisors has also benefited from putting in our time. Servicing wonderful clients looking for sustainable income and retirement planning has been a growing model. Please continue to spread the good word about our honest and personal service.

Equities Have Best Start Since 1989 – Equity Market Update

Job and wage growth skirted the government shutdown as the number of employed increased in January along with rising wages. The unemployment rate ticked up to 4.0% in January due to 800,000 federal employees furloughed during the month, a temporary effect of the shutdown. The onslaught of increased hiring by companies and higher wages translates into stronger consumer spending throughout the economy.

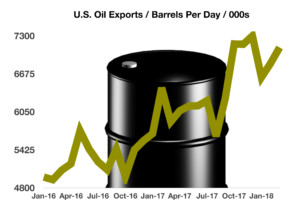

U.S. trade tensions with China continued as negotiators hashed out how to address the excessive trade imbalance between the two countries. U.S. trade representatives have set a deadline for negotiations with China for March 1st, at which point all imported Chinese goods will be subject to a 25% tariff if a compromise isn’t achieved.

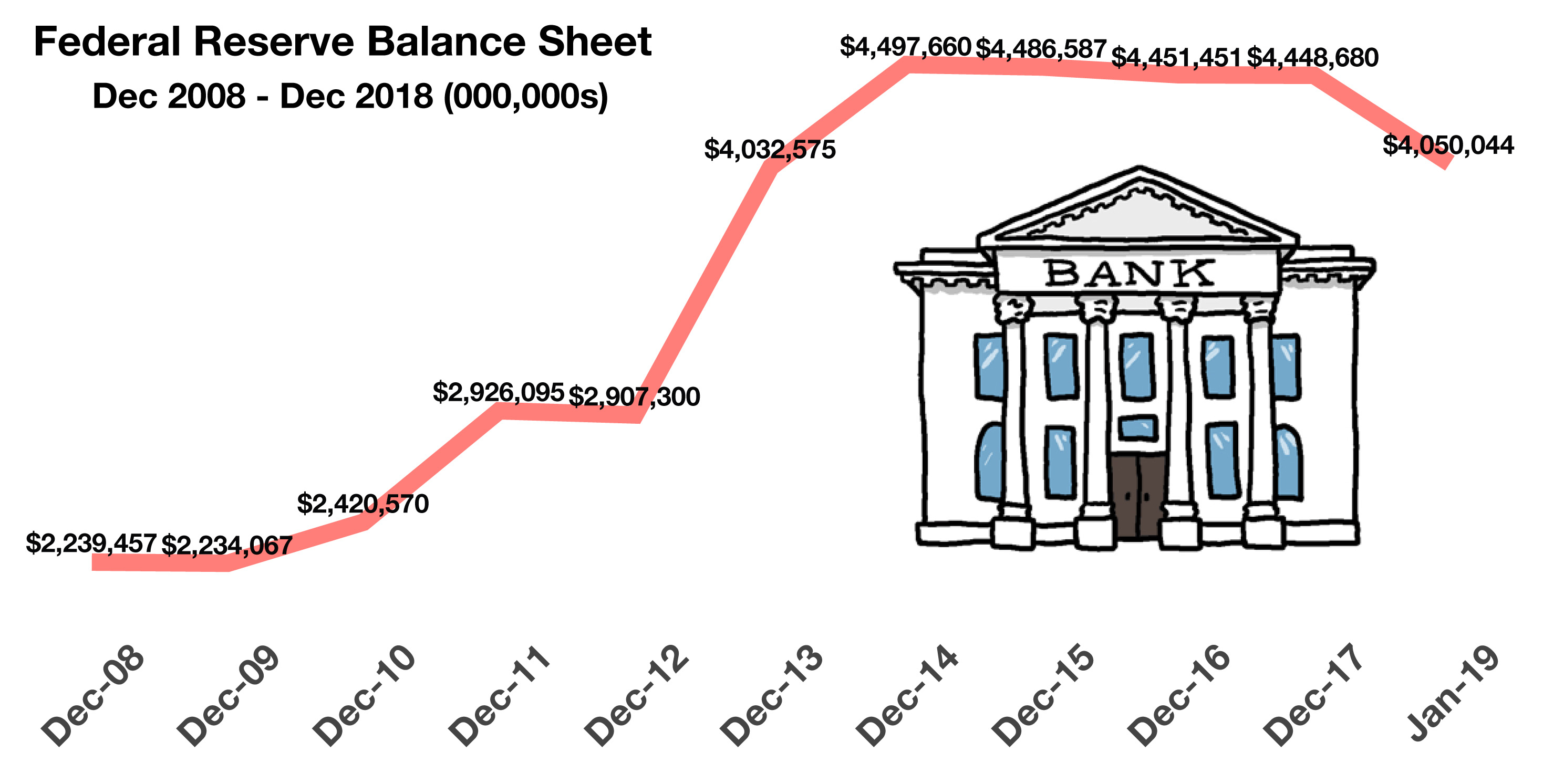

The Fed decided to leave rates unchanged during its January 30th announcement, adopting what it called a “patient rate stance” interpreted by the markets that it would hold off on raising rates for the time being. It also mentioned that it would be flexible in reducing its balance sheet, an indirect method of altering short-term rates.

Britain’s vote two years ago to exit the European Union (EU) has been vigorously contested by the British parliament leading to no formal plan in place to exit. March 29th is the formal date set for Britain to exit the EU, whether or not the country has any plans in place or not.

The dust is still settling on the recent market correction. But the projected winners are the long-term investors, again.

(Sources: Federal Reserve, CBO, BLS, Dept. of Labor)