Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Amid uncertainty surrounding the spread of the coronavirus throughout China and internationally, global equity and bond markets reacted to supply chain disruptions and factory closures. China’s vast manufacturing sector, which is an essential component of supply chains for many U.S. companies, has become vulnerable to plant closures and employee quarantines throughout the country. Markets are concerned that the coronavirus may impede global growth and recently-implemented trade agreements, as shuttered manufacturing facilities may reduce Chinese exports as well as imports of raw materials and commodities into China.

The Dow Jones Industrial Average index hit 29,000 in mid-January for the first time ever, bolstered by the first phase of a U.S.-China trade deal and assurances by the Federal Reserve that no rate increases are anticipated anytime soon.

Britain’s tumultuous 47-year membership in the European Union (EU) ended on January 31st, resulting from a vote to exit the EU in 2016. Britain’s departure from the EU, referred to as Brexit, is the first significant exit of any member countries. The exit is expected to have an impact on the financial, trade, and immigration structures of the entire EU.

The phase one trade deal between China and the United States alleviated some uncertainty regarding trade tensions. The U.S. will retain most tariffs on $360 billion of goods from China until a phase two agreement is reached.

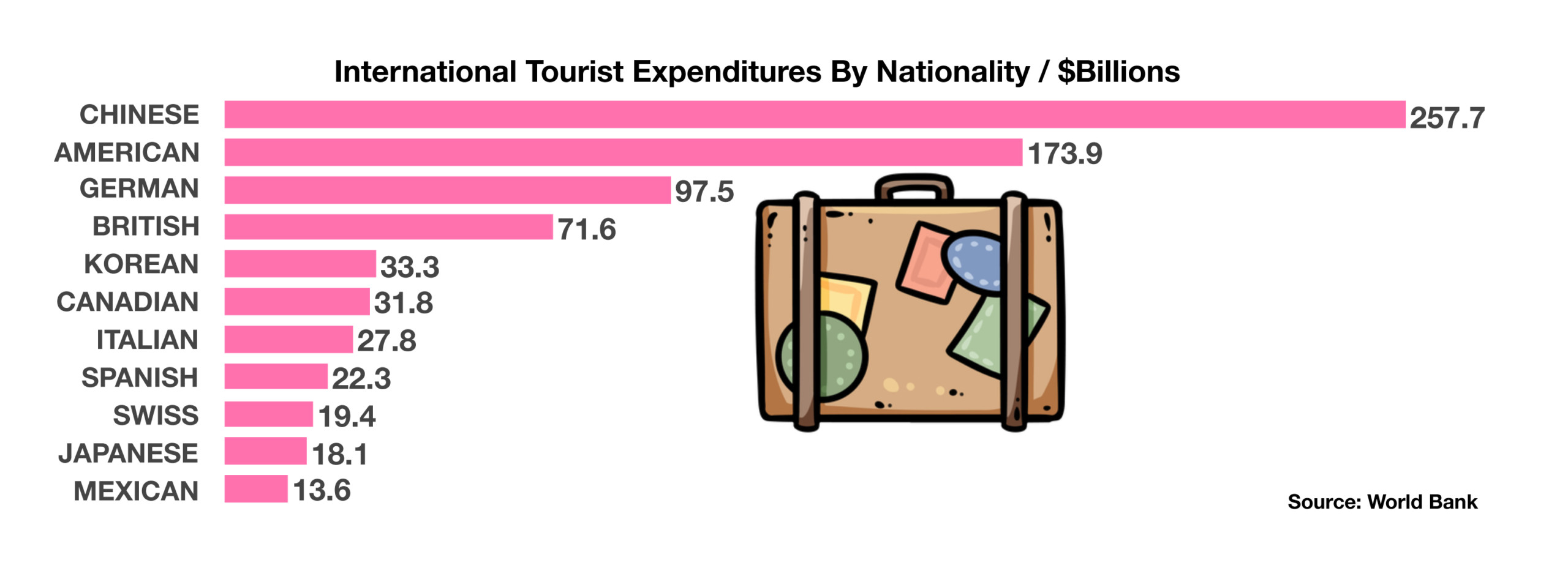

Closed manufacturing facilities due to the virus outbreak throughout China are expected to have a lingering effect on U.S. and foreign companies with operations in the country. Supply chain issues affecting products ranging from cell phones, computers, and televisions to furniture and toys may hinder production of such products for some time. A related concern is that Chinese consumers may reduce or delay spending, thus hindering Chinese consumer economic contributions at home and abroad. According to the World Bank, Chinese tourists spent over $257 billion in 2017 worldwide, more than any other international traveler. Global economic growth is sensitive to China’s massive manufacturing and consumer base, which generates wholesale and retail trade worldwide.

Sources: Commerce Department, EuroStat, Social Security Admin., World Bank