Michael J. Berger & Co., CPA’s LLP

3425 Veterans Memorial Hwy

Ronkonkoma, NY 11779

631.471.3400

www.bergercpa.com

cpa@bergercpa.com

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Speculative trading among smaller retail investors raised concerns about how social media is influencing individual stock valuations. Recently popularized social news aggregation and discussion websites are driving frenzied trading behavior among inexperienced young traders while disrupting traditional stock valuation methods. Many are calling for heightened regulation and scrutiny surrounding these websites and how they operate.

Vaccination progress is being closely monitored by market analysts and economists because of the tremendous impact it has had on consumer sentiment. Consumer expenditures have been hindered by stay at home mandates and fear of infections in public locations such as retail stores and restaurants.

The pandemic has accelerated the global wealth gap between the wealthy and poor. The Rockefeller Foundation, a private foundation, tracked roughly 2,200 billionaires worldwide that saw their net worth grow by $2 trillion in 2020, while 435 million low income families globally lost jobs, homes and asset values.

The IRS won’t be accepting 2020 tax returns until Feb 12 due to staffing shortages and COVID related rules that were enacted in December 2020. Acceptance of prior year returns traditionally would have started two weeks sooner. Taxpayers due a refund may see a delay in receiving funds, yet the April 15 tax deadline will remain the same.

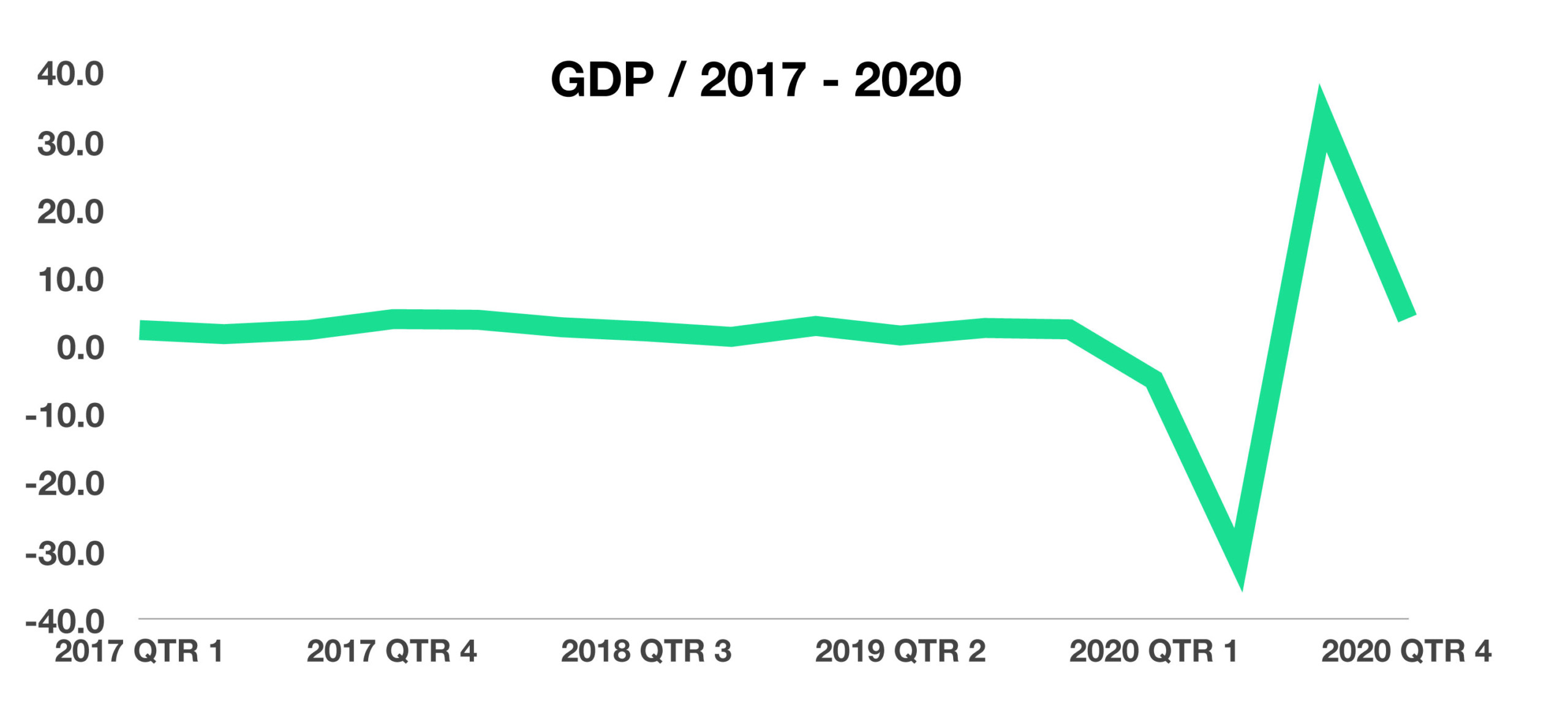

Economic growth for the U.S., as measured by Gross Domestic Product (GDP), rose at a 4% rate in 2020, following a contraction of over 31% in the second quarter alone. The dramatic collapse and ensuing rebound for economic growth was of historical proportion.

Since COVID vaccine distributions began on December 14, 2020, more than 29.5 million doses have already been administered in the United States as of January 30, 2021. Total doses distributed but not yet administered are nearly 50 million as of the end of January. The federal government has delegated prioritizing and distribution of the doses to the individual states. Health care experts and economists are concerned that the sluggish pace of vaccinations worldwide will postpone any economic resurgence.

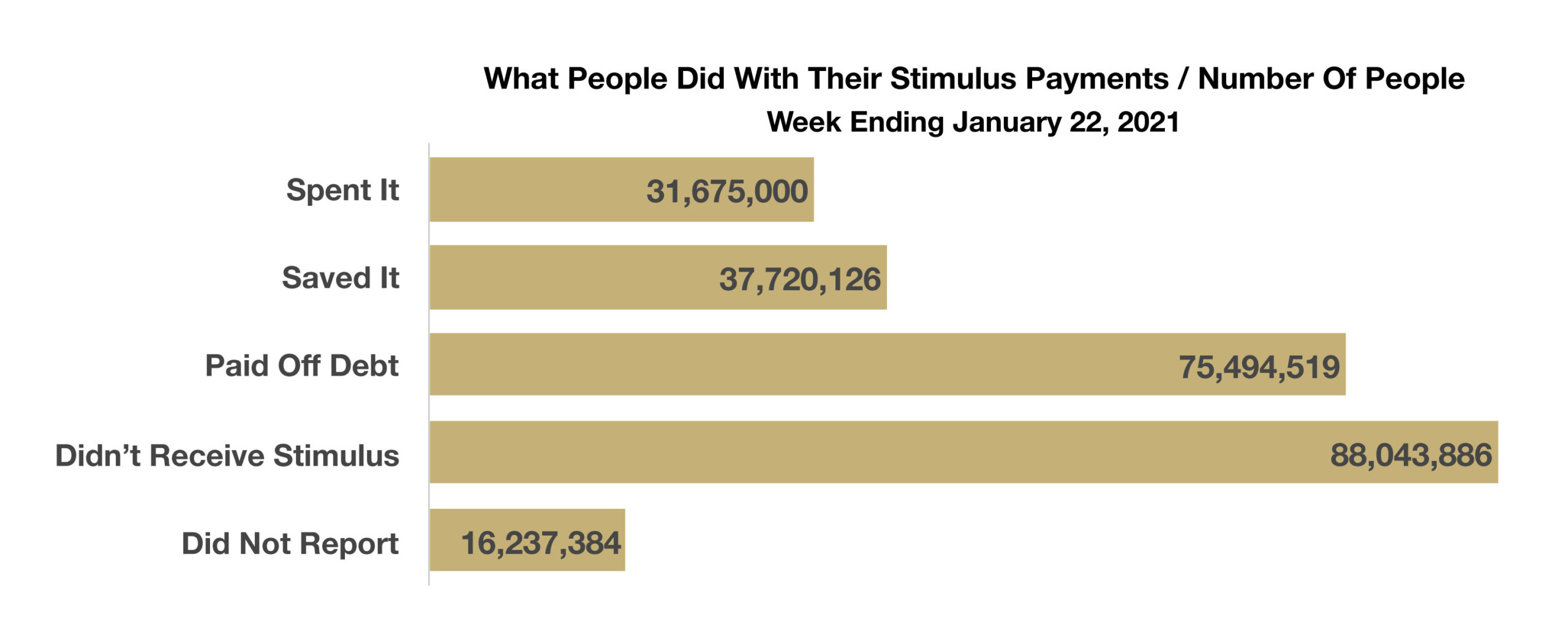

Data gathered by the U.S. Census Bureau as of January 22, 2021, reveal that millions of Americans are not spending their stimulus checks, but are instead saving the funds or paying off debt. With over 37.5 million people opting to save their stimulus payments, some believe that millions receiving stimulus checks may not actually need them.

Sources: Census Bureau, Rockefeller Foundation, CDC, Federal Reserve, IRS