Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Dear Friends,

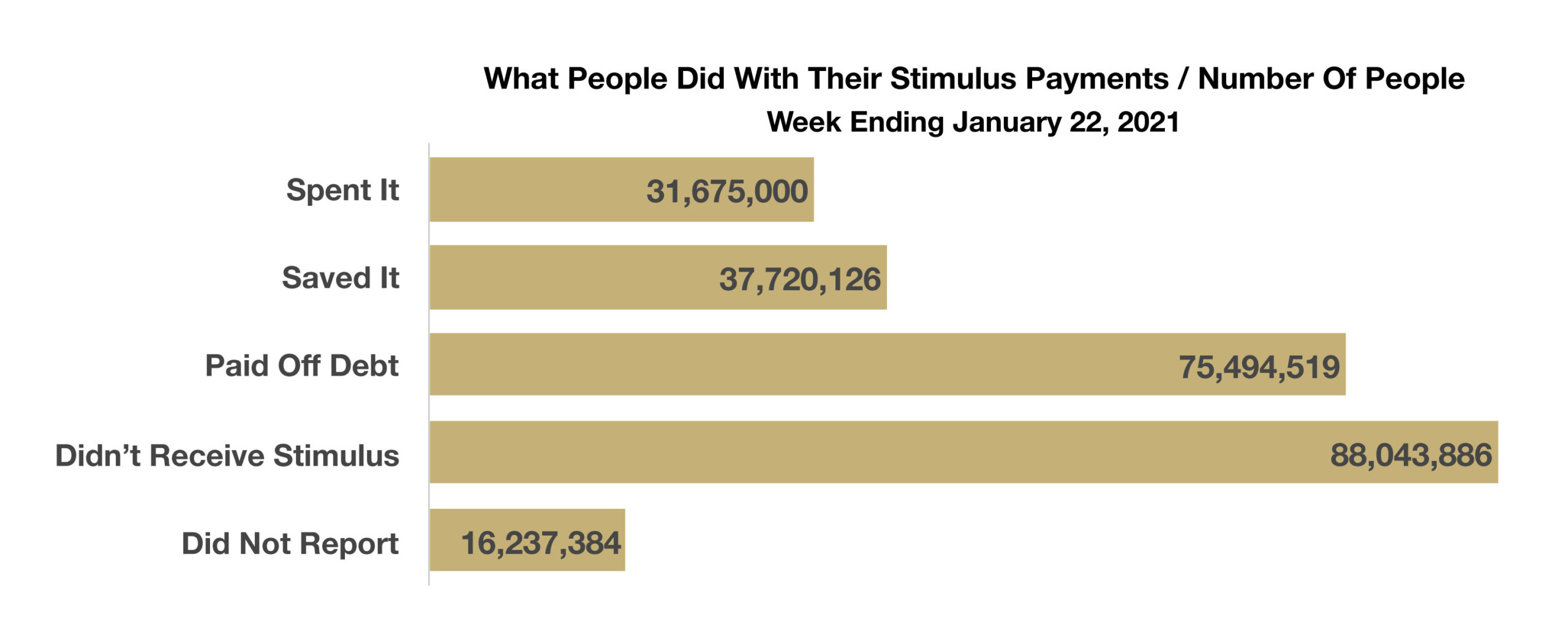

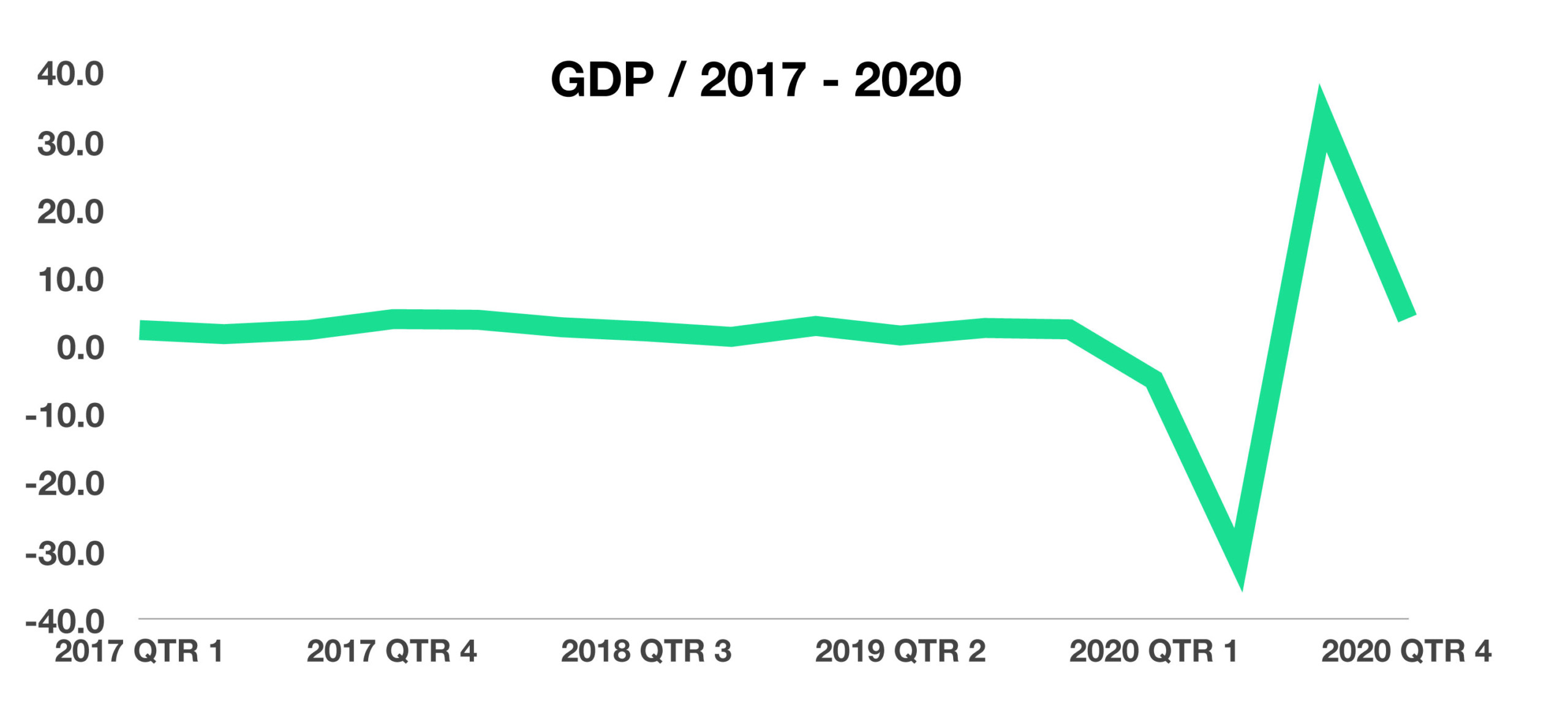

I am pleased to report the obvious – your investments are most likely doing fantastic! The pandemic has dramatically accelerated the global wealth gap between the wealthy and poor. The Rockefeller Foundation tracked roughly 2,200 billionaires worldwide that saw their net worth grow by $2 trillion in 2020, while 435 million low income families globally lost jobs, homes and asset values. For those of us on the upper leg of the ‘K’ recovery, financially, the pandemic has been mostly a pleasant experience. The increase in value of real estate and stock portfolios is pretty universal, and it’s allowing many people to continue to save as well as pay down debt at the same time. A great rule of thumb is to be saving 20% of your gross income, because during your high income years is can really add up!

Someday, of course, the market will surprise, confuse, and scare us. As I’m writing this we are paying close attention to rising interest rates. So maybe the bond market and our debt load is vying for the next narrative. Yes, our Nations debt is huge and not beautiful. But my bet is that the USA still has a lot of credit left with the world economies.

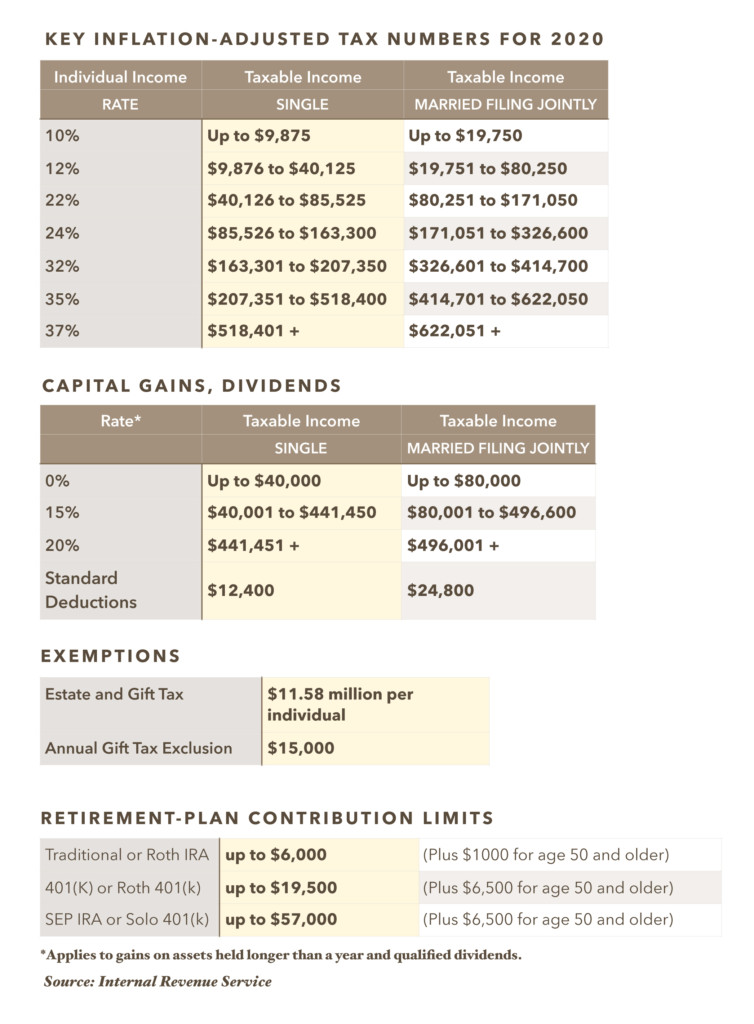

Tax Time is for Planners

Now that we are into tax season, it’s a great time to make sure you are benefitting from all the legal means avaialble to allow you to keep more of your money. From SEP IRA’s to Charitable Gift Annuities, to Roth IRA’s for your kids, we work with your CPA’s to ensure your savings are tax efficient. Time is our most valuable asset, so long as we act now.

Did you know that dividend income from stocks can be taxed as much lower rates than income from bonds or annuities? It’s not what you make, but instead what you keep!

Status: we’ve yet to get the virus (although I know a couple more people that have, and sadly some that have lost their lives). Be safe, be happy.

Nobody expects the Spanish Inquisition!

It’s a good thing we are talking about bubbles. Because few things happen in the stock market that are actually expected. Google Trends is showing a huge spike in the use of stock market bubble- 5 times the norm for the past decade.