Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Speculative trading among smaller retail investors raised concerns about how social media is influencing individual stock valuations. Recently popularized social news aggregation and discussion websites are driving frenzied trading behavior among inexperienced young traders while disrupting traditional stock valuation methods. Many are calling for heightened regulation and scrutiny surrounding these websites and how they operate.

Vaccination progress is being closely monitored by market analysts and economists because of the tremendous impact it has had on consumer sentiment. Consumer expenditures have been hindered by stay at home mandates and fear of infections in public locations such as retail stores and restaurants.

The pandemic has accelerated the global wealth gap between the wealthy and poor. The Rockefeller Foundation, a private foundation, tracked roughly 2,200 billionaires worldwide that saw their net worth grow by $2 trillion in 2020, while 435 million low income families globally lost jobs, homes and asset values.

The IRS won’t be accepting 2020 tax returns until Feb 12 due to staffing shortages and COVID related rules that were enacted in December 2020. Acceptance of prior year returns traditionally would have started two weeks sooner. Taxpayers due a refund may see a delay in receiving funds, yet the April 15 tax deadline will remain the same.

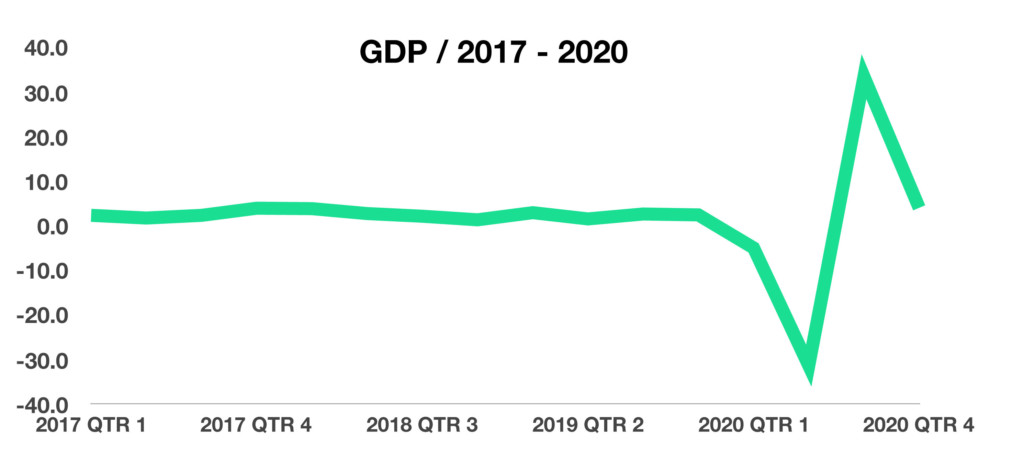

Economic growth for the U.S., as measured by Gross Domestic Product (GDP), rose at a 4% rate in 2020, following a contraction of over 31% in the second quarter alone. The dramatic collapse and ensuing rebound for economic growth was of historical proportion.

Since COVID vaccine distributions began on December 14, 2020, more than 29.5 million doses have been administered in the U.S. as of January 30, 2021. Total doses distributed but not yet administered are nearly 50 million as of the end of January. The federal government has delegated prioritizing and distribution of the doses to the individual states. Health care experts and economists are concerned that the sluggish pace of vaccinations worldwide will postpone any economic resurgence.

Data gathered by the U.S. Census Bureau as of January 22, 2021, reveal that millions of Americans are not spending their stimulus checks, but are instead saving the funds or paying off debt. With over 37.5 million people opting to save their stimulus payments, some believe that millions receiving stimulus checks may not actually need them.

Silver rose to its highest level since February 2013, driven by retail investors’ frenzy buying. Commodities such as oil and gold, have been steadily rising since the beginning of the year, a traditional indication of inflationary pressures.

Sources: Census Bureau, Rockefeller Foundation, CDC, Federal Reserve, IR

Volatility Returns To Markets – Domestic Equity Update

Equity indices were nearly unchanged in January following volatility that drove prices higher and lower throughout the month. Market performance for prior Januarys have historically been acknowledged as an indicator of where markets might head for the year.

Speculative trading among smaller retail investors raised concerns about how social media is influencing individual stock valuations. As a result, volatility spiked in late January. Leading sectors for the month were energy, heath care, and consumer discretionary, while materials and industrial lagged.

Sources: Bloomberg, Reuters

COLA Not Keeping Up With Medicare Premium Increases – Retirement Planning

Even before the onset of the COVID-19 pandemic, seniors were foregoing retirement until later as well as taking part-time jobs even after retiring. Living longer for millions of Americans has translated into a financial challenge resulting in dealing with the threat of dwindling assets during an extensive retirement.

The single greatest menace to retirees has historically been inflation. Over the past year, inflation expectations by consumers place inflation at nearly a 3% rate, nearing the 50-year average rate of 4%. With that in mind, housing, food, energy and healthcare expenses are all projected to gradually rise over the next few years. Since the majority of retirees live on a fixed income, the ability to keep ahead of inflation becomes more difficult as time goes on. So if the annual inflation rate is 3%, then the cost of living would essentially be 30% more over ten years.

At the center of controversy, which has been for decades, is Social Security. Even with COLA applied to Social Security payments, medical expenses not covered by Medicare are expected to rise more than the COLA increases as reported by the Senior Citizens League. The COLA increase for 2021 Social Security payments is 1.3%, while the increase in Medicare Part B premium for 2021 is 6%, a significant difference.

Sources: Social Security Administration, Senior Citizens League

Lending Standards Affect Consumers – Finance & Lending Overview

Even before the pandemic materialized, banks and finance companies were already starting to tighten lending standards. The low rate environment for the months leading up to the pandemic culminated into a flurry of new loans for homes and automobiles. As the pandemic took hold throughout the country, banks and lenders modified their loan requirements in order to compensate for lost wages and drops in small business revenue.

The Federal Reserve tracks loan activity via the Senior Loan Officer Opinion Survey, which details lending practices among banks and lenders nationwide. In its most recent survey of banks and lenders released in January, the Fed found that a net share of banks are easing standards for credit cards and some auto loans.

Economists and market analysts place a considerable amount of importance on loan qualifications, especially during times of economic contraction. It is expected that a continued low rate environment along with easing lending standards might help foster an economic rebound.

Source: Federal Reserve Senior Loan Officer Opinion Survey

How The Fed Makes Money For The Government – Government Structure

The Federal Reserve acts as a separate and individual entity from the U.S. government. It has the ability to create and manage its policies for the benefit of the U.S. financial system. Large banks throughout the country, also known as money center banks, deposit their excess cash with the Federal Reserve. The Fed in turn pays interest to banks on those deposits. When interest rates fall, the Fed pays out much less in interest expenses. After the Fed pays all of its operating expenses, it then sends the rest to the U.S. Treasury. The U.S. Treasury uses the funds to help cover U.S. government expenses and bills.

This past year in 2020, the Federal Reserve sent $88.5 billion in profits to the U.S. Treasury, nearly a 66% increase from the previous year. Payments to the Treasury by the Fed has actually fallen for the past few years as rates have risen. The onset of the pandemic and the dramatic reduction in interest rates by the Federal Reserve in 2020 sharply reduced interest payments paid to banks on excess reserves.

Sources: Federal Reserve, U.S. Treasury