Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

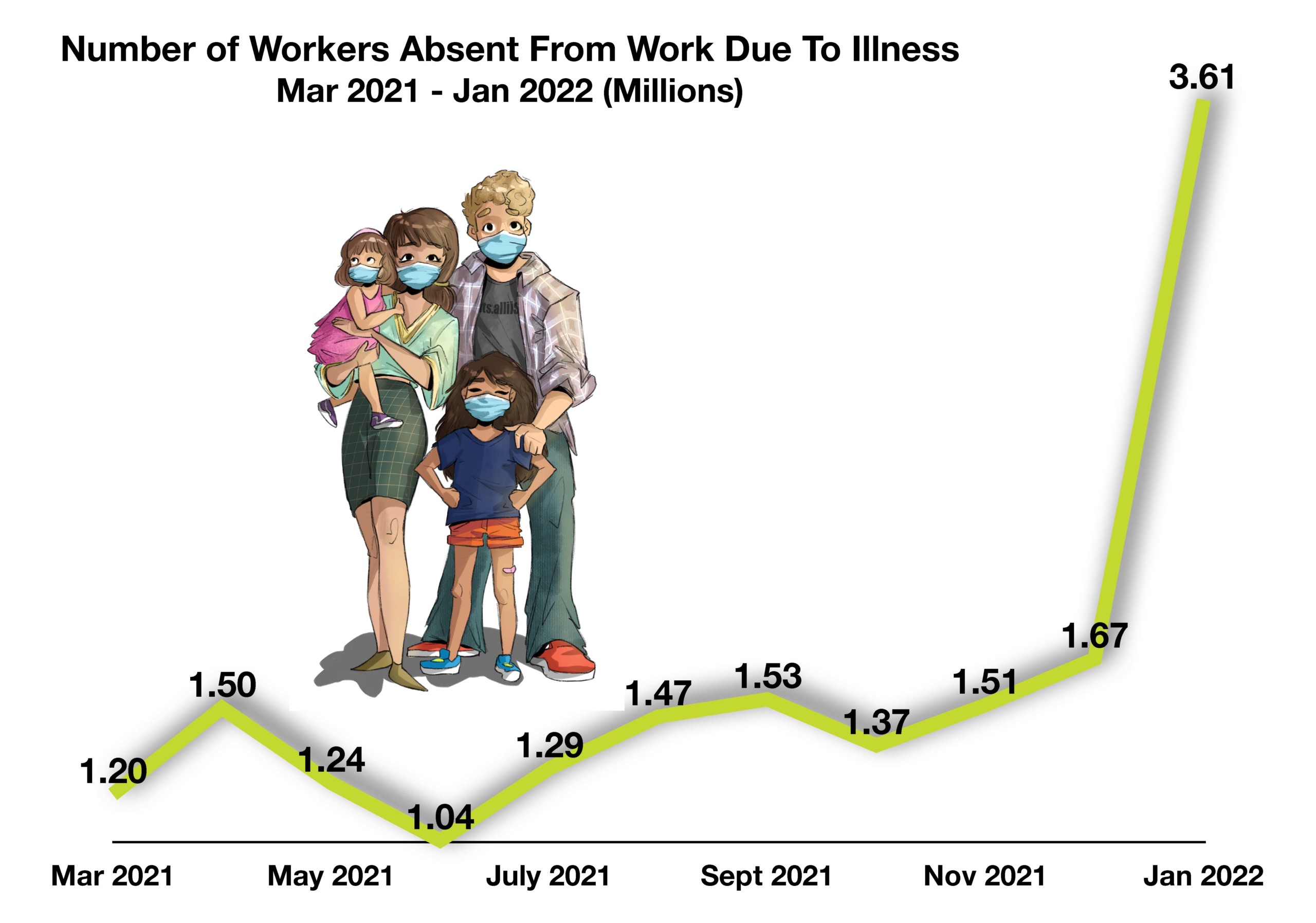

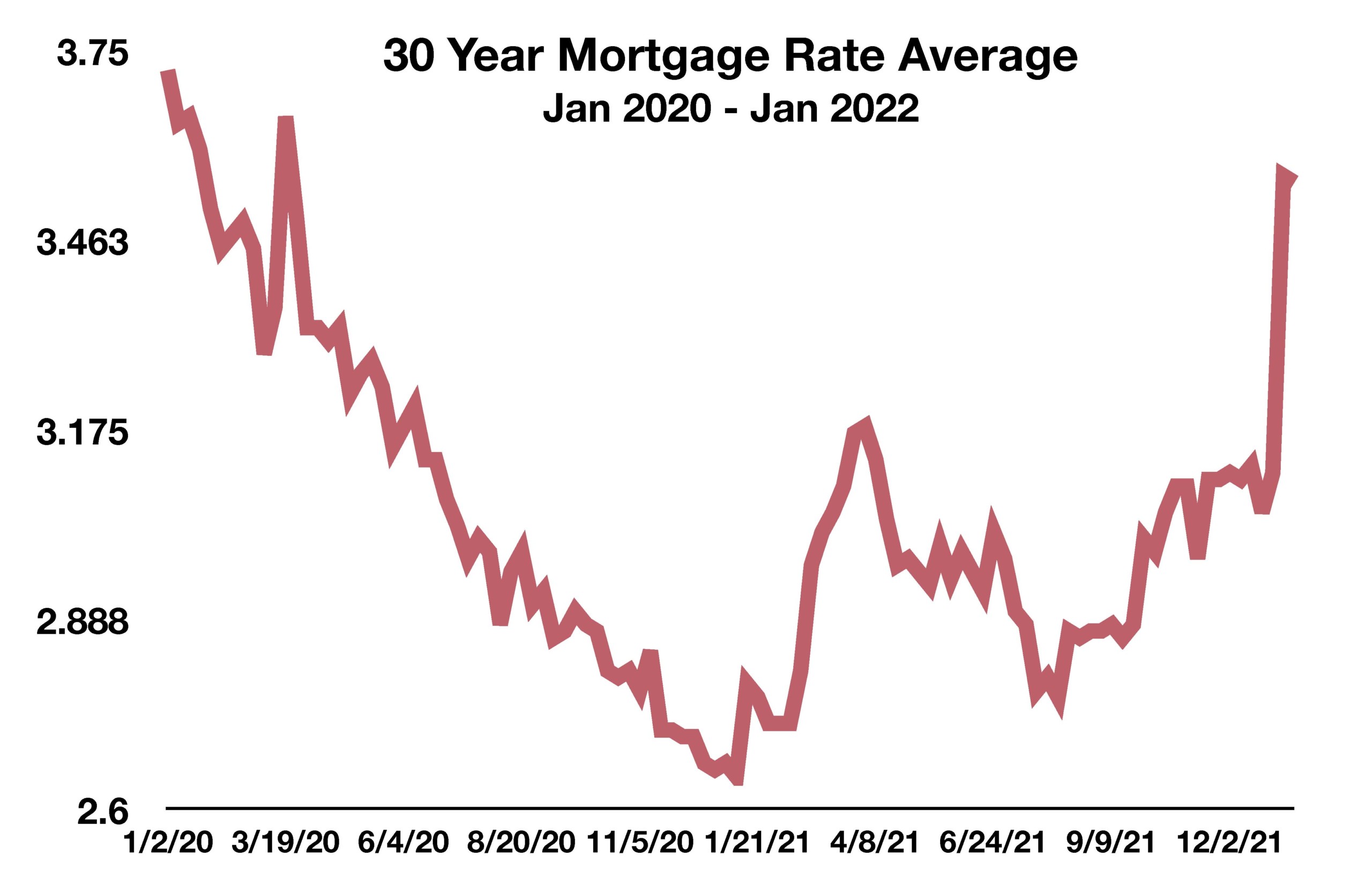

Well, so far 2022 hasn’t been any picnic. While the long view is always the way to look at the markets, short-term corrections like the one we are experiencing this year can be a bit unnerving. In comparison, it’s about half of what we experienced in the last quarter of 2018 when we had a major market correction of around -20%. While I can’t say that we have bottomed out, and a further drawdown may still be ahead, much of this volatility is due to the interest rate increases being forecasted by the FED. Eventually the market will fully price in the rate increases, and the [over]reaction to the fears of inflation will abate. Yes, there are still lots of moving parts to consider, but overall, the economy is strong with most estimates seeing continued growth this year.

Adjusting for the correction in the fixed income investments has been the most challenging. It’s a constant trade-off between trying to mitigate the correction while not taking on undue risk in other sectors to do it. My models are designed to adjust to market conditions, and some of the model holdings are actively managed and do the same. I’ve added a new investment to the IncomeX model that will add to that active management, and together it should be a great combination of mitigating risk and still capturing income. Our Exposure Index is at 78%, which tracks the commitment to the equity positions. It’s almost at a maximum level of a 25% cash hedge. Markets typically rebound quickly and at this point the hedge has done its job and I’m waiting for conditions to indicate reinvestment of the funds.

The Macro Overview section tells it like it is, and although there are still challenges, some of the headwinds will begin to lessen as these issues find a leveling point from which to build from. The specific conditions vary, but the markets and the economy are always cyclical, and in the macro sense this is no different.

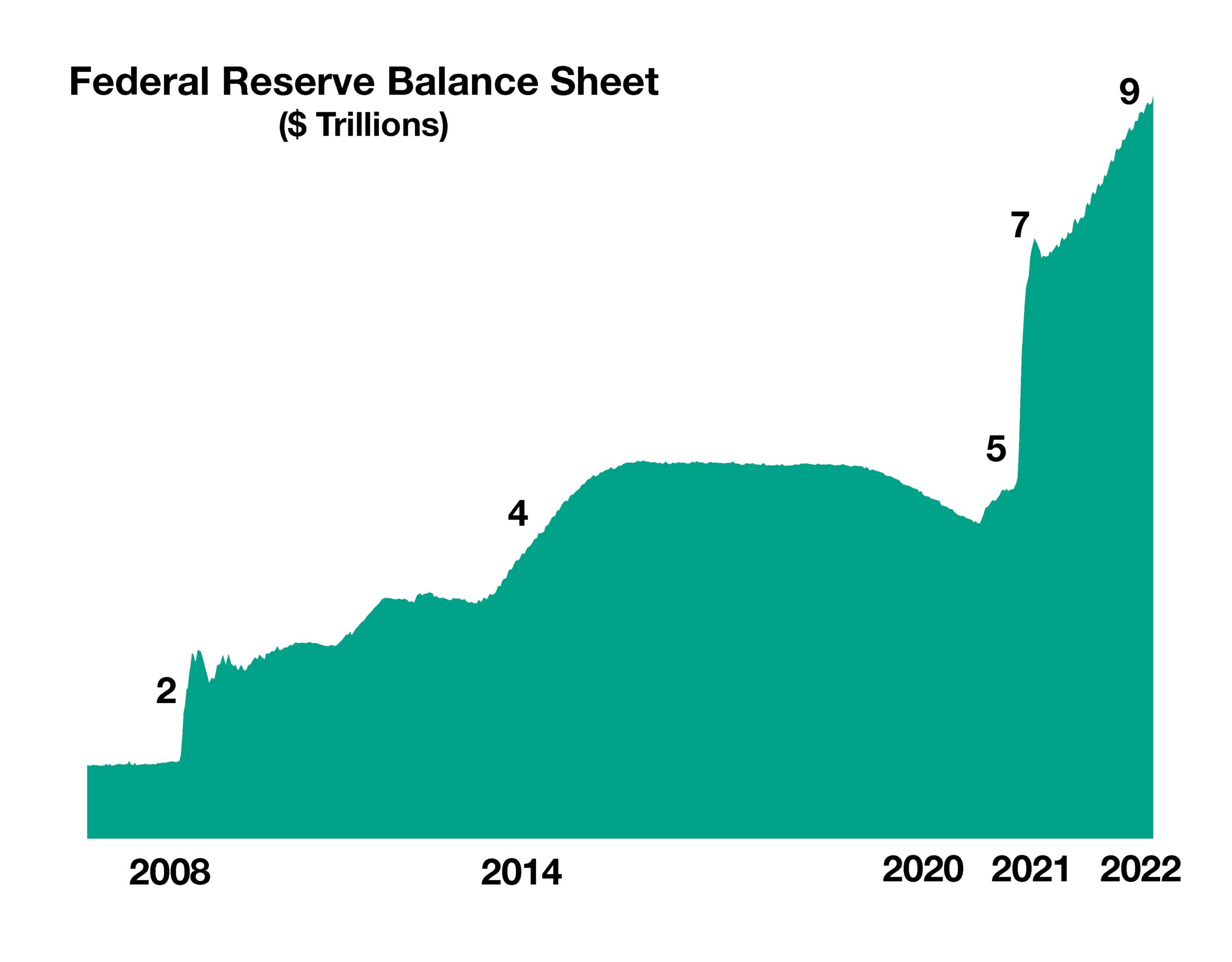

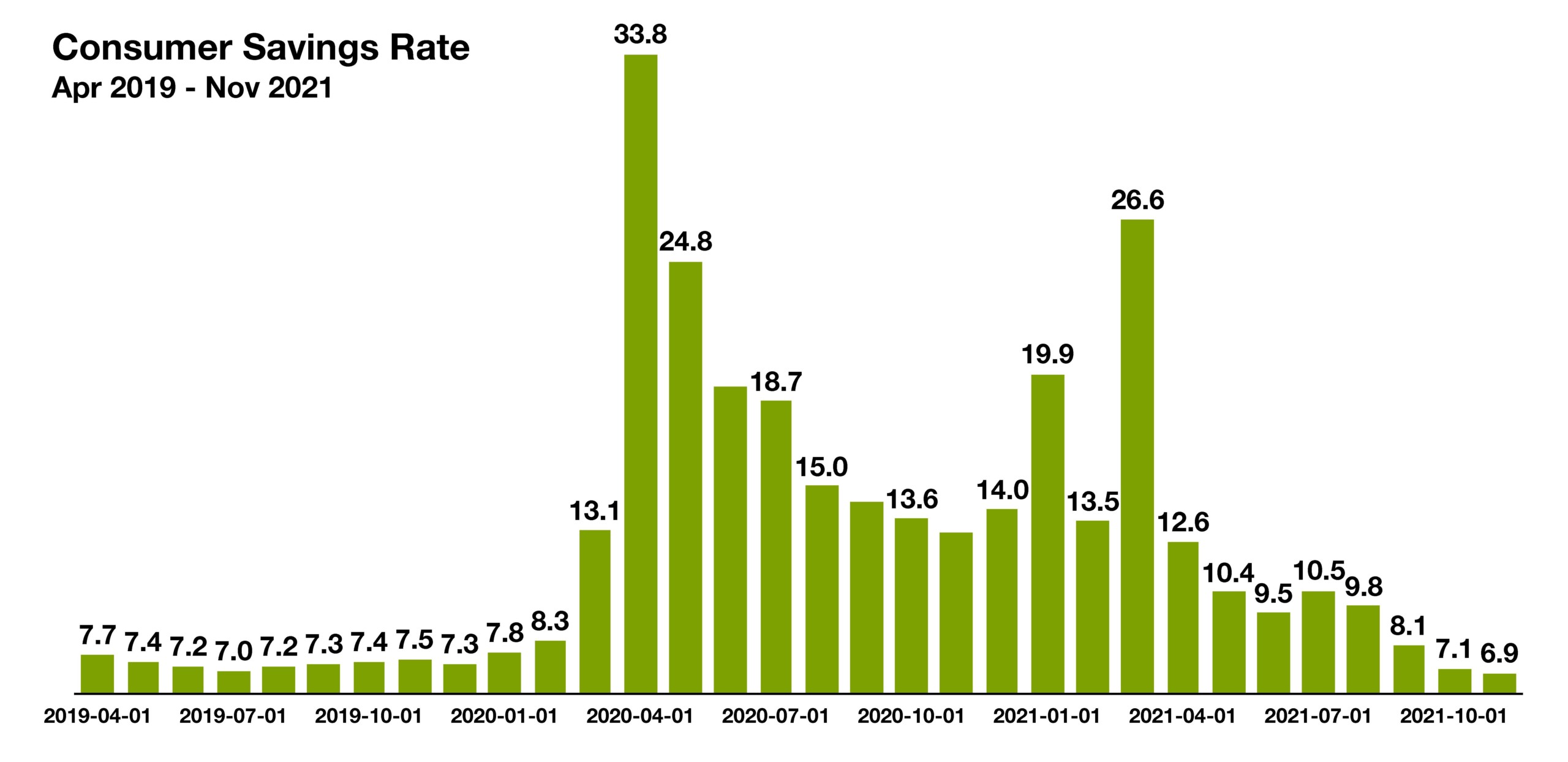

The updates on the FED, savings rates and fixed income help to paint the reality that cyclically things are shifting. We’ve seen steady gains in most sectors over the last several years, and things naturally need a pause and adjustment. Most analysts and economists predict that growth…both economically and in the markets, will slow in the near future. They are probably right. It’s pause and refresh time.

Keeping my finger on the pulse,

The most recent data show that the savings rate dropped to 6.9 percent in November 2021, lower than where it stood at roughly 7.5 percent before the pandemic began.

The most recent data show that the savings rate dropped to 6.9 percent in November 2021, lower than where it stood at roughly 7.5 percent before the pandemic began.