Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

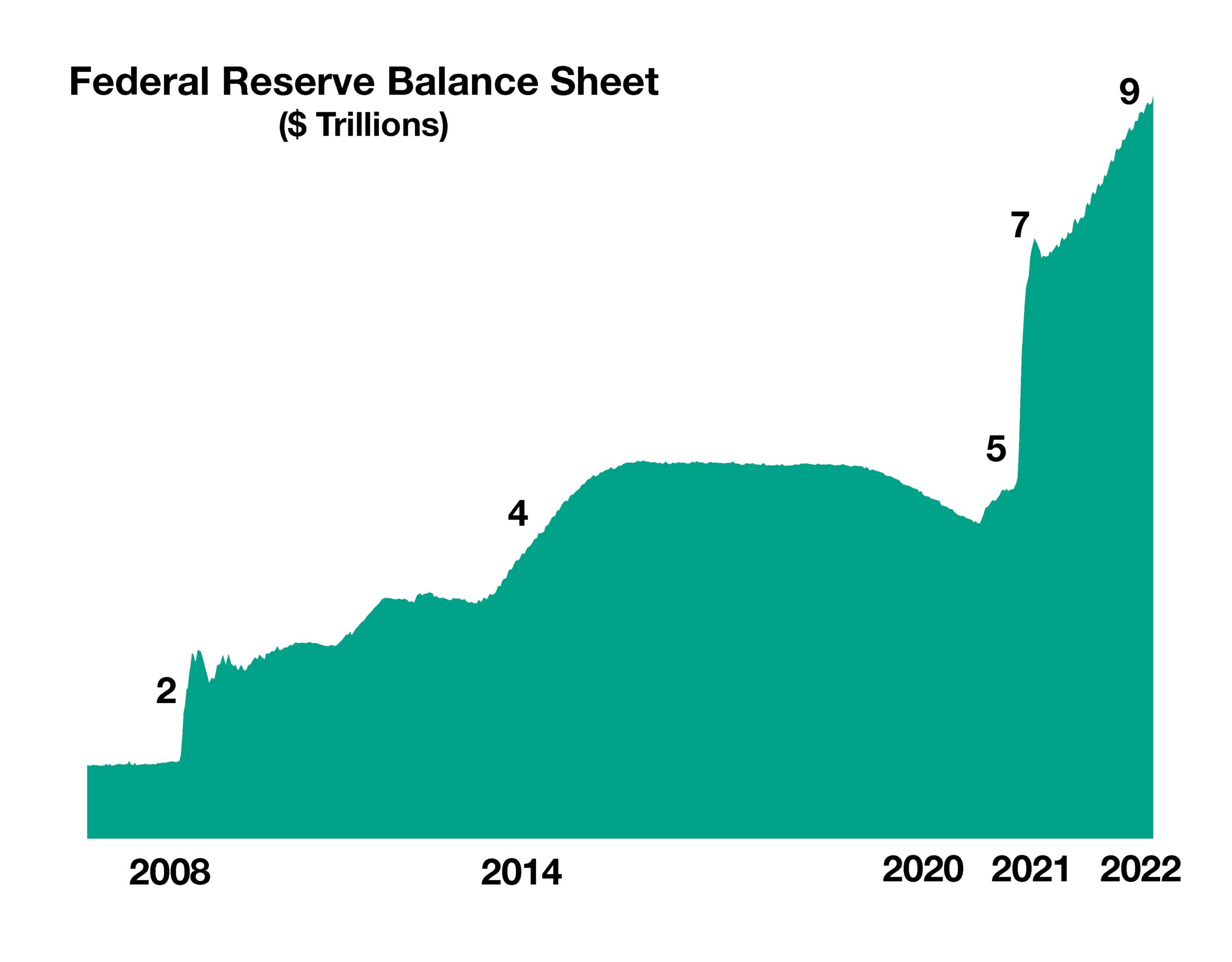

Market dynamics are shifting as the Federal Reserve outlines its plan to end monetary stimulus in order to squash inflationary pressures.

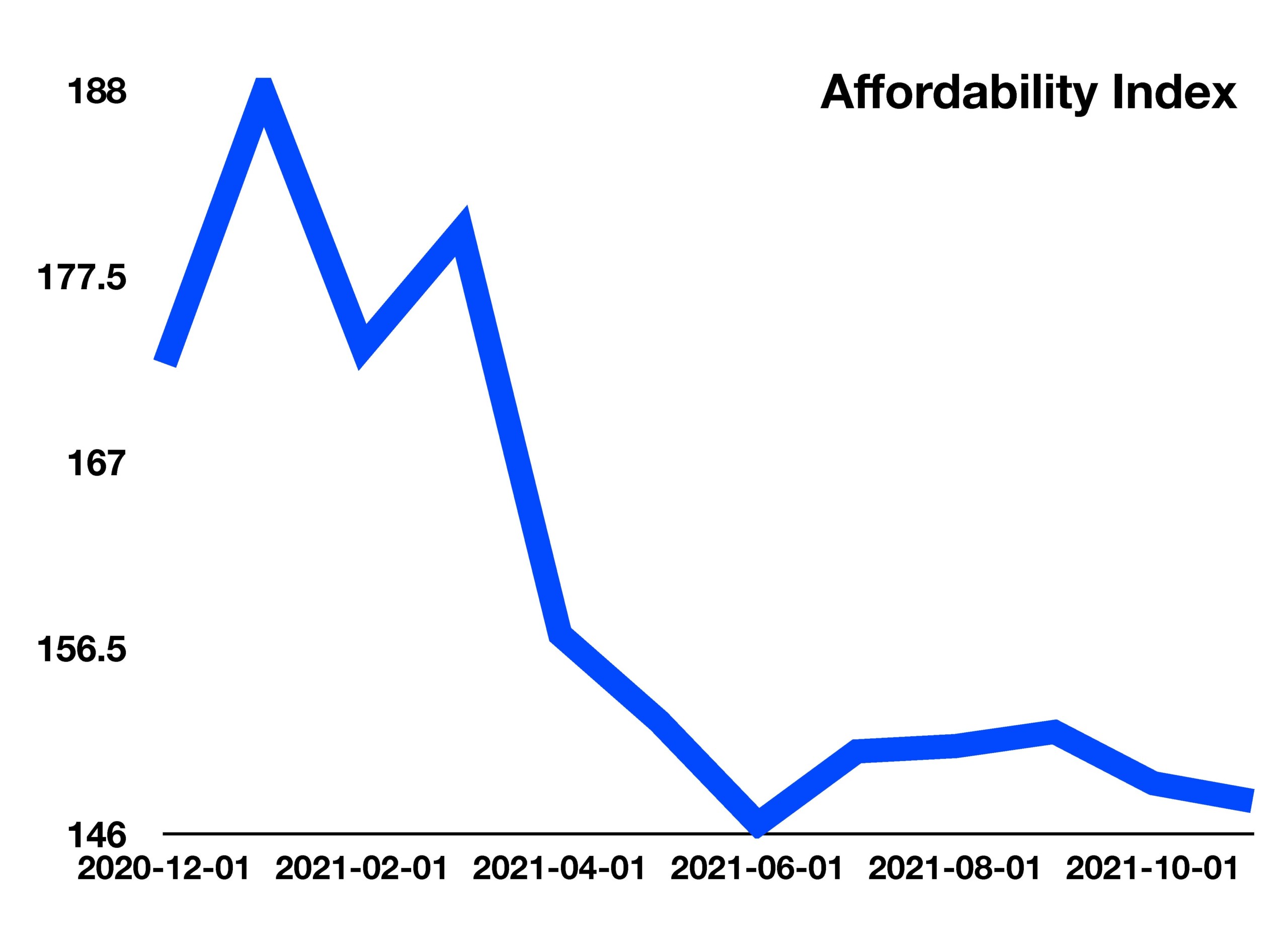

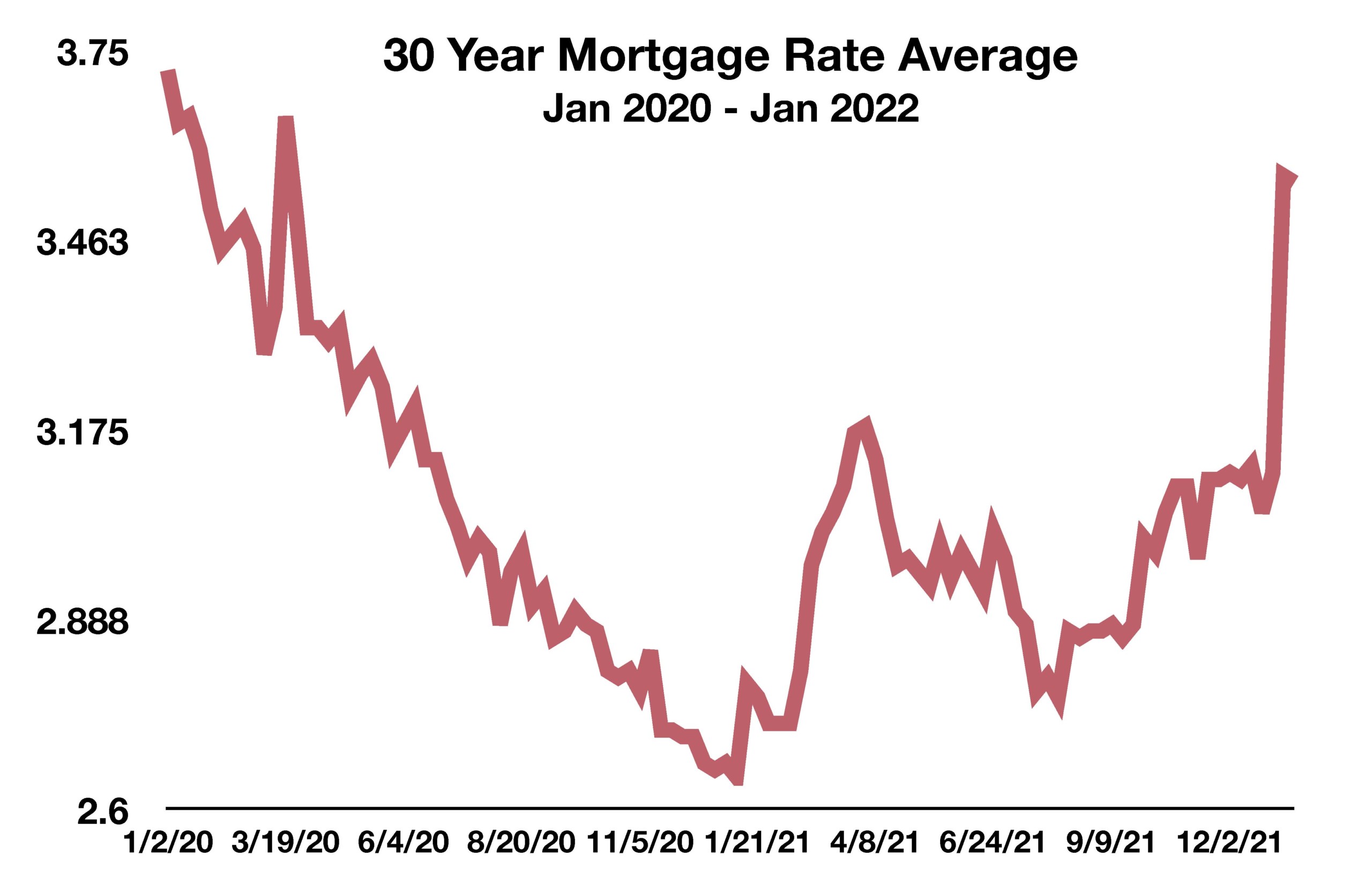

Economists expect market volatility to continue as the Federal Reserve prepares to embark on its interest rate increase strategy. The Fed’s objective is to execute rate increases this year culminating in a “soft landing,” while ensuring that a rise in rates to control inflation doesn’t stifle economic expansion.

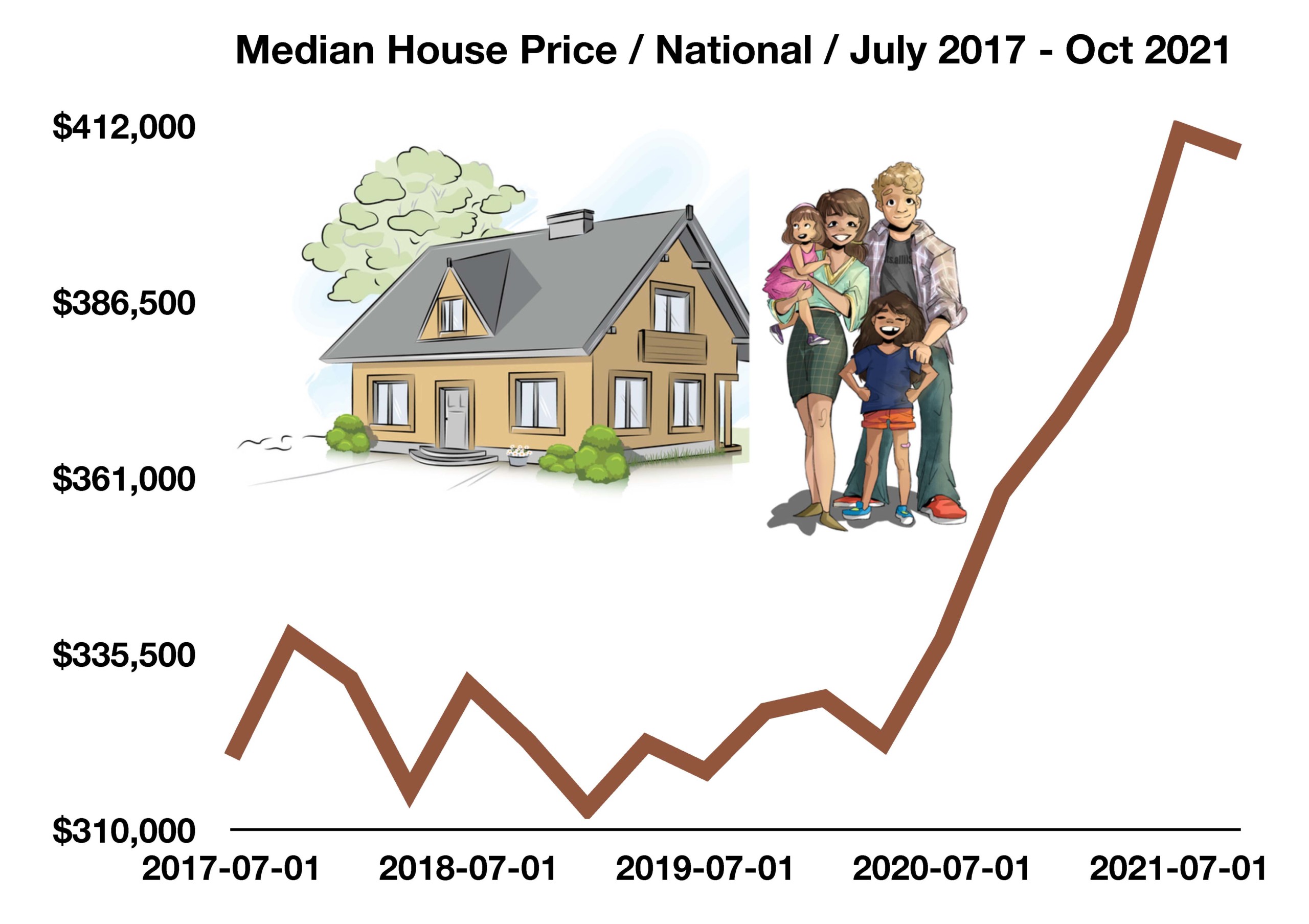

Inflation reached the highest level in 40 years, annualizing 7% at the end of 2021. Several analysts project that inflation may be peaking and could actually reverse course in coming months. It is also plausible that the Fed’s push to raise rates, as pandemic-related government stimulus funds have evaporated, may slow economic growth more than anticipated.

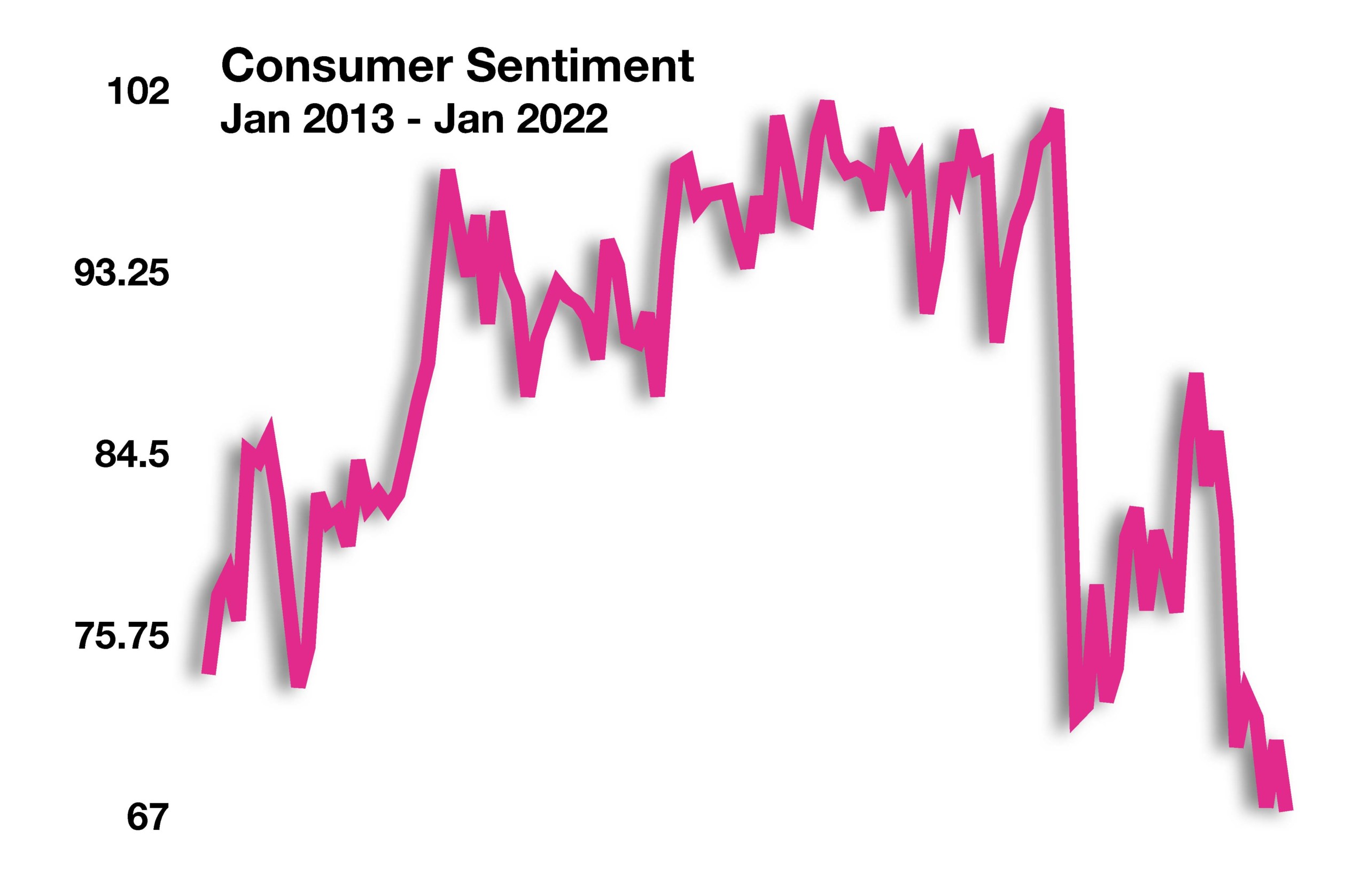

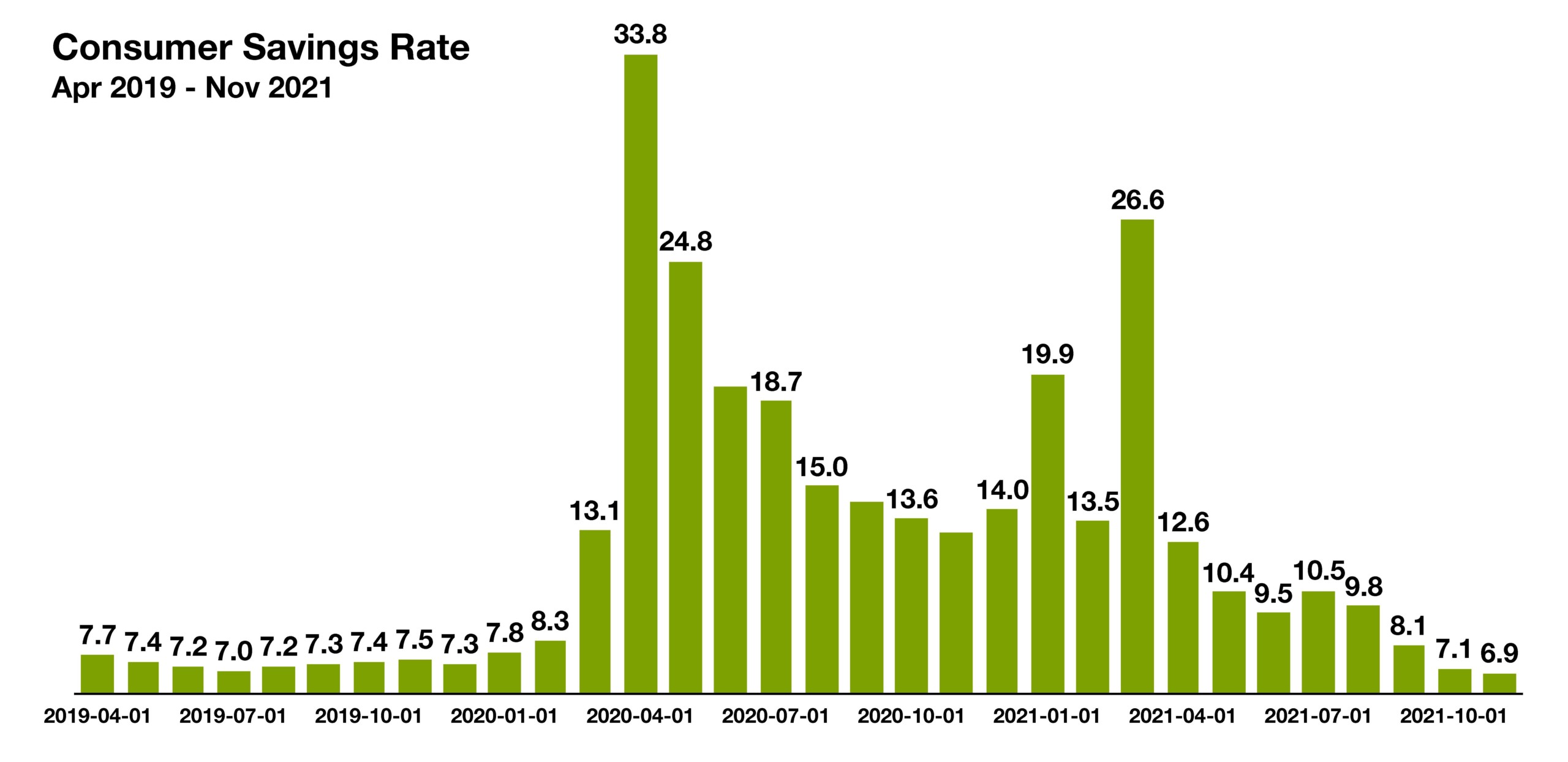

Supply constraints remain prevalent, caused by multiple factors that neither the administration nor the Federal Reserve can alleviate. As the supply constraints precipitate higher prices, consumers modify spending behavior in order to accommodate inflationary pressures. The Atlanta Fed GDPNow forecast model projects a substantial pullback in retail spending as consumers exhaust remaining stimulus funds and pare back expenditures on costly discretionary goods.

Financial market volatility intensified in January, as geopolitical tensions coupled with expectations of imminent Fed rate hikes drove equity and bond prices in extreme directions. Major equity and fixed income indices saw price declines in January.

Crude oil prices posted their strongest January in decades as expanding global demand and limited supply propelled prices higher. Rising oil prices translated into rising gasoline prices nationwide, with some analysts expecting even higher prices heading into the summer months.

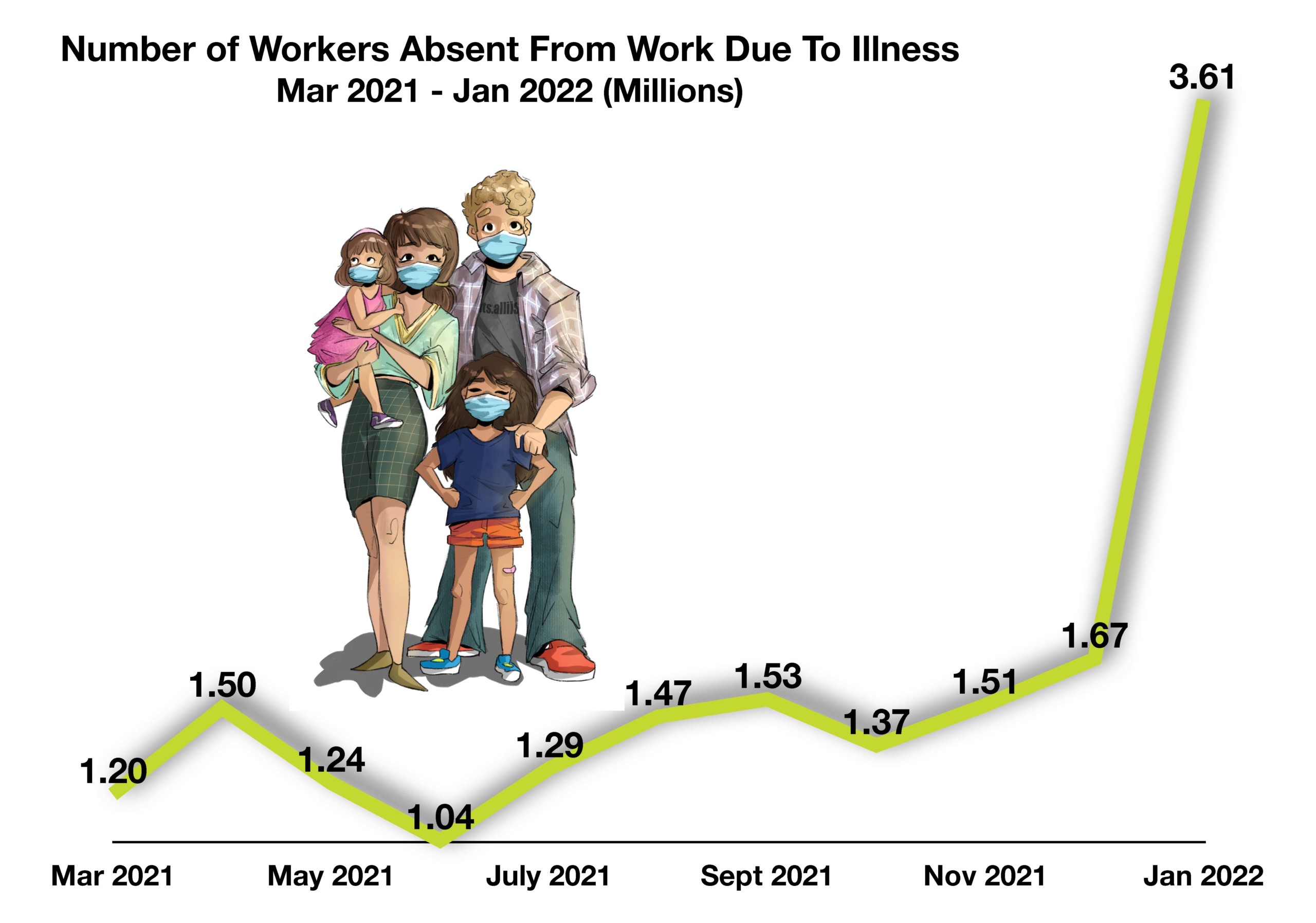

The Census Bureau, via its Household Pulse Survey, found that over 40% of unemployed individuals blame reasons related to COVID-19 for their unemployment. The same survey revealed that over 3.5 million workers absent from work in January due to illness, a record number. Labor market data is a focal point for the Federal Reserve and financial markets, as a crucial indicator of economic health. (Sources: Fed, Labor Dept., www.census.gov/data/experimental-data-products/household-pulse-survey.html)

The most recent data show that the savings rate dropped to 6.9 percent in November 2021, lower than where it stood at roughly 7.5 percent before the pandemic began.

The most recent data show that the savings rate dropped to 6.9 percent in November 2021, lower than where it stood at roughly 7.5 percent before the pandemic began.