Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

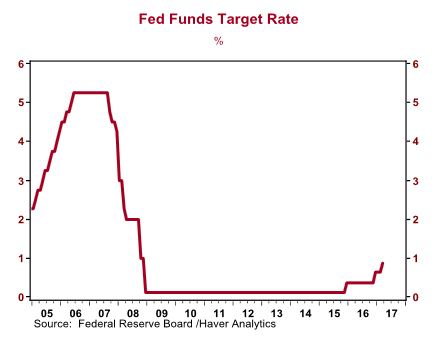

Fed Raises Rates Again

The Fed’s commentary after yesterday’s rate hike was interesting for what it did not say. There was no mention of the balance sheet being unwound. This is significant because the chorus of Fedsters who were speaking out in the media during January/early February, were uniformly in favor of the Fed starting the unwind process. It is more likely the Fed will sequentially hike rates, starting now, running through year-end.

Four hikes would b

The U.S. equity market moved higher after the rate hike was announced, as did gold, oil and even long dated bonds. The Fed surprised no one. A tightening monetary cycle is an indication that inflation and the economy are on the rise, but why then did defensive asset classes like gold and bonds rally?? The stock market is a forward looking indicator and it has already priced in 3-4 rate hikes in 2017.

For the past 8 years, the Fed’s actions have helped signal the market direction. The market has become less concerned with Fed policy and now is focused on the economy and Presidential Policy.

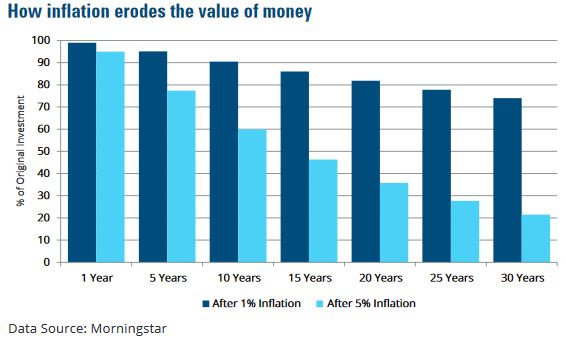

The economy has recovered enough that prices are starting to go up. The Consumer Price Index* (CPI), a measure of what we pay for the products we purchase, saw the strongest annual price growth since October 2014. Rising inflation means the purchasing value of your dollars has gone down, essentially your money is worth less than it once was. Inflation is being driven due to a tightening labor market that is leading to wage growth. In addition, oil prices have recovered and President Trump has promised major tax cuts that will result in more dollars in consumers’ pockets. More disposable income will result in an increase demand for products and services, and this would directly lead to higher prices-hence higher inflation.

Inflation has been on the rise, but with the election of Donald Trump and his pro-growth policies, we see inflation expectations climbing. Shamrock made changes to our client portfolios and invested in areas that typically benefit from a generalized rise in prices, such as commodities, financials, and cyclical sectors like materials and industrials. We have also shifted away from investments like long duration bonds, REITs, and utilities/consumer staples that typically perform well in a low inflationary environment.