Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

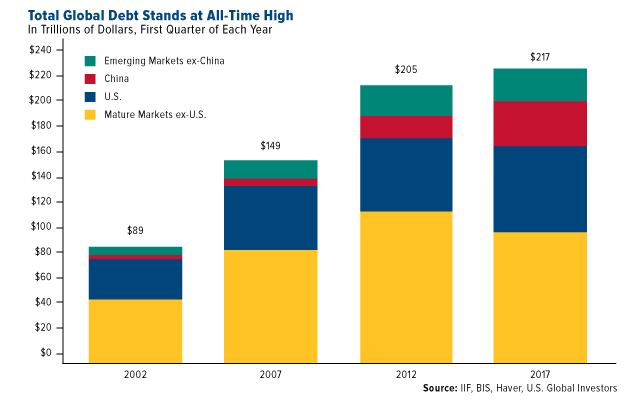

Global Debt Bubble

According to the highly-respected Institute of International Finance (IIF), global debt levels reached an astronomical $217 trillion in the first quarter of 2017—that’s 327 percent of world gross domestic product (GDP). Notice that before the financial crisis, global debt was “only” around $150 trillion, meaning the world has added close to $120 trillion in as little as a decade. Much of the leveraging occurred in emerging markets, specifically China, which is spending big on international infrastructure projects.

It goes without saying that this is a huge risk. Some are calling this mountain of debt “the mother of all bubbles,” and we all remember how the last two bubbles ended, in 2000 (the tech or dotcom bubble) and 2007 (the housing bubble).

As interest rates rise, the cost to service the debt increases resulting in less money for other expenditures like infrastructure, defense, or social services. Central banks’ efforts to promote economic growth through monetary easing haven’t exactly been a raging success, nor can they continue forever. Plus, near-zero interest rates are precisely what encouraged such inflated levels of borrowing in the first place. The US Federal Reserve and European Central Bank are all signaling that they would like to begin unwinding monetary support, and this synchronized tightening could be the catalyst that results in a market correction. Many Wall Street analysts believe stocks and other risk assets could come under selling pressure amid the balance sheet unwind. After global central banks embarked on quantitative easing, investors were forced out of bonds into equities and high-yielding debt, as they sought to deliver richer returns. Against that backdrop, the Dow, S&P 500, and Nasdaq indexes are all trading at or near all-time highs.