Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

The Sustainability of a Global Upswing

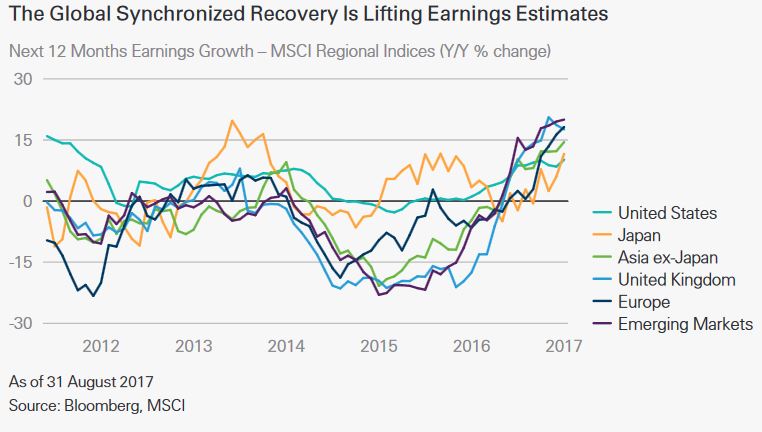

The S&P 500 Index continued to move higher in the third quarter of 2017, because domestic and global growth are reaccelerating. Profits from corporate earnings and GDP growth are intertwined, and the U.S. economic output grew at a 3.1% annual rate in the second quarter of 2017, the best quarterly rate of growth in two years. The U.S. economy remains stable with steady job growth, a rising stock market, and little inflation. According to survey data from the Purchasing Managers’ Index (PMI), which provides a useful indication of GDP’s direction, growth in the third quarter should also be strong. Based on market exchange rates, the global GDP growth rate for the third quarter of 2017 is estimated by J.P. Morgan to have been around 3.8%, which might be higher than the U.S. third quarter GDP estimates. This is the highest growth rate recorded since mid-2010. The positive economic data has been good for equity and credit markets, lifting both earnings and earnings forecasts. We expect that this constructive environment—improved growth, low inflation, and relatively loose financial conditions—will continue over the short-to-medium term. Looking forward, we see geopolitical tensions (particularly in North Korea), the risk of monetary policy mistakes, a failure to raise the debt ceiling, and potential protectionist measures as the biggest risks to market stability.

Core inflation has been undershooting the Phillips Curve, which assumes the inverse relationship between inflation and unemployment, giving the Federal Reserve some hesitancy in raising interest rates by 0.25% in December of 2017. The U.S. Federal Reserve policy acknowledges some downside risks to its goal of price stability and may be undershooting inflation. Although the Federal Reserve has raised rates four times since 2015, the consensus opinion is that more tightening is warranted as bond yields appear too complacent about growth. The Federal Reserve will also start to reduce its balance sheet this October, a quantitative easing (QE) in reverse. While the process will begin slowly, once begun it will accelerate on autopilot between 2022 and 2023. The Federal Reserve has detailed a pace of mortgage backed securities (MBS) runoff of $4 billion a month rising to $20 billion a month by the end of next year and $6 billion a month of Treasuries (TSY), rising to $30 billion by next year. The Federal Reserve is taking great precautions to send a smooth message to investors. To put the Federal Reserve policy in perspective, the $6 billion per month of initial unwinding is approximately one fifth of the average monthly maturities over the next year.

In Europe, growth has not been hampered by the euro’s strength. Unemployment across the Eurozone is at eight-year lows, while manufacturing leading indicators are at six-year highs. There is now widespread acceptance that real activity growth in the Eurozone and Japan has been much firmer than originally expected this year. The European Central Bank (ECB) is beginning to discuss tapering for 2018 while the Bank of England (BOE) is considering an interest rate hike. European corporate earnings are in the early stages of recovery. Japan’s recovery continues as the weak yen has helped exports. China appears stable although the yuan strength softens Chinese demand for foreign currency, including U.S. Treasuries.