Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Has the Trump Rally Stalled?

Last week the stock market experienced its worst decline (S&P 500 declined by 1.4%) since President Trump won the election back in November. While the market rarely goes up or down in a straight line, investor optimism and euphoria led many to say, “this time it is different”. The recent stock market decline was not driven by a tweet or terrorist attack, but the common consolidation that occurs during bull markets cycles. The Investment Committee at Shamrock has cautioned that a correction could occur if many of President Trump’s campaign promises were not started within the Administration’s first 100 days in office. We are currently 65 days into the Trump Administration and the stunning setback for health care reform shows the President could have some difficulty pushing his agenda forward.

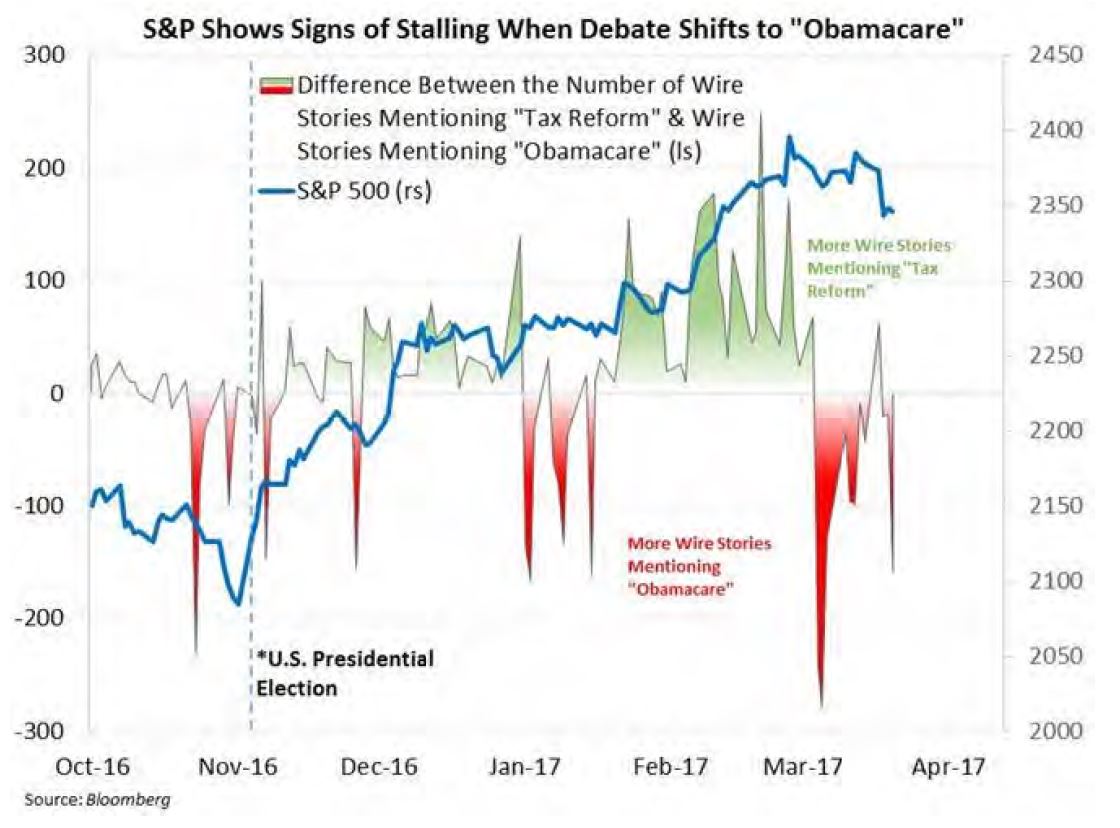

The stock market sold off when it appeared the Healthcare bill was not going to have the votes needed to pass. It is clear health care reform was not market friendly, while tax reform is. Tax reform is the single most important factor for U.S. equity investors and will have the most meaningful impact on driving the markets higher. The following chart displays the market direction when the media attention was focused on tax reform vs. health care reform.

The Trump rally, that has been fueled by his pro-growth plan, could be in jeopardy of stalling out if Republicans are unable to shift quickly to tax reform. We still expect deregulation, and infrastructure spending, and tax reform to push the market higher; but if legislation is delayed until 2018, a five to seven percent correction could occur this summer. Our tactical strategies have already started taking some risk out of the US equity sleeve, removed commodity exposure, and allocated more to international equities where valuations are more attractive and offer greater upside opportunity.