Stencil Financial

28734 Rain Creek Road

Hanover, MI 81129

851.357.2257

dan@stencil.com

Short Term Bond Rates Rise – Fixed Income Review

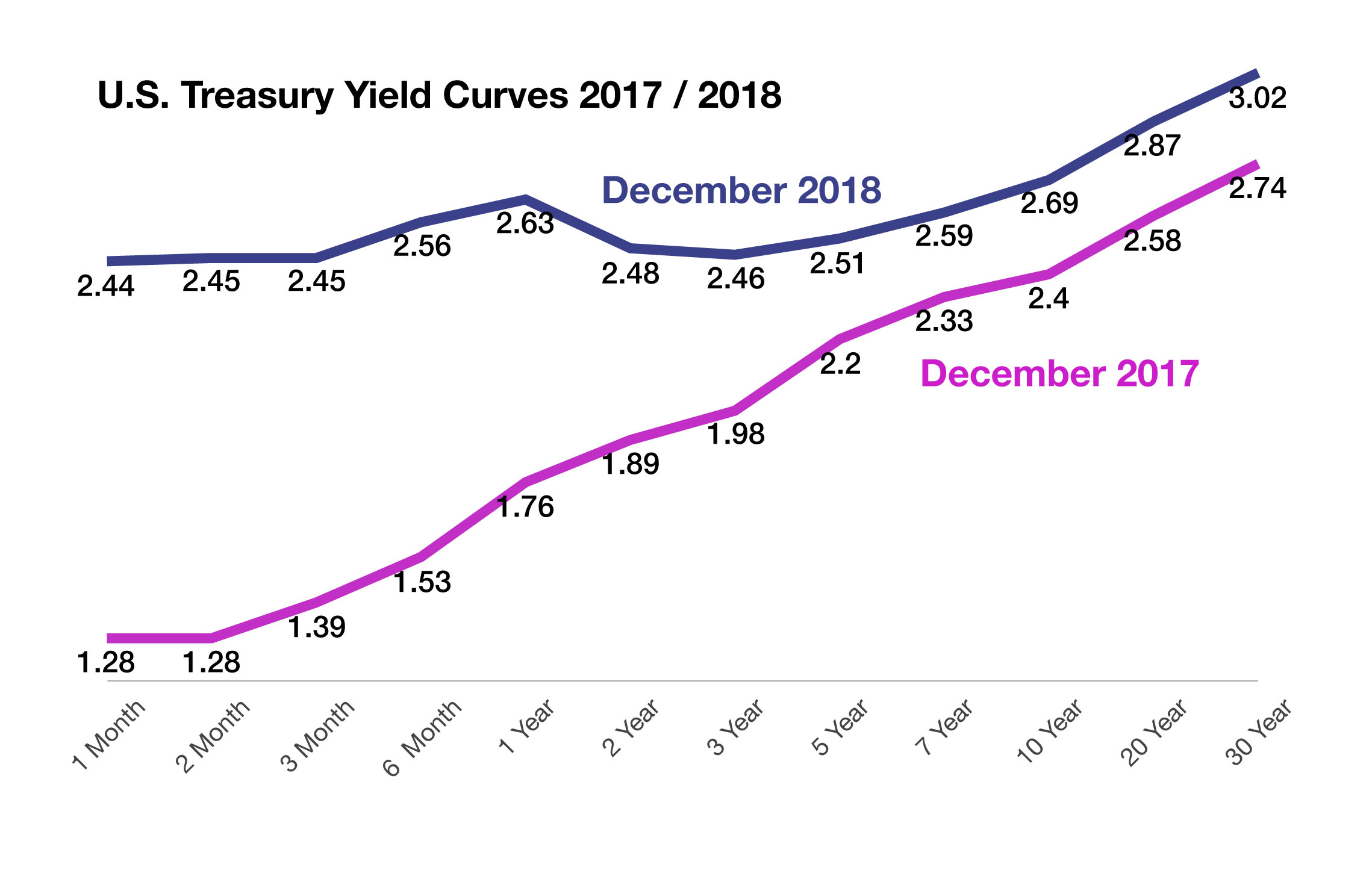

Shorter term bond yields rose closer to longer term bond yields, thus further flattening the Treasury bond yield curve, an economic gauge closely followed by market analysts. The benchmark 10-year Treasury Bond ended the year at 2.69%, down from a mid-year high of 3.24% it reached in November.

The Fed indicated that it would continue to shrink its balance sheet by $50 billion a month, a reversal from balance sheet expansion following the 2008-2009 financial crisis. What this means is that rather than buying government bonds in the marketplace and placing them on the Fed balance sheet, the Fed will instead forego holding additional bonds and allow bonds to mature without replacing them. This is a form of quantitative tightening as is raising short-term rates.

Over the past year, nearly every developed country central bank began reversing monetary stimulus and started tightening just as the Federal Reserve has. The anticipation of rising rates and less accommodative policy may be prohibitive for smaller emerging market economies in need of inexpensive capital.

The Fed raised rates four times in 2018 and has risen rates nine times since it began tightening rates from near-zero three years ago. The Fed signaled that it expects to raise rates at least twice in 2019. Some analysts believe that the Fed has raised rates in order to be able to lower them as a form of stimulus should economic conditions deteriorate.

Sources: Treasury Dept., Federal Reserve

Short Term Bond Rates Rise – Fixed Income Review

Shorter term bond yields rose closer to longer term bond yields, thus further flattening the Treasury bond yield curve, an economic gauge closely followed by market analysts. The benchmark 10-year Treasury Bond ended the year at 2.69%, down from a mid-year high of 3.24% it reached in November.

The Fed indicated that it would continue to shrink its balance sheet by $50 billion a month, a reversal from balance sheet expansion following the 2008-2009 financial crisis. What this means is that rather than buying government bonds in the marketplace and placing them on the Fed balance sheet, the Fed will instead forego holding additional bonds and allow bonds to mature without replacing them. This is a form of quantitative tightening as is raising short-term rates.

Over the past year, nearly every developed country central bank began reversing monetary stimulus and started tightening just as the Federal Reserve has. The anticipation of rising rates and less accommodative policy may be prohibitive for smaller emerging market economies in need of inexpensive capital.

The Fed raised rates four times in 2018 and has risen rates nine times since it began tightening rates from near-zero three years ago. The Fed signaled that it expects to raise rates at least twice in 2019. Some analysts believe that the Fed has raised rates in order to be able to lower them as a form of stimulus should economic conditions deteriorate.

Sources: Treasury Dept., Federal Reserve

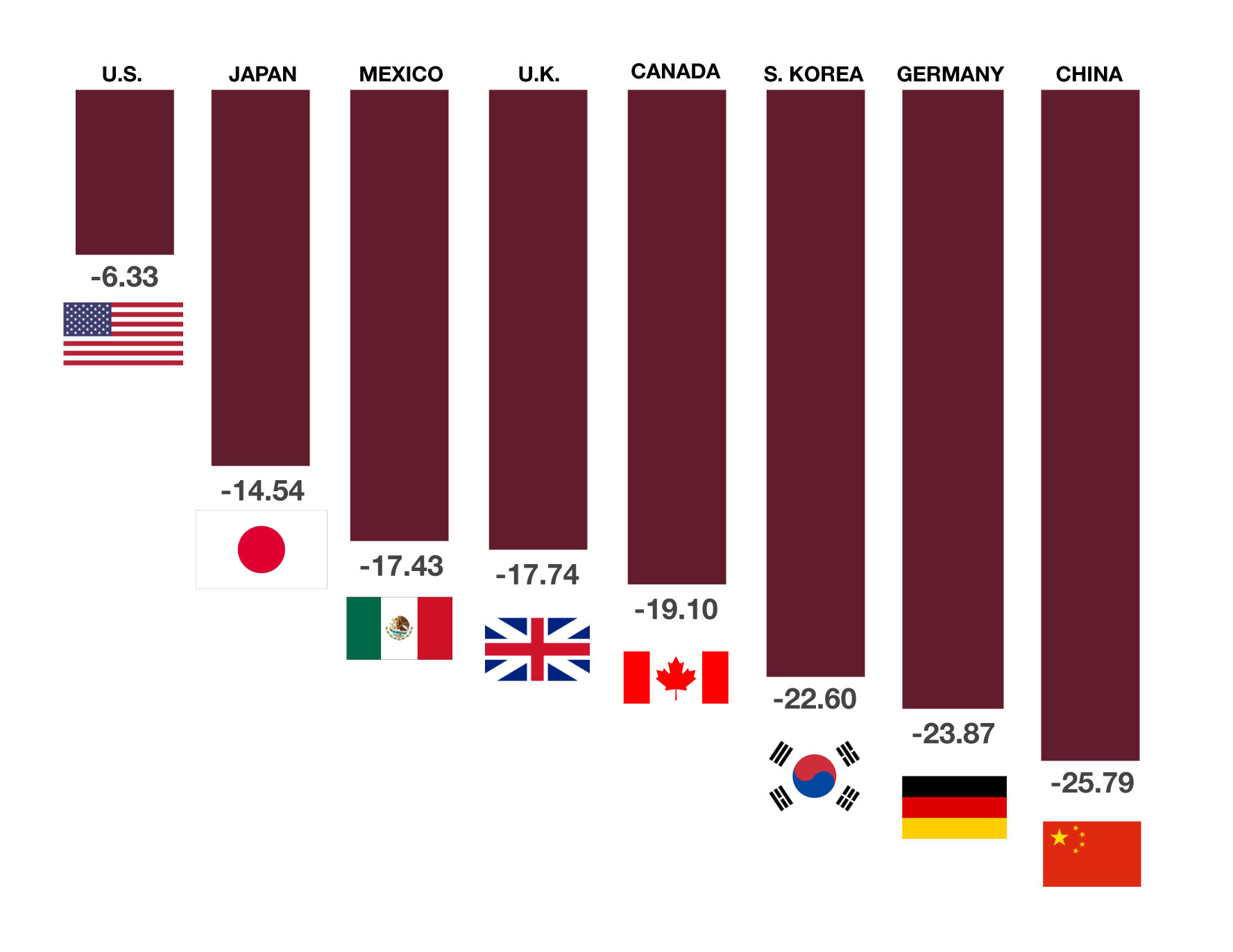

Global Equity Markets Decline – Equity Review

Volatility throughout the trading year kept stock valuations tough to determine. A popular process that analysts use to value stocks is based on Price Earnings (PE) ratios, calculated by dividing the current market price of a stock by its earnings per share. PE ratios for stocks began the year above 20 for all three major equity indices and finished the year near 15. The lower the PE the less expensive stocks are relative to their earnings so a drop in PEs has made stocks more appealing to value seeking investors.

Billions of dollars in pension funds are among the culprits responsible for the dramatic upswings in the equity markets towards the end of December. Pensions allocate to equities for long-term holds rather than short-term trades, boosting the overall stability of the markets.

Global equity markets experienced widespread negative returns for 2018 with both developed and emerging market indices falling. Domestic equities faired better than international stocks for the year as earnings optimism and a strong dollar helped stabilized U.S. markets.

An increase in the use of options as a hedge against market volatility increased to roughly 20 million option contracts a day being traded, surpassing previous records according to data compiled by Options Clearing Corporation. Creative option strategies have evolved as increased stock volume accompanied by consistent volatility has become the norm. Computer as well as human initiated trades have also leant to staggering trading days resulting in wild market swings as traders cover open option contracts.

Sources: Options Clearing Corp., Bloomberg, Federal Reserve; https://fred.stlouisfed.org/series