Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview / Year In Review

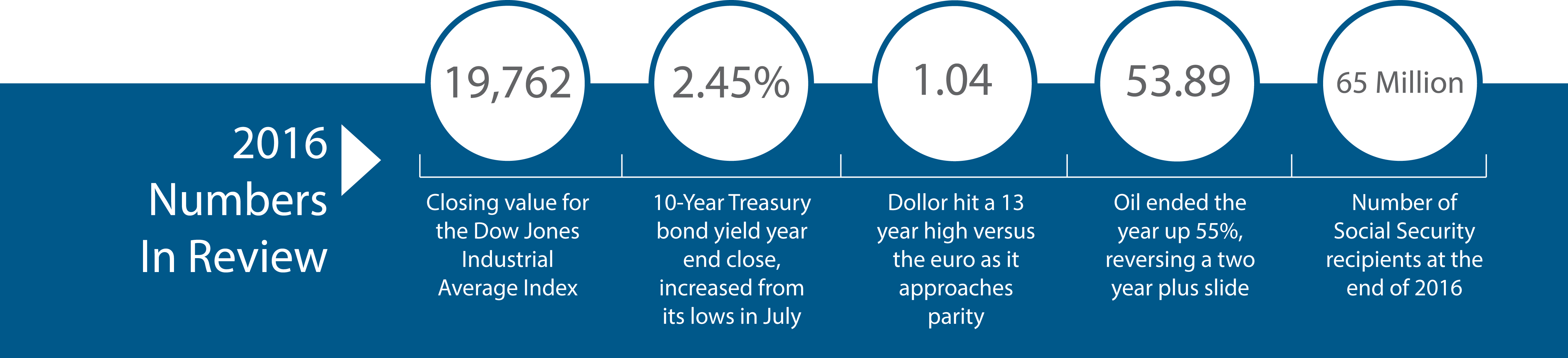

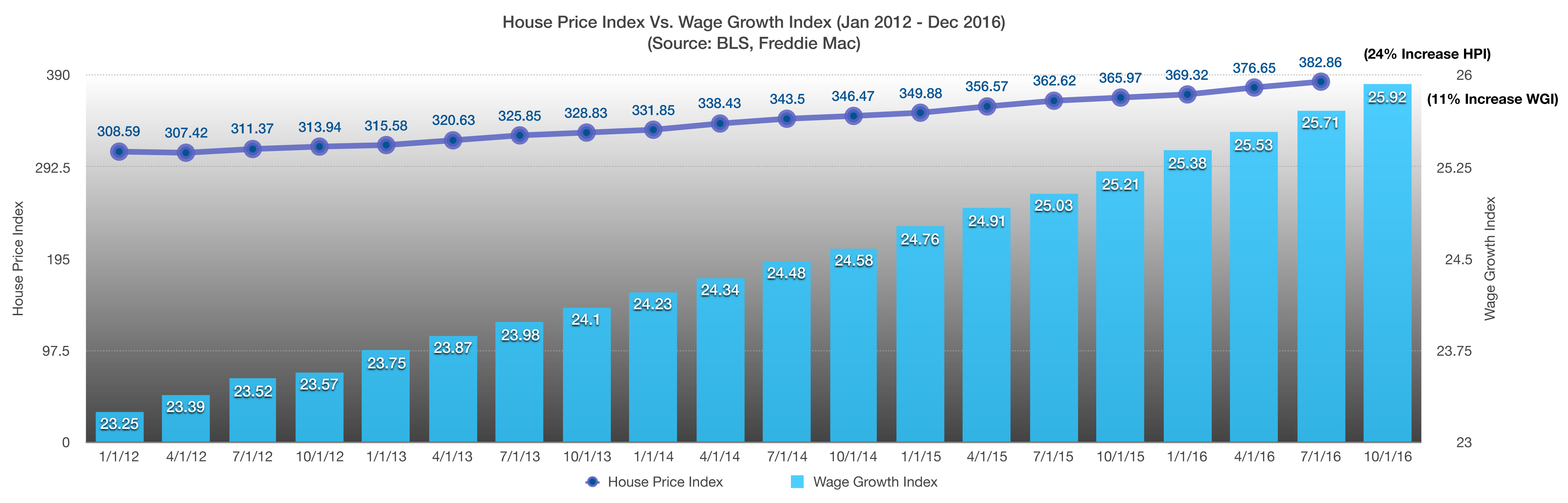

A year-end equity rally induced by a Trump victory lost momentum towards the end of December as doubts surfaced regarding Trump’s success in garnering support for his proposals from both Republicans and Democrats in the House and Senate.

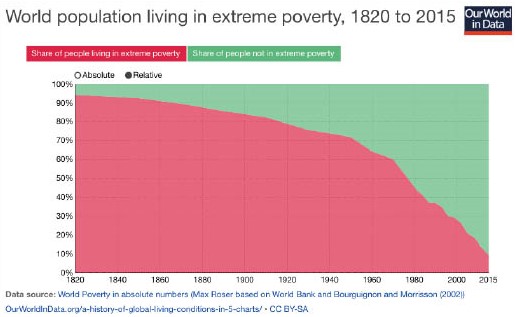

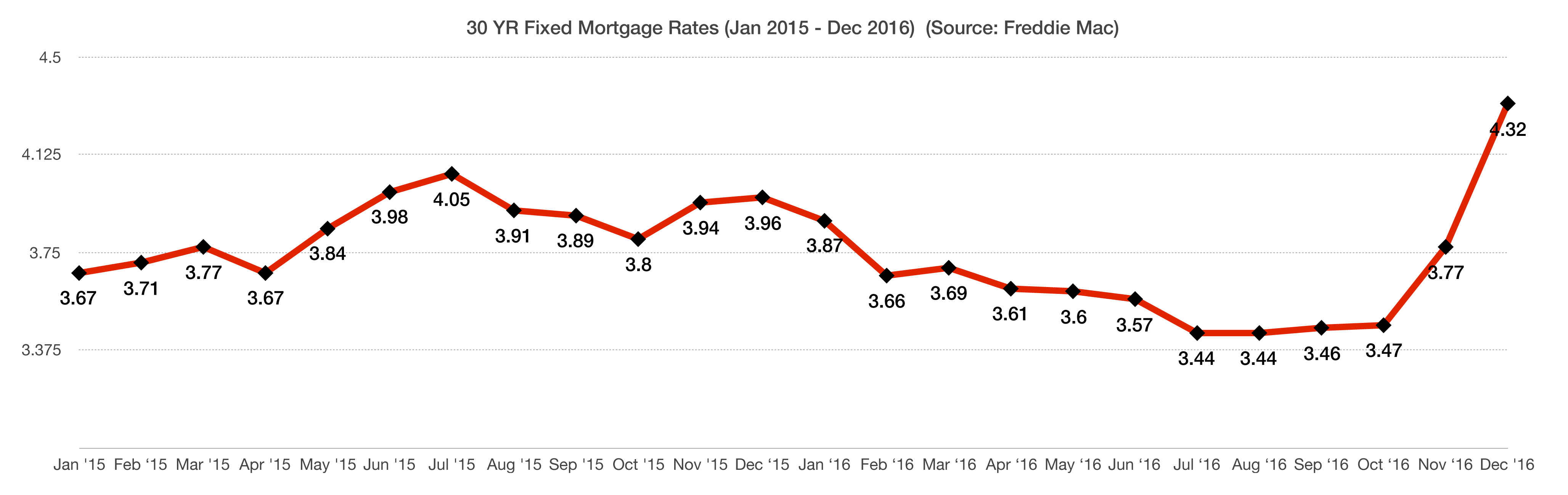

Two thousand sixteen was laden with uncertainty surrounding rates, growth, oil, the election, and Brexit. The S&P 500’s 15% drop in February proved to be temporary, as did the 10-Year Treasury Bond yield drop to 1.36% in July following Britain’s vote to leave the EU. As many times before, the market’s resilience carried it out of negative territory and onward to positive gains.

Oil also made a powerful comeback in 2016, rising from $26 a barrel in February to $53 a barrel at year-end. The rise in oil prices was a result of OPEC production cuts and an abundance of production coming from U.S. producers, helping lead the U.S. towards energy independence.

Equity markets pulled back at year-end as a gradual shift from equities to bonds took place, encouraged by the recent increase in bond yields, making fixed income attractive relative to a couple of months ago. A traditional rebalancing occurs at the end of each year, either shifting assets away from stocks to bonds or from bonds to stocks. This occurs as multi-billion dollar pension funds reallocate asset classes as expectations adjust.

The U.S. dollar had strong gains against various major currencies in 2016. Clarity surrounding the Fed’s decision to start raising rates along with anticipated growth expectations from Trump’s policies have catapulted the dollar. Both the anticipation of higher rates and a growing economy can help send currencies higher.

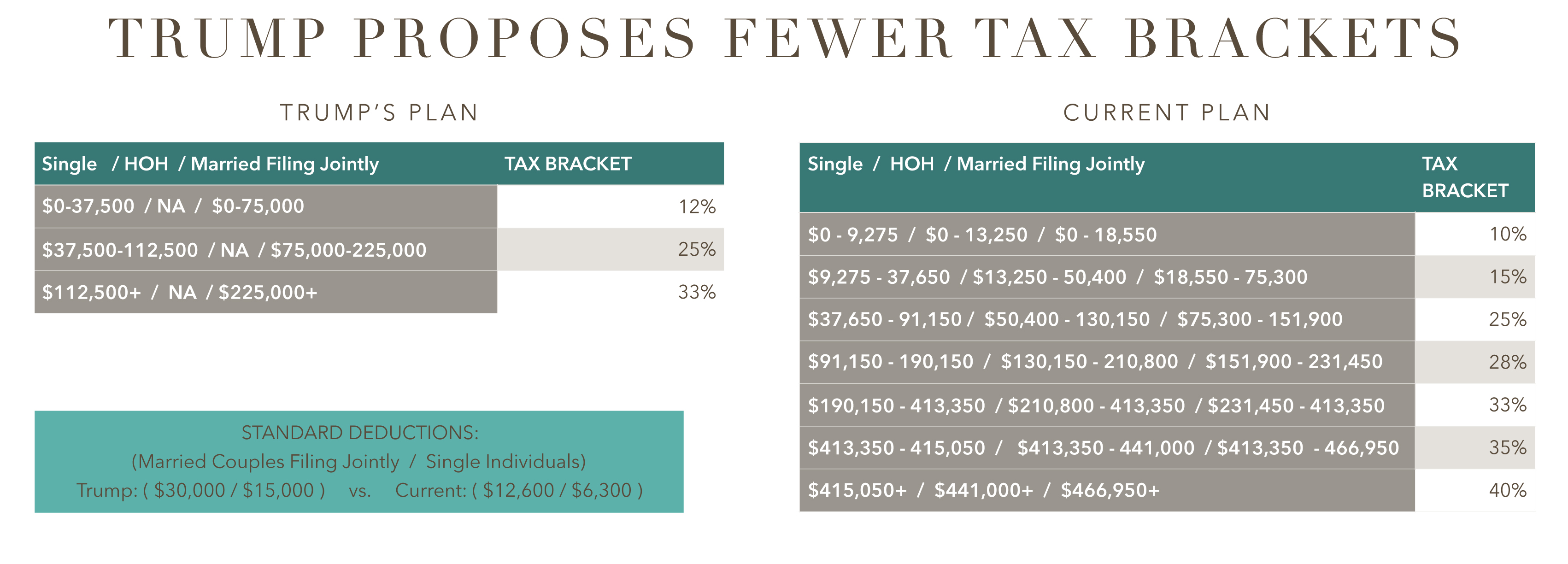

A number of banking and financial industry regulations are in question as Trump is expected to repeal various rules and provisions that many believe have hindered lending and consumer credit expansion. Trump will have the ability to repeal numerous rules and regulations almost immediately under the Congressional Review Act (CRA). The possibility of political hurdles and non-approvals for some of Trump’s appointments may cause uncertainty leading to volatility in the markets.

Two well regarded barometers of consumer confidence rose in December to higher levels. The University of Michigan’s preliminary consumer confidence index rose to 98 and the Conference Board’s Consumer Confidence Index rose to 113.7. Sentiment among U.S. consumers is critical to the health of economic growth as greater spending evolves from growing confidence. (Sources: Univ. of Michigan, Conference Board, S&P)

arketplace.

arketplace.