Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

The rally in stocks that began following the election in 2016 propelled through 2017 as optimism and expectations that growth oriented policies and tax cuts would materialize. Political turmoil was not a deterrent for the markets, as major U.S. equity indices finished the year at near record levels.

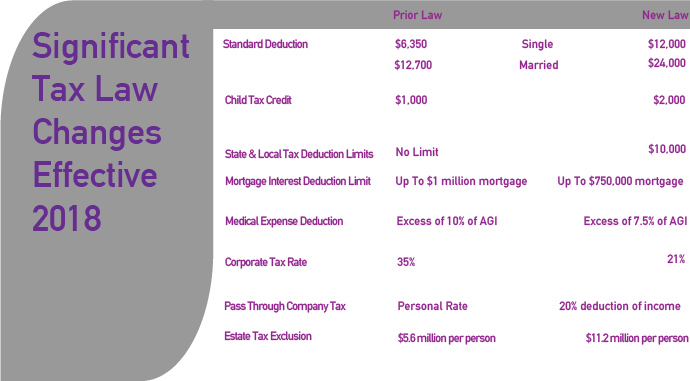

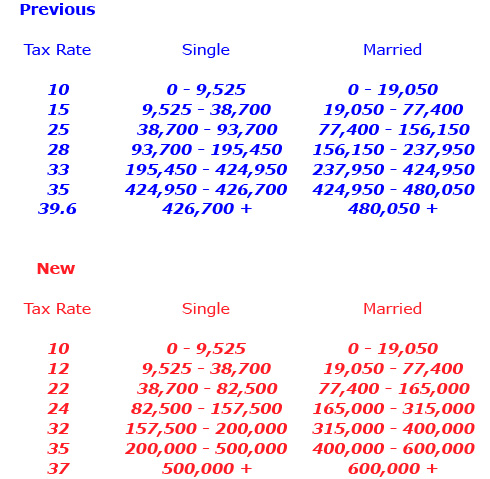

The Tax Cut & Jobs Act was signed into law by the President on December 22nd, setting the stage for new tax codes and rules effective January 1, 2018. Following the passage of the new tax law legislation, small businesses and larger corporations prepare for optimal methods of spending capital and expanding in 2018.

Congress passed a short-term funding plan to avert a government shutdown between December 22nd to January 19th. Since federal funding gaps are common, Congress institutes a continuing resolution or CR to provide interim funds in order to maintain government operations.

Strengthening economic conditions throughout the international markets helped buoy global stocks and mildly boost inflationary pressures, which can be beneficial for certain equities. Economic stimulus efforts by central banks were reigned in during 2017, as developed and emerging market economies exceeded growth expectations.

The Federal Reserve raised rates as expected with the objective of curtailing inflationary pressures. The December rate hike was the third of the year, pushing shorter-term rates higher, which are more sensitive to Fed rate increases. Overall, rates remained fairly stable in 2017, as inflation and economic growth were tepid. The 10-year Treasury yield ended 2017 at 2.40%, down from 2.45% at the beginning of the year.

Confusion surrounding prepayment of property taxes was a nationwide problem the last week of the year as homeowners rushed to prepay 2018 property tax bills without being certain if a deduction could be taken in 2017. In a statement, the IRS did specify that taxpayers could deduct prepaid 2018 state and local property taxes on 2017 returns only if the taxes were assessed before 2018.

(Sources: Congress.gov, Federal Reserve, IRS, U.S. Treasury)

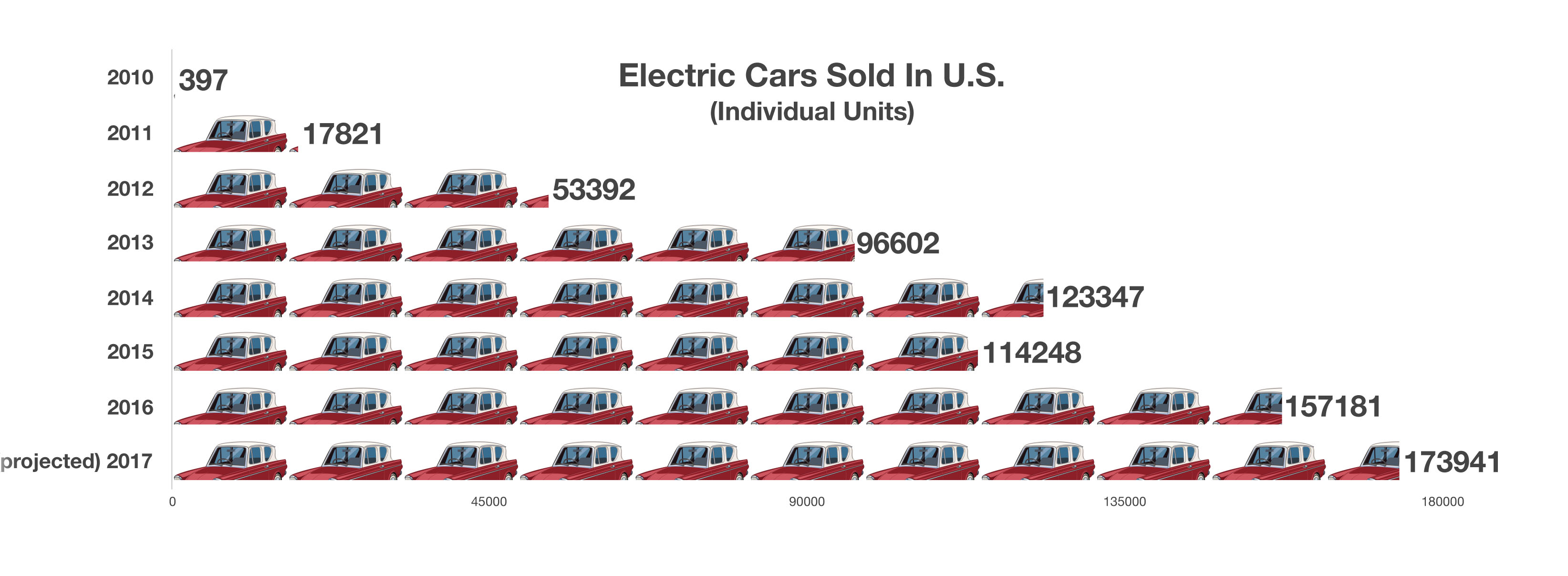

There are currently over 253 million cars and trucks on U.S. highways, with roughly 550,000 of them electric. Electric vehicles have also grown in popularity in other countries as new models and manufacturers have evolved. China, Japan, the Netherlands and Norway are among the countries with the largest amount of electric vehicles. Estimates for 2017 electric car sales in the U.S. are expected to be about 174,000 vehicles, up from 157,000 in 2016. Numerous manufacturers and brands have introduced new models prompting competition in the industry. (Sources: InsideEVs, Dept. of Transportation)

There are currently over 253 million cars and trucks on U.S. highways, with roughly 550,000 of them electric. Electric vehicles have also grown in popularity in other countries as new models and manufacturers have evolved. China, Japan, the Netherlands and Norway are among the countries with the largest amount of electric vehicles. Estimates for 2017 electric car sales in the U.S. are expected to be about 174,000 vehicles, up from 157,000 in 2016. Numerous manufacturers and brands have introduced new models prompting competition in the industry. (Sources: InsideEVs, Dept. of Transportation)

many of the changes directly benefit large and small businesses in order to encourage hiring.

many of the changes directly benefit large and small businesses in order to encourage hiring.