Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Erin Muterspaugh, Client Service

With the Holidays behind us and the New Year underway, we are excited to see what 2019 has in store! In the months ahead, you can expect to enjoy a monthly newsletter like the one below with interesting articles on current events as it relates to the financial industry. This month we’ve included an article discussing federal shutdowns and a quick overview of tax rule changes going into effective in 2019. As always, we are

Ben Shrader, Financial Advisor

here to help you !

The Common Occurrence Of Government Shutdowns – Fiscal Policy

Government shutdowns have been a common occurrence over the years under most every president. The length of the shutdowns have varied from 2 days in 1981 under

Estimated costs of the most recent government shutdown are still unknown, with lost wages, exports, and government services essential to the operation of private sector businesses being affected. How much the shutdown may have weighed on the economy may not be known until later in the year.

Government shutdowns entail partial closure of certain agencies and departments, not complete closures. Departments affected during the most recent shut down include Homeland Security, Housing & Urban Development, Commerce, FCC, Coast Guard, FEMA, Interior, Transportation, and the Executive Office of the President.

Federal employees deemed as “essential” among the various departments are required to work without pay until a funding bill is passed by Congress. The closures affect numerous private businesses that rely and adhere to regulatory rules imposed by the Federal government, such as mortgage loans and Housing & Urban Development.

Sources: Congressional Records, https://www.congress.gov/congressional-record/2018/12/22

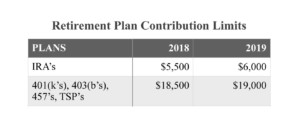

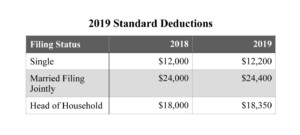

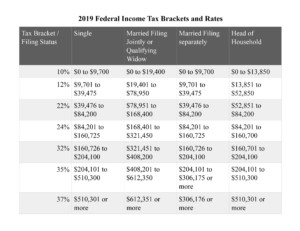

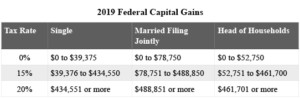

Tax Rule Changes For 2019 – Tax Planning

Tax Rule Changes For 2019 – Tax Planning