Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

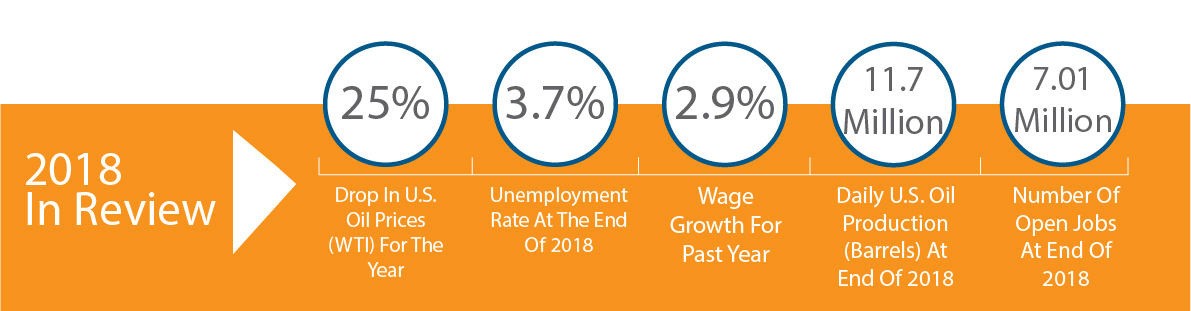

Even during the turbulent year of 2018, the U.S. economy continues its resilience into 2019, with unemployment at its lowest level in 49 years, wage growth reaching levels not seen since 2009 and consumer spending and industrial production remaining strong. A tight labor market along with moderate inflation has maintained an accommodating environment for consumers.

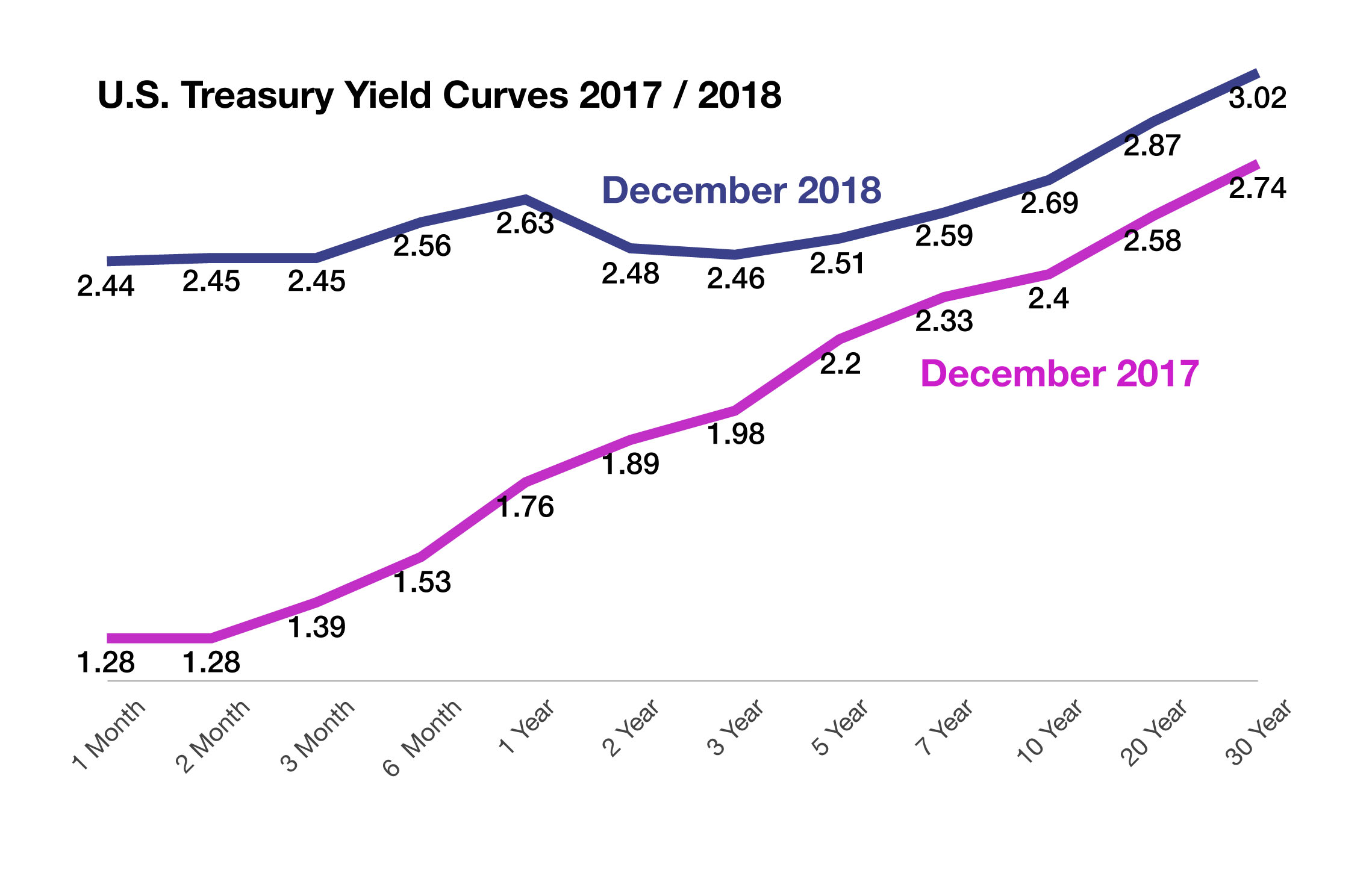

The year-end climate heading into 2019 became more challenging as equity markets reacted negatively to another rate hike in December along with two more expected hikes in 2019. Market sentiment seemed to change from the view of Fed hikes as validation that U.S. economic activity is healthy enough to endure them, to concern over slowing corporate earnings combined with balance sheet reductions could lead to a recession.

Weariness among investors escalated towards the end of 2018 with uncertainty also surrounding trade, a government shutdown, and global economic growth.

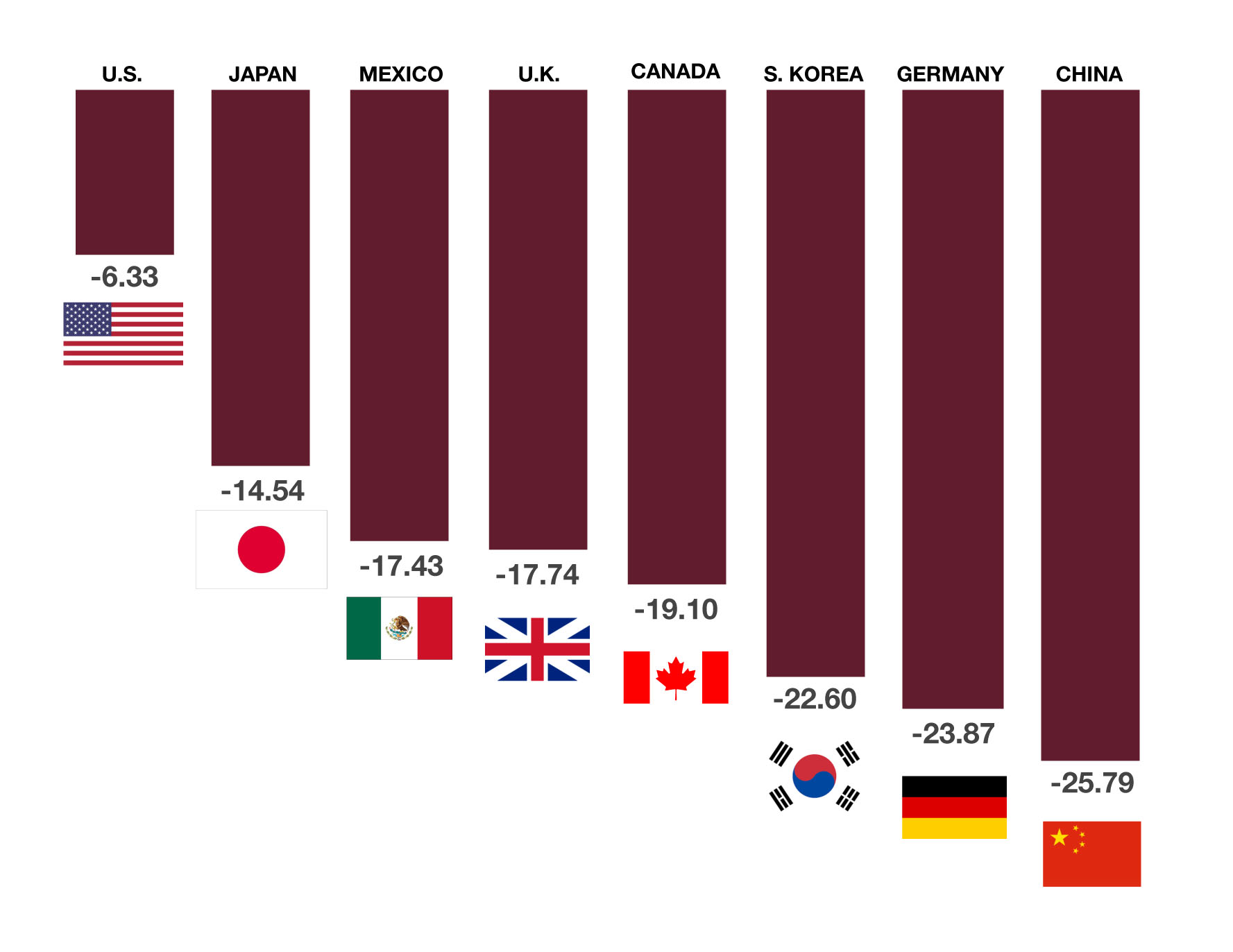

Global equity markets ended 2018 in negative territory with nearly every major index in both developed and emerging markets falling. China’s stock market was among the worst performer internationally as trade tensions took a toll on Chinese manufacturers and exporters. U.S. stock markets experienced volatility that had not occurred in several years resulting in a pullback for all major domestic equity indices in 2018.

Ongoing trade disputes and the imposition of new tariffs negatively influenced the markets and economic projections throughout the year. Relations with China were forefront as the administration negotiated trade terms intended to better protect U.S. intellectual property and disparate tariffs.

Growing U.S. oil production and an increase in supplies led to a drop of U.S. oil prices by 25% in 2018. The benchmark for U.S. oil, West Texas Intermediate (WTI), fell from $60 per barrel in the beginning of the year to $45 per barrel by year-end, simultaneously reducing the price of gasoline nationwide and freeing up cash for consumers.

According to the Federal Reserve Bank of New York, the likelihood of a recession remains relatively low with less than a 15% probability one will occur in the next year. The Fed has historically seen greater than 30% probabilities before each of the last seven recessions since 1970.

(Sources: Federal Reserve Bank of New York, Treasury, Labor Dept., Bloomberg)