Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

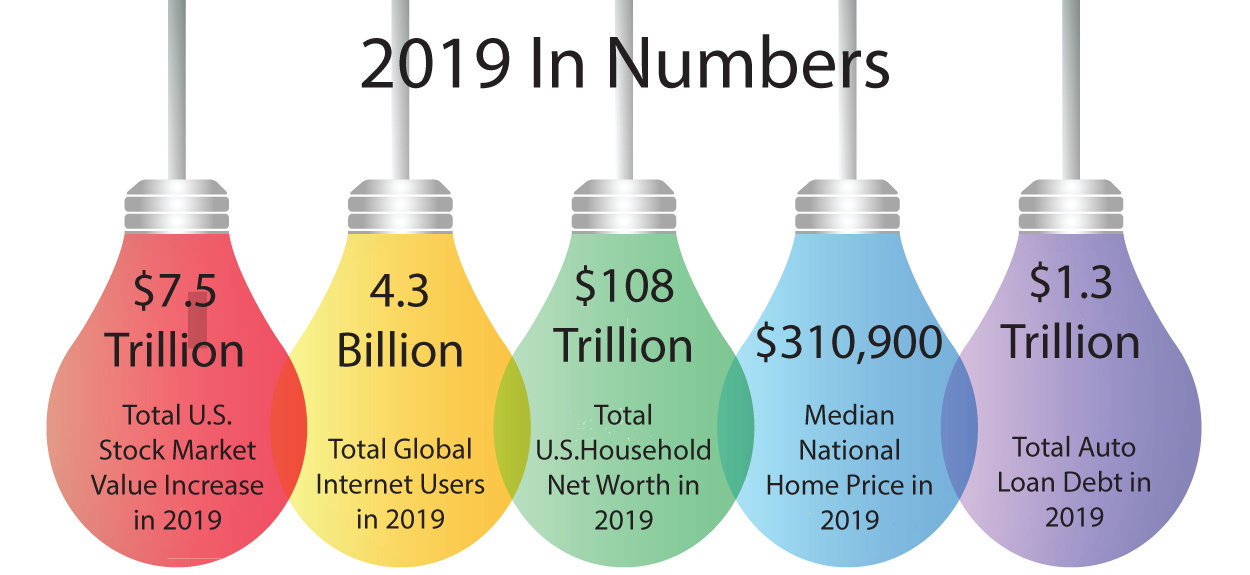

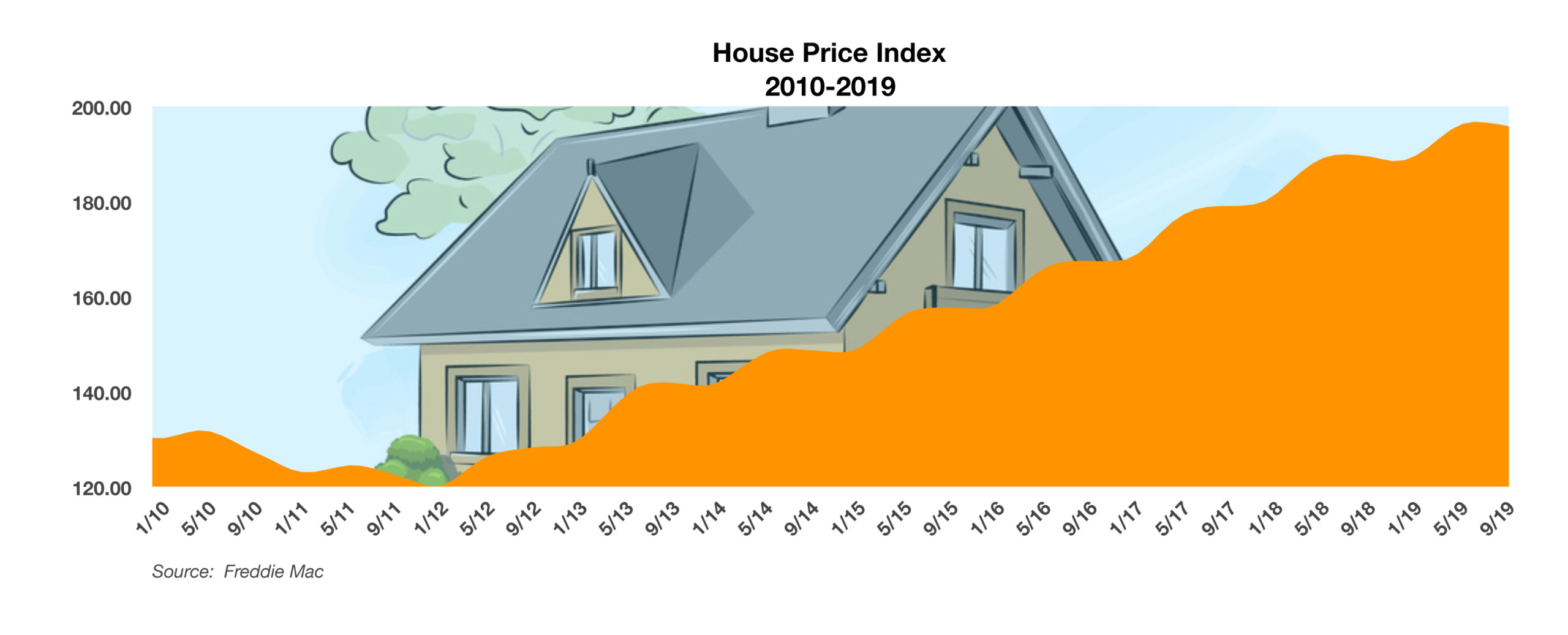

Financial markets experienced a bountiful decade for stocks and bonds, bolstered by innovative technological advances and a low-interest-rate environment fostered by the Federal Reserve. The 2010s was the first decade in U.S. history to avoid a domestic economic recession, with accelerated growth in various sectors including technology, healthcare, and industrials.

A calm in the markets was displaced as tensions in the Middle East spurred concern early in the new year. Global equity, bond, and commodity markets reacted to developments in the region that unleashed a tsunami of unease as the U.S. and Iran faced off over the repercussions of the death of Iranian military leader Major General Qasem Soleimani.

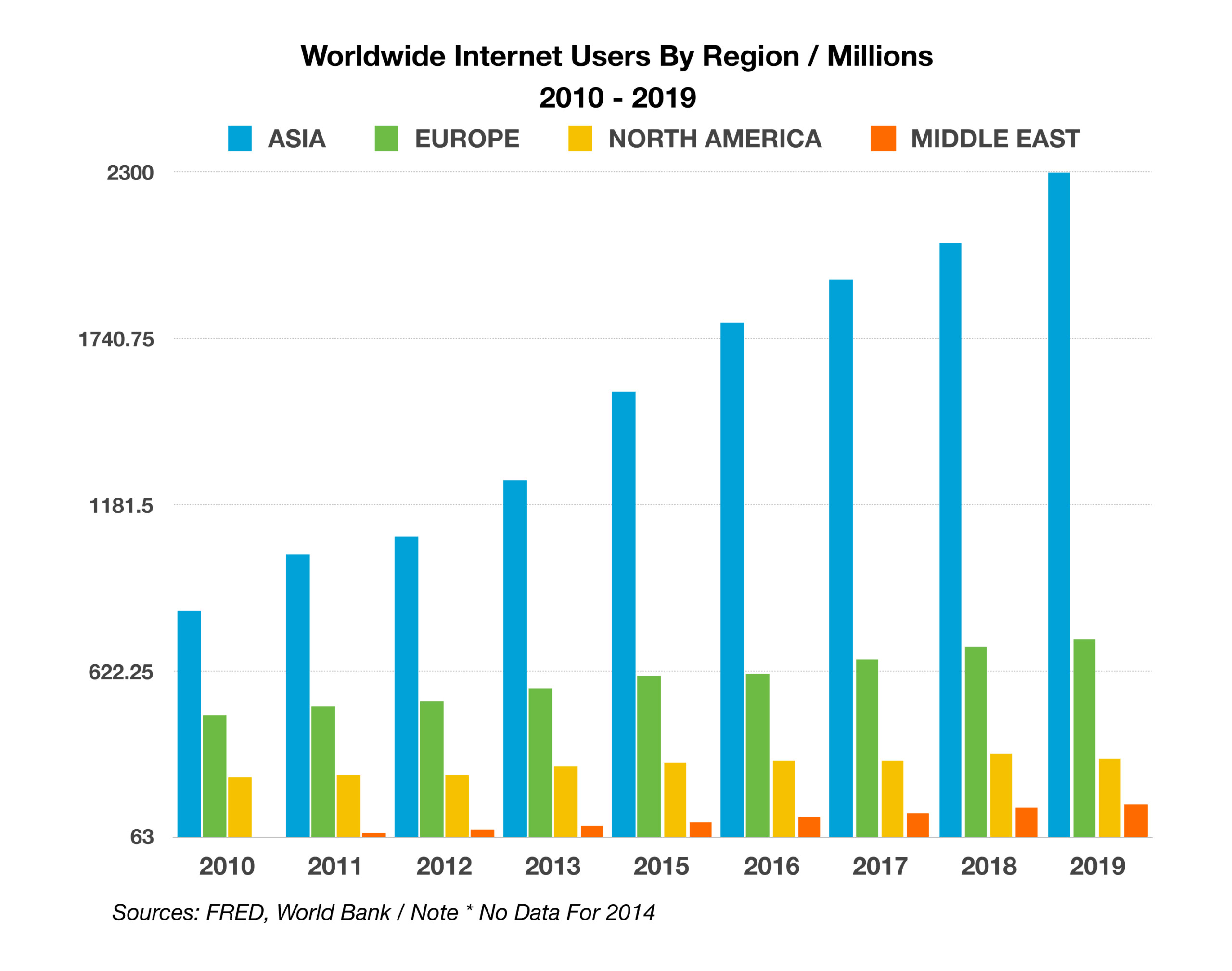

International markets advanced in 2019, propelled by low interest rates and a gradual global expansion. Robust gains in global equity markets occurred against a backdrop of negative rates in parts of the world, traditionally representative of dismal economic dynamics. The Federal Reserve plans to keep rates steady, with no expected increases or decreases unless inflationary pressures become prevalent. Inflation has been surprisingly subdued, despite the unemployment rate sitting at a 50-year low alongside gradual economic expansion.

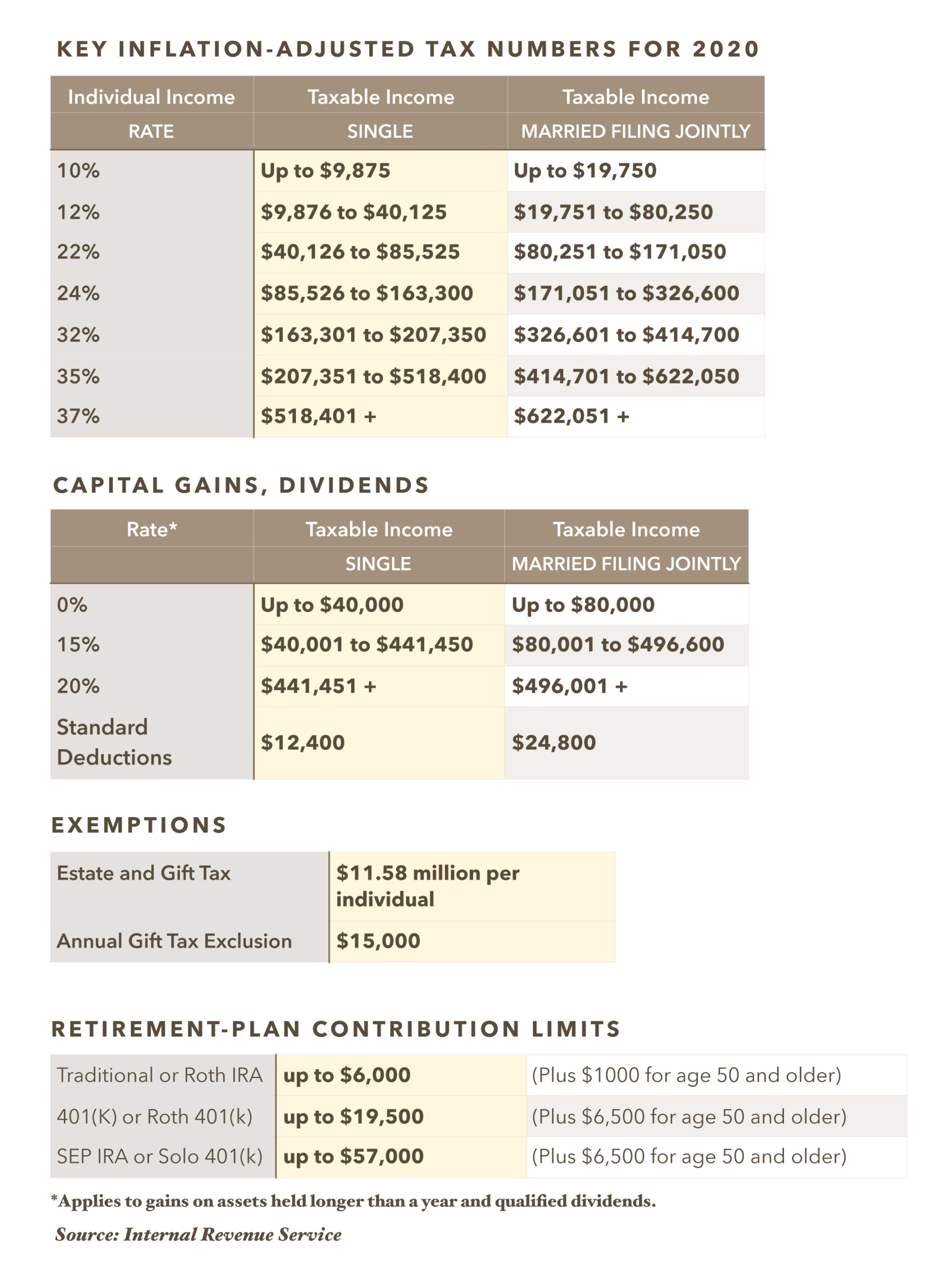

The IRS is providing annual inflation adjustments for over 60 tax provisions, including tax rate schedules, exemptions, and standard deductions. Notable increases affecting many taxpayers include the standard deduction for those married, filing jointly increased to $24,800, and 401k contribution limits increased to $19,500 for 2020. The tax code provision allowing for a $3,000 write-off for capital losses, applicable to stocks and mutual funds, is an unindexed provision that is will not be changing this year and hasn’t seen an increase since 1977.

The Federal Reserve continued to inject liquidity into the financial markets by buying bonds and actively participating in the repo market at the end of 2019. Many analysts believe that the Fed’s actions have dampened volatility prompted by the recent geopolitical upheaval in the Middle East. (Sources: IRS, Labor Dept., Federal Reserve, CBO.gov., U.S. Treasury, Tax Policy Center)