Troy Peterson, CFP®, ChFC®, RFC®, CF2®, CBDA, MBA

PGP Wealth Services

Mobile: 818-842-5625

Toll-Free: 888-693-5292

tpeterson@pgpwealthservices.com

www.pgpwealthservices.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

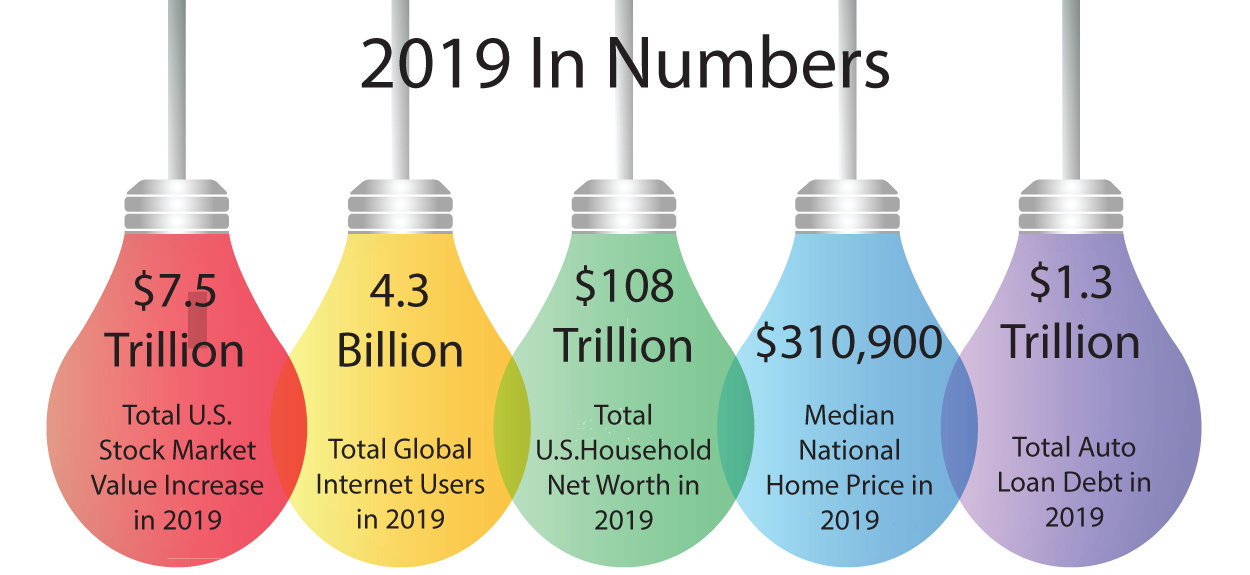

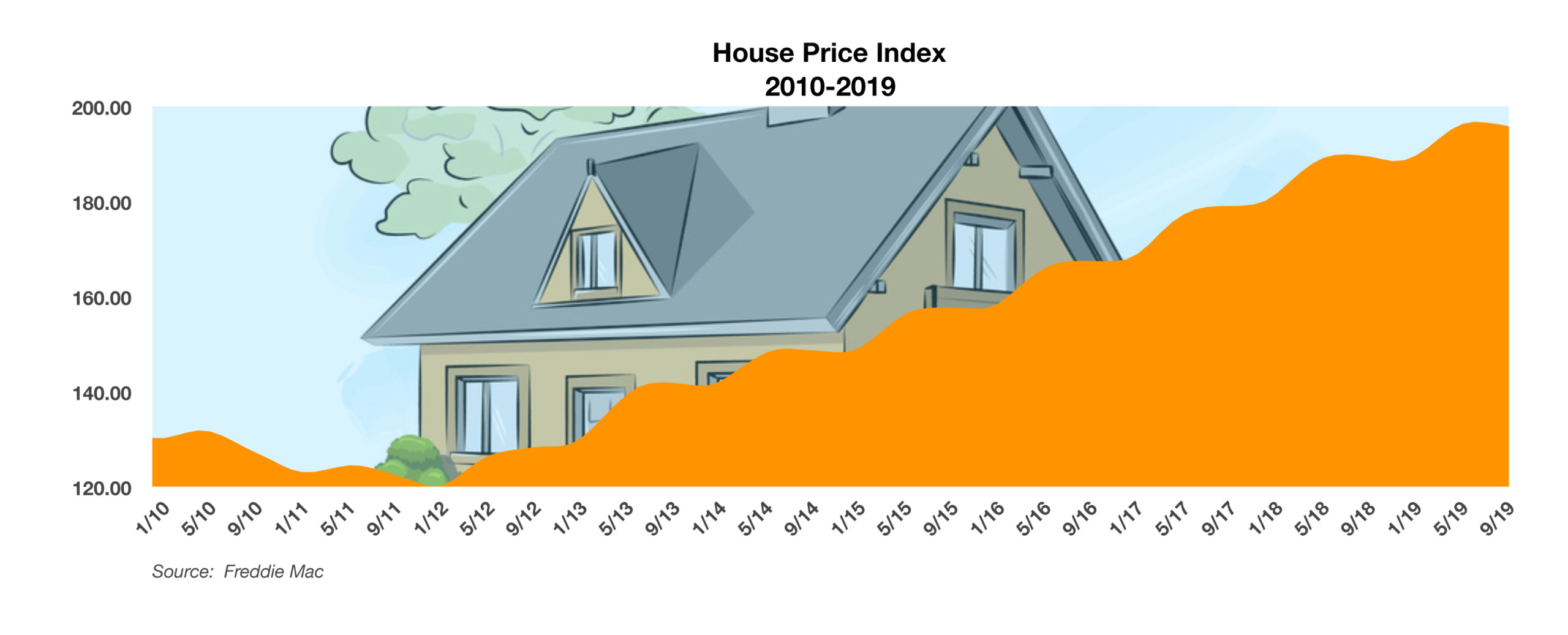

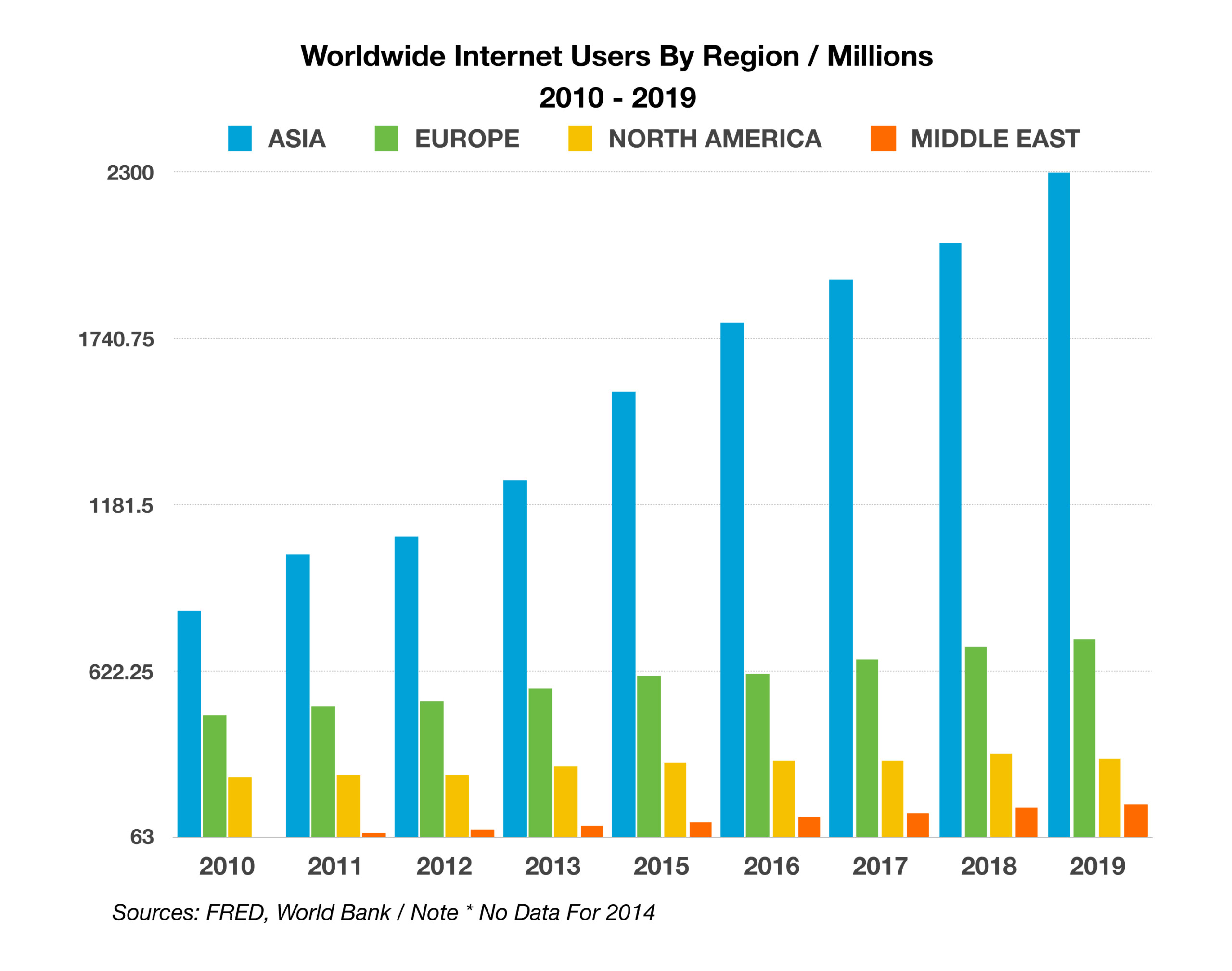

Financial markets experienced a bountiful decade for stocks and bonds, as a low rate environment fostered by the Federal Reserve and technological advances driven by innovation, catapulted values higher. The 2010 decade was the first decade to avoid a domestic economic recession, with accelerated growth in various sectors including technology, healthcare, and industrials.

A calm in the markets was displaced as tensions in the Middle East spurred concern early in the new year. Global equity, bond, and commodity markets reacted to developments in the region that unleashed a wrath of unease.

International markets advanced in 2019, propelled by low interest rates and a gradual global expansion. Robust gains in global equity markets came about against a backdrop of negative rates in parts of the world, traditionally representative of dismal economic dynamics. Historically low rates during the past decade also incentivized governments and companies worldwide to borrow, boosting growth in expansion and capital investments globally. The Federal Reserve plans to keep rates where they are, with no expected increases or decreases unless inflationary pressures become prevalent. Inflation has been surprisingly contained even with the unemployment rate at a 50-year low along with a gradual economic expansion.

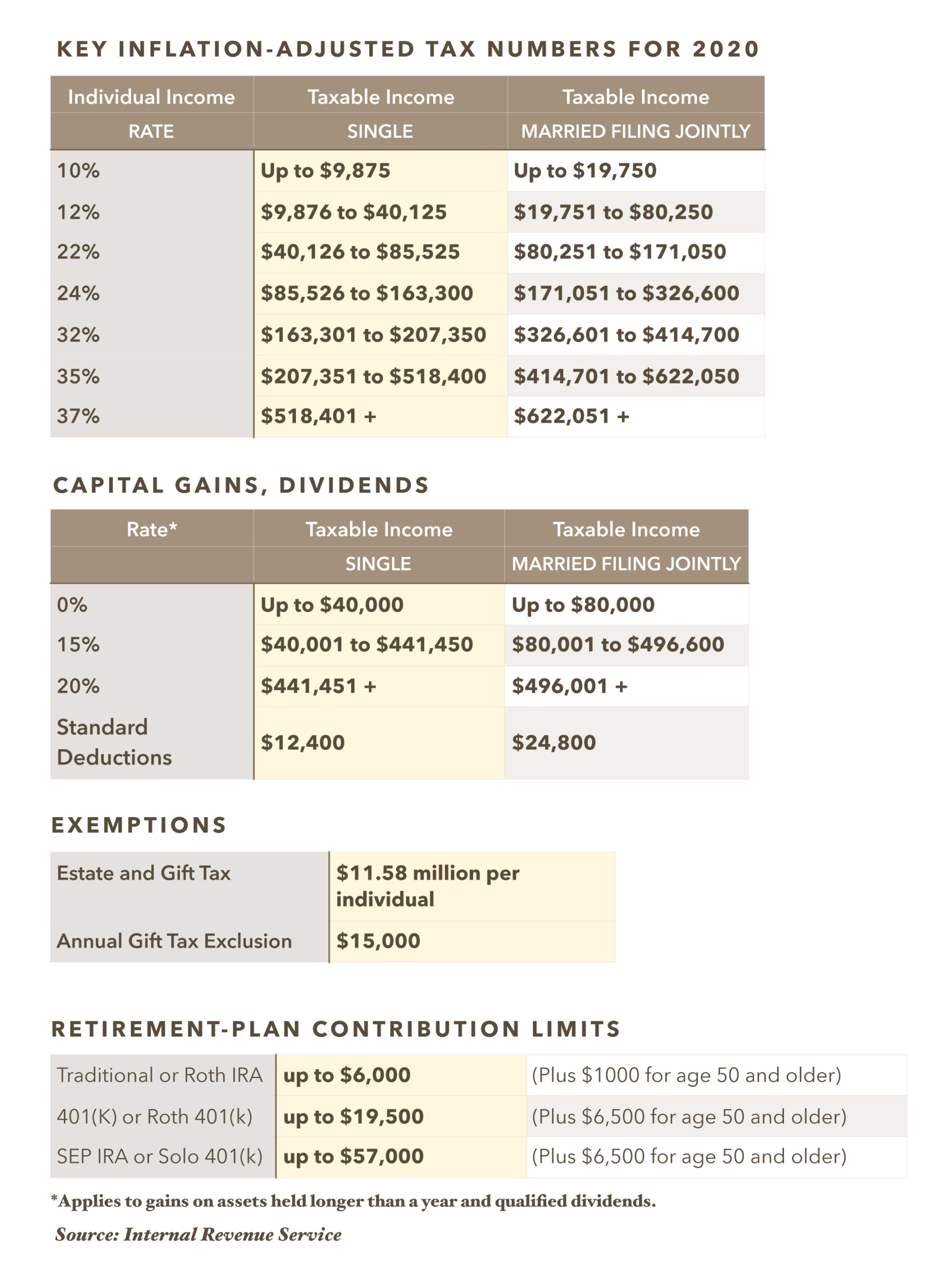

The IRS is providing annual inflation adjustments for over 60 tax provisions, including tax rate schedules, exemptions, and standard deductions. Notable increases affecting many tax payers include the standard deduction for married, filing jointly up to $24,800, and 401k contribution limits up to $19,500 for 2020. The tax code allowing for a $3,000 write off for capital losses, such as on stocks and mutual funds, is an unindexed provision that isn’t changing and hasn’t had an increase since 1977.

The Federal Reserve continued to inject liquidity into the financial markets via buying bonds and actively participating in the repo market at the end of 2019. Many analysts believe that the Fed’s actions have dampened volatility ensued by the recent upheaval in the Middle East. (Sources: IRS, Labor Dept., Federal Reserve, CBO.gov., U.S. Treasury, Tax Policy Center)