Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

COVID-19 reshaped financial markets, trade, retail, and consumer behavior globally in 2020, with lingering effects heading into 2021. Markets shrugged off pandemic concerns toward the end of the year, with all major U.S. equity indices reaching new highs in December. The distribution of vaccines, along with an anticipated resurgence in consumer demand, could elevate economic activity to levels last seen prior to the emergence of COVID-19.

The recently-passed $900 billion Coronavirus Relief Bill will place checks into the hands of millions of Americans, extend unemployment benefits, and provide renewed funding for the Paycheck Protection Program (PPP). Other provisions in the relief bill include deductions for business meals in 2021 and 2022, and a ban on surprise medical billing.

Vaccinations across the United States and internationally are expected to take months as distribution efforts pose a challenge. The CDC estimates that at least 70% to 80% of the 330 million U.S. population needs to be vaccinated in order to achieve herd immunity. Guidelines issued by the CDC suggest that healthcare and essential workers should receive vaccinations first, then offered to the general public. The CDC is delegating the distribution of vaccines and the prioritization of inoculations to the individual states.

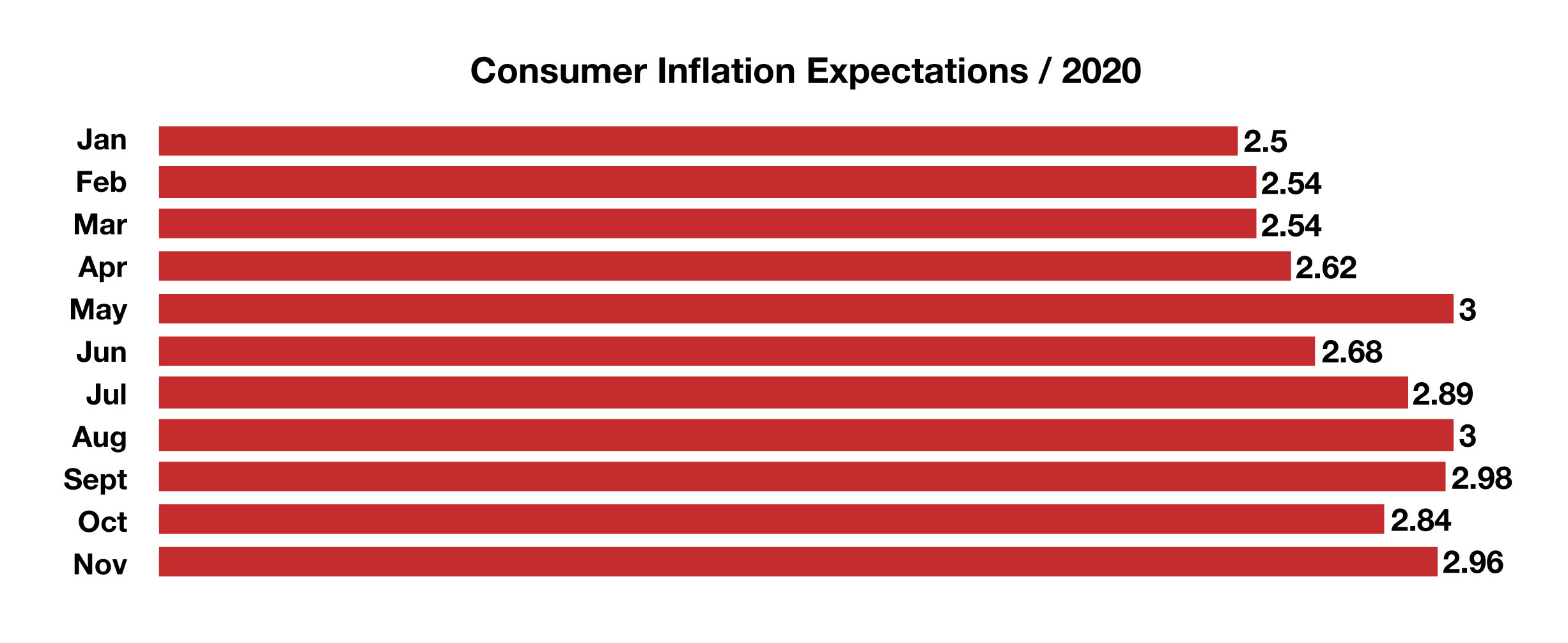

Economic analysts widely expect optimism regarding the national vaccination campaign to propel consumer confidence higher, potentially leading to elevated spending levels. Employment and wages, which were under pressure for most of 2020, are also critical factors in determining ongoing consumer expenditures. Consumer inflation expectations rose in 2020 with the anticipation of lasting inflationary pressures heading into 2021.

The Federal Reserve communicated in December that it would continue to keep the federal funds rate near zero and buy $120 billion worth of bonds monthly until the employment situation improves. Rates held relatively steady near historic lows in 2020, as ambitious efforts by the central bank facilitated liquidity and borrowing to support economic stability.

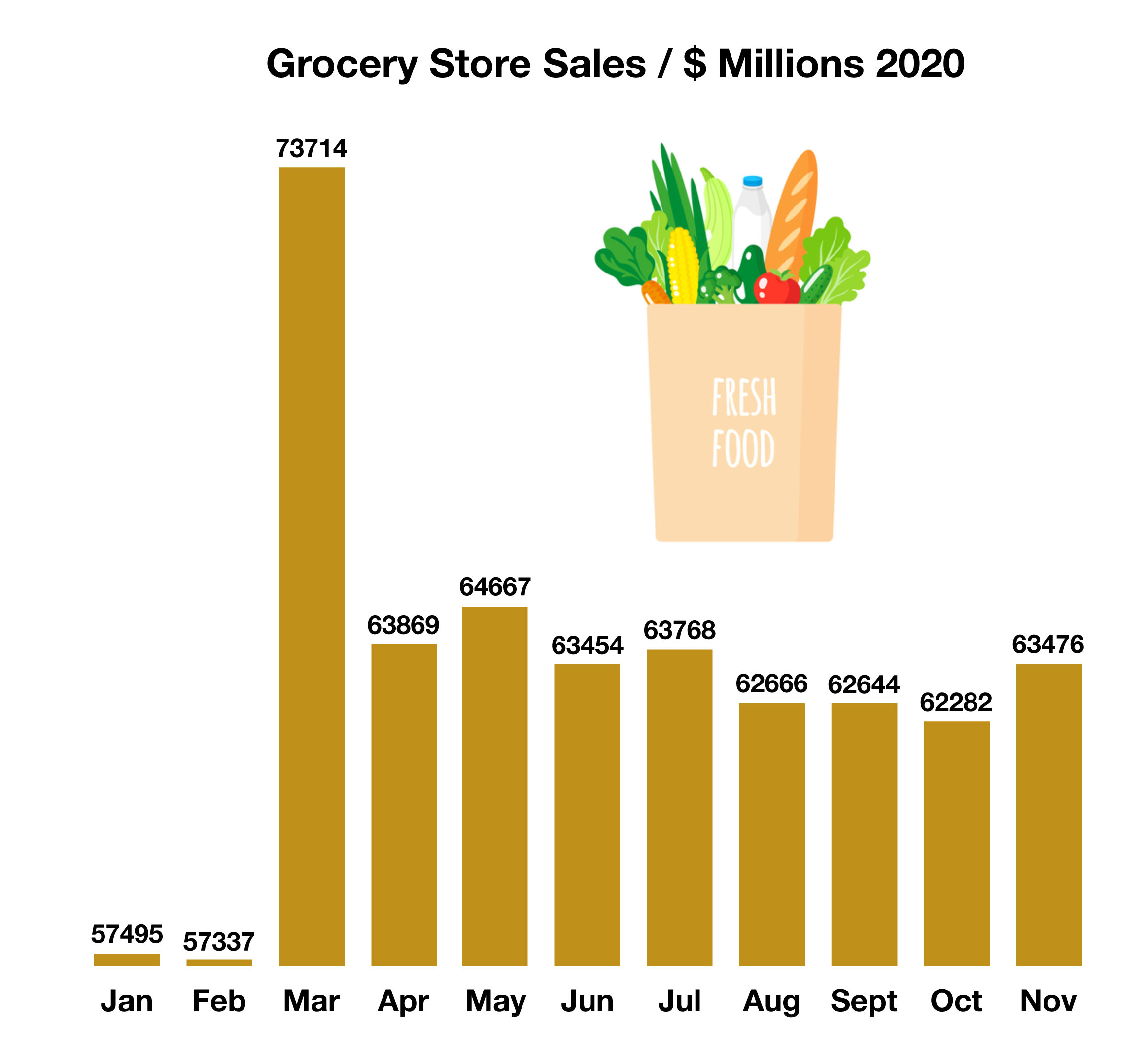

Behavioral consumer changes precipitated by the pandemic shifted spending from restaurants, travel, and movies to grocery stores and online shopping. Some economists expect these trends to remain even in a post-pandemic environment.

Sources: Federal Reserve, CDC, Treasury, Tax Foundation