Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Portfolio Overview

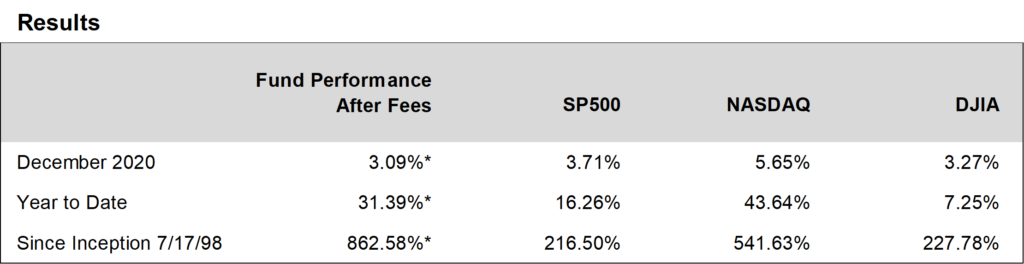

2020 was an extraordinary year for the Ocean Park funds. The Ocean Park Investors Fund gained 31.38%*, almost double the performance of the S&P 500 (up 16.26%) and the HFRI Equity Hedge Index (up 17.41%). Technology stocks generated outsized gains, with standout performance from, among others, Coupa Software, Crowdstrike, Docusign, Nvidia, Service Now, and Zoom Video.

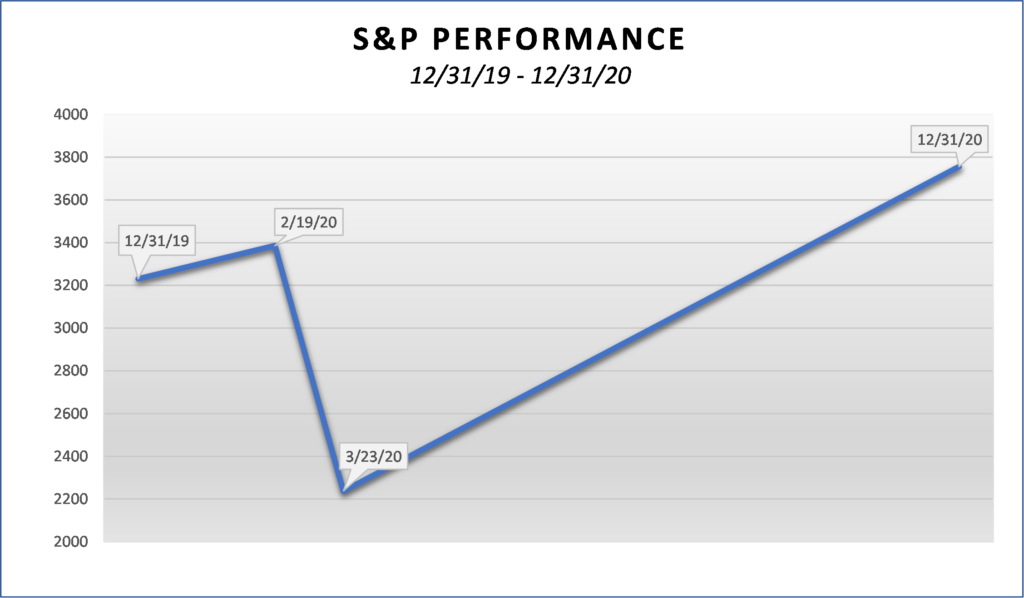

In any year, we make innumerable decisions about which stocks to buy or sell, and our performance is the accumulated result of the accuracy of those decisions. But this year one of our most important decisions was neither a buy nor a sell, but a decision not to sell. As we pointed out in the April newsletter, rather than trying to time the market, we chose to maintain the portfolio essentially intact during the dramatic downturn in March. This allowed us to participate fully in the equally dramatic upturn which followed, and put us in position to outperform for the rest of the year.

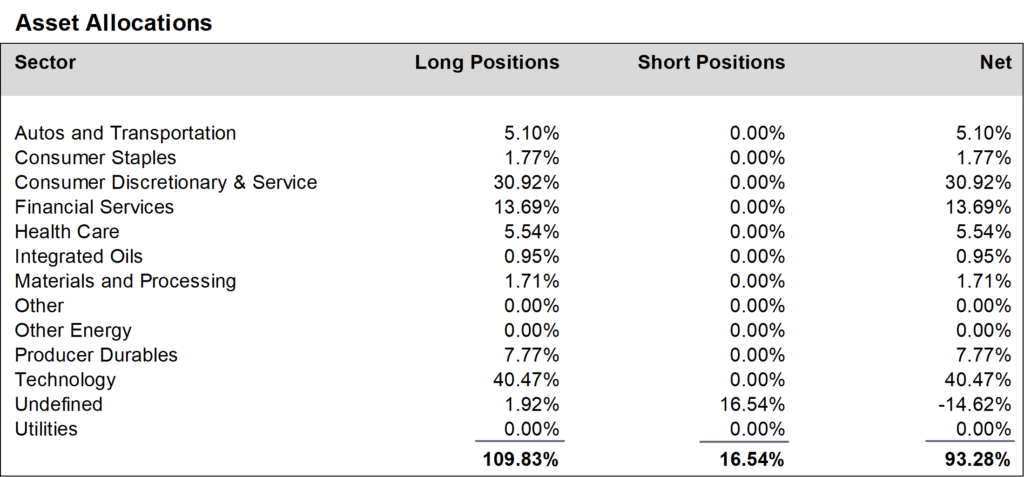

During December, we increased positions in the financial services sector and the autos and transportation sector, and reduced positions in the consumer discretionary and service sector. We also closed out our short position in QQQ options and we finished the month at about 93% net long, down from about 98% in November.

We once again thank you for your investment in the Fund, as we strive to build upon our long-term performance and earn your continued confidence.

Daily updates on our activity are available on our Results Line, at 310-281-8577, and current information is also maintained on our website at www.oceanparkcapital.com. To gain access to the site enter password opcap.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4. Past performance does not guarantee future results.