Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

January 2021 |

Macro Overview

COVID-19 reshaped markets, trade, retail, and consumer behavior globally in 2020 with lingering effects heading into 2021. Markets shrugged off pandemic concerns throughout the year, with all major equity indices reaching new highs in December. The anticipation of vaccinations along with the hope of a resurgence in consumer demand may eventually elevate economic activity to where it was before the emergence of COVID-19.

Passage of the $900 billion Coronavirus Relief Bill will place checks into the hands of millions of Americans as well as extend unemployment benefits and provide renewed funding for the Paycheck Protection Program (PPP). Other provisions included in the relief bill include deductions for business meals in 2021 & 2022 and a ban on surprise medical billing.

Vaccinations across the United States and internationally are expected to take months, as distribution efforts pose a challenge. The CDC estimates that at least 70% to 80% of the 330 million U.S. population needs to be vaccinated in order to achieve herd immunity. Guidelines issued by the CDC suggest that healthcare and essential workers should receive vaccinations first, then offered to the general public. The CDC is delegating the distribution of vaccines as well as the prioritization of inoculations to the individual states.

Optimism surrounding vaccinations is expected to propel consumer confidence higher, possibly leading to elevated spending levels. Employment and wages, which were hindered for most of 2020, are also critical factors in determining consumer expenditures.

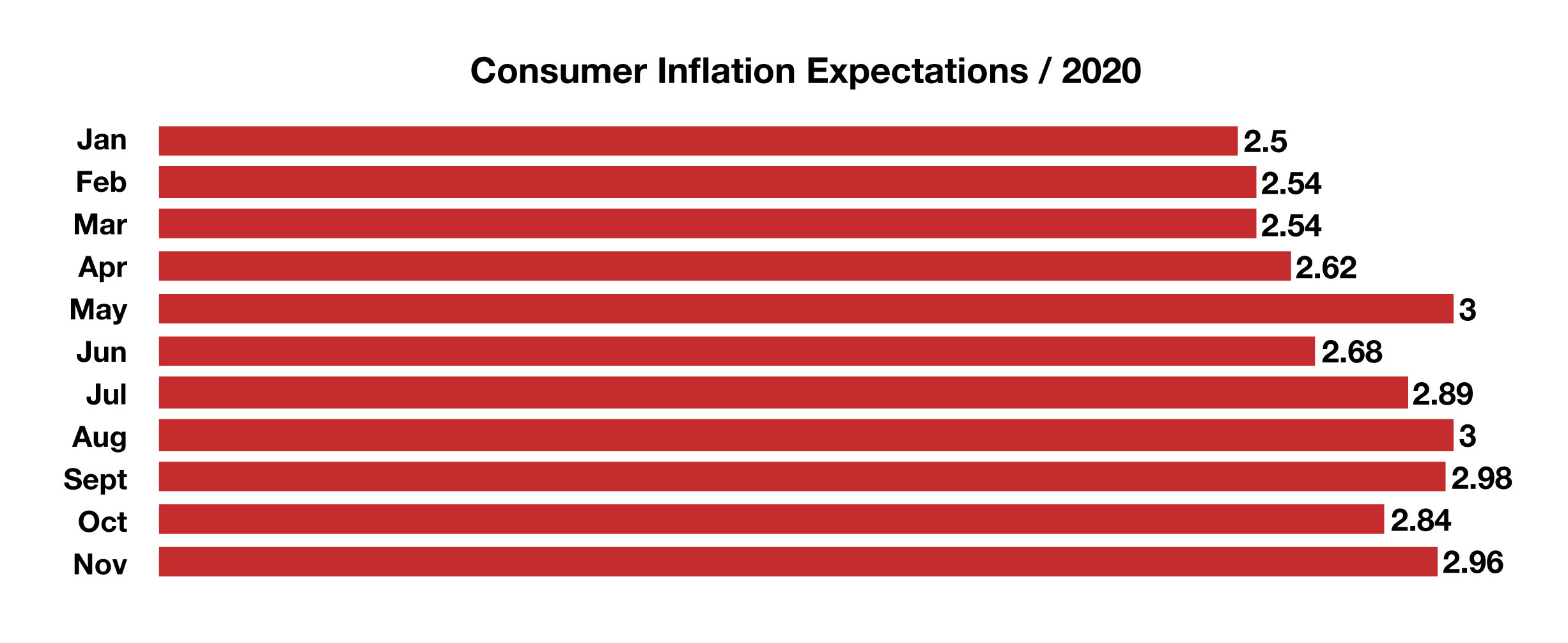

The onset of inflation is becoming a reality for millions of Americans, as the cost of services and products has gradually been increasing since the pandemic began. Consumer inflation expectations rose in 2020 with the anticipation of lasting inflationary pressures heading into 2021.

The Federal Reserve communicated in December that it would continue to keep the federal funds rate near zero and buy $120 billion worth of bonds monthly until the employment situation improves. Rates held at historic lows in 2020 as ambitious efforts by the central bank facilitated liquidity and borrowing to maintain economic stability.

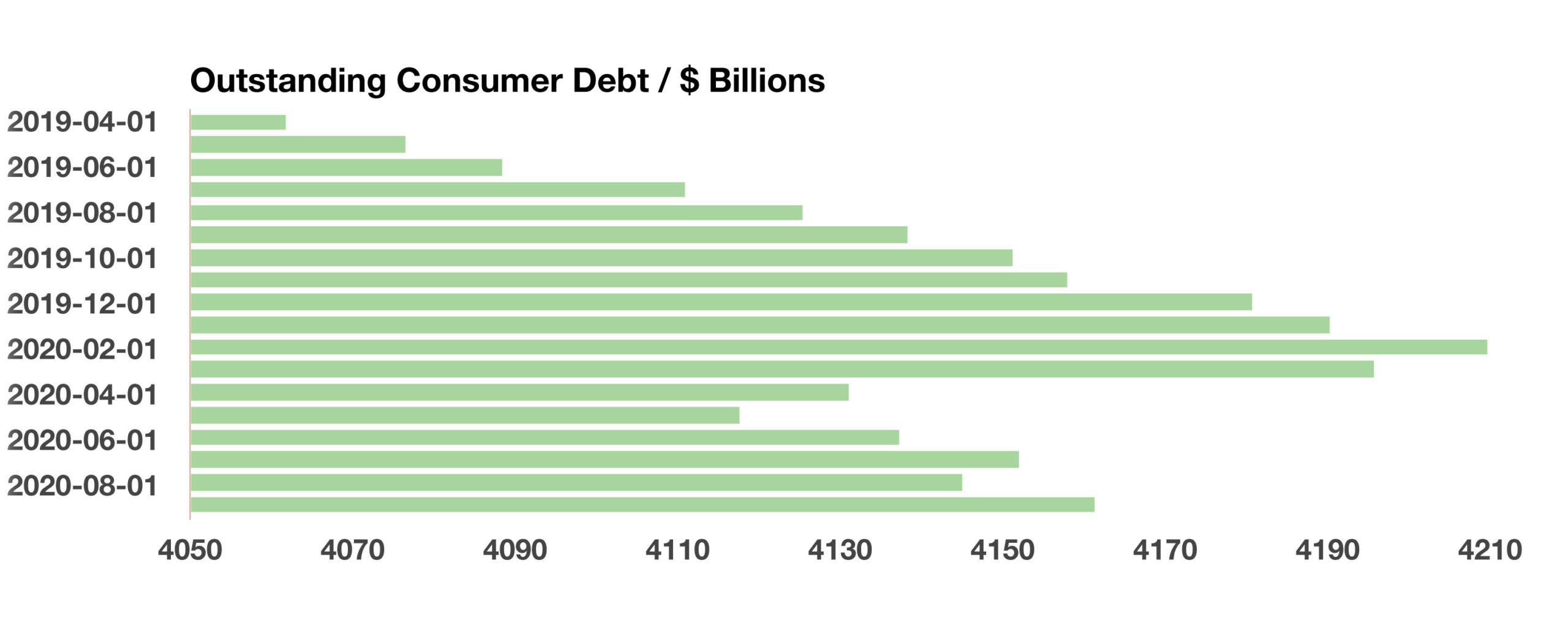

Behavioral consumer changes brought about by the pandemic shifted spending from restaurants, travel and movies to grocery stores and online shopping. Some economists expect the trend to stick even in a post pandemic environment.

Sources: Federal Reserve, CDC, Treasury, Tax Foundation