Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

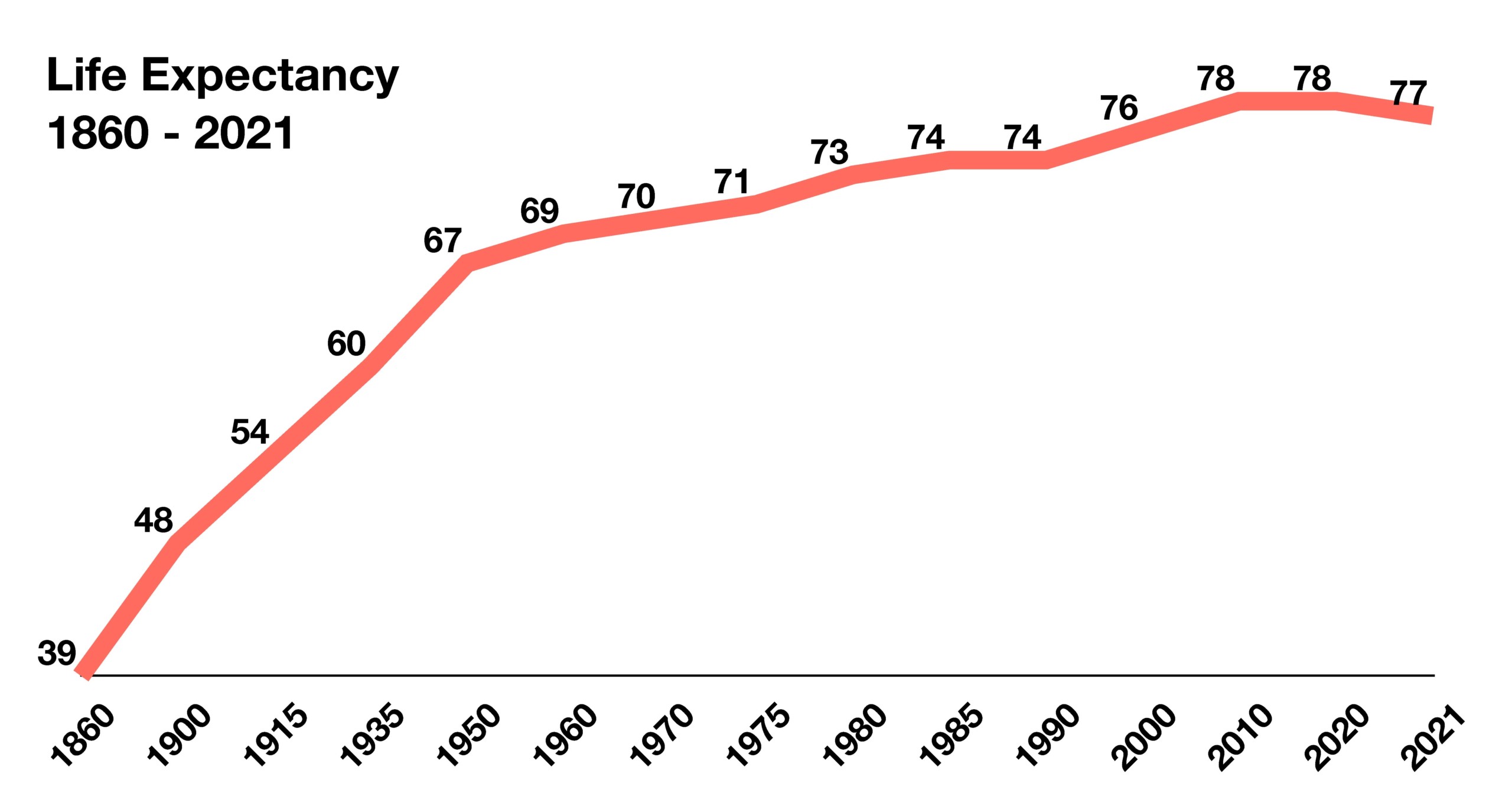

A year after COVID-19 changed the course of travel, social interaction, and financial markets, 2021 experienced a more rapid market rebound than most analysts anticipated.

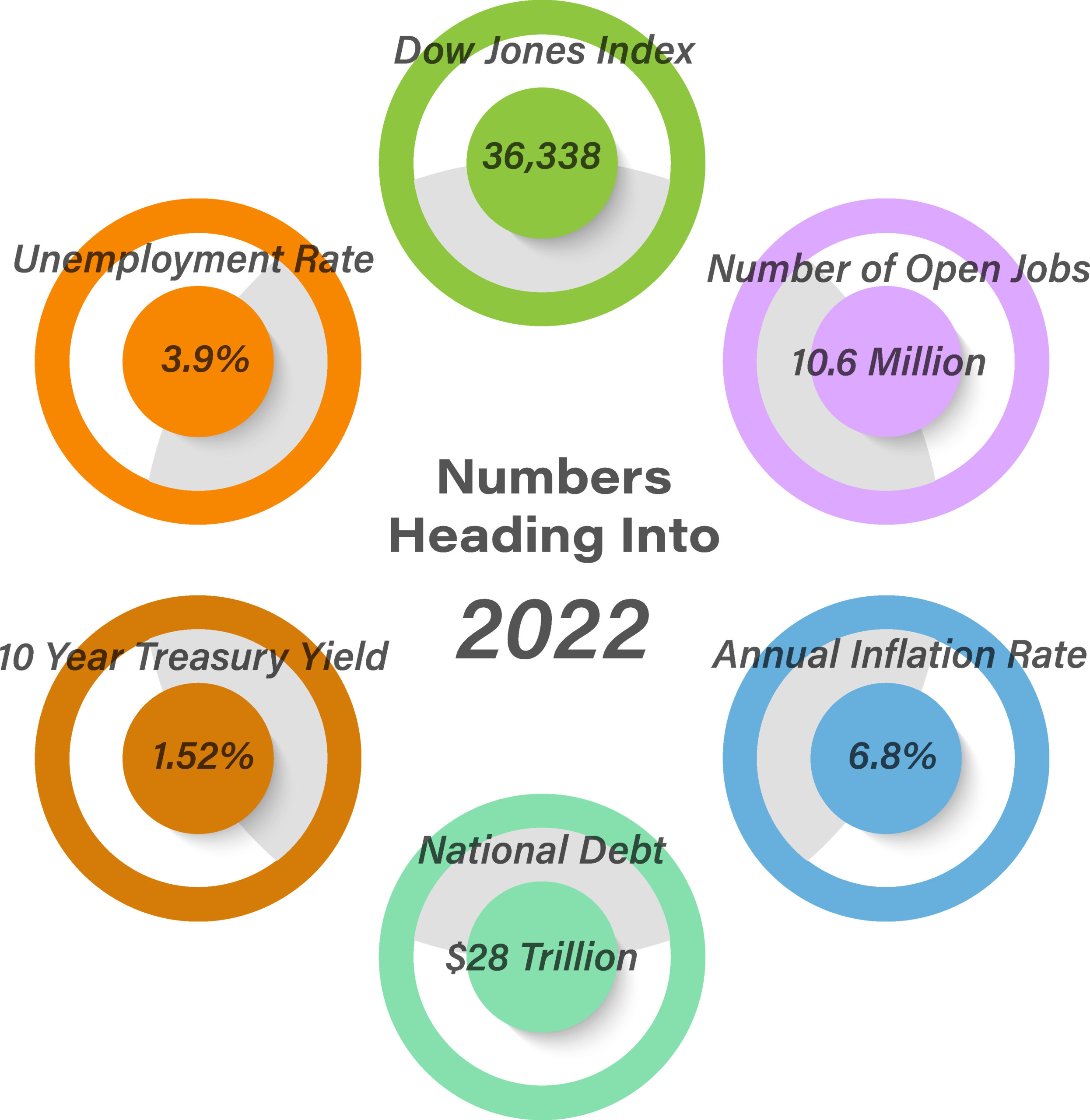

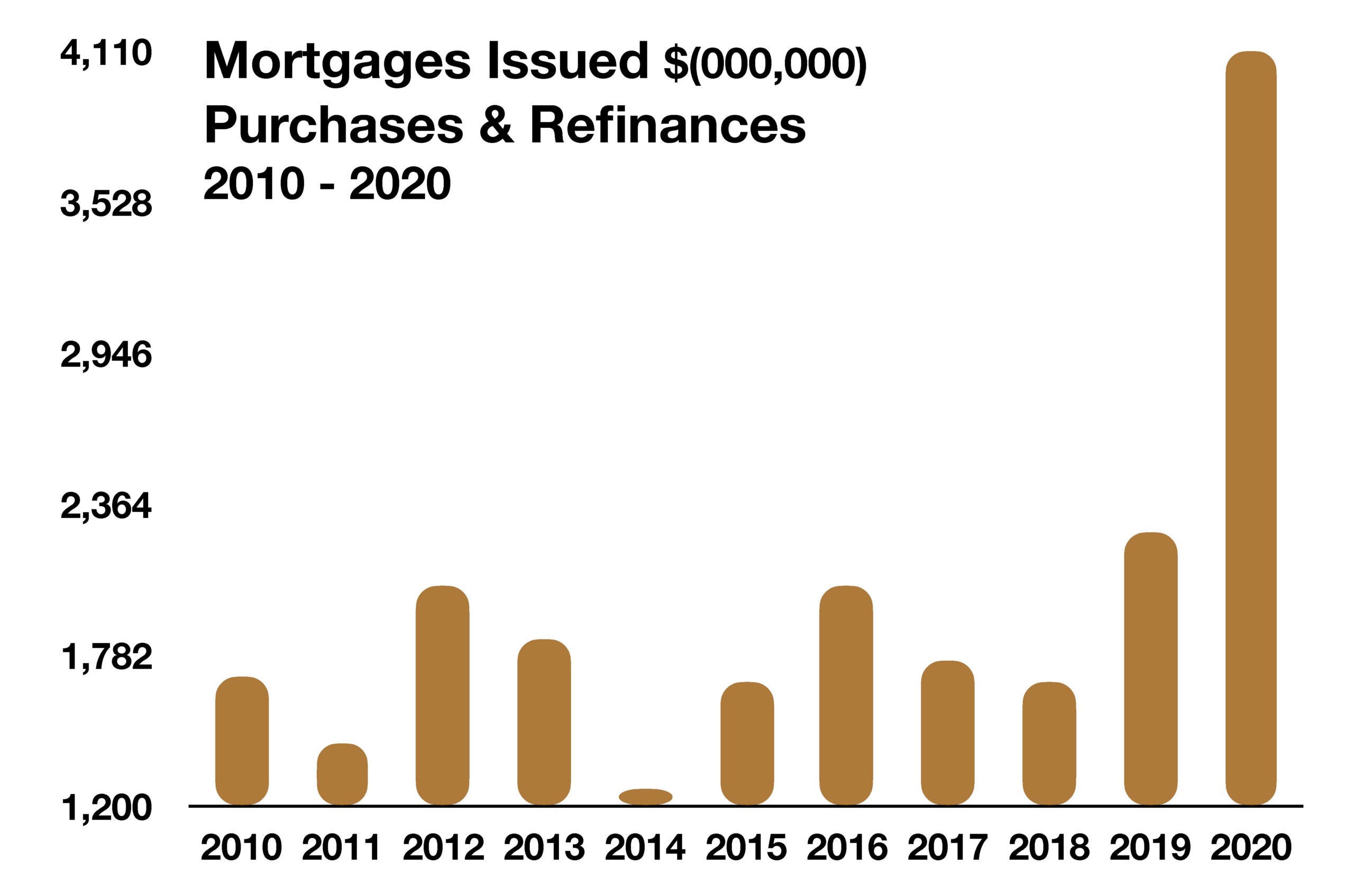

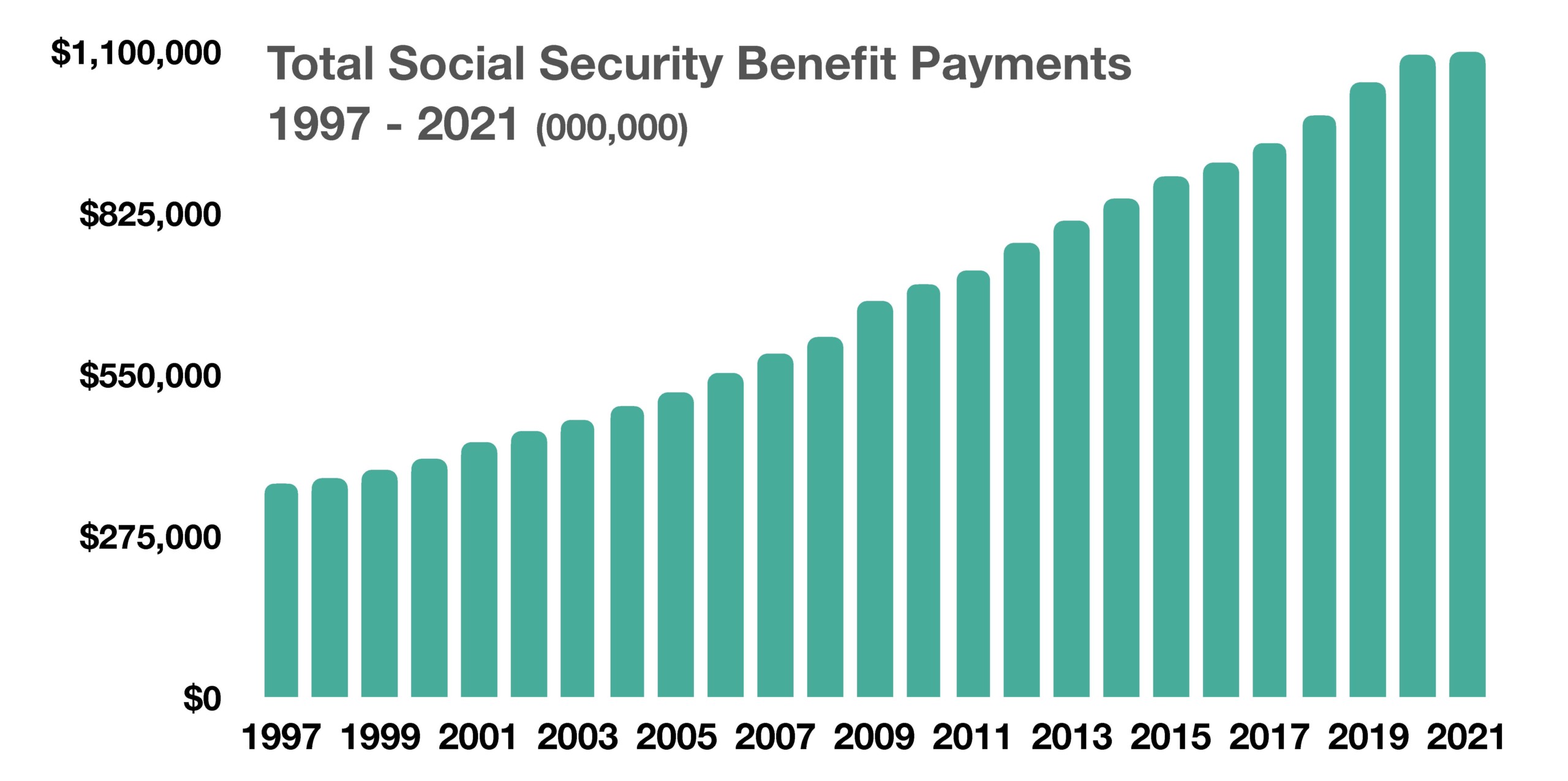

Inflation, caused in part by supply chain constraints, tight labor market conditions, and increased money supply, is expected to linger well into 2022 with little abatement as underlying inflationary pressures persist. Some economists are even projecting stagflation to become an issue in 2022 if economic growth sputters and inflationary pressures persist.

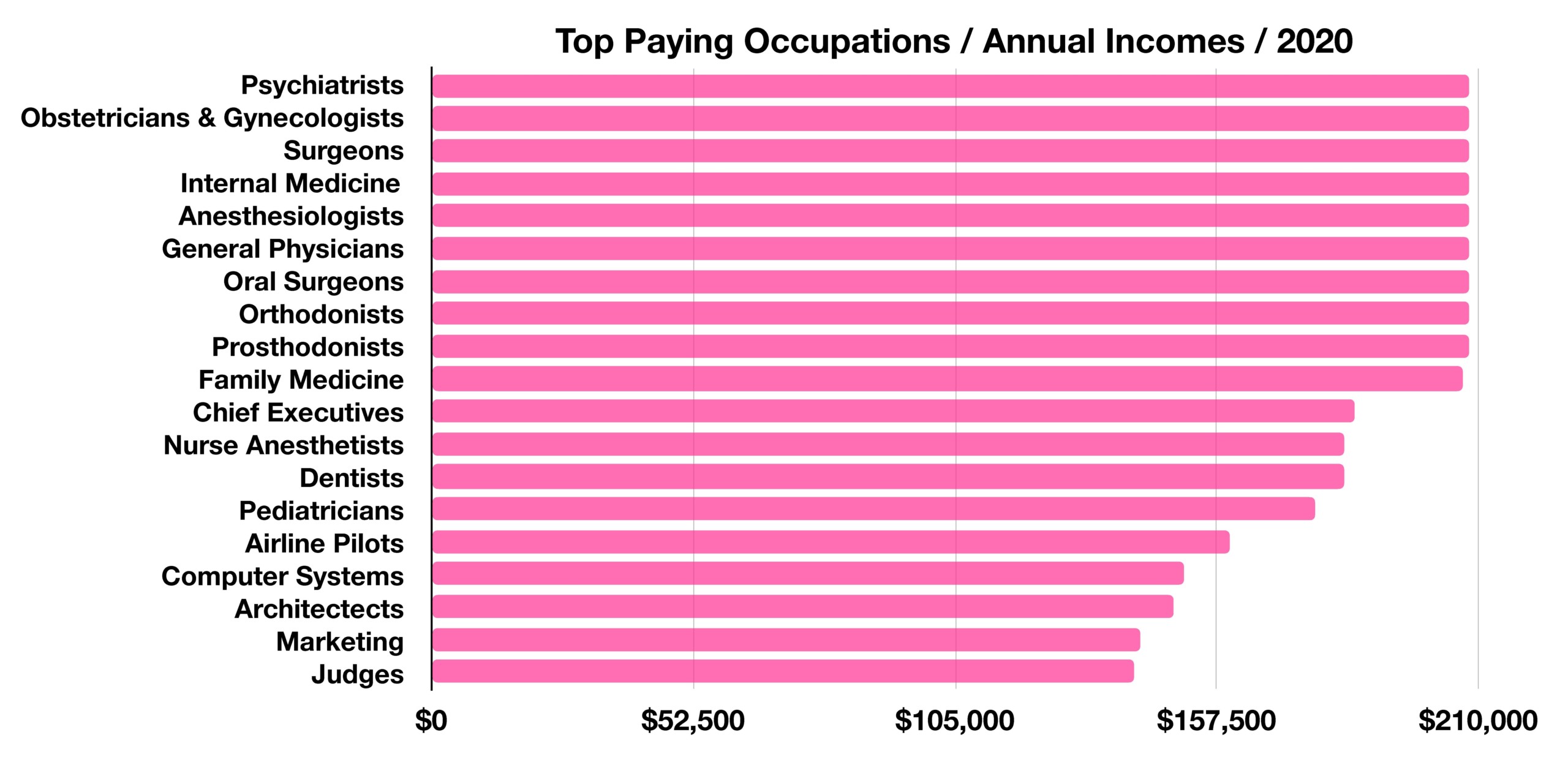

Labor shortages continue into 2022, leading to wage inflation and challenges for employers who are attempting to fill more than 10 million open positions nationwide. Workers are quitting their jobs at record levels, transitioning to higher-paying positions and new occupations.

The Federal Reserve is on course to start removing monetary stimulus from the economy and begin raising short term rates as soon as March in an attempt to curtail inflation. Federal Reserve governor Christopher Waller described current inflationary pressures as “alarmingly high.”

A gradual end to lockdowns in 2021 enabled the world economy to begin recovering last year. However, the recent emergence of new coronavirus variants threaten to once again derail economic recovery efforts across the globe.

Volatility due to uncertainty affected financial markets throughout 2021, distorting economic data and possibly misleading Federal Reserve members as they took steps to shape monetary policy. Central banks from several countries began to raise short-term interest rates in their efforts to combat inflationary threats in both developed and emerging economies.

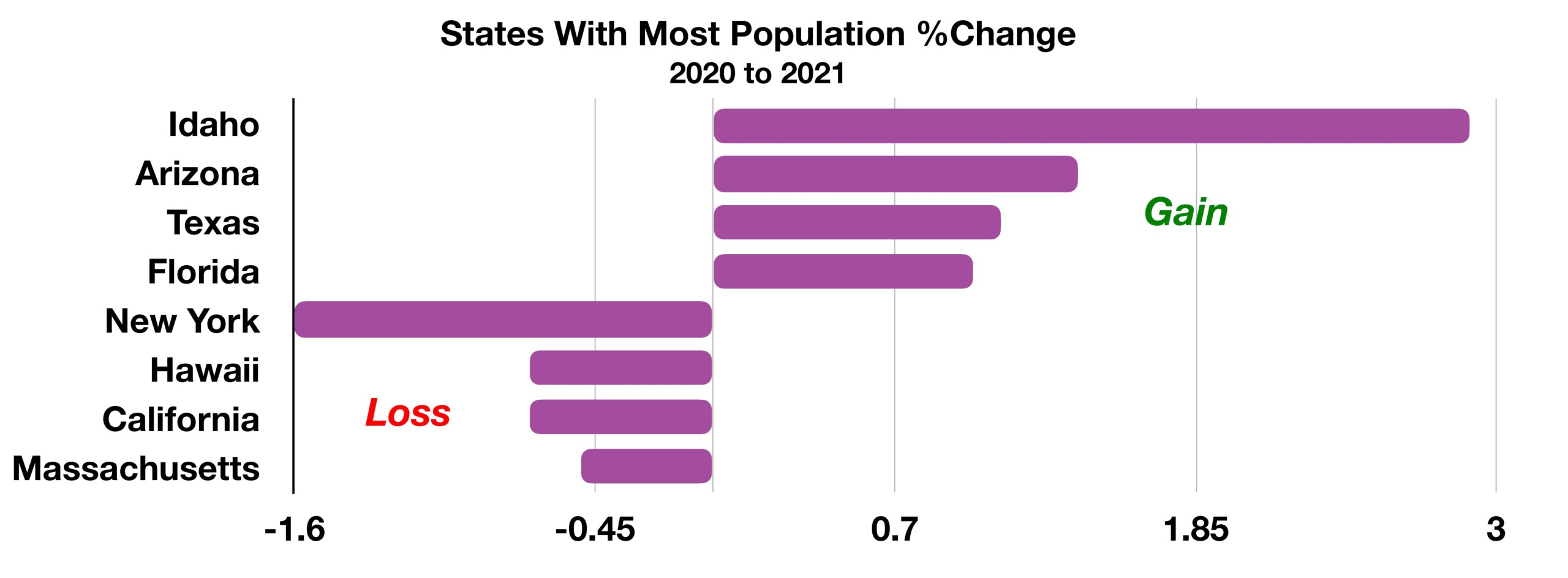

U.S. Census Bureau data revealed that for the first time ever immigrants surpassed the number of births for the past census year that ended July 2021. Population growth was driven by 245,000 net entrants into the country, versus only 148,000 net births.

Sources: Federal Reserve, Census Bureau, CDC, Labor Dept., Treasury Dept.