Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

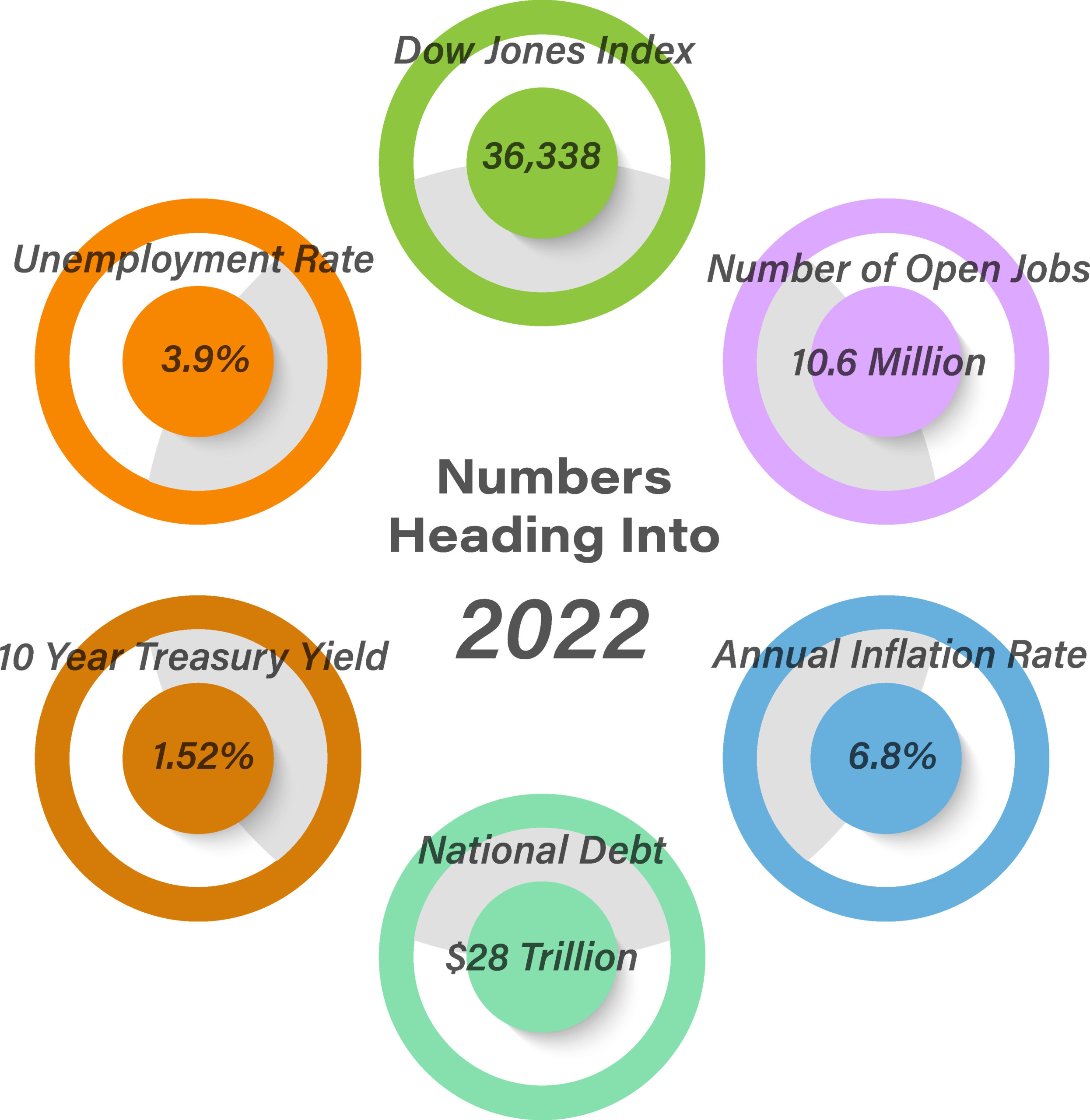

2021 was a year of recovery and rebound, and we expect that 2022, in contrast will be a year of moderation -specifically in growth, inflation and returns. We believe overall growth will be slower in 2022 than 2021, but still above trend. Equities should continue to outperform bonds. In addition, though inflation may not have peaked yet, it will likely decline over the year. We expect the 10-year U.S. Treasury yield to rise to around 2% by the end of 2022.

A year after Covid-19 changed the course of travel, socialization, and financial markets, 2021 witnessed a much quicker rebound than had been anticipated. The equity market upswing caught many by surprise as it was not anticipated.

Inflation brought about by supply constraints and rising labor costs are expected to linger well into 2022, with little abatement as underlying inflationary pressures persist. Some economists are even expecting stagflation to become an issue in 2022 should economic growth stagger and inflationary pressures persist.

Labor shortages triggered by the pandemic continue into 2022, leading to wage inflation and difficulty for employers filling over 10 million open positions nationwide. Workers are quitting their jobs at record levels, transitioning to higher paying positions and new occupations.

Consensus is that the Federal Reserve is on course to start removing monetary stimulus from the economy and begin raising short term rates as soon as March, in order to curtail inflation. Federal Reserve governor Christopher Waller described current inflationary pressures as “alarmingly high”.

Pandemic driven volatility due to uncertainty affected financial markets throughout 2021, distorting economic data and possibly misleading Federal Reserve members. Central banks from various countries worldwide have started to raise short term interest rates in their efforts to combat inflationary threats in both developed and emerging economies.

Sources: Federal Reserve, Census Bureau, CDC, Labor Dept., Treasury Dept.