W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Global equity and fixed-income markets navigated through a volatile environment as 2022 unfolded to be a challenging year. The Russian invasion of Ukraine, rising interest rates, inflationary pressures, and a slowing economy all weighed on financial markets. The S&P 500 closed the 2022 year at 3,839.50, down 19.4%. This makes 2022 the worst year for the S&P since 2008 and the fourth-worst year since the index’s launch 1957. (Source: Yahoo Finance)

2022 was the worst year on record for bonds – mainly because the Federal Reserve raising interest rates aggressively. The 30-year US Treasury bond, at its low, sunk to its worst return, -35%, in a century. The Bloomberg Barclays U.S. Aggregate Bond Index (which represents the U.S. investment-grade bond market) was down approximately -15%. (Source: CNBC, Glenmede)

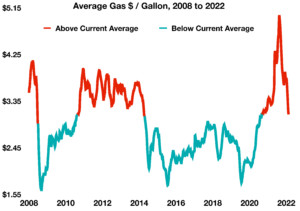

Inflation hindered both consumers and businesses in 2022, as rising prices for food and fuel shifted spending away from non-essential items. Higher labor costs along with elevated operating expenses reduced company margins and profit projections.

The labor market still has 11 million positions were open heading into 2023. Many companies that over-hired since the start of the pandemic began to reduce jobs and trim staff as economic headwinds have become more prominent.

Stubborn supply constraints experienced over the past two years have easied, resulting in better inventories and, in some instances, lower prices. Some economists and analysts expect a gradual slowing in inflationary pressures, leading to lower prices and easing consumer worries.

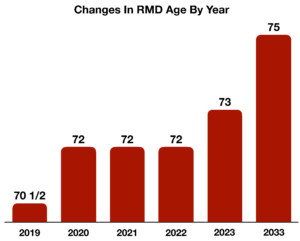

Congress passed the SECURE Act 2.0 in late December, carving the path for revised retirement provisions intended to help Americans save more intelligently for retirement. Among the changes is an increased RMD age of 73 for IRAs, and the ability to convert 529 college savings funds into Roth IRAs.

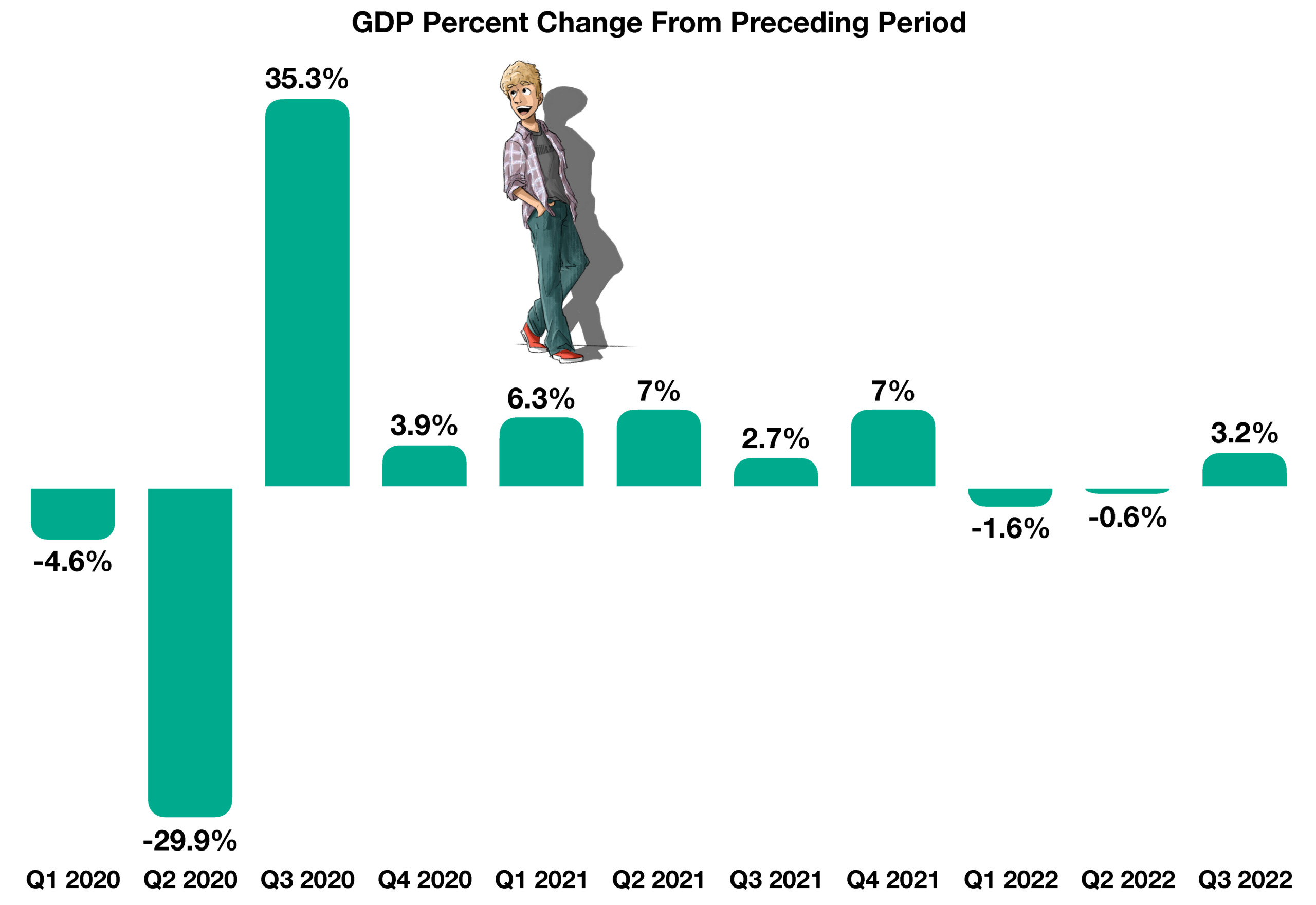

Economic expansion, as measured by Gross Domestic Product (GDP), staged a mild recovery in the third quarter of 2022, up from two consecutive quarters of negative GDP growth. Some analysts believe that the bounce may be short-lived, as ongoing challenges are expected in 2023. A lingering recessionary environment is still a concern for the markets and consumers, instilling a more cautious approach to investing and spending. (Sources: BEA, BLS, U.S. Center for Disease Control and Prevention, U.S. Congress, Federal Reserve)