Aspen Wealth Management, Inc.

9300 W. 110th Street, Suite 680

Overland Park, KS 66210

913.491.0500

Stock Indices:

| Dow Jones | 37,815 |

| S&P 500 | 5,035 |

| Nasdaq | 15,657 |

Bond Sector Yields:

| 2 Yr Treasury | 5.04% |

| 10 Yr Treasury | 4.69% |

| 10 Yr Municipal | 2.80% |

| High Yield | 7.99% |

YTD Market Returns:

| Dow Jones | 0.34% |

| S&P 500 | 5.57% |

| Nasdaq | 4.31% |

| MSCI-EAFE | 1.98% |

| MSCI-Europe | 2.05% |

| MSCI-Pacific | 1.82% |

| MSCI-Emg Mkt | 2.17% |

| US Agg Bond | 0.50% |

| US Corp Bond | 0.56% |

| US Gov’t Bond | 0.48% |

Commodity Prices:

| Gold | 2,297 |

| Silver | 26.58 |

| Oil (WTI) | 81.13 |

Currencies:

| Dollar / Euro | 1.07 |

| Dollar / Pound | 1.25 |

| Yen / Dollar | 156.66 |

| Canadian /Dollar | 0.79 |

Macro Overview

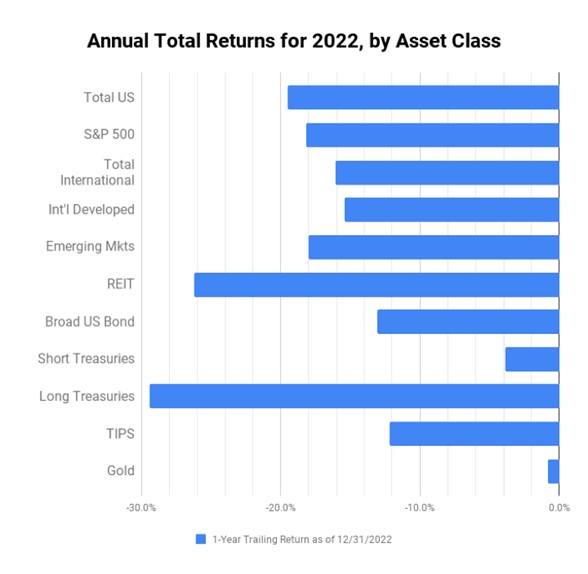

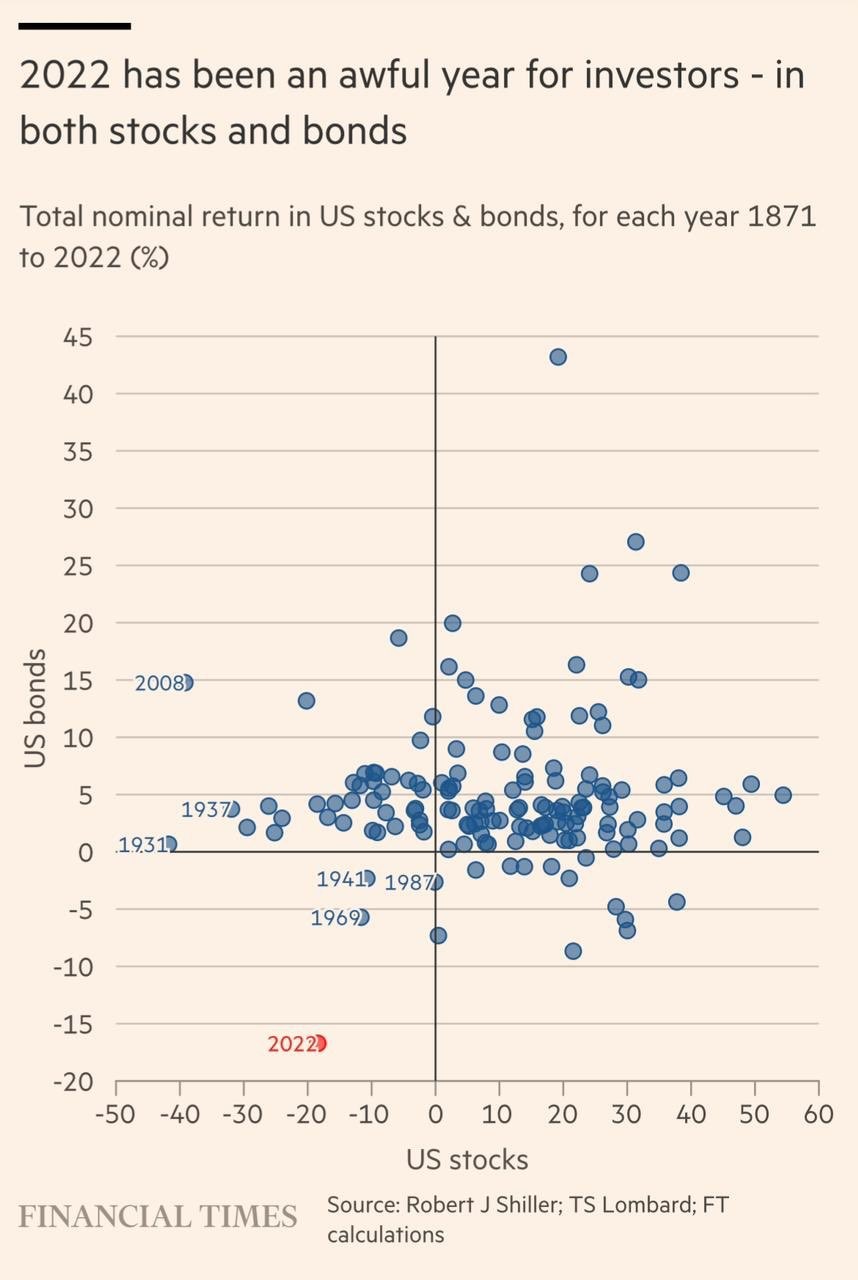

The biggest development in 2022 was the unforeseen rise in inflation and the Federal Reserve’s seven interest rate hikes. Since the financial markets weren’t expecting the quantity nor aggregate size of the seven rate hikes, the impact to equities and bonds created the worst investment year on record. There were very few safe places to invest. The SP500 was down 19.4% and the Barclay Aggregate Bond index was down 13%. The chart on the right illustrates the returns for all major asset classes in 2022. All of them were down more than 10% except for gold and short-term treasuries.

The Russian invasion of Ukraine caused significant disruption in the crude oil, natural gas, and grain markets. This event added to the rise of inflation. Inflation hindered both consumers and businesses in 2022, as rising prices for food and fuel shifted spending away from non-essential items.

Optimistically, the labor market remained resilient as unemployment stood below 4% at the end of 2022, still at historically low levels. Over 11 million positions were open heading into 2023, solidifying a buffer for millions of workers searching for employment. The strong labor market is causing wage pressure as companies need to pay higher wages to retain and attract workers. Higher wages are good except they lead to higher inflation.

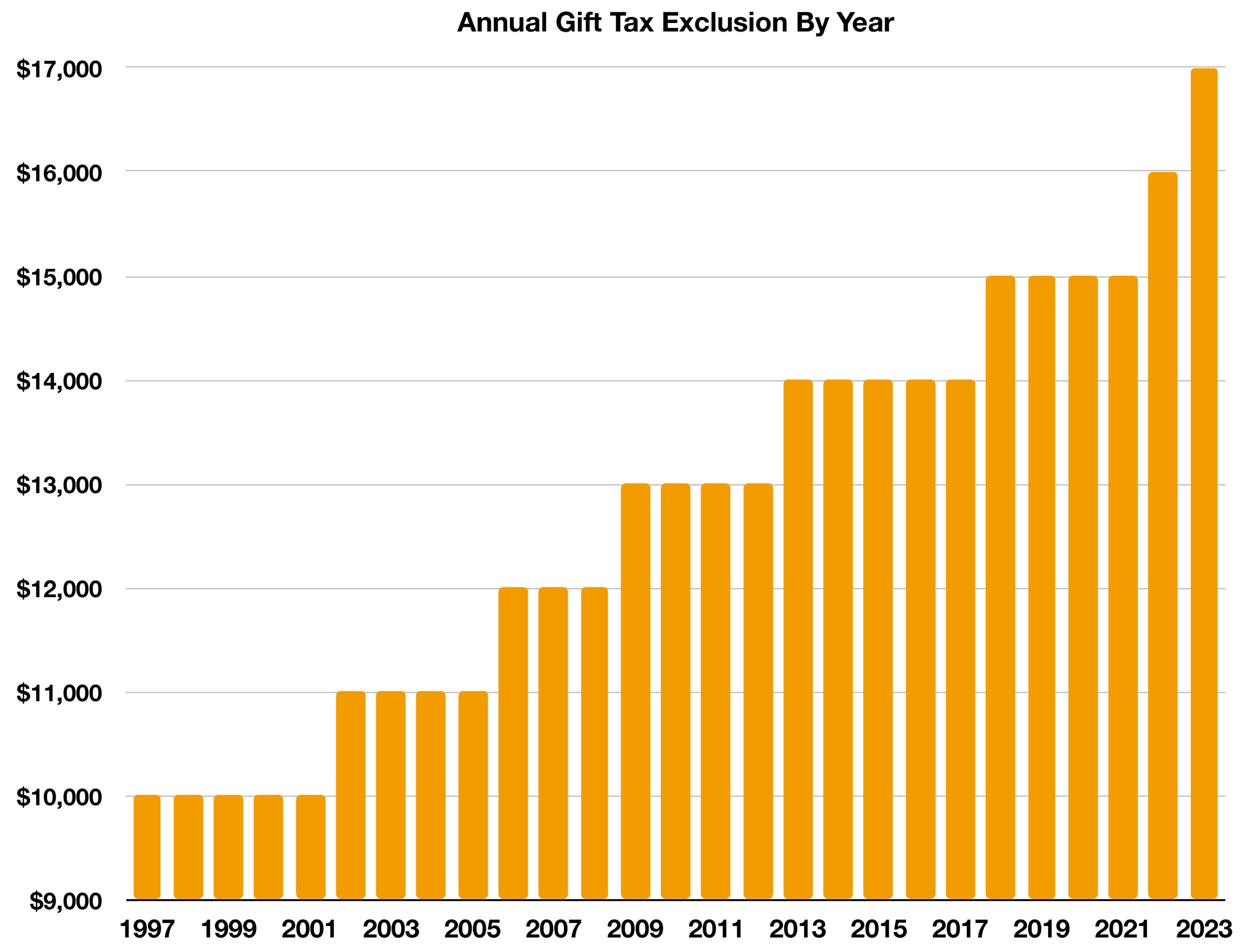

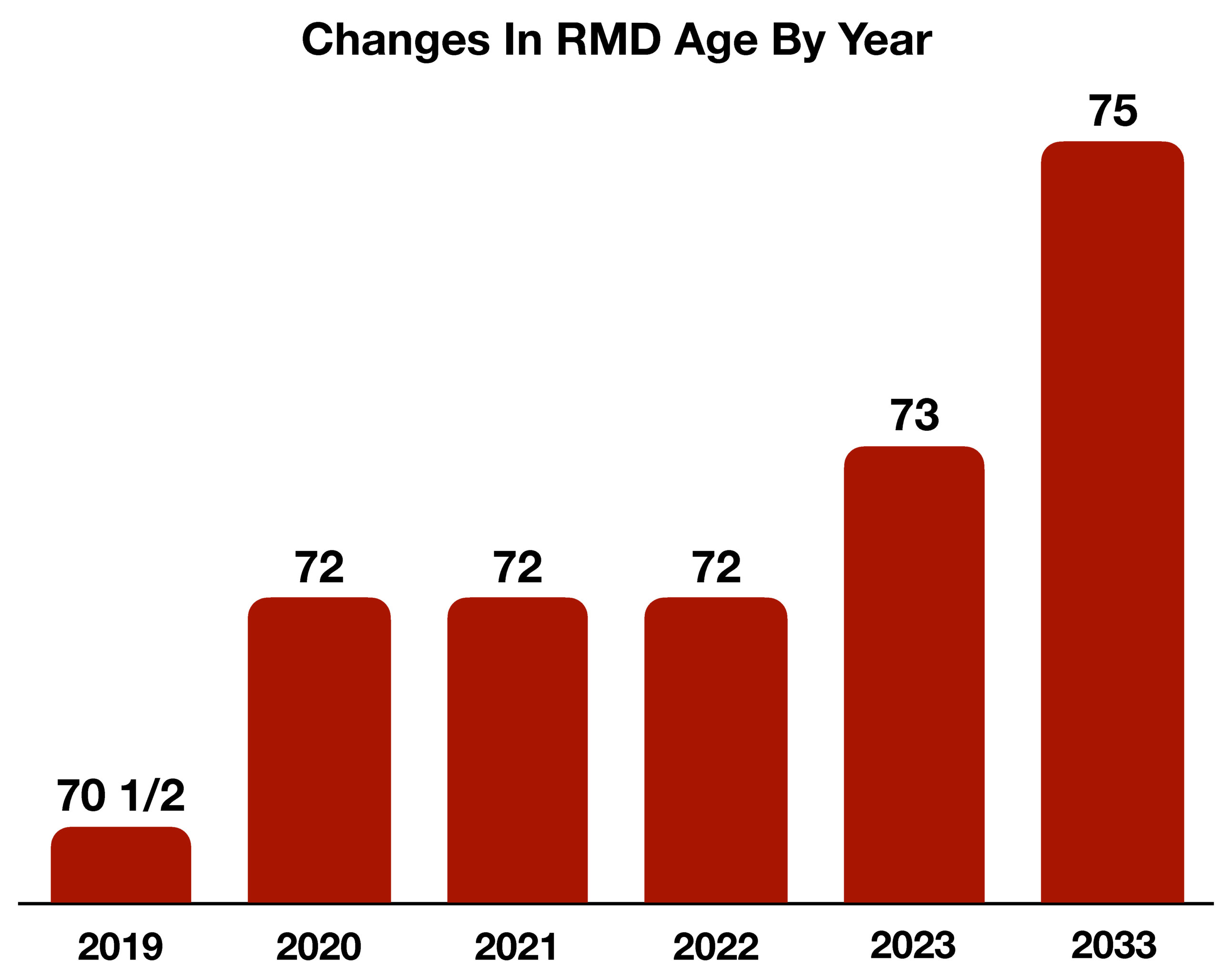

Congress passed the SECURE Act 2.0 in late December, carving the path for revised retirement provisions intended to help Americans save more intelligently for retirement. Among the changes is an increased RMD age of 73 for IRAs, and the ability to convert 529 college savings funds into Roth IRAs.

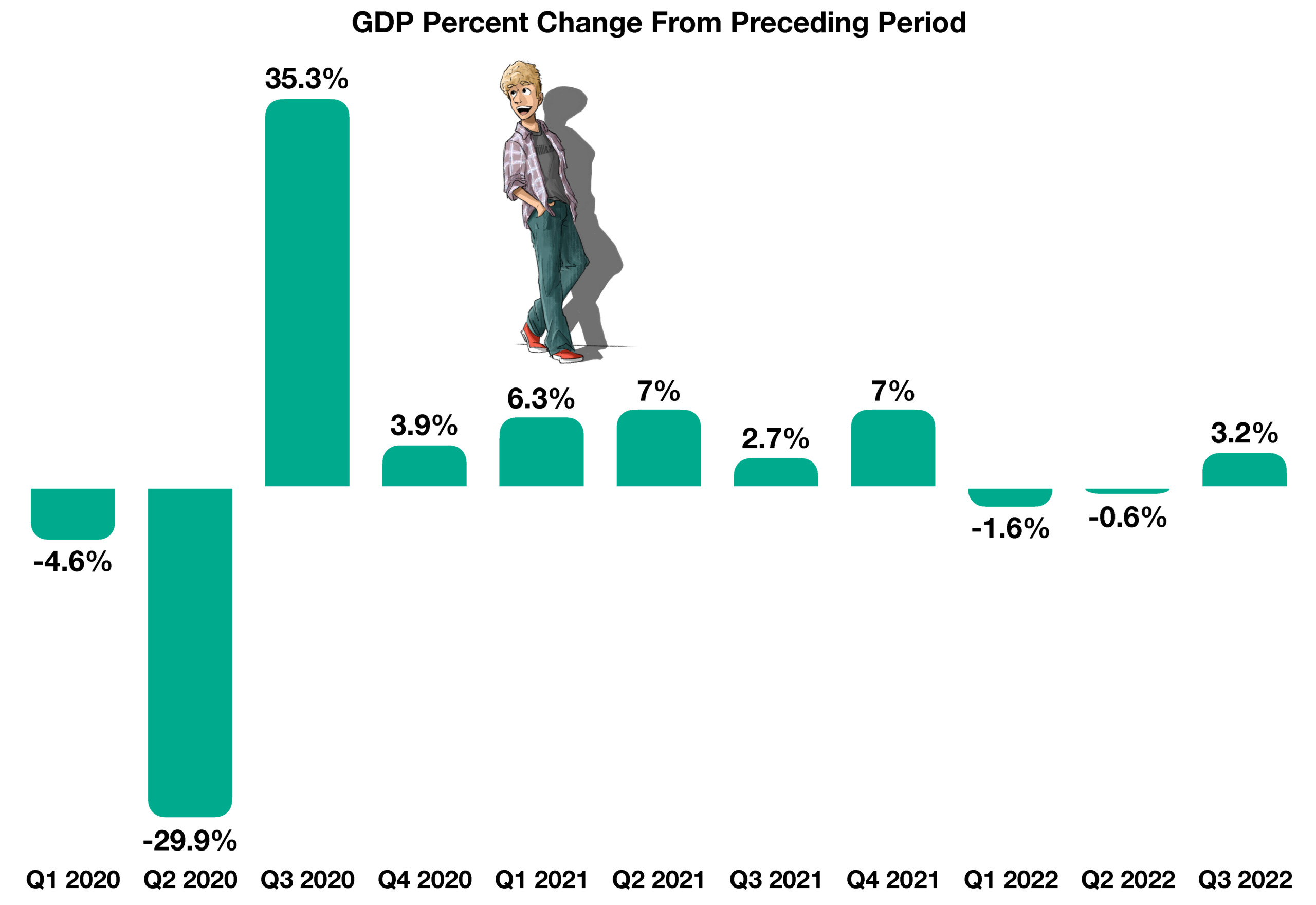

Economic expansion, as measured by Gross Domestic Product (GDP), staged a mild recovery in the third quarter of 2022, up from two consecutive quarters of negative GDP growth. Some analysts believe the bounce may be short-lived, as ongoing challenges are expected in 2023. A lingering recessionary environment is still a concern for the markets and consumers, instilling a more cautious approach to investing and spending. (Sources: BEA, BLS, U.S. Center for Disease Control and Prevention, U.S. Congress, Fed. Reserve)

workers and retirees to leave funds in retirement accounts for longer, thus pushing off additional tax liability. In 2019, the RMD age was raised from 70½ years of age to 72. Now, the Secure Act 2.0 raises it to 73 beginning in 2023 and to 75 in 2033. These gradual changes are expected to accommodate and assist an incoming wave of baby boomers nearing retirement. With a few extra years before RMDs kick in, older workers have greater incentives to continue saving for retirement. Company-sponsored retirement plans will require automatic enrollments into 401(k) and 403(b) plans, whereas it is currently only optional for employers to do so. In these plans, employers must also set up a contribution rate between 3% and 10%, plus an automatic contribution increase of 1% annually until a range of 10% to 15% is met. This provision will go into effect beginning December 31, 2024.

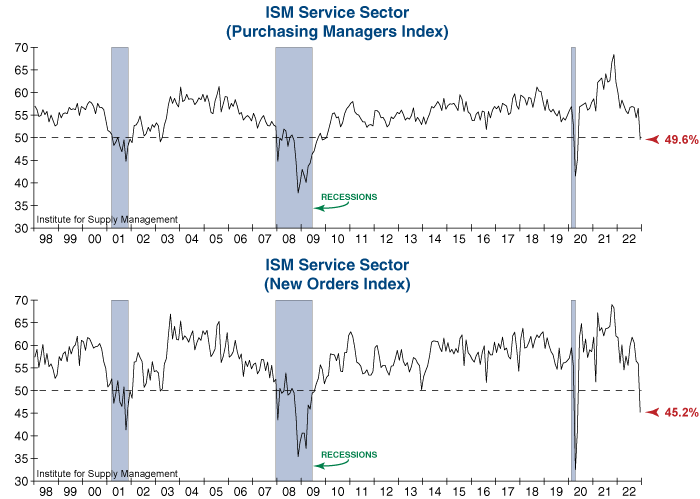

workers and retirees to leave funds in retirement accounts for longer, thus pushing off additional tax liability. In 2019, the RMD age was raised from 70½ years of age to 72. Now, the Secure Act 2.0 raises it to 73 beginning in 2023 and to 75 in 2033. These gradual changes are expected to accommodate and assist an incoming wave of baby boomers nearing retirement. With a few extra years before RMDs kick in, older workers have greater incentives to continue saving for retirement. Company-sponsored retirement plans will require automatic enrollments into 401(k) and 403(b) plans, whereas it is currently only optional for employers to do so. In these plans, employers must also set up a contribution rate between 3% and 10%, plus an automatic contribution increase of 1% annually until a range of 10% to 15% is met. This provision will go into effect beginning December 31, 2024. is in contraction. The ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy. The ISM Service Sector suffered its third-largest decline on record last month as it shockingly plunged into contraction territory (readings below 50.0). Last month’s massive -6.9 point drop was due in large part to a collapse in new orders (bottom chart), yet weakness was still broad-based as eight of its ten components showed declines. While services was one of the few remaining economic bright spots prior to this report, it has now joined the large and growing list of recessionary warning flags.

is in contraction. The ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy. The ISM Service Sector suffered its third-largest decline on record last month as it shockingly plunged into contraction territory (readings below 50.0). Last month’s massive -6.9 point drop was due in large part to a collapse in new orders (bottom chart), yet weakness was still broad-based as eight of its ten components showed declines. While services was one of the few remaining economic bright spots prior to this report, it has now joined the large and growing list of recessionary warning flags.