Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

Macro Overview

Global equity and fixed-income markets navigated through a volatile environment as 2022 unfolded to be a challenging year. The Russian invasion of Ukraine, rising interest rates, inflationary pressures, and a slowing economy all weighed on financial markets. The three major equity indices saw their largest declines since 2008, while rates rose from their historic lows.

Inflation hindered both consumers and businesses in 2022, as rising prices for food and fuel shifted spending away from non-essential items. Higher labor costs along with elevated operating expenses reduced company margins and profit projections.

Optimistically, the labor market remained resilient as unemployment stood below 4% at the end of 2022, still at historically low levels. Over 11 million positions were open heading into 2023, solidifying a buffer for millions of workers searching for employment. Many companies that over-hired since the start of the pandemic began to reduce jobs and trim staff as economic headwinds have become more prominent.

Stubborn supply constraints experienced over the past two years have essentially vanished, resulting in ample inventories and, in many instances, lower prices. Some economists and analysts expect a gradual slowing in inflationary pressures, leading to lower prices and easing consumer worries.

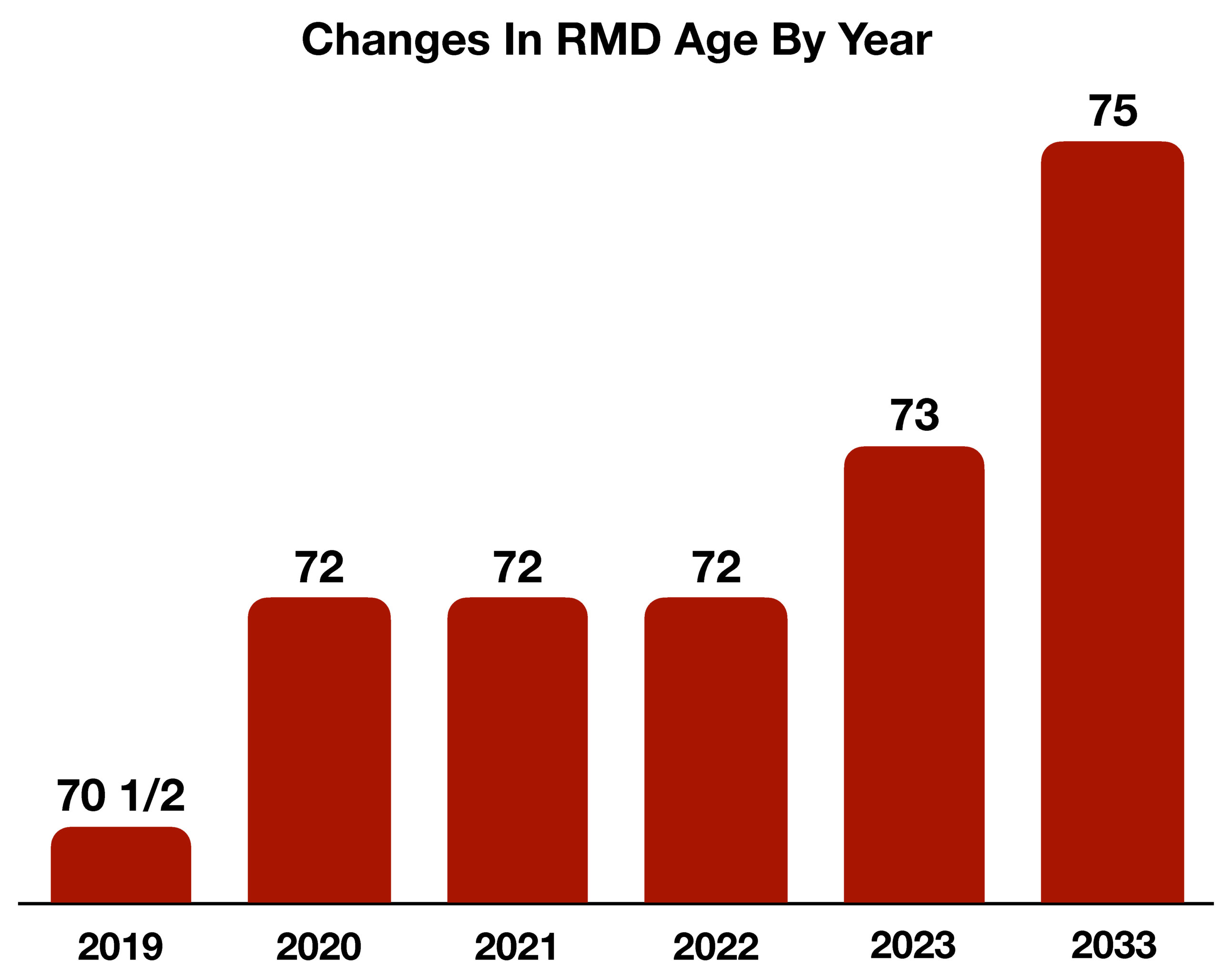

Congress passed the SECURE Act 2.0 in late December, carving the path for revised retirement provisions intended to help Americans save more intelligently for retirement. Among the changes is an increased RMD age of 73 for IRAs, and the ability to convert 529 college savings funds into Roth IRAs.

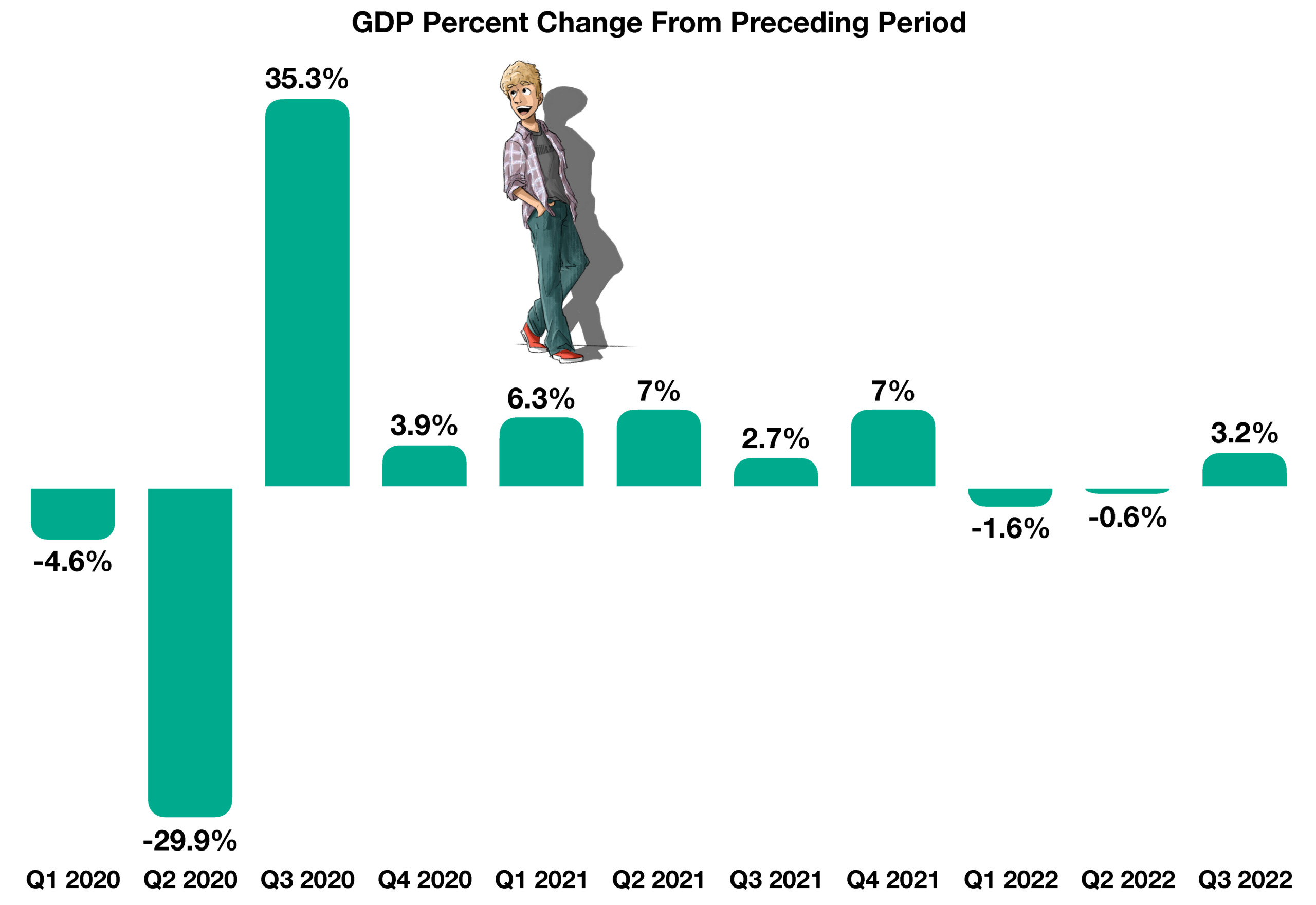

Economic expansion, as measured by Gross Domestic Product (GDP), staged a mild recovery in the third quarter of 2022, up from two consecutive quarters of negative GDP growth. Some analysts believe that the bounce may be short-lived, as ongoing challenges are expected in 2023. A lingering recessionary environment is still a concern for the markets and consumers, instilling a more cautious approach to investing and spending. (Sources: BEA, BLS, U.S. Center for Disease Control and Prevention, U.S. Congress, Federal Reserve)

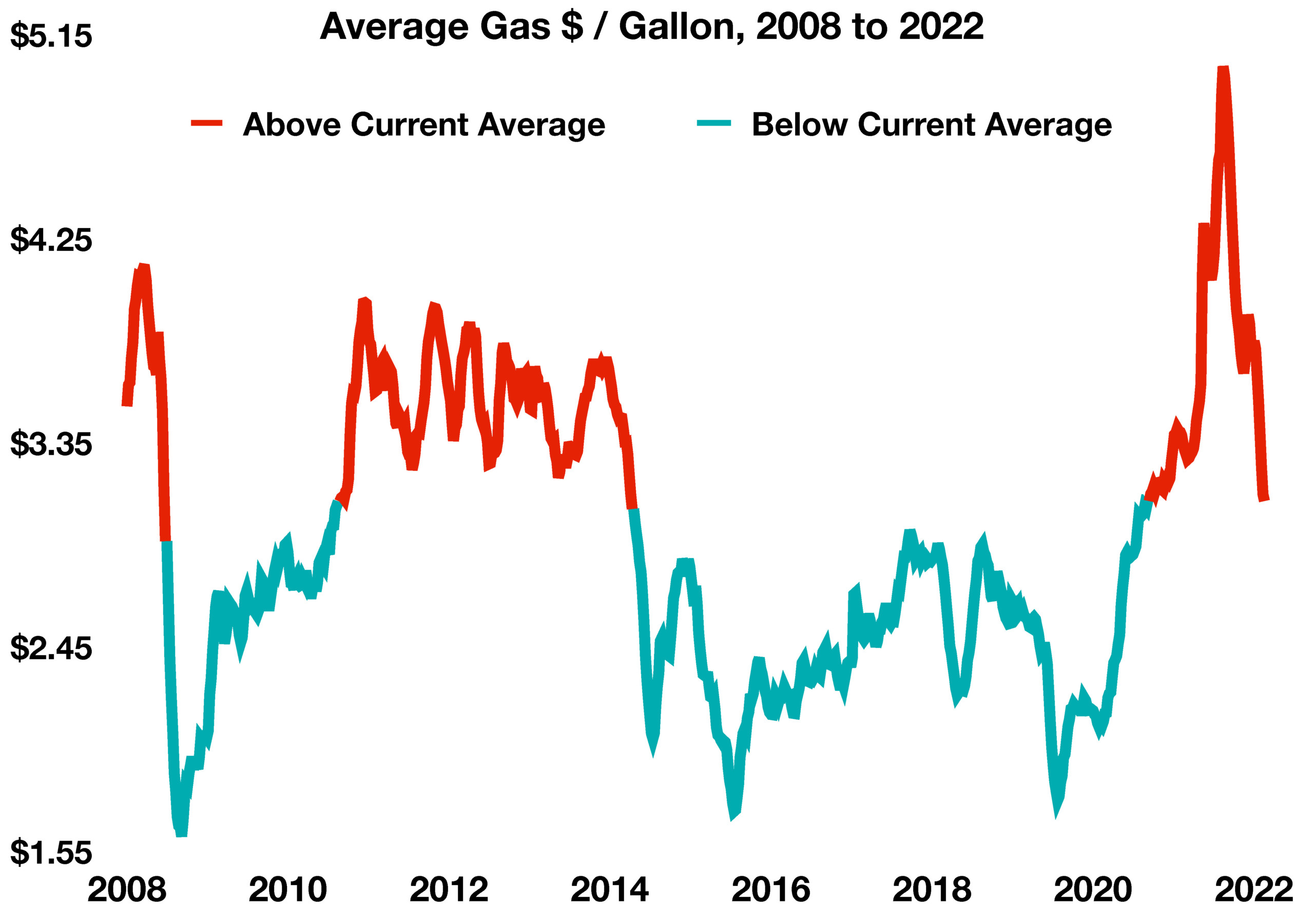

Average gasoline prices have officially reached an 18-month low after extraordinary prices in 2022. The average price per gallon of regular gasoline across the U.S. stood at $3.09 at the end of 2022, which was last seen over 18 months ago in June of 2021. In 2022, several international factors including supply limitations due to the war in Ukraine led to abnormally high fuel costs for consumers. The average price per gallon across the nation eclipsed $4 for 22 weeks in a row and surpassed $5 in June of 2022. Gasoline became a financial burden for many consumers throughout 2022, compounding already higher prices for other essential items. (Sources: U.S. Energy Information Administration, Federal Reserve Bank of St. Louis)

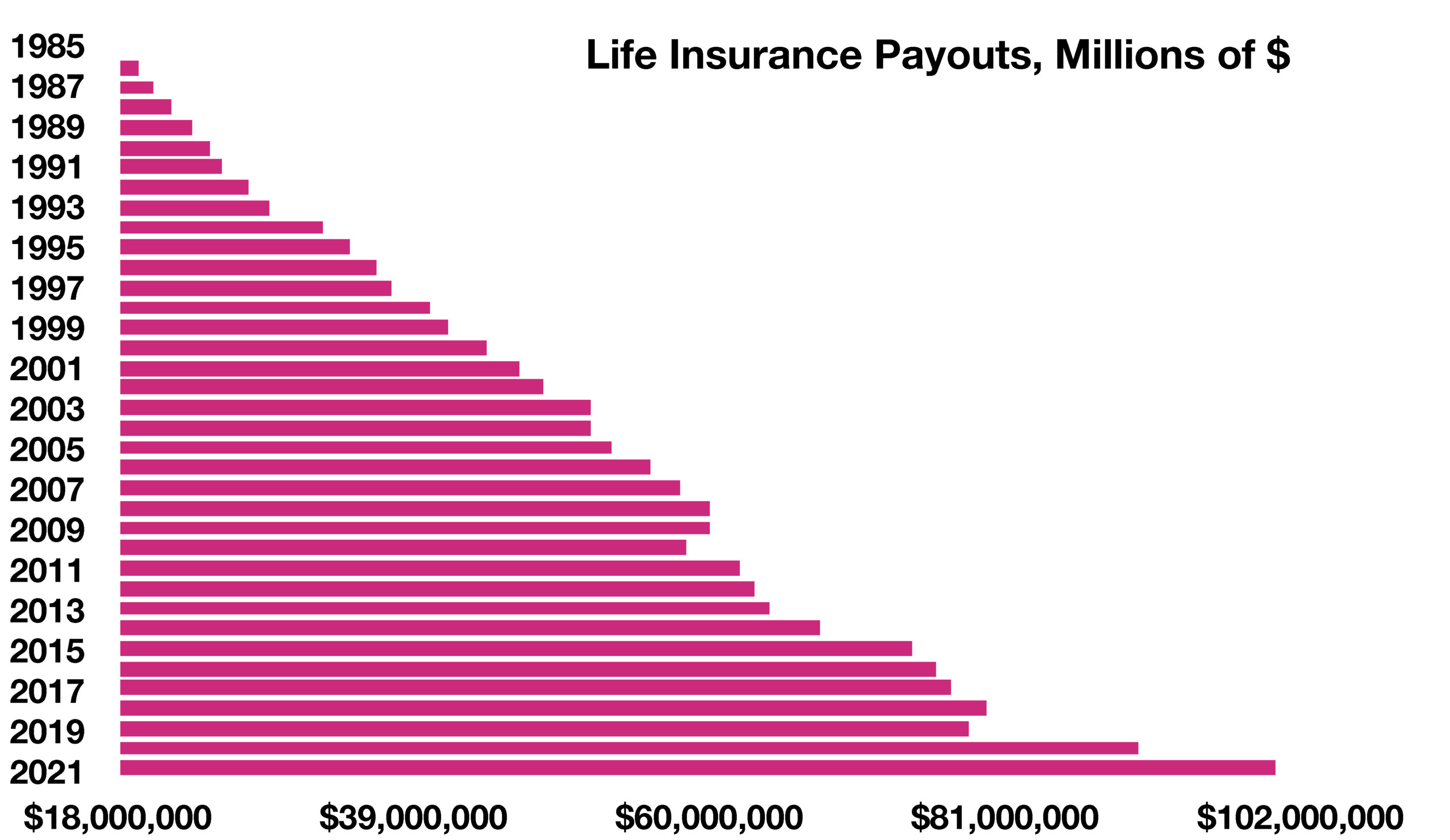

Average gasoline prices have officially reached an 18-month low after extraordinary prices in 2022. The average price per gallon of regular gasoline across the U.S. stood at $3.09 at the end of 2022, which was last seen over 18 months ago in June of 2021. In 2022, several international factors including supply limitations due to the war in Ukraine led to abnormally high fuel costs for consumers. The average price per gallon across the nation eclipsed $4 for 22 weeks in a row and surpassed $5 in June of 2022. Gasoline became a financial burden for many consumers throughout 2022, compounding already higher prices for other essential items. (Sources: U.S. Energy Information Administration, Federal Reserve Bank of St. Louis) According to the U.S. Center for Disease Control and Prevention, approximately 460,000 death in the U.S. were related to COVID-19 over the course of 2021. Life insurance is utilized to ensure families do not undergo unbearable financial hardships after the loss of a loved one, and these spikes in payouts are expected to provide necessary financial support. (Sources: U.S. Center for Disease Control and Prevention, American Council of Life Insurers, National Association of Insurance Commissioners)

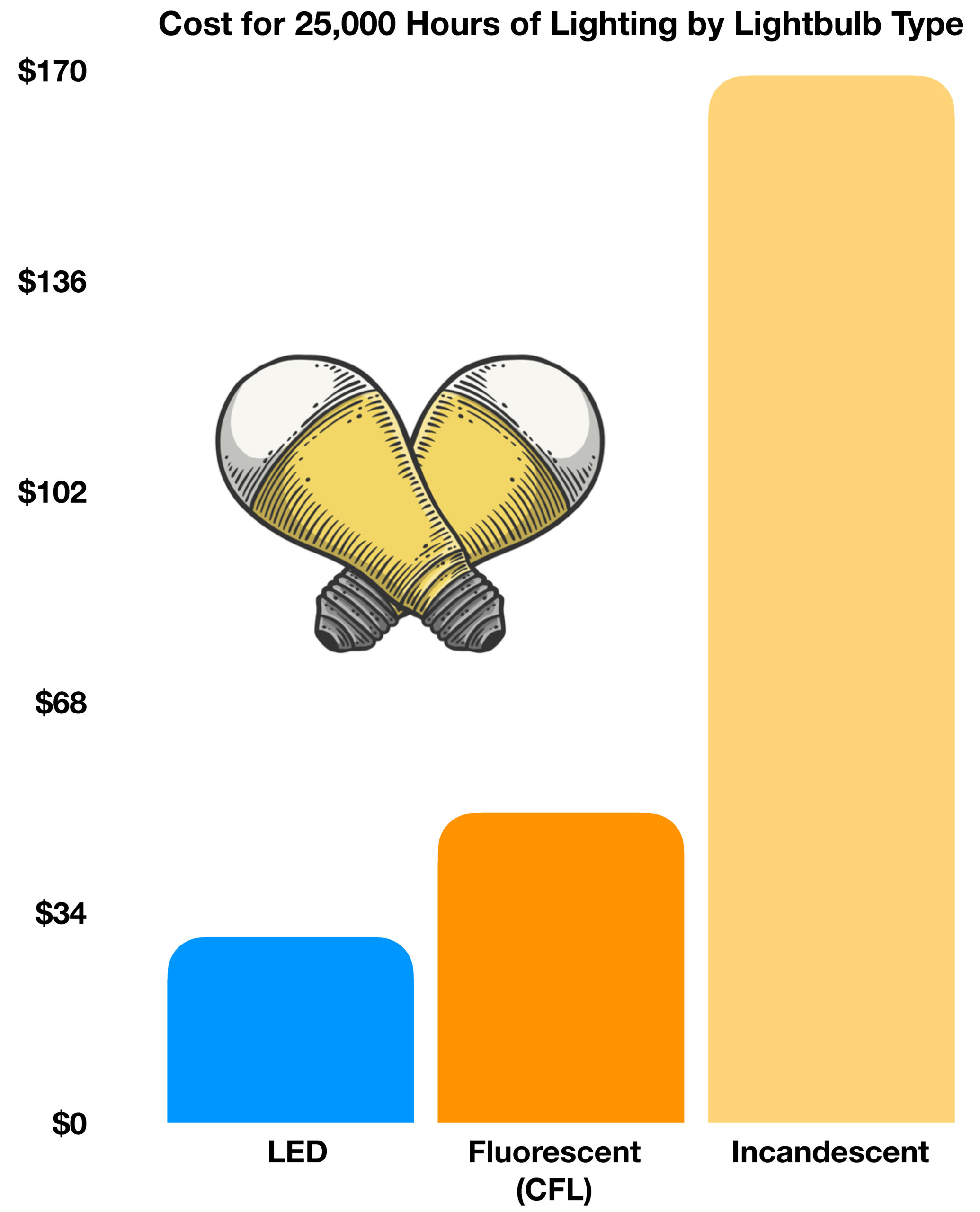

According to the U.S. Center for Disease Control and Prevention, approximately 460,000 death in the U.S. were related to COVID-19 over the course of 2021. Life insurance is utilized to ensure families do not undergo unbearable financial hardships after the loss of a loved one, and these spikes in payouts are expected to provide necessary financial support. (Sources: U.S. Center for Disease Control and Prevention, American Council of Life Insurers, National Association of Insurance Commissioners) By installing LED bulbs in rooms with heavy use of lighting, households can save hundreds or even thousands of dollars over the lifetime of their bulbs. Currently, lighting accounts for around 15% of the average electricity use in U.S. homes, with LEDs offering a more efficient alternative to incandescent light bulbs. LED bulbs consume 90% less energy, which results in estimated savings of over $225 every year for the average household. LEDs also last 25 to 50 times longer than traditional light bulbs, resulting in households needing to replace them far less frequently. Data from the Department of Energy reported that in 2018 consumers saved $14.7 billion from adopting LEDs in their households. As LEDs continue to fall in price, these savings are expected to rise for consumers. The U.S. Department of Energy has officially decided that the deadline for all American stores to no longer sell incandescent bulbs will be July 2023. Many households may be hesitant to transition to LEDs due to their higher up-front costs, yet over several years of usage, the savings produced by these bulbs greatly eclipses those of incandescent or fluorescent bulbs. (Source: U.S. Department of Energy)

By installing LED bulbs in rooms with heavy use of lighting, households can save hundreds or even thousands of dollars over the lifetime of their bulbs. Currently, lighting accounts for around 15% of the average electricity use in U.S. homes, with LEDs offering a more efficient alternative to incandescent light bulbs. LED bulbs consume 90% less energy, which results in estimated savings of over $225 every year for the average household. LEDs also last 25 to 50 times longer than traditional light bulbs, resulting in households needing to replace them far less frequently. Data from the Department of Energy reported that in 2018 consumers saved $14.7 billion from adopting LEDs in their households. As LEDs continue to fall in price, these savings are expected to rise for consumers. The U.S. Department of Energy has officially decided that the deadline for all American stores to no longer sell incandescent bulbs will be July 2023. Many households may be hesitant to transition to LEDs due to their higher up-front costs, yet over several years of usage, the savings produced by these bulbs greatly eclipses those of incandescent or fluorescent bulbs. (Source: U.S. Department of Energy)