Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Economic Overview

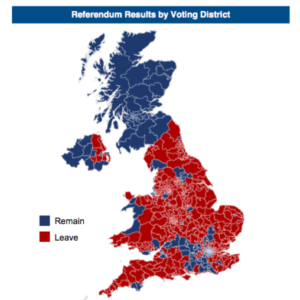

The British vote to exit the EU was a validation that a disintegration process of the EU is possibly underway, causing destabilization of countries throughout the EU. Britain’s vote may lead to other similar referendums, particularly with the Netherlands and France where populist sentiment is growing.

The British pound fell to a 30-year low versus the U.S. dollar following the outcome of the referendum. From a contrarian viewpoint, the plummeting British pound could provide a tailwind for the country as exports become cheaper worldwide, and tourism increases on stronger foreign currencies.

The Fed Reserve’s plan to further increase rates this year took a different course as the repercussions from Britain’s vote are expected to lead to slowing economic growth and a sustained low interest rate environment. While some pundits feel the Fed may ramp up stimulus efforts again by lowering interest rates should the EU and Europe’s economy falter, we do not fall into that category of thinking. We expect the low interest rate environment to remain for much longer than originally anticipated.

In the midst of the Brexit turmoil, the Federal Reserve announced that 33 selected U.S. banks passed an imposed stress test to see how well they’d perform under severe circumstances, such as high unemployment, recession, and falling asset prices. The stress test revealed that the 33 banks tested had nearly twice the amount of required capital needed, up significantly from the last stress test conducted.

Sources: Eurostat, Bloomberg, Federal Reserve

With a population of over 500 million throughout the 28 EU countries, the United Kingdom represents 12.7% of the EU’s total population, one of the larger components making up the EU. The union was developed as an integral single market through a standardized system of laws that apply to all 28 member countries, thus allowing for the free movement of people, goods, services and capital.

With a population of over 500 million throughout the 28 EU countries, the United Kingdom represents 12.7% of the EU’s total population, one of the larger components making up the EU. The union was developed as an integral single market through a standardized system of laws that apply to all 28 member countries, thus allowing for the free movement of people, goods, services and capital.