Could Italy Be The Next Greece – International Update

Italians are expected to cast votes in an upcoming election that may entail a referendum to exit the eurozone. Should such a vote occur, it would be similar to Britain’s vote to exit the eurozone in 2016, a

The recent news from Italy is reminiscent of the Greek Credit Crisis that lingered on for nearly 6 years until a resolution with the IMF was agreed upon in 2016. Nearly six years ago, the eurozone was on the brink of a breakdown when Greece and other smaller economies of the region were in a serious debt crisis. Moody’s rating agency downgraded Italy’s credit rating two notches above junk status, making it more expensive for the country to borrow.

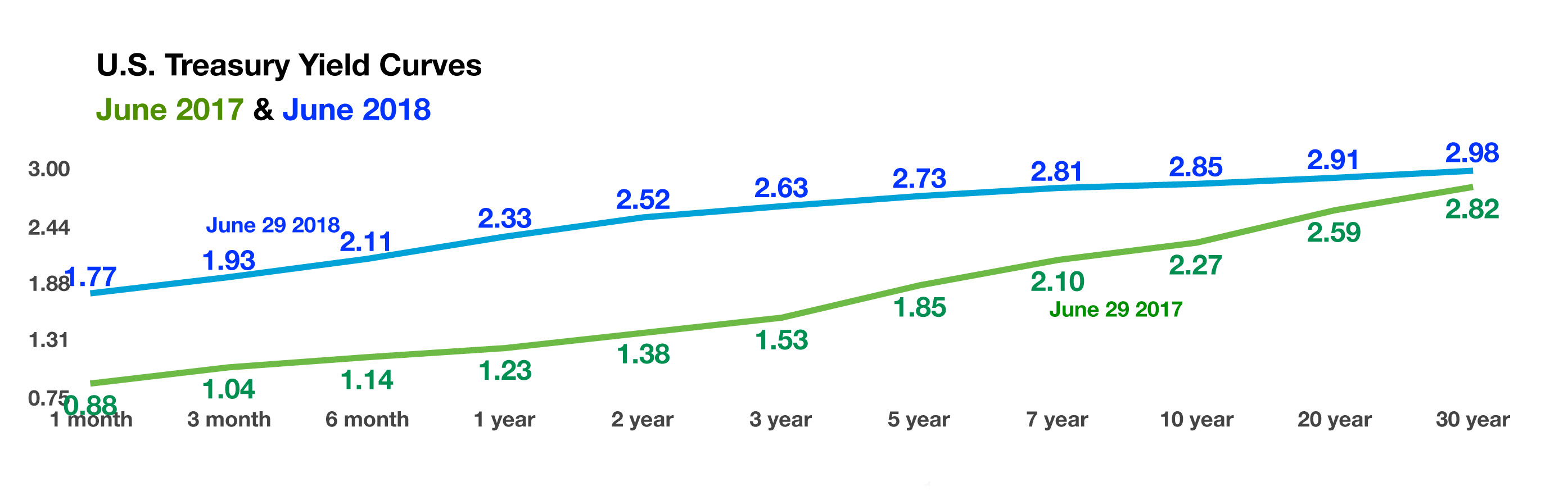

A rising dollar has hindered emerging markets as their dollar-denominated debt has become more costly to repay. The Institute of International Finance estimates that emerging markets held a record $6.3 trillion in dollar-denominated debt at the end of 2017. Rising U.S. interest rates can also entice international investors to extract assets from emerging countries and migrate them to U.S. assets such as Treasuries. Sources: Eurostat, IMF, Institute of International Finance

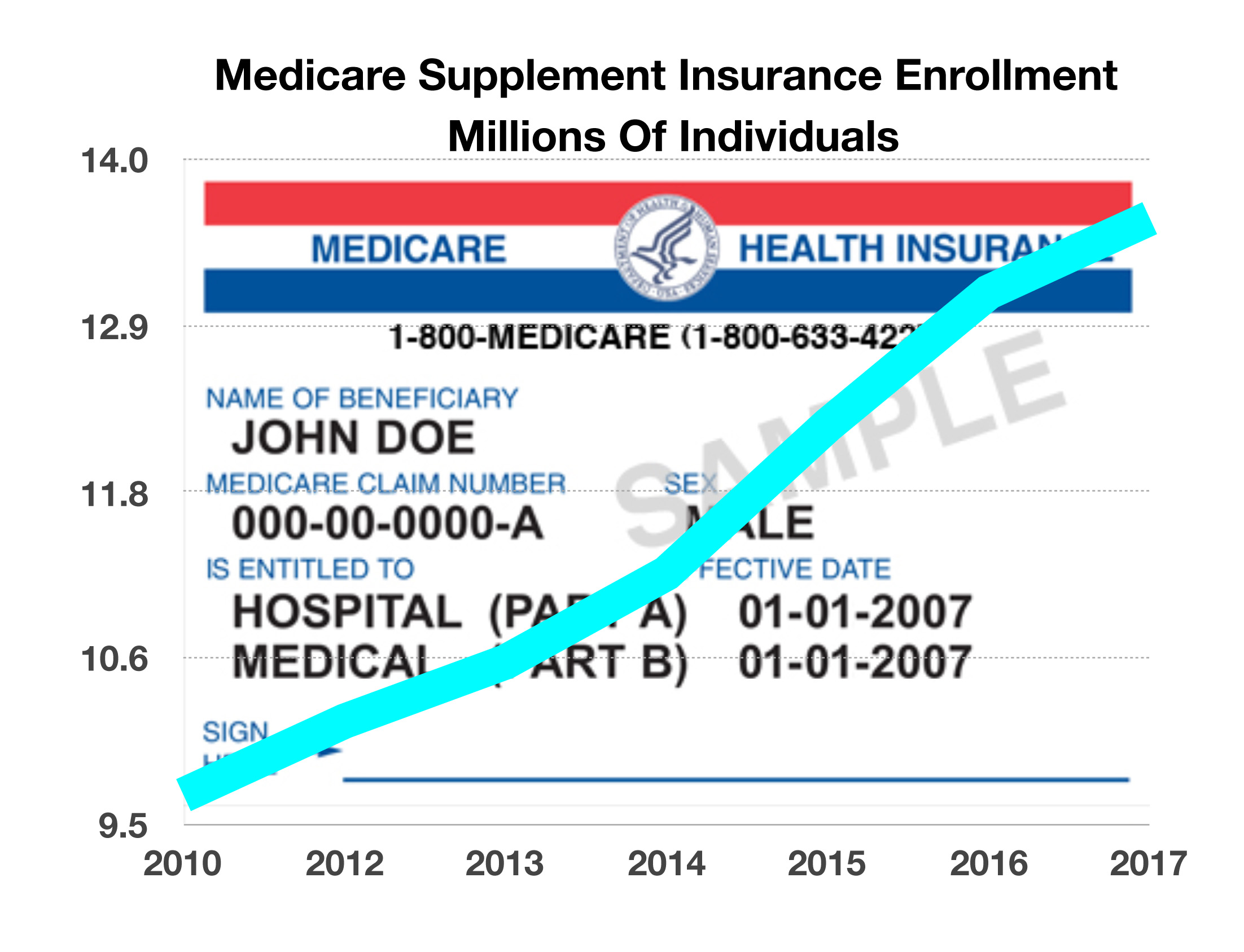

Medicare Supplemental Insurance Purchase On The Rise – Healthcare Overview

Supplemental insurance coverage that pays for medical expenses not covered by Medicare is on

Retirees can optionally enroll in private individual insurance policies that supplement original Medicare. These plans are standardized and identified by plan letter (Plans A-N). Also called Medicare Supplemental Insurance, retirees have the ability to choose their doctors, specialists, and care facilities. Sources: Congressional Research Service, American Association for Medicare Supplement Insurance

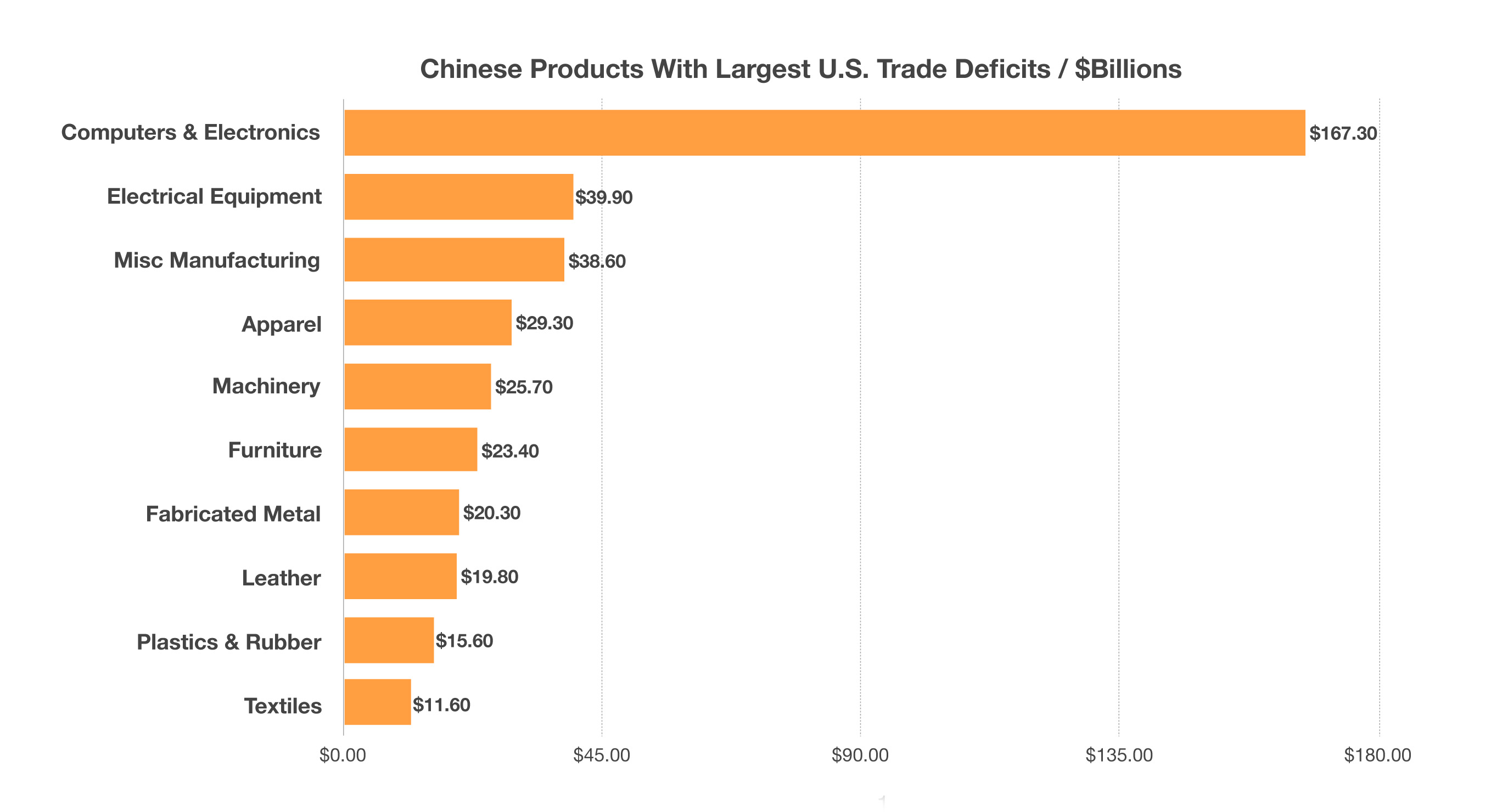

Foreign manufacturers have skirted tariffs and manufacturing rifts over the years by having certain products assembled in the United States, but comprised of imported components. Hence the controversial tag noting “assembled in the USA”, which many consumers and consumer groups have found to be misleading. (Sources: U.S. Department of Commerce)

Foreign manufacturers have skirted tariffs and manufacturing rifts over the years by having certain products assembled in the United States, but comprised of imported components. Hence the controversial tag noting “assembled in the USA”, which many consumers and consumer groups have found to be misleading. (Sources: U.S. Department of Commerce)