Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Dear Valued Clients,

As you are probably aware, not much has changed about our Three Big Things since our last quarterly newsletter.

Profit – Earnings growth has slowed, but not reversed; Tariff talks continue with the G-20 meeting right around the corner; US Energy exports continue to exceed imports in 2018, though gas prices, set globally, are going higher as a result of Iran’s shenanigans; Manufacturing output and employment continue to increase steadily.

Liquidity – Credit markets continue to be more conservative; Inverted yield curves persist; Interest rates increased in the second quarter, but Fed Chair, Jay Powell put a stop to that by signaling a cut in July.

Sentiment: Participate & Protect ! – A slow down is not a crisis and a recession can be a natural trough in the normal market cycle, generally followed by economic expansion. This is not the time to “seek shelter” or to “go all in”. Rather, revert to your optimal, long-term target allocation as defined in your Investment Policy Statement, which we developed with you, commensurate to your own circumstances and risk tolerance.

With so little change, I would like to use this space to share some of the business concerns and solutions that KCG has used to address them on your behalf.

KCG Contingency and Succession Plan

Many of you, my Clients, have experienced the transition from one advisor to another, and realize the importance of having a plan, as well as the right person to carry it out. In addition to my concern for you, I have talked with some of you about the services available to your children and beneficiaries and will be sharing more over the next few months. A very important question for you to ask is “What if something happens to Kimberly?” I am relatively young, with no plan to retire (I love my work!), but things don’t always go as planned and I am writing today in hopes of dispelling any concerns you may have.

As your fiduciary, KCG maintains up-to-date plans and procedures to keep your data safe, secure and available in the event of a hurricane, other destructive natural disaster, or even my own incapacity or death. Copies of these plans are kept in our offices – hard copy, electronically and in the cloud. A separate copy is with our corporate attorney.

While I am seeking an ideal candidate for my succession plan, I have named my attorney, who is also a Certified Financial Planner (CFP) as your legal contact for KCG, should the need arise. Benjamin P. O’Neal Esq., MBA, CFP, CPCU, of Strategic Solutions and Counsel, LLC has agreed to help answer your questions, and access the financial services you and your family would need in the unlikely event of my absence. My Executor has been instructed to work closely with Benjamin until every Client need is addressed.

While these topics can be somewhat unpleasant to discuss, it is important that you know they are being addressed and that your interests remain our first priority. If I can answer any additional questions or concerns, please don’t hesitate to call.

Sincere Regards,

Kimberly

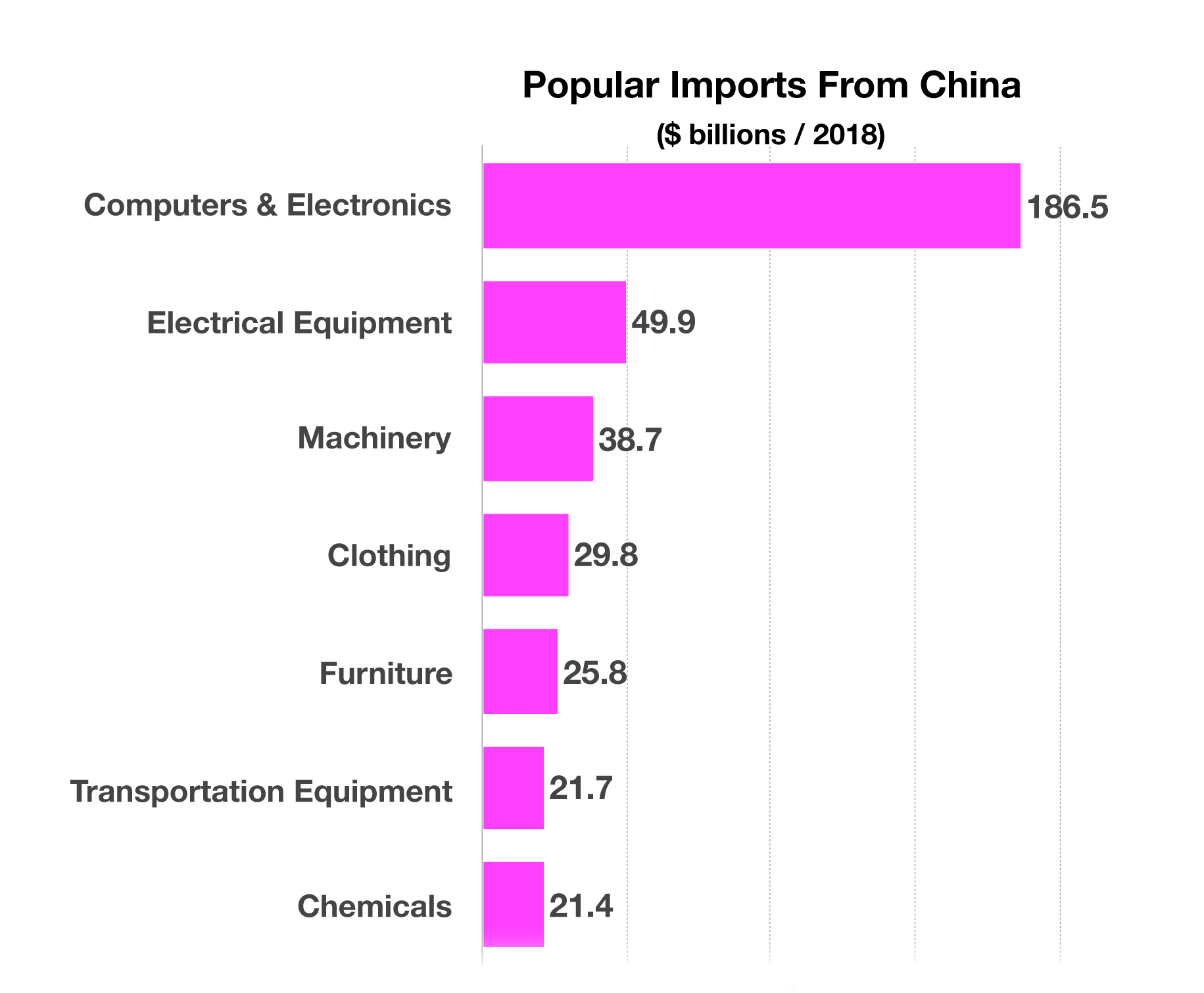

As a product exporter, China is able to manufacture and export finished products worldwide. In addition, China is also an exporter of components, which may be used in the manufacture and assembly of products in other countries, such as the United States. By exporting components in addition to finished products, China is able to hedge against tariff issues and labor costs should they become a factor.

As a product exporter, China is able to manufacture and export finished products worldwide. In addition, China is also an exporter of components, which may be used in the manufacture and assembly of products in other countries, such as the United States. By exporting components in addition to finished products, China is able to hedge against tariff issues and labor costs should they become a factor.