Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Stocks and bonds rose in unison in June as lower rates drove equities higher while also buoying bond prices. Recent indications by the Fed and the bond market that there may be a rate cut as soon as the end of July helped sustain stock prices near all-time highs.

On the forefront of global concerns was the June 28-29 G20 summit in Japan where trade tensions between the U.S. and China were discussed between President Trump and Chinese President Xi Jinping. Fortunately, the U.S. and China reached a temporary ceasefire for additional tariffs and agreed to re-start negotiations that had fallen apart and roiled the markets in May, and stocks rallied into the end of the first half of 2019.

The 10-year U.S. Treasury bond yield finished June at 2.00%, down from 2.68% to start the year. Yields dropped lower in Europe with Austria notably issuing 100-year government bonds with a yield of 1.17%. Highly rated, positive yielding government bonds are in enormous demand globally as investors seek reliable income and relative safety, so several bond analysts expect the 10-year U.S. Treasury it to fall below the psychological 2.00% level.

Mortgage rates continued to fall in June and ended the month at 3.73% on a 30-year fixed conforming loan, helping to spur mortgage applications. Despite lower rates, home price growth as measured by the latest S&P Case-Shiller Home Price 20-city composite index slowed to 2.5% in April and is the flattest growth since August 2012.

Commodity prices including oil, gold, and iron ore all rose in the first half of 2019, with much of the gains occurring in June. Cold and wet weather across the Midwest also pushed grain prices higher as many American farmers have been unable to plant their corn, soy, and wheat crops.

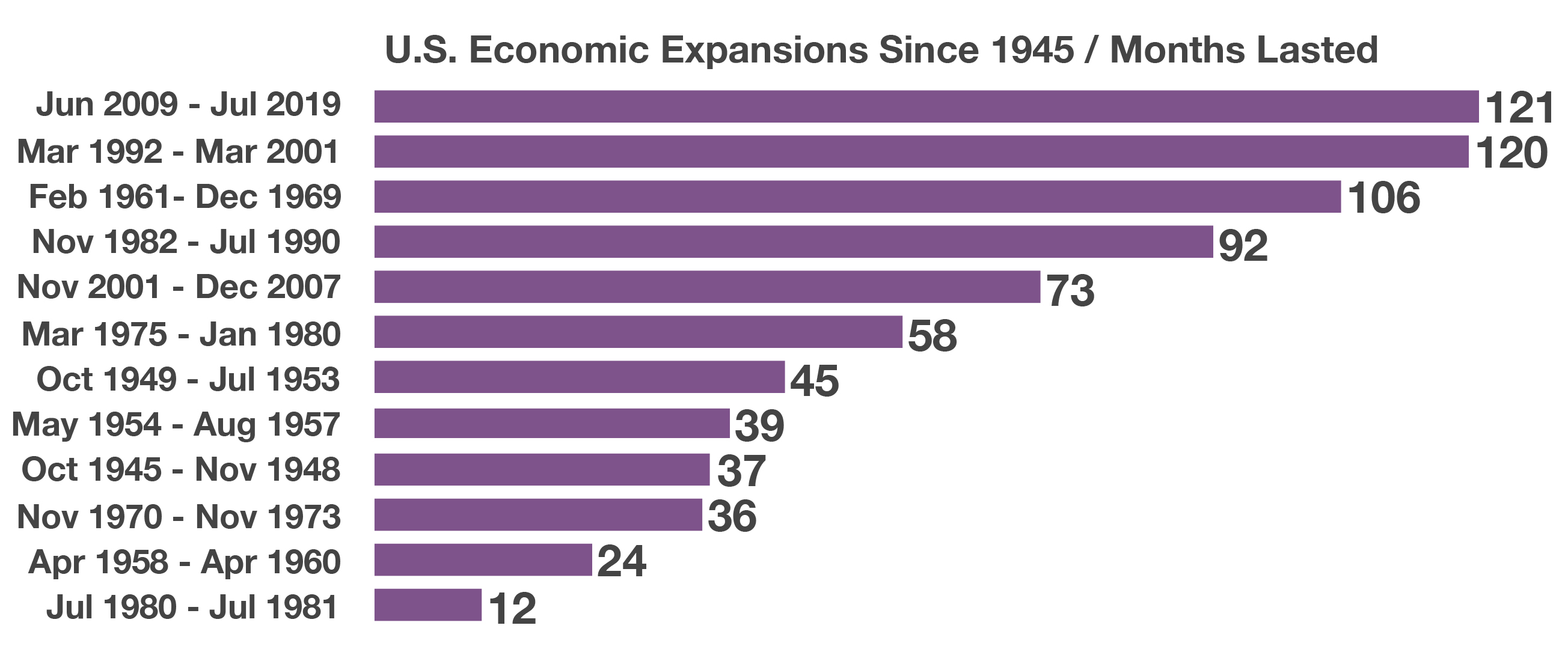

The U.S. Bureau of Economic Analysis found that the current economic expansion is now the longest on record since 1945. Since 1945 with the end of World War II, there have been 12 economic expansion periods and the general trend seems to be longer business cycles as the U.S. economy continues to structurally shift away from being more industrial and manufacturing based to more dependent on consumer spending which is now approximately two-thirds of U.S. GDP. (Sources: BEA, Freddie Mac, U.S.Treasury, g20.org, Bloomberg, Federal Reserve)

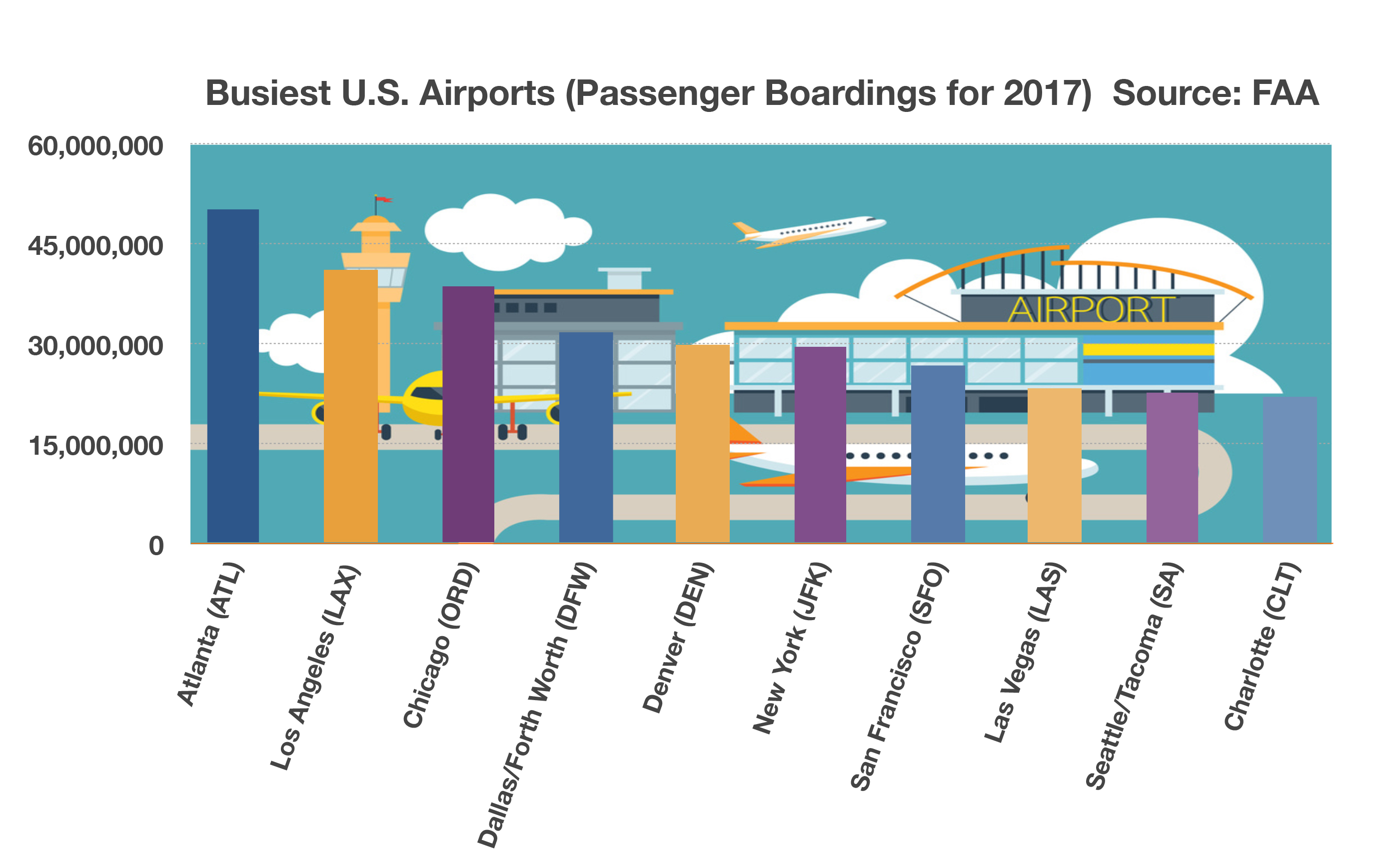

With some of the most popular travel destinations in the world, American airports cater to a host of tourists. Not only is the Atlanta International Airport the busiest airport in the country, it is also the busiest passenger airport in the world, with Beijing a close second. Atlanta is also geographically attractive, located only a two-hour flight away from 80 percent of the U.S. population.

With some of the most popular travel destinations in the world, American airports cater to a host of tourists. Not only is the Atlanta International Airport the busiest airport in the country, it is also the busiest passenger airport in the world, with Beijing a close second. Atlanta is also geographically attractive, located only a two-hour flight away from 80 percent of the U.S. population.