Aspen Wealth Management, Inc.

9300 W. 110th Street, Suite 680

Overland Park, KS 66210

913.491.0500

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Stocks and bonds rose in June as lower rates drove equities higher and international diplomatic tensions elevated bond prices. Indications by the Fed that there may be a rate cut later in the year helped sustain stock prices near record levels.

The G20 met in Osaka, Japan, at the end of June where trade tensions between the U.S. and China were on the forefront of global concerns. The U.S. and China reached a temporary truce over the trade war as the leaders from both countries agreed to re-start negotiations that had fallen apart earlier on. The de-escalation of trade tensions between the two countries led to heightened optimism surrounding global economic growth. Central banks from around the world will weigh as to how much a trade truce or settlement might impact other economies globally.

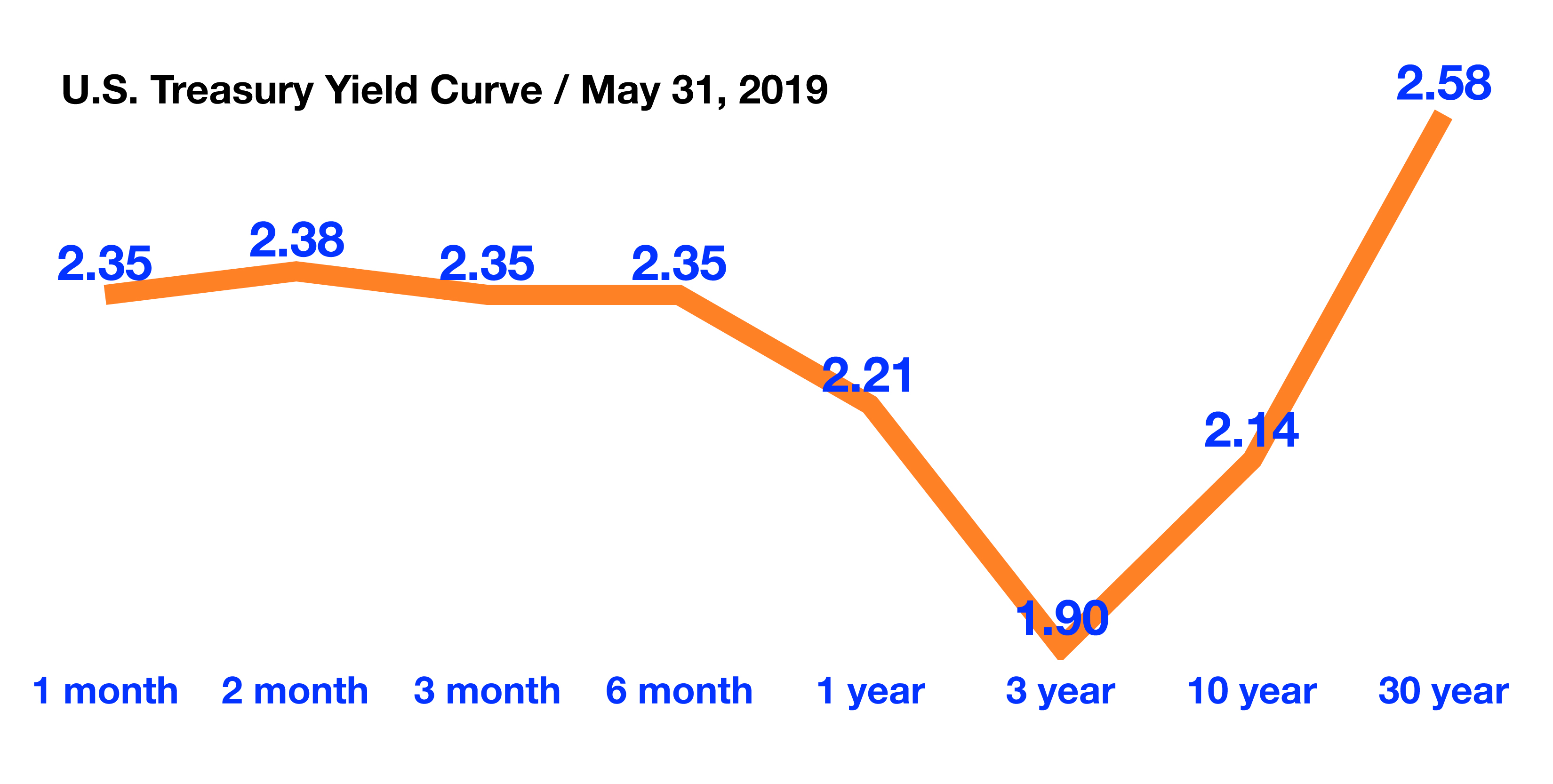

The 10-year Treasury bond yield fell to 2.00% at the end of June, with several bond analysts expecting it to fall below the psychological 2.00% level. Yields dropped lower in Europe with Austria issuing 100-year government bonds with a yield of 1.17%. Highly rated, positive yielding government bonds are in enormous demand globally as investors seek income from viable and reliable sources.

Mortgage rates dropped again in June to 3.73% on a 30-year fixed conforming loan, helping to sustain the housing market. The low rate environment has also fostered an inexpensive source of capital for U.S. and international companies, allowing for expansion and hiring as demand reappears.

Commodity prices including oil, gold, and iron ore all elevated in the first half of 2019, with most of the gains occurring in June. Rather than a traditional sign of inflation, falling inventories of oil and iron ore have pushed prices higher as demand has remained constant.

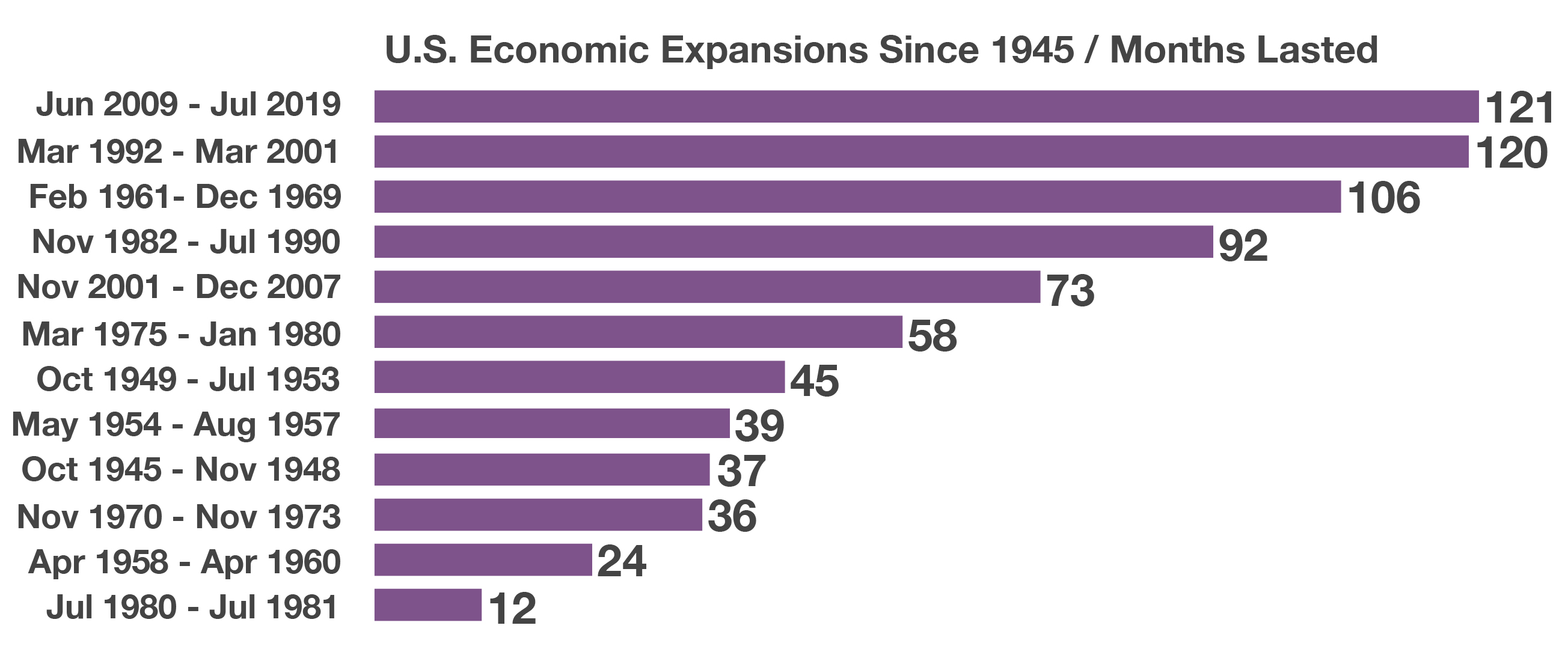

The U.S. Bureau of Economic Analysis found that the current economic expansion is the longest on record since 1945. The economic expansion that began in June 2009, following the depths of the financial crisis, has now lasted 121 months as of the end of June. The second longest economic expansion lasted 120 months, running from March 1992 until March 2001 when the dot-com bubble burst. There have been 12 economic expansion periods since the end of World War II in 1945 lasting 12 months or longer. (Sources: BEA, Freddie Mac, U.S.Treasury, g20.org, Bloomberg, Federal Reserve)

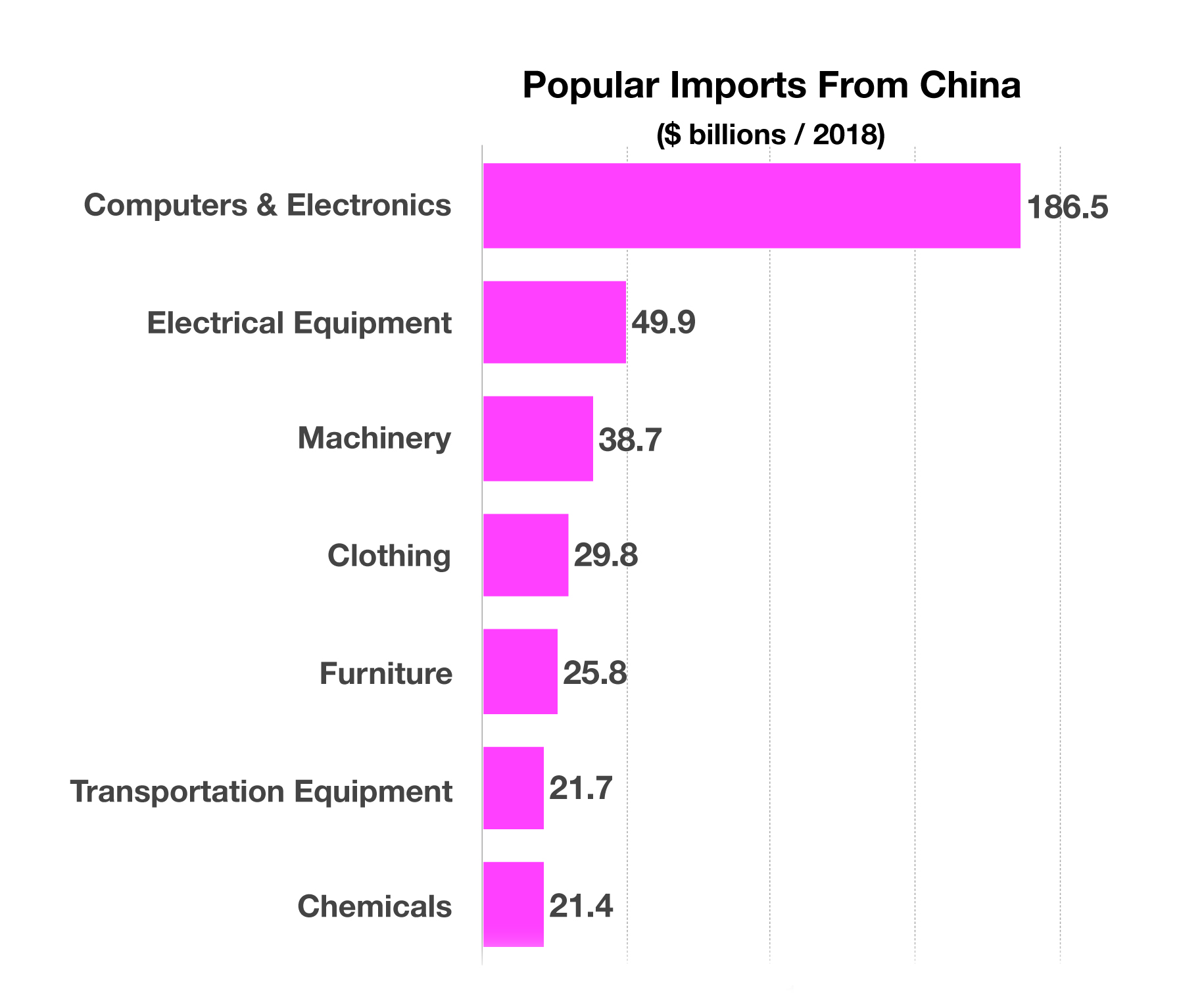

In the past twenty-plus years, China has evolved from a heavy equipment machinery exporter to a prominent leader in technology product exports. Large international conglomerates have established an enormous manufacturing presence throughout China, utilizing its cheap labor and quick turnaround times. China’s manufacturing plants are among the most modern in the world, producing large capacities almost entirely for export.

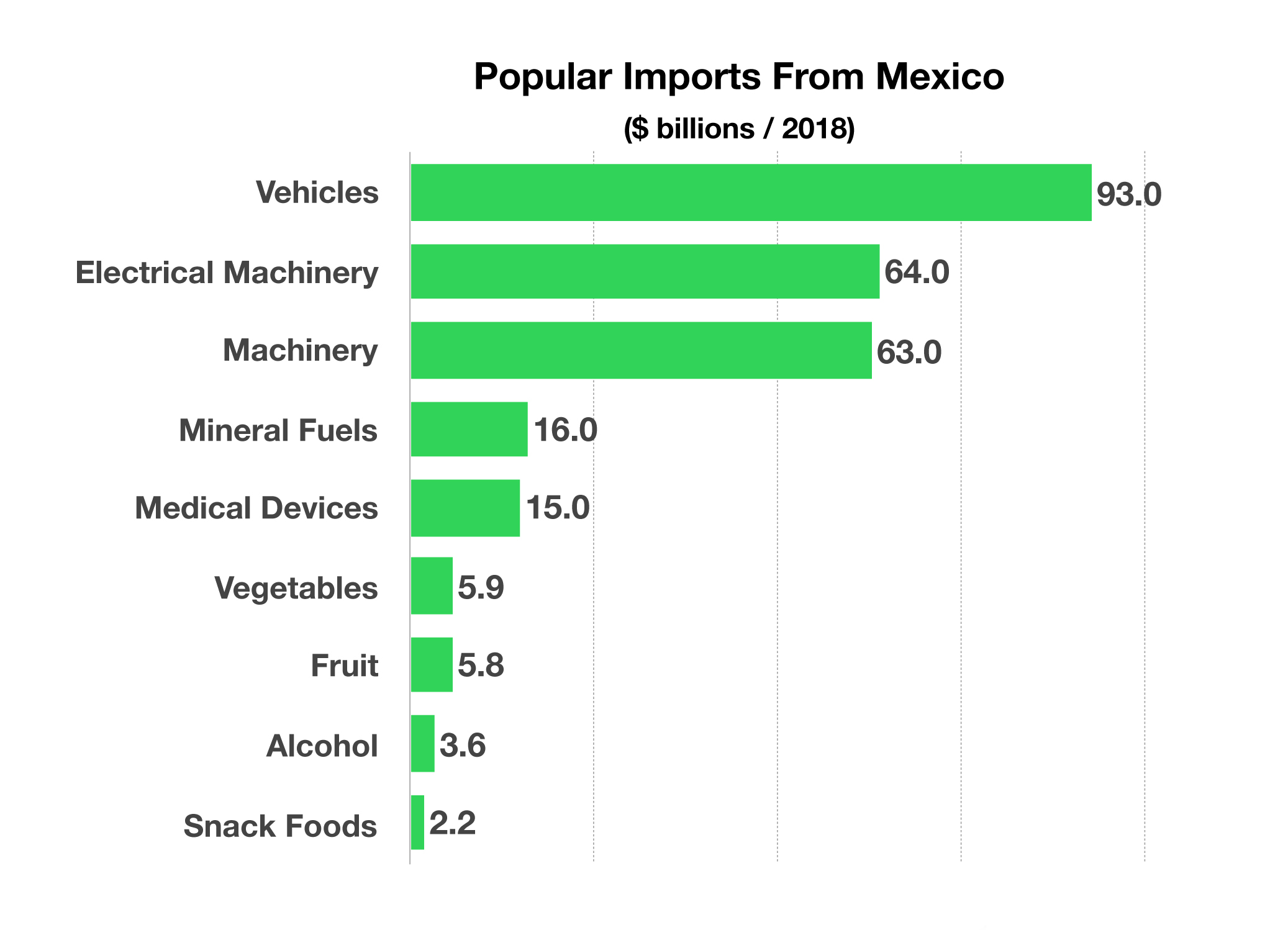

In the past twenty-plus years, China has evolved from a heavy equipment machinery exporter to a prominent leader in technology product exports. Large international conglomerates have established an enormous manufacturing presence throughout China, utilizing its cheap labor and quick turnaround times. China’s manufacturing plants are among the most modern in the world, producing large capacities almost entirely for export. The U.S. imported $93 billion worth of vehicles from Mexico in 2018, with auto parts accounting for the single largest type of product imported from Mexico valued at over $51 billion in 2016, making the automotive industry an integral component of trade with Mexico. Interestingly enough, exports headed from the U.S. to Mexico are primarily for use in the automotive industry, with machinery, fuels, and plastics making up the largest portions.

The U.S. imported $93 billion worth of vehicles from Mexico in 2018, with auto parts accounting for the single largest type of product imported from Mexico valued at over $51 billion in 2016, making the automotive industry an integral component of trade with Mexico. Interestingly enough, exports headed from the U.S. to Mexico are primarily for use in the automotive industry, with machinery, fuels, and plastics making up the largest portions.