Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

July 2019

Macro Overview

Stocks and bonds rose in June as lower rates drove equities higher and international diplomatic tensions elevated bond prices. Indications by the Fed that there may be a rate cut later in the year helped sustain stock prices near record levels.

The G20 met in Osaka, Japan, at the end of June where trade tensions between the U.S. and China were on the forefront of global concerns. The U.S. and China reached a temporary truce over the trade war as the leaders from both countries agreed to re-start negotiations that had fallen apart earlier on. The de-escalation of trade tensions between the two countries led to heightened optimism surrounding global economic growth. Central banks from around the world will weigh as to how much a trade truce or settlement might impact other economies globally.

The 10-year Treasury bond yield fell to 2.00% at the end of June, with several bond analysts expecting it to fall below the psychological 2.00% level. Yields dropped lower in Europe with Austria issuing 100-year government bonds with a yield of 1.17%. Highly rated, positive yielding government bonds are in enormous demand globally as investors seek income from viable and reliable sources.

Mortgage rates dropped again in June to 3.73% on a 30-year fixed conforming loan, helping to sustain the housing market. The low rate environment has also fostered an inexpensive source of capital for U.S. and international companies, allowing for expansion and hiring as demand reappears.

Commodity prices including oil, gold, and iron ore all elevated in the first half of 2019, with most of the gains occurring in June. Rather than a traditional sign of inflation, falling inventories of oil and iron ore have pushed prices higher as demand has remained constant.

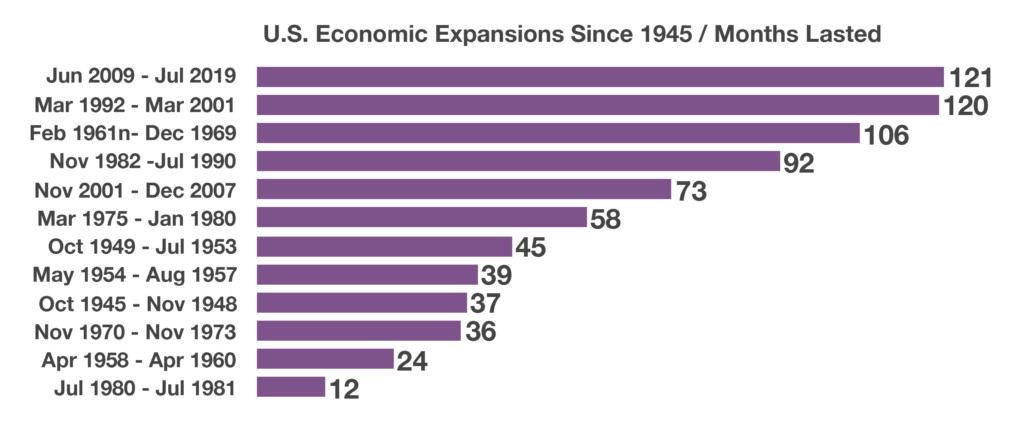

The U.S. Bureau of Economic Analysis found that the current economic expansion is the longest on record since 1945. The economic expansion that began in June 2009, following the depths of the financial crisis, has now lasted 121 months as of the end of June. The second longest economic expansion lasted 120 months, running from March 1992 until March 2001 when the dot-com bubble burst. There have been 12 economic expansion periods since the end of World War II in 1945 lasting 12 months or longer

Sources: BEA, Freddie Mac, U.S.Treasury, g20.org, Bloomberg, Federal Reserve

Stocks Rebound In June – Equity Overview

Stocks and bonds registered the first half of the year with formidable gains propelled by an expected rate cut by the Fed later in the year. It was the best first half of the year since 1997 for equities, with the Dow Jones Industrial Index, S&P 500 Index, and the Nasdaq nearing new highs.

Equities were also driven higher in June by a relief in trade tensions between the U.S. and China as the expectation that the Fed will eventually cut rates sometime this year. Historically, a low-rate environment is favorable for equities in the form of inexpensive capital for expansion and loans.

The rebound in stock prices in the first half of 2019 from the turmoil that hindered markets in December 2018 has been one of the strongest rebounds in decades.

The Federal Reserve gave large U.S. banks the approval to repurchase their own shares and lift dividends, part of the Comprehensive Capital Analysis and Review process set in place by the Fed. Large money center banks as well as smaller regional banks were restricted from buying back their own shares as well as increasing dividends in order to fortify bank balance sheets following the financial crisis.

Sources: Federal Reserve, Dow Jones, S&P, Bloomberg, Reuters

Yields Drop Further In June – Fixed Income Update

The 10-year Treasury bond yield dropped below 2% for the first time since November 2016. The 10-year Treasury continues to trade at a lower yield than the 3-month Treasury bill, signaling an inversion, which is when shorter term maturity bonds yield more than longer term bonds.

Rates concurrently dropped in Europe, India and Australia as central banks maintained stimulus efforts with a continued low interest rate environment.

The Federal Reserve communicated its confidence with the labor market and rising wages for lower paid workers as positive for the U.S. economy, but noted that inflation is still mundane and below expectations. Its concern is slowing global growth with anemic economic expansion in other parts of the world. Such concerns may lead to dismal expansion with the need to eventually reduce rates to help prop up economic growth.

Sources: U.S. Treasury, Federal Reserve

IRS Scams – Consumer Awareness

Identity theft and stolen funds are becoming a growing risk as thieves have devised clever methods of masking IRS communications. Various government entities have identified some of the most prevalent scams.

Refund Scam Fraudulent emails, appearing to come from the IRS, notify you that you are eligible for a tax refund, but need to provide sensitive bank details in order to receive the funds.

Inherited Funds, Lottery Winnings, & Cash Consignment Scams Emails claiming to come from the U.S. Department of Treasury, notify you that you will receive millions of dollars if you follow the instructions in the email.

SS Scam An identity thief could use your social security number to fraudulently file a tax return and claim a refund. You could be completely unaware that your identity has been stolen until your return is rejected for e-filing or you get a notice or letter from the IRS.

Rejected e-File An electronically filed return is rejected because the social security number belonging to you, your spouse, or a dependent has already been used on a tax return.

Suspicious IRS Items You receive a fraudulent notice from the IRS stating that more than one return was filed in your name for the year.

You have a balance due, refund offset, or initiation of collection action for a year when you did not file.

IRS records indicate that you received wages from an employer you didn’t work for.

You should respond immediately to the name and phone number printed on the IRS notice or letter. You should also complete Form 14039, Identity Theft Affidavit.

Source: IRS.gov, consumer.ftc.gov, treasury.gov