Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Concern has elevated regarding the possibility of a second wave of COVID-19 infections following a surge in cases across the country. Markets, however, continued to shrug off dismal economic data amid pandemic worries, as a sporadic easing of restrictions targeting businesses came about. The second quarter, which ended June 30th, saw a rebound in all eleven sectors of the S&P 500 Index, a reversal following the first quarter of the year.

The increase in new coronavirus cases in various states and cities has escalated anxiety among investors and market analysts. Fear of a second wave of infections has led to re-closures by some cities and businesses, inflicting further harm on already struggling businesses. The variance of methods being utilized by states and cities continues to be vastly inconsistent.

The World Health Organization (WHO) suggested that certain countries and regions reinstate lockdowns in order to stem an acceleration of the pandemic. The WHO also believes that the United States and the world will eventually need to learn to live with virus outbreaks and the turmoil that accompanies them.

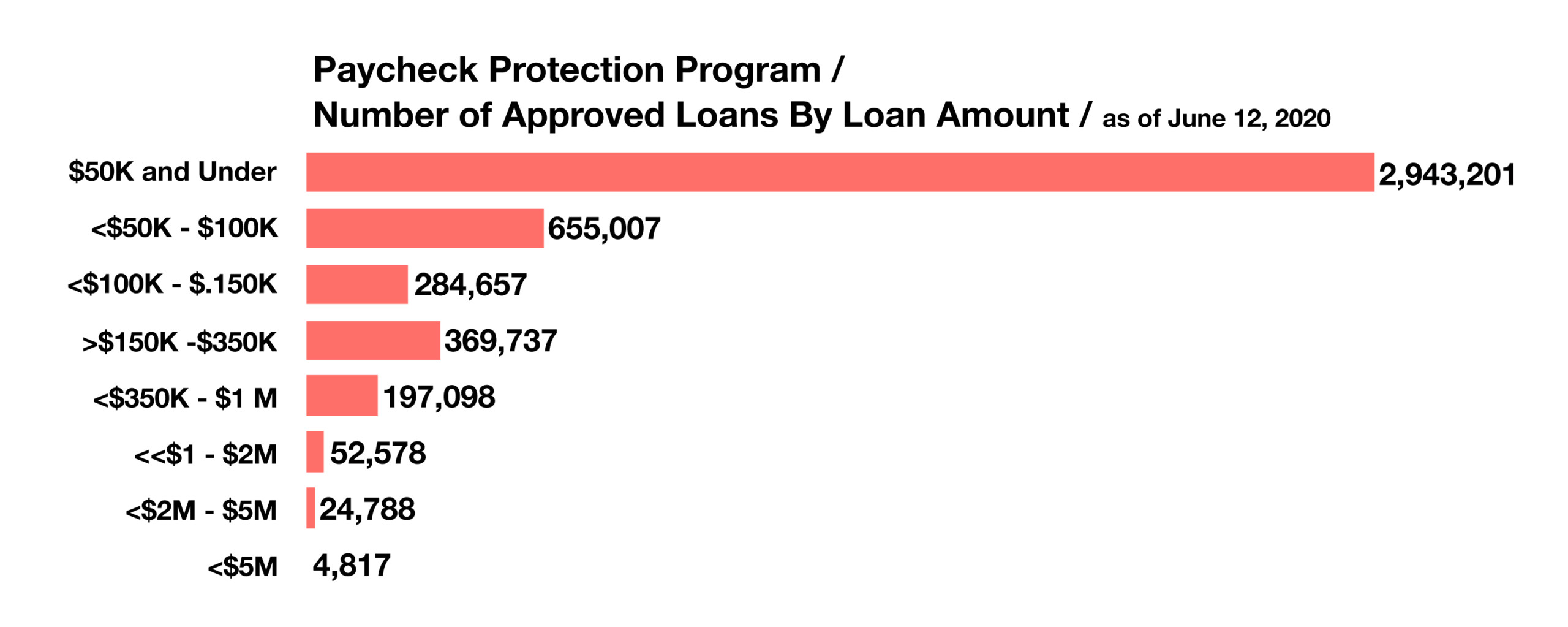

The Federal Reserve is placing safeguards in place, should a second wave of infections emerge which could further debilitate economic activity. The safeguards include two newly created lending programs to facilitate liquidity for cities and businesses across the country. The Municipal Liquidity Facility provides essential funds to cities and municipalities suffering from the financial fallout of the outbreak, and the Main Street Lending Program provides loans to small and mid-sized businesses.

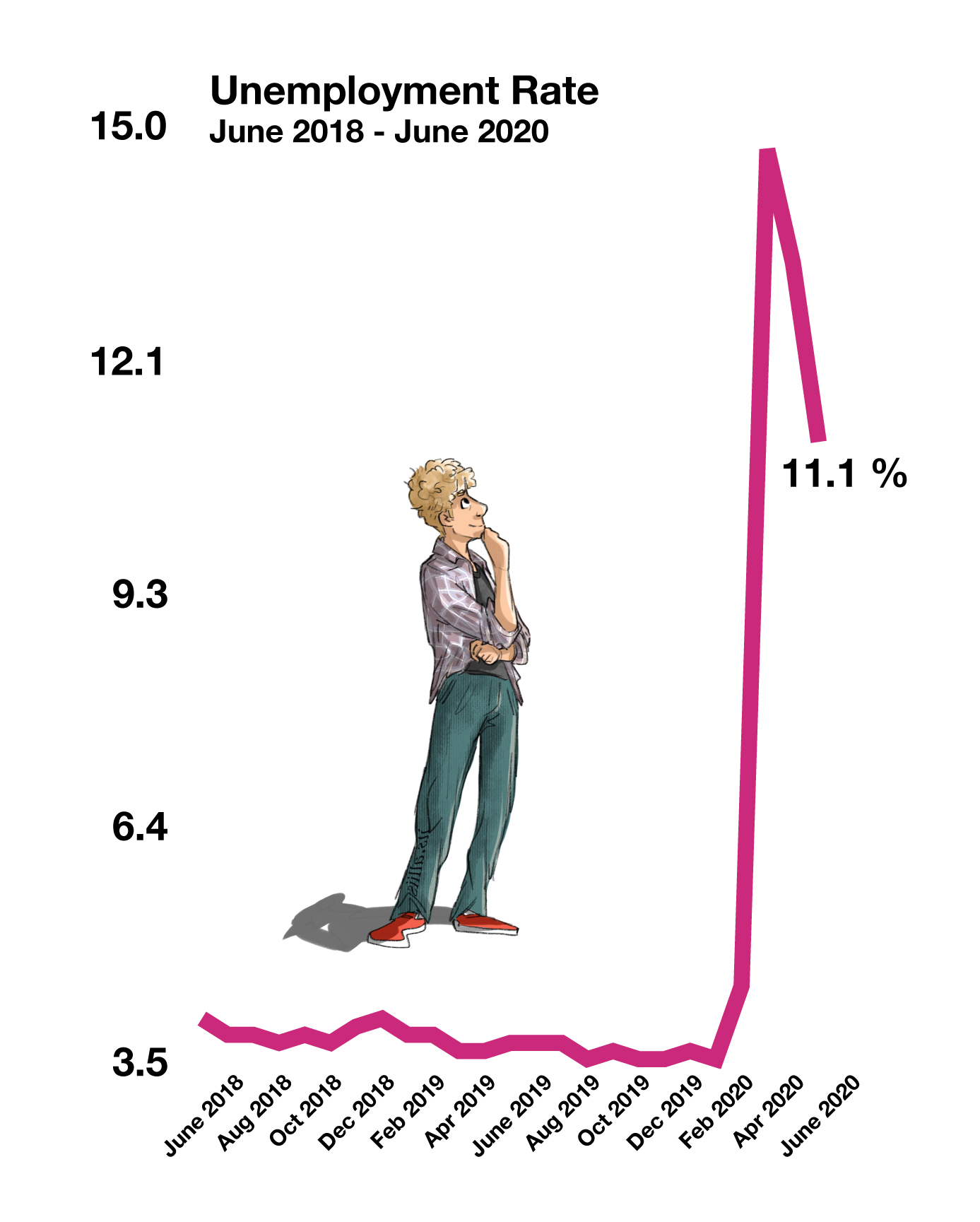

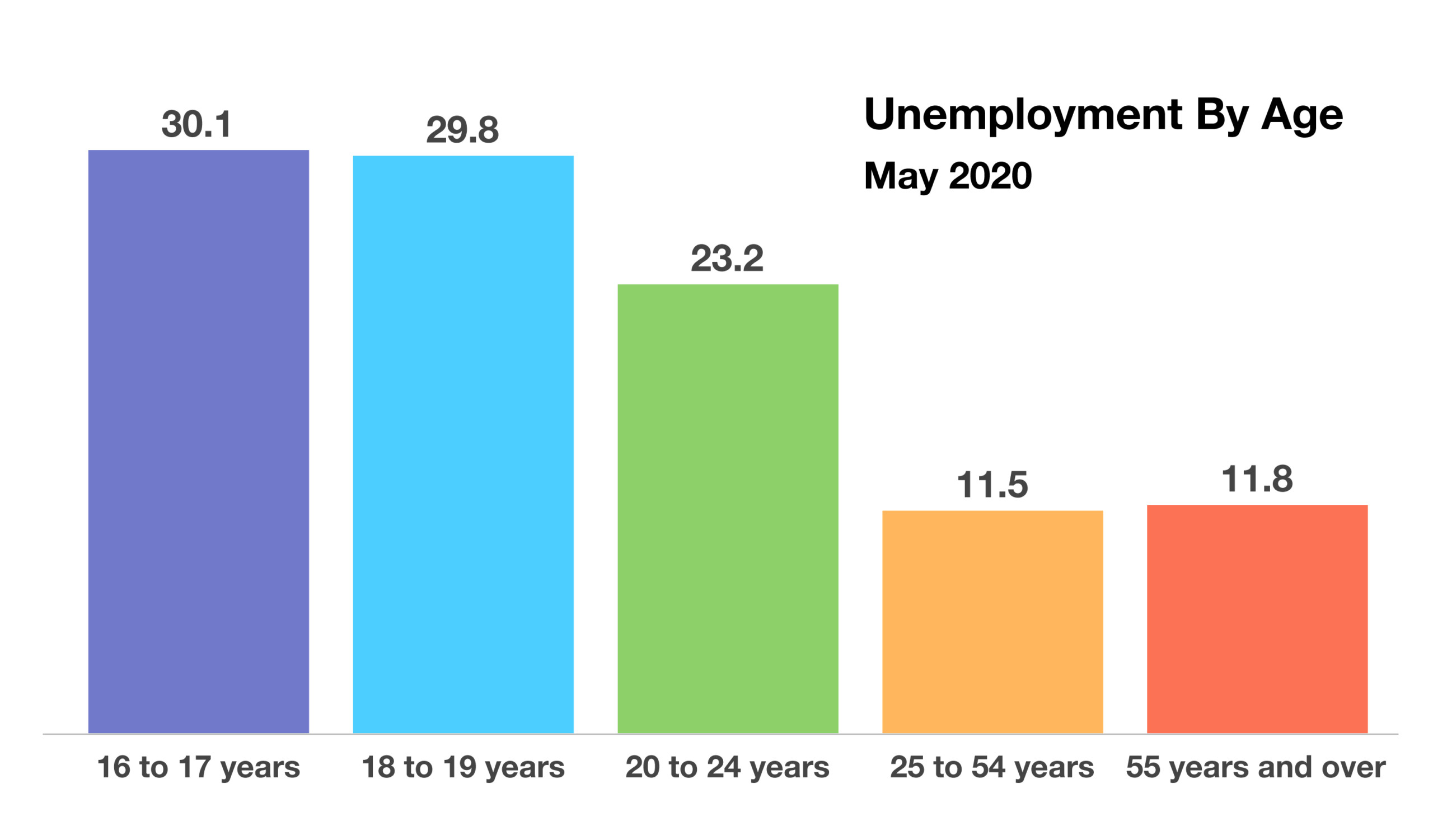

The Department of Labor acknowledged that it misclassified 4.9 million non working people as newly employed for the month of May. The May employment data was initially questioned by economists and market analysts, yet propelled equity markets when released. Such data mishaps can place Labor Department data as well as data from other government entities into question. June employment data revealed a decrease in the unemployment rate, propelled by a resurgence in restaurant, hospitality, and leisure jobs.

The European Union (EU) remained closed to U.S. travelers this past month despite borders opening up to residents from other countries as of late June. In response to the steady increase of reported COVID-19 cases within U.S. borders, the EU extended the original July 1st travel ban suspension noting epidemiological factors as the justification.

The Congressional Budget Office (CBO) estimates that the virus outbreak will cost the U.S. economy $7.9 trillion over the next ten years. The uncertainty of how the virus may evolve and when a vaccine is introduced will alter cost estimates. (Sources: Fed, CBO, U.S. Treasury, CDC, Labor Department, WHO)