Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview / July 2020

Concern has elevated regar

The increase in new coronavirus cases in various states and cities has escalated anxiety among investors and market analysts. Fear of a second wave of infections has led to re-closures by some cities and businesses, inflicting further harm on already struggling businesses. The variance of methods being utilized by states and cities continues to be vastly inconsistent.

The World Health Organization (WHO) suggested that certain countries and regions reinstate lockdowns in order to stem an acceleration of the pandemic. The WHO also believes that the United States and the world will eventually need to learn to live with virus outbreaks and the turmoil that accompanies them.

The Federal Reserve is placing safeguards in place, should a second wave of infections emerge which could further debilitate economic activity. The safeguards include two newly created lending programs to facilitate liquidity for cities and businesses across the country. The Municipal Liquidity Facility provides essential funds to cities and municipalities suffering from the financial fallout of the outbreak, and the Main Street Lending Program provides loans to small and mid-sized businesses.

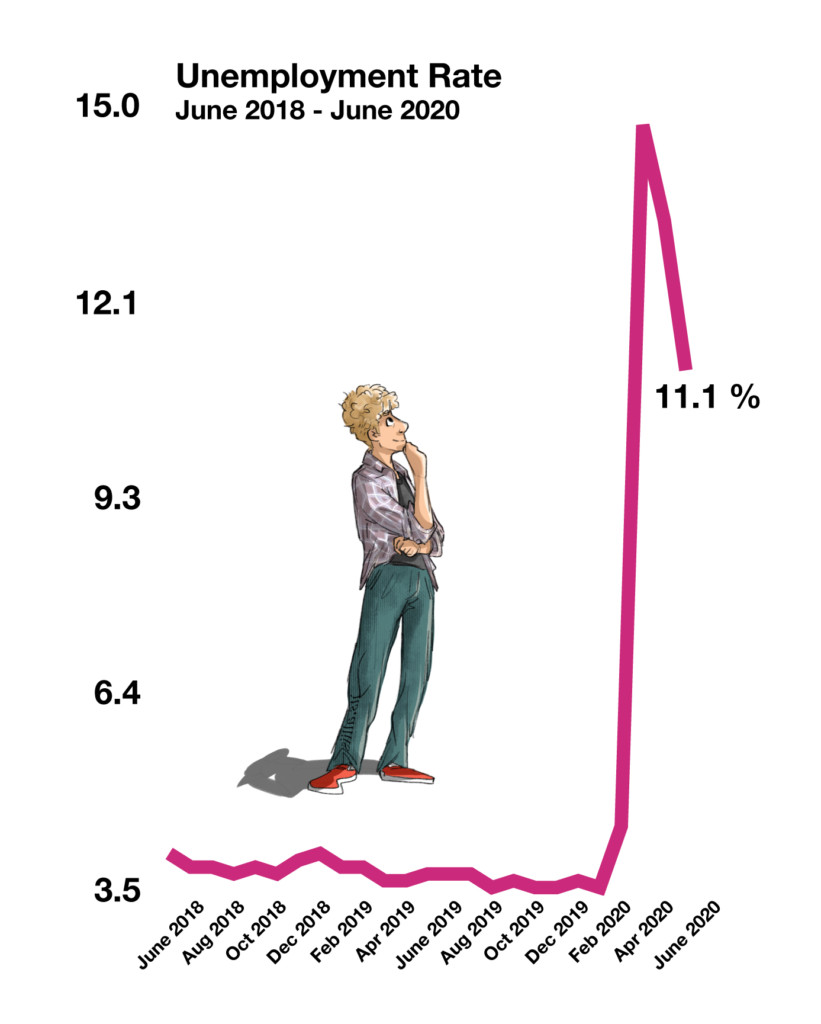

The Department of Labor acknowledged that it misclassified 4.9 million non working people as newly employed for the month of May. The May employment data was initially questioned by economists and market analysts, yet propelled equity markets when released. Such data mishaps can place Labor Department data as well as data from other government entities into question. June employment data revealed a decrease in the unemployment rate, propelled by a resurgence in restaurant, hospitality, and leisure jobs.

Economists believe that the short-term benefits brought about by the stimulus checks may be waning, as well as unemployment benefits due to expire at the end of July unless extended by Congress.

Comments by Fed Chair Jerome Powell suggested that additional fiscal support in addition to the CAREs Act would be necessary to safeguard economic stability should conditions worsen. The Fed is also concerned that an extensive period of high unemployment could have detrimental long-term effects on consumer behavior and the U.S. economy.

The relaxation of businesses restrictions has created a wait and see environment as the Fed and Congress decipher what additional stimulus may be necessary.

The upcoming flu season this fall may be complicated by the coronavirus pandemic as reported by U.S. health agency Centers for Disease Control & Prevention.

The Congressional Budget Office (CBO) estimates that the virus outbreak will cost the U.S. economy $7.9 trillion over the next ten years. The uncertainty of how the virus may evolve and when a vaccine is introduced will alter cost estimates.

A lingering trade deal between the U.S. and China has essentially been on hold since the coronavirus erupted into a pandemic in March. Prospects for a continued deal have been clouded leading to uncertainty of any formal follow through.

Sources: Fed, CBO, U.S. Treasury, CDC, Labor Department, WHO

Equities Remain Resilient – Domestic Equity Update

Equities rebounded in the second quarter, with all eleven sectors of the S&P 500 Index positive for the quarter. Sectors with the most advancements included consumer discretionary, energy, materials and technology. Economists and analysts believe that the upswing in these sectors is representative of an economic recovery, yet hinged on the risk of a second outbreak wave.

The technology heavy Nasdaq Index has outperformed the S&P 500 and the Dow Jones Industrial Index both year to date and for the second quarter. Some stock analysts believe that the disparity in performance is reminiscent of the dot-com expansion 20 years ago.

Sources: S&P, Nasdaq, Dow Jones, Bloomberg

Rates Stabilize In June – Fixed Income Overview

Federal Reserve buying of debt securities continued in the second quarter under the Secondary Market Corporate Credit Facility program, which was established to maintain liquidity in the bond markets. Individual corporate bonds and ETFs have been part of the Fed’s buying program, which was launched in mid-June. Bonds purchased so far include debt issues from both investment grade and non-investment grade rated companies.

Corporate and government bonds continued to post positive returns in the second quarter, as yields stabilized following the dramatic drop in yields during the first quarter of the year. The benchmark 10-year Treasury bond yield closed at 0.66% at the end of June, helping to boost consumer lending and mortgage rates.

Sources: Treasury Dept., Federal Reserve, Bloomberg

Tapping 401k & Retirement Plan Assets During The Crisis – Retirement Planning

Provisions initiated by the CAREs Act, allows for the withdrawal of retirement plan assets with waived penalties and minimized tax liabilities. During the current tax year, retirement account owners will be able to withdraw funds from 401k plans, tax deferred plans, and IRAs without any penalties. Loan limitations on company sponsored 401k plans will also be relaxed, allowing employees to take larger loan amounts. Required Minimum Distributions (RMD)s are also being waived for 2020 distributions.

Section 2202 under the CAREs Act enacted on March 27, 2020, provides for special distribution options and rollover rules for retirement plans and IRAs. Under the revised rules, IRA owners and retirement plan participants are allowed to withdraw up to $100,000, but must meet certain criteria to qualify. The IRS notes the following as criteria to meet:

You are diagnosed with the coronavirus (COVID-19).

Your spouse is diagnosed with the coronavirus (COVID-19).

You experience adverse financial consequences as a result of being quarantined, furloughed, laid off, or having reduced work hours all due to COVID-19.

Unable to work due to a lack of child care as result of COVID-19.

Experience adverse financial consequences as a result of closing a business or loss of hours as a result of COVID-19.

Distributions from IRAs and qualified plans will have the 10% penalty waived but are still taxed at the individual owner’s corresponding tax rate. Qualified distributions up to the $100,000 maximum are for distributions made between January 1, 2020 and December 30, 2020. Taxes on distributions may be paid over a three year period starting with the year in which the initial distribution was made.

Distributions may also be repaid back to an IRA or qualified plan over a three year period to avoid any tax consequences.

Source: https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-answers

Small Business Loan Program Still Has Funds – Stimulus Program Review

Three months following the administration’s launch of pandemic relief programs, major debates have arisen in response to the remaining surplus of undirected funds in conjunction with the Paycheck Protection Program (PPP). The program was established to assist small businesses with critical funds in order to remain in business during the pandemic.

As the COVID-19 crises continues to perpetuate mixed discussion and growing numbers, disputes over the remaining funds result, showing an increased bipartisan support for fund allocation towards small business relief. Senate democrats consider nuance legislation that would provide secondary PPP loan allocations for eligible small businesses. Contrary to primary requirements that were more restrictive, a second PPP loan would be available to those small businesses with previous PPP loans, limited to 100 or fewer employees. The proposed legislation hopes to aid prolonged relief and support to those small businesses subject to projected additional loss.

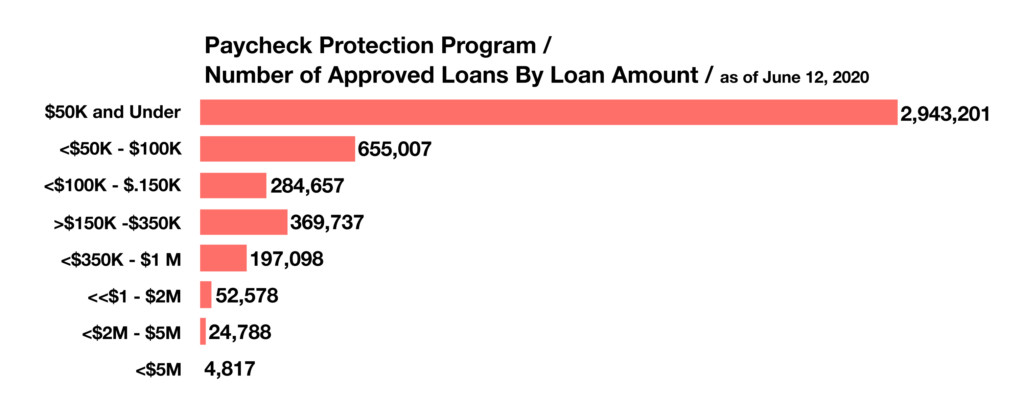

PPP loan measures have been taken and proposed by congressional members considering the excuse of loans $150,000 or less, which represents nearly 85% of all PPP loans, in order to minimize the burden while utilizing a minimal proportion of the Paycheck Protection Program’s overall expenditure.

After the Small Business Administration’s approval of increased loans, the program’s outlays are the largest financial outlay within COVID-19 spending. Loan applications have shown promising results to nearly 81% of PPP loan applicants, many reporting having already received the funds.

Unless extended by Congress, the Paycheck Protection Program stopped accepting new loan applications on June 30, 2020. As of June 12, 2020, the SBA reported that over 4.5 million PPP loans had been approved, with an average loan amount of $113,000.

Sources: SBA, congress.gov, National Federation of Independent Business

American Travelers To E.U. Banned – International Policy

The European Union (EU) remained closed to U.S. travelers this past month despite borders opening up to residents from other countries as of late June. In response to the steady increase of reported COVID-19 cases within U.S. borders, the EU extended the original July 1st travel ban suspension noting epidemiological factors as the justification. The travel ban surfaced mid-March and constituted a pause on all nonessential travel both internally and externally. Despite internal borders opening up mid-June, the EU withheld non-EU countries until July.

The reopening has the hopes of amplifying tourism and repairing the weakened industry from the constraints and trauma of the COVID-19 pandemic. Tourism accounts for nearly 10% of the EU’s economy, making this transition a potentially large economic component for the European travel industry. As the EU continues to ban U.S. travelers in response to rising COVID-19 cases, many questions remain regarding the future of international and even domestic travel within the United States.

Despite the ban that is still in effect, some exceptions have been permitted for essential travelers including political, medical and returning domestic travelers, lending some countries to adopt independent quarantine and travel policies. However, these exceptions also hold weight as the risk of internal travel bans could be a reality if the EU ban is not held seriously. Additionally, the U.S. travel ban on European nations that was set into effect in March has also not lifted restrictions, despite a decreased report of European COVID-19 cases. These mutual bans draw many considerations and uncertainty regarding the travel ban lift on U.S. and EU nations. Although no nationwide domestic travel ban currently prevails, rising cases project a curious sentiment and conversation considering future internal travel bans within the U.S.

Sources: Eurostat, U.S. Dept. of State