Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Financial markets responded to news regarding the Delta variant mutation of Covid-19, as some countries in Europe reconsider easing restrictions on businesses and travel. Regardless, global equities finished the 2nd quarter on a positive note and interest rates stabilized following an upward trend earlier in the year.

A dearth of spending amidst stay-at-home orders during the pandemic left millions of consumers with abundant cash balances, which was a factor in the recent uptick in economic activity nationwide. Some economists question the sustainability of high levels of spending once the plentiful cash positions are depleted.

Comments by St. Louis Federal Reserve Bank member James Bullard suggested that there is a “housing froth that seems to be developing” and indicated that the Federal Reserve may pull back on mortgage bond purchases as early as 2022.

Half of home buyers in April who took out a mortgage put a 20% down payment, while a quarter of buyers paid in all cash, according to the National Association of Realtors. Cash offers, in addition to large down payments, are pushing some buyers out of the market, forcing many to rent until market conditions change.

There is growing concern that the Delta variant of Covid-19 may evolve into a dominant strain in the U.S. The reportedly highly-transmissible variant made up 30% of positive samples in the U.S. for the two-week period ending June 19th, according to the U.S. Centers for Disease Control and Prevention. The Delta mutation first emerged in India and has since spread worldwide, forcing some countries to reevaluate loosened restrictions on businesses, travel and public events.

An eviction moratorium for tenants set to expire on June 30th was extended to July 31st after a Supreme Court decision. The moratorium was initiated in August 2020 by the prior administration to help tenants who experienced financial hardships due to Covid-19. Landlords across the country subsequently saw months of non-payment by some tenants with the inability to evict them. The U.S. Department of Agriculture extended through July 31st a moratorium on foreclosures for properties financed by USDA Single Family Housing Direct and guaranteed federal loans.

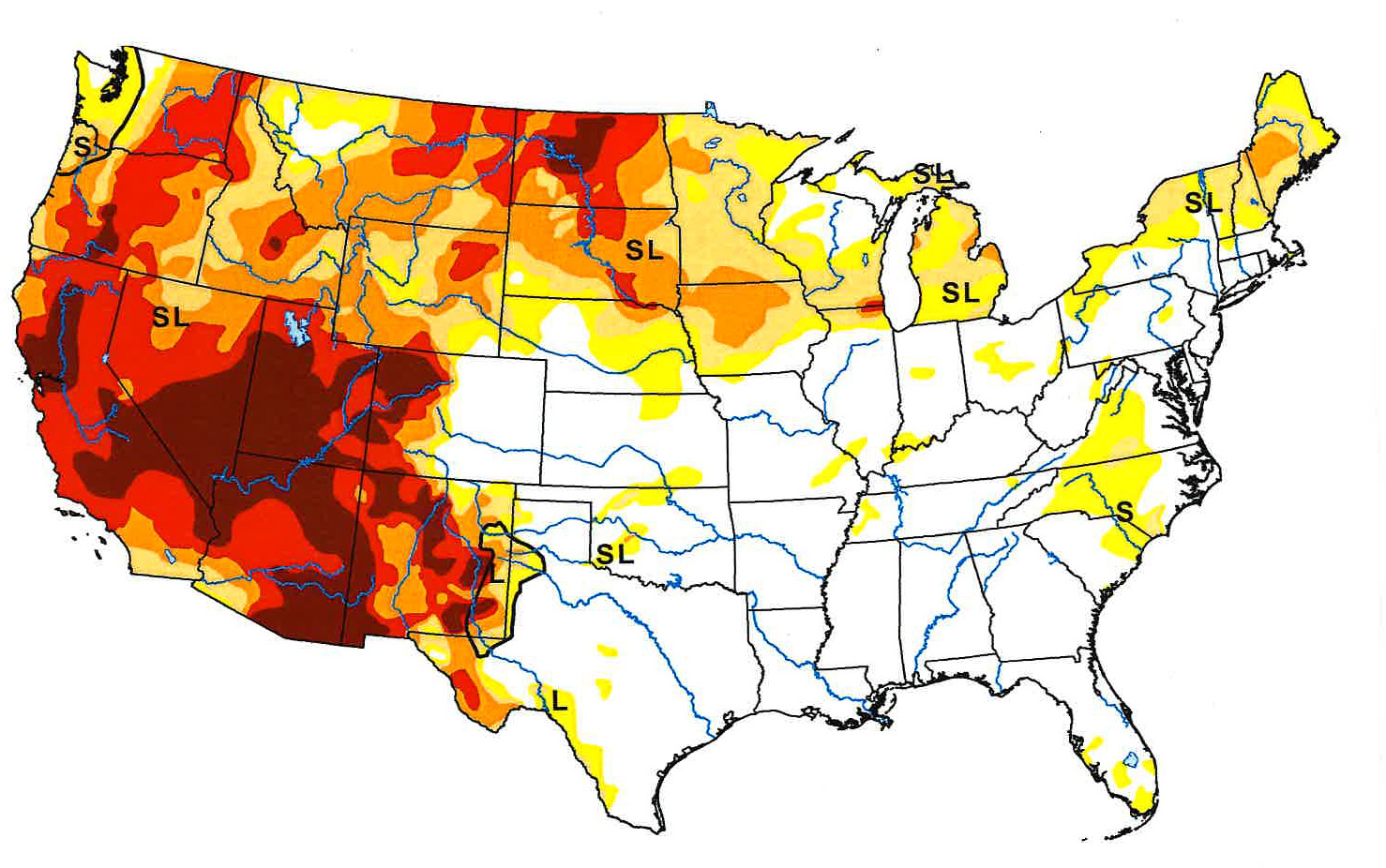

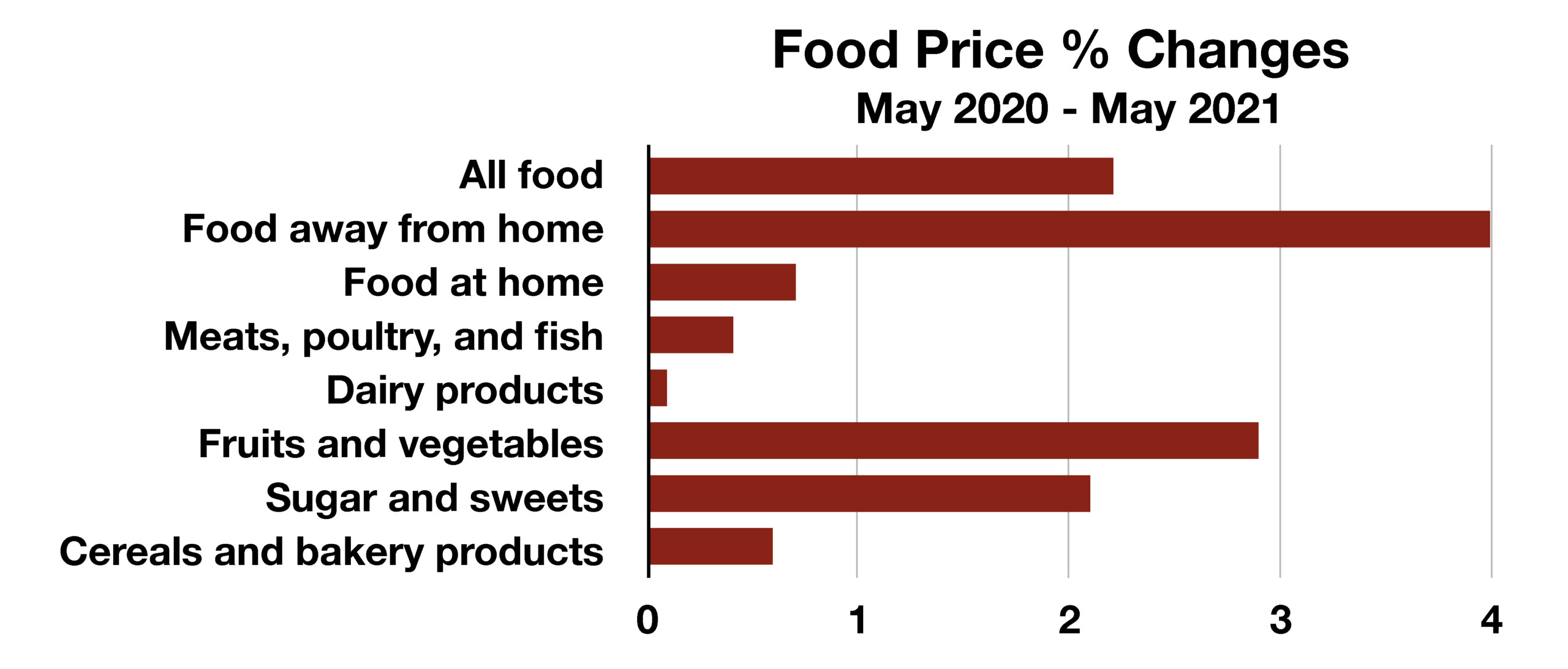

The U.S. Drought Monitor shows that nearly ten percent of the United States is experiencing exceptional drought characteristics as of June 30th. Severe drought conditions are primarily affecting the western states even as excessive rains inundate other parts of the country. Food crops including wheat, corn and grains are expected to be affected, pushing prices higher in an already inflationary environment. (Sources: Labor Dept., U.S. Drought Monitor, NAR, USDA, Fed, CDC)