Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

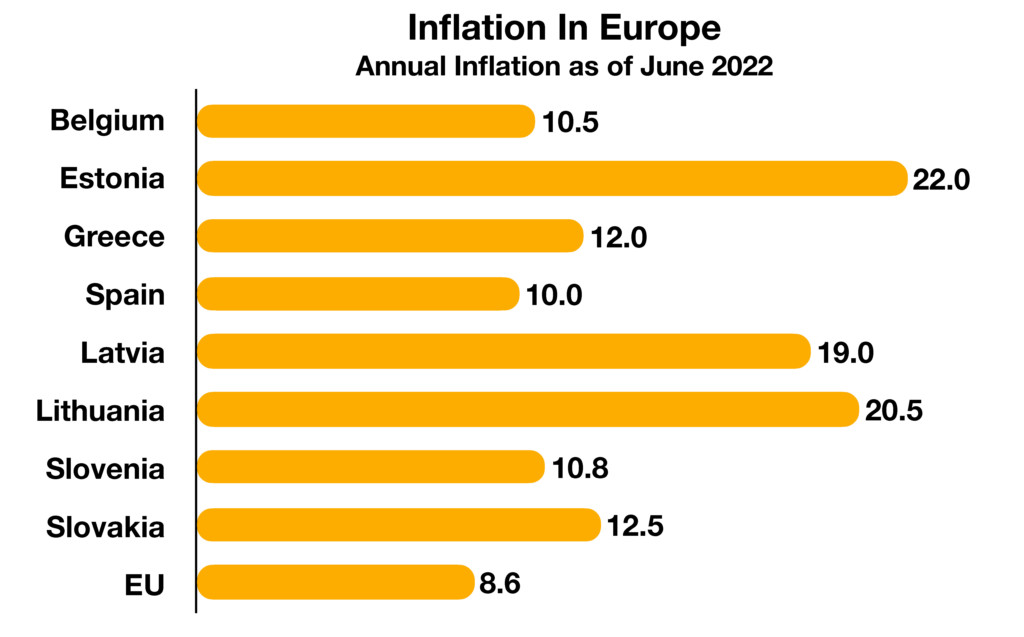

Attention has shifted from inflation to recession as housing, wages, interest rates, commodities, and consumer expenditures have all receded from their highs, an indication to economists that an economic slowdown or recession may be evolving. Numerous countries worldwide are restricting the export of food, adding to global supply constraints already causing shortages and hunger in various third-world countries. Such restrictions, which have been exacerbated by the invasion of Ukraine, are considered a form of food protectionism. The EU imposed a partial ban on crude oil imports from Russia in response to the invasion of Ukraine. With energy prices already soaring in Europe, the ban is expected to cause even further inflationary pressures throughout the European region. In addition to consumers noticing the price increases in gasoline and diesel at the pump, they will also be indirectly affected by higher prices as transportation costs are passed along to consumers. Diesel is the primary fuel for railroads and trucking, which transport the bulk of consumer goods nationwide. Equity indices had their worst first six months in decades, with the Dow Jones, S&P 500, and Nasdaq averages all posting negative returns.

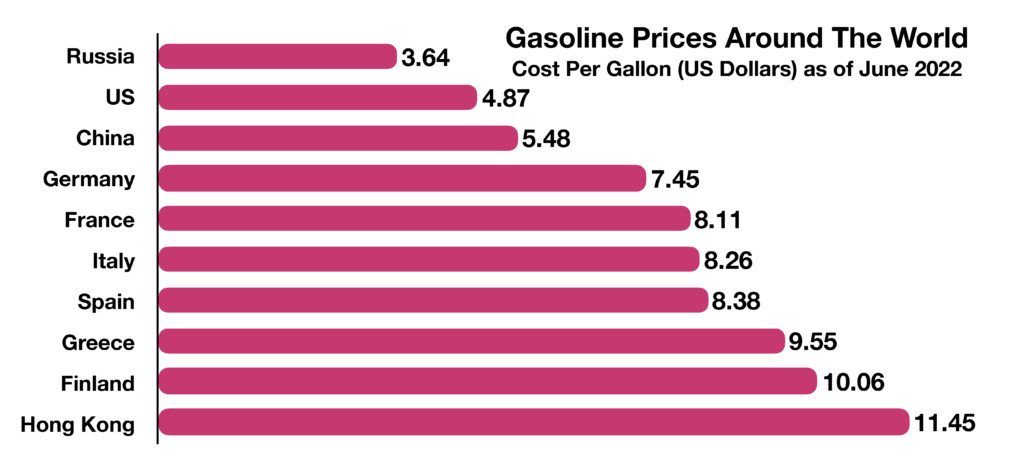

Elevated labor and material costs, recessionary concerns, and an increasingly faltering sentiment have fostered downward momentum. Russia missed payment on its government bonds in late June, which is considered a default by the international bond market. The last time Russia defaulted on its debt was in 1917, during the Russian Revolution. As a reminder, the Russian Revolution saw the abolition of the Russian monarchy and the beginning of Russia’s communist regime, a huge turn for the nation. The Federal Reserve Bank of Atlanta estimates Gross Domestic Product (GDP) with a model it has been utilizing for years, with a very low average tracking error of just -0.3. The model, known as GDPNow, estimates GDP for the second quarter of the year at negative 2.1%, following another negative 1st quarter GDP of 1.6%. Fed Chairman Jerome Powell said that the risk of a recession is heightened as rates continue to move higher, stating that a recession is not the Fed’s “intended outcome”, but that it is “certainly a possibility.” Some companies over the past few weeks have also announced hiring freezes and layoffs in response to slowing economic activity. Fortunately, the cutbacks have so far been limited to a few industries including technology, mortgage lending, and popular pandemic-era companies. Various companies are believed to have over-hired during the past two years when growth was more prominent, and costs were still contained. Other signs of stabilizing inflationary pressures are present in the commodities market, where copper, oil, wheat, rice, and lumber continued to fall from their highs this past month. Lower commodity prices tend to help alleviate some expenses and inflation for consumers. Gasoline prices eased a bit this past month with the national average for a gallon of regular gasoline falling to $4.87 at the end of June, down from $5.00 earlier in the month. As pricey as gasoline may seem, gasoline prices can be much higher in other countries, such as in Hong Kong where consumers are paying upwards of $11 per gallon.

Sources: The Federal Reserve Bank of Atlanta, EuroStat, EIA, S&P, World Food Program