Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Macro Overview

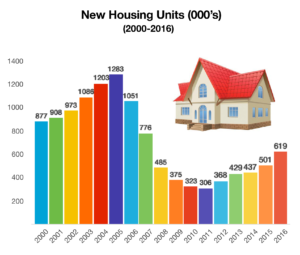

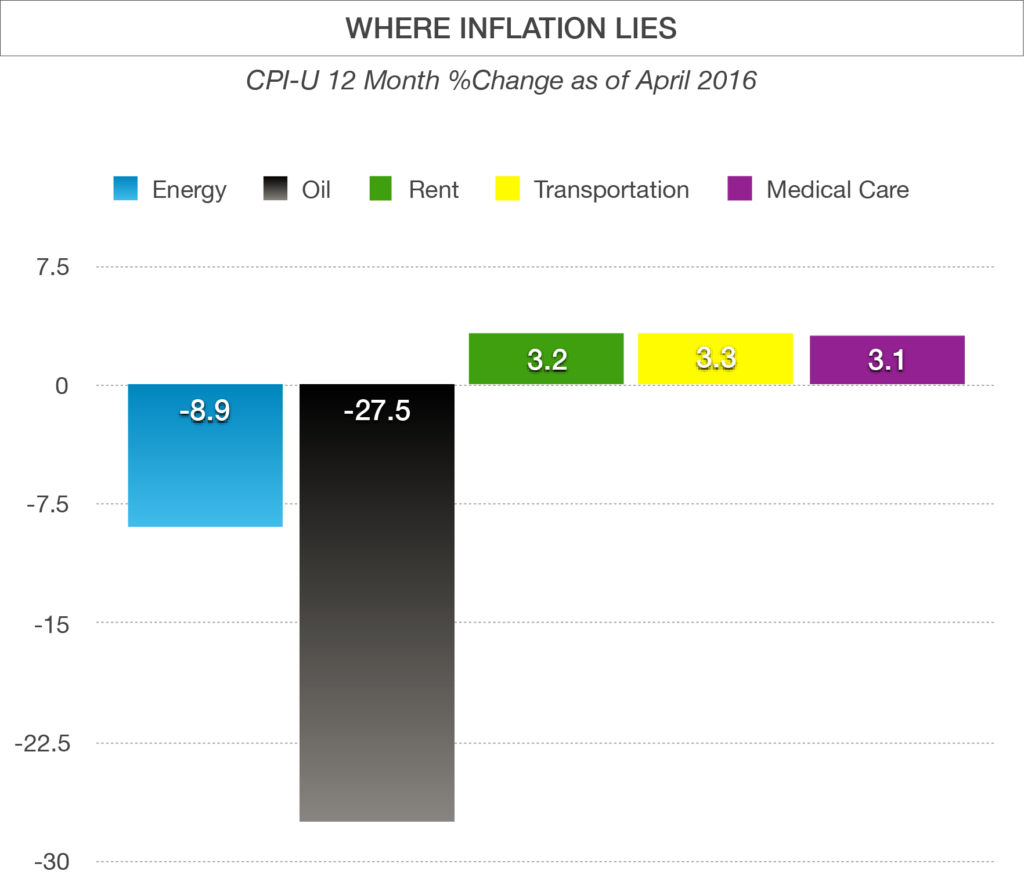

Inflationary pressures are beginning to reveal themselves as U.S. consumer prices recorded their biggest increase in more than three years. Demand for new homes grew as housing starts rose more than expected last month. Such positive economic growth has prompted Fed officials to consider raising rates this summer, stating “its appropriate for the Fed to gradually and cautiously increase rates in the coming months.”

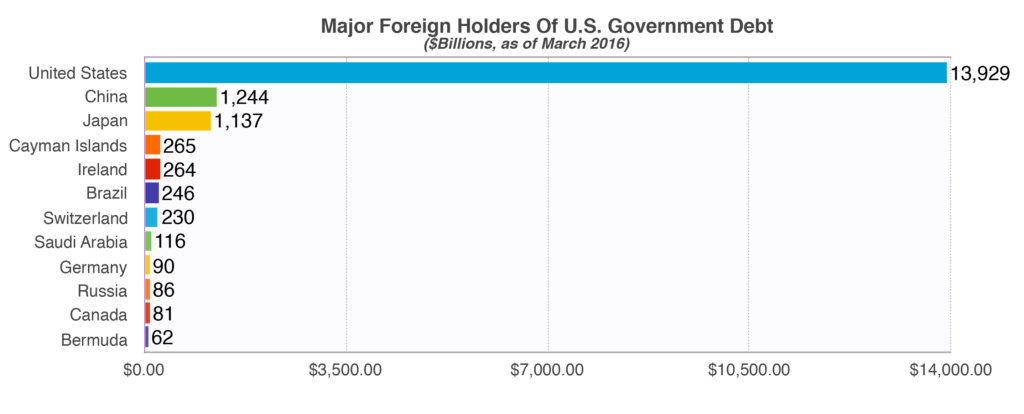

Another rate increase by the Fed would put the Fed Funds Rate at 0.50%, up from its current 0.25% which was the last rate increase in December 2015. The Fed Funds Rate was essentially zero since 2008 when the Fed began its bond buying stimulus program, known as Quantitative Easing (QE).

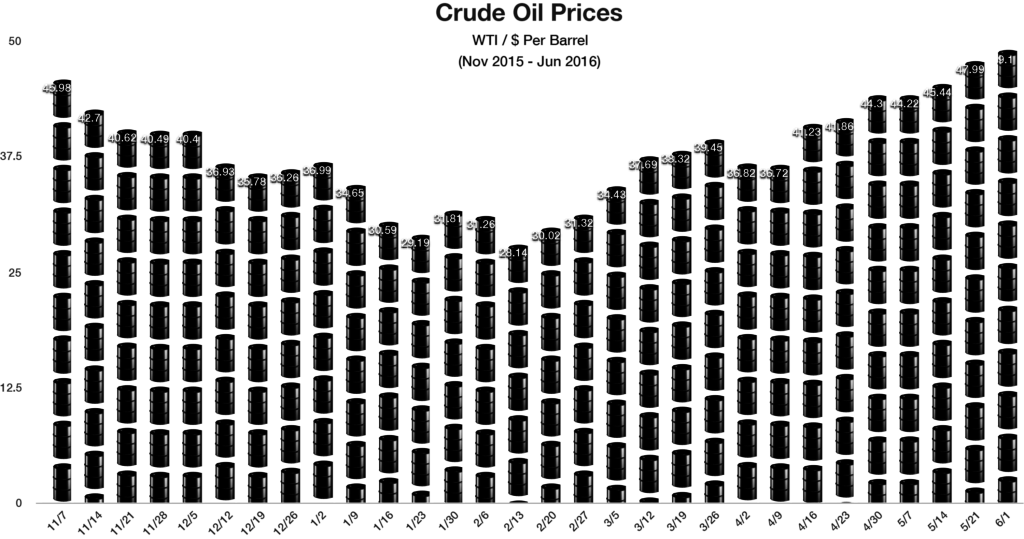

Oil’s dramatic drop from its highs nearly two years ago has inflicted fiscal hardship on Saudi Arabia. The country has issued debt to fund a drop in oil revenue and plans to sell part of its giant government owned oil company. This past month, rising tensions with other OPEC members led to the firing of the countries oil minister, raising speculation that Saudi Arabia is actively migrating away from being almost entirely dependant on oil exports. A new regulation implemented by the Labor Department in May will now allow “exempt” employees making up to $47,476 a year to earn overtime pay. Exempt employees are salaried workers who work over 40 hours per week but receive no overtime pay.

U.S. crude oil prices reached a 7-month high in May, as prices traded over $50 per barrel, the highest levels since October 2015. U.S. crude prices are represented by West Texas Intermediate (WTI), the benchmark for U.S. produced oil. The price rise came after the U.S. Energy Department released data showing that crude oil inventories had dropped in the U.S. Inventories tend to drop as the economy uses more oil and gasoline going into the summer months.

The European Union and central bankers world-wide are eagerly awaiting Britain’s vote on June 23rd to either stay within the Euro Zone or exit, also known as Brexit. Such a departure could cause riffs across markets in Europe as Britain’s banking and financial system presents a vital component of Europe.

Sources: Federal Reserve, ECB, EuroStat

of Personnel Management, and the Department of State.

of Personnel Management, and the Department of State.

bor Statistics which tracks the CPI reported that prices, as measured by the CPI, increased at the highest rate in three years as of April 2016. This latest report showed prices increasing at annual rate of 1.1%.

bor Statistics which tracks the CPI reported that prices, as measured by the CPI, increased at the highest rate in three years as of April 2016. This latest report showed prices increasing at annual rate of 1.1%.