Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Political turmoil was not able to derail market momentum in May as the three major market indices continued on their upward trajectory. Delayed passage of stimulus driven legislation is reducing inflation expectations as markets anticipate an extended low rate environment.

The Federal Reserve Bank of Atlanta’s closely watched GDPNow forecast model is predicting second quarter economic growth of 3.4%, a generous number.

Globally, the price of commodities such as iron ore, copper and oil have fallen since the beginning of the year. A weaker dollar is also buoying emerging markets as their currencies rise to fend off inflationary pressures in emerging market economies.

Changes in banking rules and regulations may be in the air as the Trump Administration made its first major regulatory change, replacing the head of the Comptroller of the Currency, the banking industry’s primary regulatory entity.

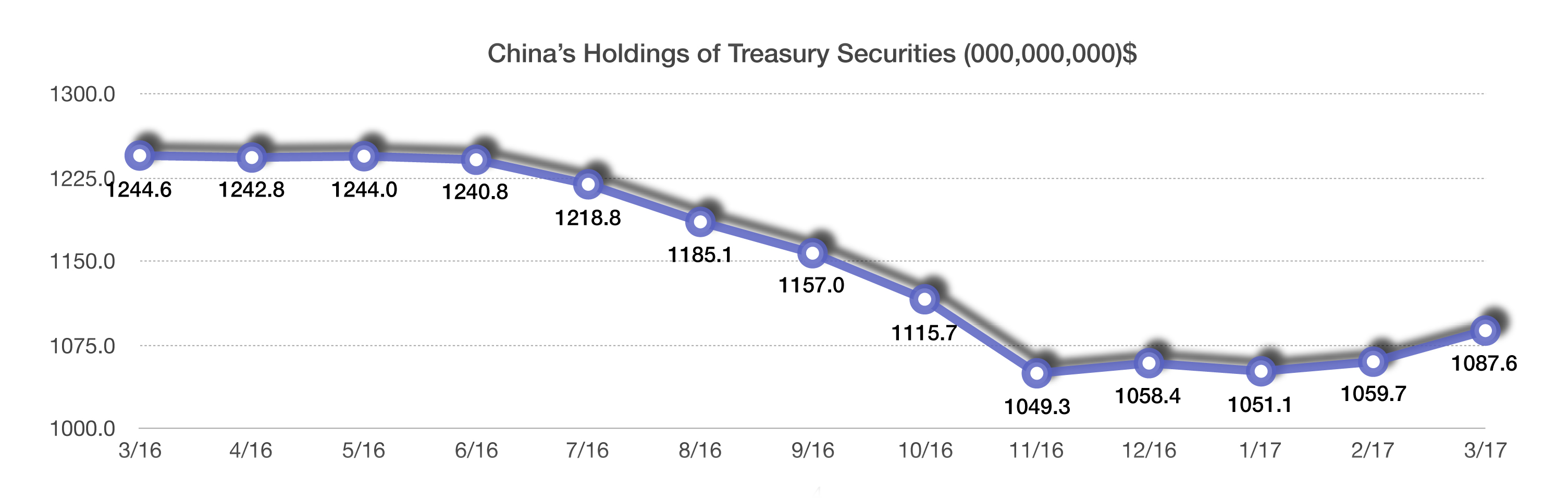

The Treasury department is exploring the issuance of longer term bonds maturing in 50 and 100 years. Current ultra low rates encourage debt issuance for longer periods of time.

Puerto Rico sought court protection in the largest ever U.S. municipality bankruptcy, owing over $72 billion to creditors, including Puerto Rican municipal bond holders. Detroit’s bankruptcy in 2013 amounted to $18 billion, which at the time was considered the largest municipality to go bankrupt. Moody’s & S&P credit rating agencies both downgraded the credit quality of Illinois state municipal bonds to one notch above junk status, giving it the lowest rating of all 50 states. Illinois state legislators’ impasse on passing a budget and spending cuts led to the downgrades. (Sources: Dept. of Labor, Fed, Moody’s, Reuters, Bloomberg)

Elite Relative Value Investment Strategy Examination & GIPS Project.

Earlier this year Texas Elite Advisory (TEA) contracted Ashland Partners & Company LLP to conduct a full examination of documents and calculations related to our performance claims for the Elite Relative Value Strategy (ERVS). Ashland examined documents and calculations from strategy inception April 30, 2008 through December 31, 2016. A copy of Ashland’s attestation is available upon request. Please direct all inquiries to: vbell@texaseliteadvisory.com

On May 24, 2017 TEA contracted Ashland to provide annual Global Investment Performance Standard (GIPS) consulting services. Over the next several months we will be busy making any procedural changes and creating documentation required to bring TEA into full compliance with GIPS. For more information on the GIPS standard please access the following URL: https://www.gipsstandards.org/

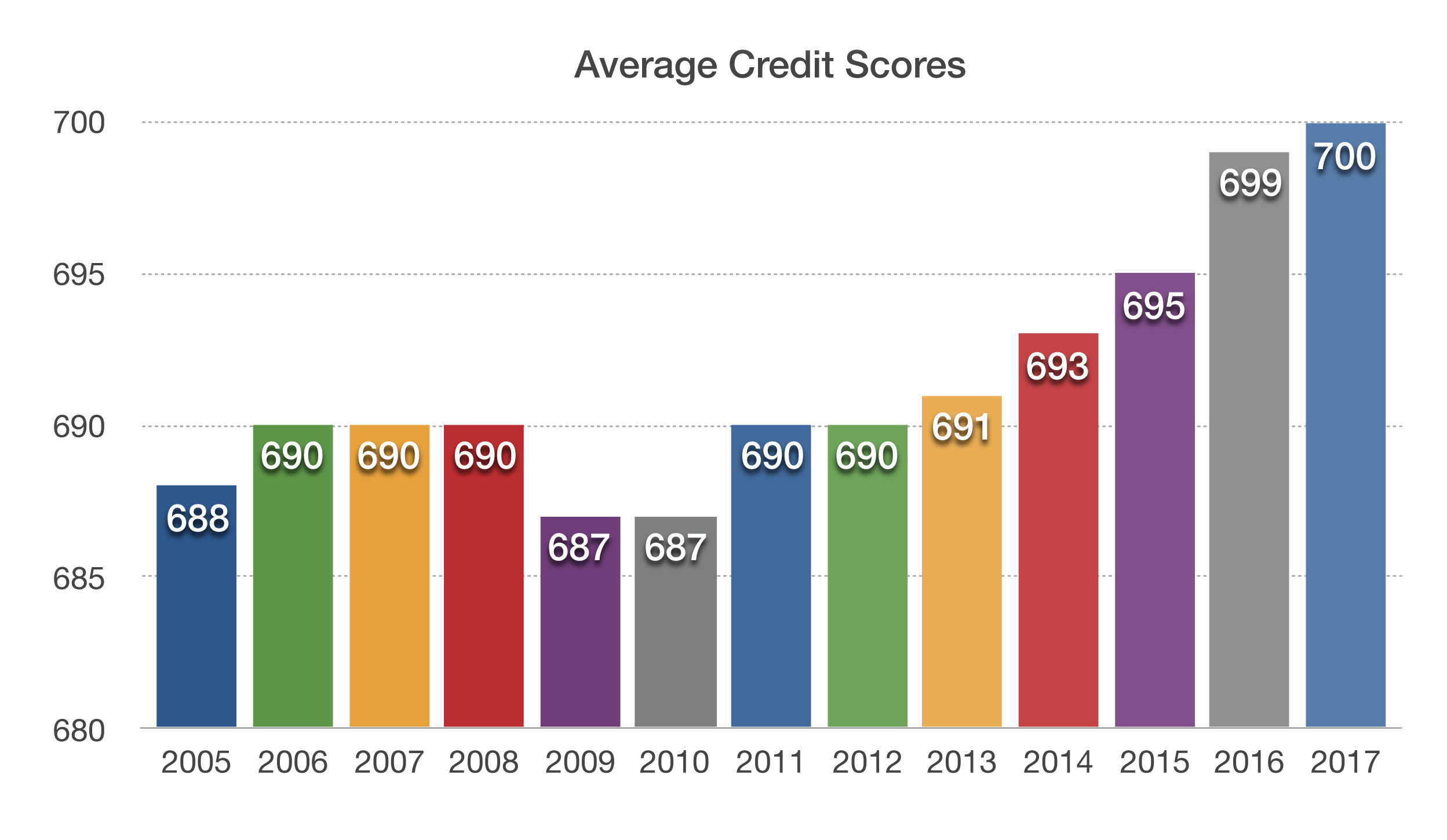

es also increase, but some believe it might be different this time. More favorable and higher credit scores are usually held by older consumers, who actually spend less as they enter retirement and empty nester years.

es also increase, but some believe it might be different this time. More favorable and higher credit scores are usually held by older consumers, who actually spend less as they enter retirement and empty nester years.

“Stock” most commonly refers to common stock, the simplest form of ownership in a corporation. If Pepsi is worth $100B (billion) and has 1B shares of outstanding common stock, each share is worth $100. An investor holding 100 shares owns 0.00001% of Pepsi. In reality, there are many variations of stock; for example: some stocks have certain voting rights, others do not. The vast majority of investors will not control enough stock to have any meaningful impact on how a company is run.

“Stock” most commonly refers to common stock, the simplest form of ownership in a corporation. If Pepsi is worth $100B (billion) and has 1B shares of outstanding common stock, each share is worth $100. An investor holding 100 shares owns 0.00001% of Pepsi. In reality, there are many variations of stock; for example: some stocks have certain voting rights, others do not. The vast majority of investors will not control enough stock to have any meaningful impact on how a company is run.