MINNESOTA

15600 Wayzata Blvd | Suite 304 | Wayzata, MN 55391

952.681.7254

FLORIDA

P.O. Box 551 | Boca Grande, FL 33921

941.964.2434

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

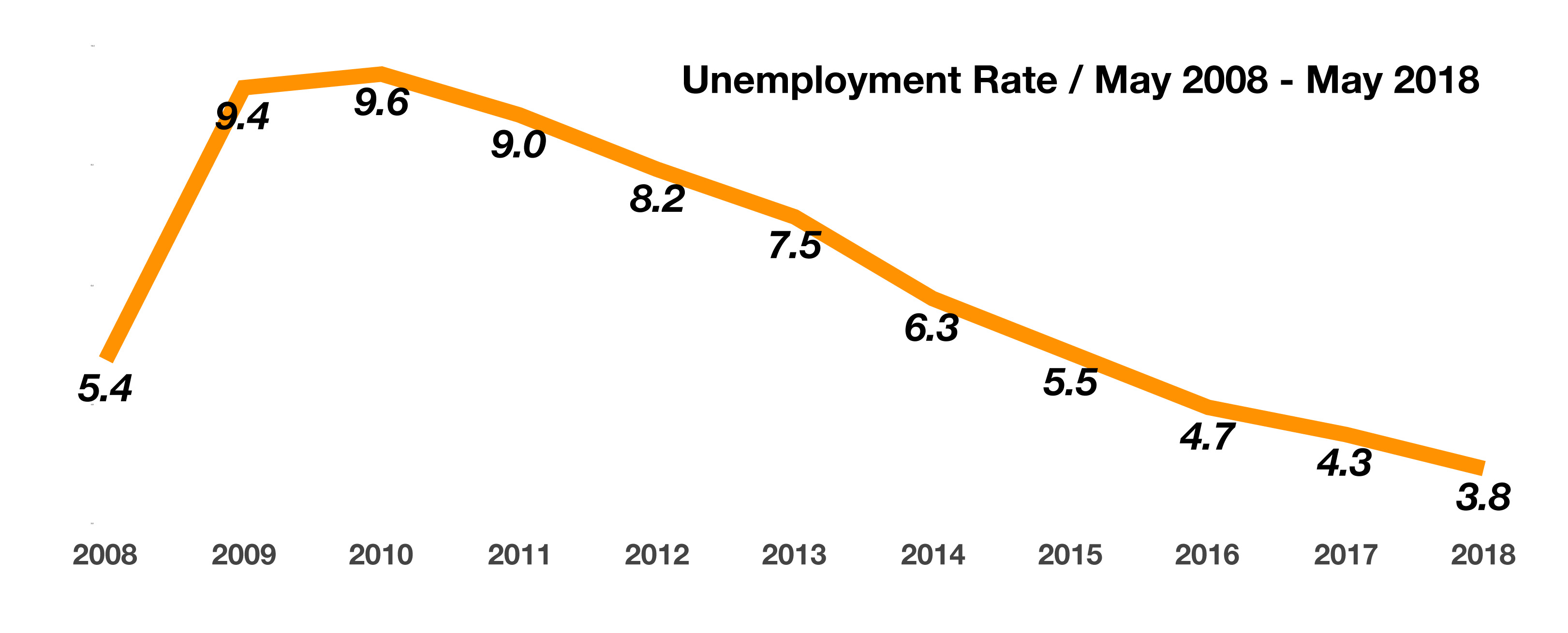

Renewed fears of tariff influenced trade disputes and uncertainty with the euro was buffered by an unemployment rate decline to 3.8% and a rising dollar driven by optimism surrounding the U.S. economy.

Eurozone turmoil drove volatility as international and domestic markets reacted to Italy casting votes in an upcoming election that may entail a referendum to exit the eurozone. Should such a vote occur, it would be similar to Britain’s vote to exit the eurozone in 2016, also known as Brexit. Italy is the third largest member of the eurozone in terms of population and economic status, making an exit from the eurozone an instrumental blow to the financial and political stability of the region.

The increased yield on the 10-year Treasury bond is heightening pressure on the credit markets, since the yield serves as a barometer for numerous lending rates including mortgages, auto loans, consumer and business loans. The U.S.Treasury plans on borrowing more money by selling additional U.S. government bonds over the next few months, which is expected to inflate yields on government bonds across all maturities.

Mortgage rates hit a seven-year high in May with the average rate on a conforming 30-year fixed mortgage jumping to 4.66%, according to Freddie Mac. Homeowners are becoming increasingly reluctant to sell, adding to the supply shortage. As interest rates have risen, so have mortgage rates, leading to higher mortgage payments, if one were to sell and move.

U.S. companies flush with cash are buying back their stock, increasing dividend payouts, and paying down debt, which is perceived as fundamentally sound for the equity markets. Rising rates are discouraging companies from issuing new debt, yet have simultaneously increased stock buybacks by over 34% from last year.

The unemployment rate fell to 3.8% in May, the lowest since April 2000 and once before that in 1969. Job gains were broad with the retail, healthcare, and construction sectors seeing the most hires. Some economists believe that the unemployment rate can fall even further as employers ramp up hiring, with limited skilled workers available in the workforce.

The House & Senate voted on extinguishing some regulations under the Dodd-Frank legislation signed into law in 2010. The alleviation of certain rules will allow smaller regional banks to broaden their loan base by loaning more ambitiously, reduce data collection requirements, and minimize the threat of lawsuits for defaulted mortgage loans. The United States currently has more than 5000 banks across the nation, yet only 13 of the largest banks account for roughly 50% of all assets and deposits. Sources: Freddie Mac, Fed., Labor Dept., EuroStat

A challenge for U.S. multinationals when the dollar rises is the price of U.S. exports becoming more expensive worldwide. As the dollar increases in value versus other currencies, U.S. exported goods become less affordable in the international markets.

A challenge for U.S. multinationals when the dollar rises is the price of U.S. exports becoming more expensive worldwide. As the dollar increases in value versus other currencies, U.S. exported goods become less affordable in the international markets. 8-year low.

8-year low. lso known as Brexit. Italy is the third largest member of the eurozone in terms of population and economic status, making an exit from the eurozone an instrumental blow to the financial and political stability of the region.

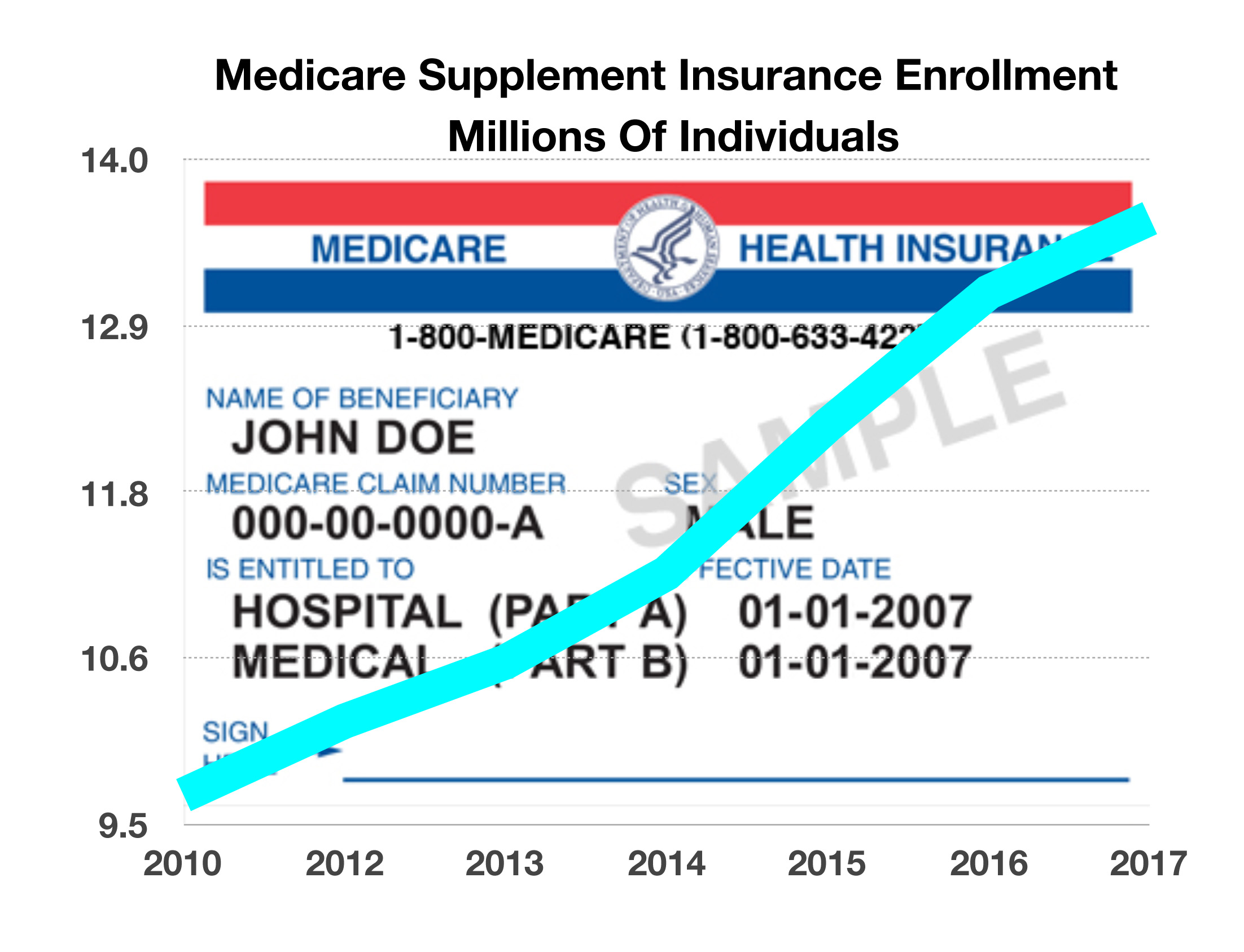

lso known as Brexit. Italy is the third largest member of the eurozone in terms of population and economic status, making an exit from the eurozone an instrumental blow to the financial and political stability of the region. the rise. Over 500,000 new supplemental policies were purchased in 2017, with over 13.6 million retirees carrying supplemental insurance coverage as of December 2017. Over the past ten years, the number of retirees with supplemental coverage increased 40%, driven by demographics and cuts in Medicare covered services.

the rise. Over 500,000 new supplemental policies were purchased in 2017, with over 13.6 million retirees carrying supplemental insurance coverage as of December 2017. Over the past ten years, the number of retirees with supplemental coverage increased 40%, driven by demographics and cuts in Medicare covered services.