Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

The ongoing trade dispute between the U.S. and China escalated in May as the U.S. signaled that it had not finalized a deal yet with China. The lack of a deal led to the U.S. announcing an increase in tariffs from 10 percent to 25 percent on $200 billion of Chinese imports.

The U.S. Department of Commerce began assessing Chinese imports arriving at U.S. ports with a 25% tariff at 12:01 AM on June 1st. The tariff increase affects a broad range of imported products, including modems, routers, furniture, and vacuum cleaners. Additional tariffs were also proposed by The Office of the United States Trade Representative on essentially all remaining imports from China, valued at about $300 billion.

The proposed tariff increases by the United States caused China to retaliate against the U.S. with its own tariff proposals on U.S. goods including alcohol, swimsuits, and liquefied natural gas (LNG). The Chinese government may apply additional tariffs to more impactful products including food, energy and aircraft products from the U.S.

The recent escalation of the U.S. trade disputes between the United States and China, along with the prospect of new tariffs on Mexican imports, has placed an additional strain on global economic growth projections.

The recent market downturn has primarily been due to the uncertainty of the trade disputes and the effects of tariffs on the U.S. and international economies. Analysts believe that the equity market pullback along with the pending trade disputes have raised the possibility of an interest rate cut by the Federal Reserve later this year.

Longer term U.S. Treasury bond yields fell to their lowest levels since 2017. Combined pressures from the trade disputes to the pending Brexit turmoil in Europe has fostered increasing demand for U.S. Treasury bonds, which has resulted in higher bond prices.

The fixed income market is looking at the probability that economic weakness will lead to the Federal Reserve to actually cut interest rates sometime this year in order to bolster the U.S. economy. Many believe that the Fed needs to move quickly in order to shore up growth at the first sign of any economic contraction.

Mortgage rates fell below 4% for the first time since early last year helping to stabilize housing market activity. The average mortgage rate on a 30-year fixed conforming loan was 3.99% at the end of May, as tracked by Freddie Mac, the lowest since January 2018. Falling mortgage rates tend to entice buyers to sell their homes and trade up to larger homes with bigger mortgage balances, a boom for the housing market.

The most recent unemployment data revealed that unemployment unexpectedly fell to a 50 year low this past month to 3.6 percent, the lowest since 1969. Historically, a low unemployment rate tends to drive consumer confidence higher and act as a buffer during economic uncertainty.

Canada, Mexico, and the United States introduced legislation that would replace the North American Free Trade Agreement (NAFTA) and establish a new trade treaty among the three countries to be referred as the U.S.-Mexico-Canada Agreement (USMCA). Existing tariffs on steel and aluminum imports from Canada would be eradicated. Canada is the second largest foreign supplier of steel and aluminum to the United States.

Sources: Dept. of Commerce, Treasury Dept., Freddie Mac, IMF, Office of the U.S. Trade Representative

Unemployment Falls to 50 year low at 3.6% – Labor Market Update

A tight labor market with a voracious demand for skilled workers has brought the unemployment rate down to a 50 year low. The 3.6% rate is the lowest on record since 1969, when U.S. companies were eagerly hiring workers and paying higher wages. Yet this time it has been different as noted by the Department of Labor, whereas higher wages haven’t prevailed as they were expected to. Suppressed wages are one of the factors that inflation has remained relatively tame and in-turn preventing the Fed from raising rates any time soon.

The drop in unemployment from 3.8% to 3.6% is also representative of a smaller workforce, where a growing number of baby boomers retire, leaving companies with minimal if any qualified workers to replace them. That dynamic is tracked by the participation rate, which has fallen to 62.8% as of April 2019, from a high of 67.3% in 2000. This means that there are fewer people willing and able to work even as companies can’t fill open positions.

Sources: Dept. of Labor

Rates Drop Rapidly Amid Inverted Yield Curve – Fixed Income Update

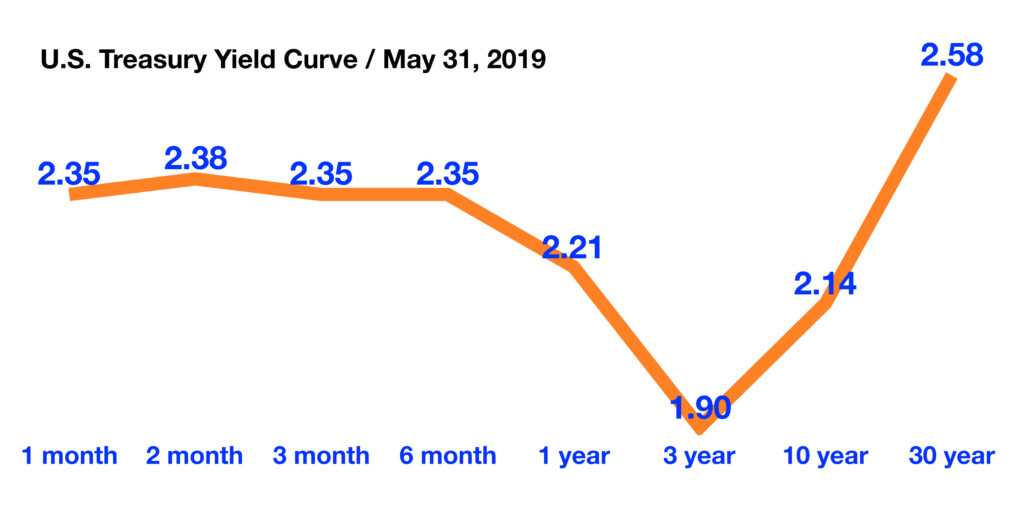

Markets tend to look at the yield curve in order to find clues as to what the expectations are about future economic growth and inflation. The yield curve is essentially the current yield on government Treasury bonds from 3-month maturities to 30-year maturities. At the end of May, the 1, 2, 3, 6 month and 1-year notes all yielded more than the benchmark 10-year bond. When shorter term bonds are yielding more than longer term bonds, it is known as an inversion or inverted yield curve

Economically sensitive copper and oil prices fell in May, perhaps signaling weaker global growth activity. Such dynamics in the commodities market tends to push yields lower internationally. Some analysts believe that a continued escalation of trade disputes with countries in addition to China will crimp global economic growth and force the Federal Reserve to lower interest rates.

Total global debt as of the end of 2017 was $184 trillion, as monitored by the International Monetary Fund (IMF). Global bond yields fell in May with an estimated $10.6 trillion worth of debt now in negative yielding territory, the highest since 2016.

Some fixed income analysts are projecting lower yields later this year due to slowing economic expansion, continued demand for U.S. government debt, and an increasing probability that the Fed will eventually lower rates.

Sources: IMF, Treasury Dept., Federal Reserve

Deciding When To Take Social Security – Retirement Planning

Deciding when to take Social Security benefits is one of the most important decisions one will make for retirement. You may either base the decision strictly on monetary benefits, or your decision may be more personally based.

The important question is when to start taking benefits, at age 62 or postponing benefits until age 66, or even later. The answer is different for everyone, as it depends on various factors such as health, lifestyle, and marital status.

The amount of your monthly benefit depends on two variables, when you elect to start receiving them, and how much you’ve earned during your working years. Interestingly enough, how many years you’ve contributed to Social Security can’t be changed, yet the option as to when you start taking the actual benefit payments is all up to you.

To determine how much you’ve earned, the Social Security Administration adds up the income subject to Social Security tax adjusted for inflation during your 35 highest-earning years. It then divides that total by 420, the number of months in 35 years. This figure arrives at your average indexed monthly earnings. The higher this is, the higher your benefits will be.

The Social Security Administration designs the benefit formula based on an average, so the same amount of lifetime benefits is calculated irrespective of when you begin receiving payments. The U.S. Government Accountability Office (GAO) explains this in a report on social security retirement saying “the Social Security benefit formula adjusts monthly payments so that someone living to average life expectancy should receive about the same amount of benefits over their lifetime regardless of which age they claim”.

When it comes to deciding as to what age to start taking benefit payments, various strategies and philosophies come into play. The calculated benefit amount per the Social Security Administration is known as the “full benefit”, in essence providing 100% of the calculated benefit due.

The caveat is that you need to be at least 66 years of age to take the full benefit amount. For workers retiring in 2014, the full retirement age is currently 66. However, if you elect to receive them earlier, then your monthly benefit is reduced for each month short of your 66th birthday. If you begin receiving them at age 62 for example, then your benefit will be reduced by 25%.

Conversely, if you wait until turning 70, then you’re entitled to delayed retirement credits, which increase your benefits by 8% for each year of deferment, capping out at a total of 32%.

So how do you determine the optimal age to take benefits and whether or not waiting may be worthwhile? A break-even analysis can be done, thus calculating how much more in benefits you may get, either by waiting for a higher benefit say age 70, or taking a lower benefit at a younger age such as 62.

Essentially, if you decide to wait, then you lose out on payments you could have been receiving since age 62. If you wait, yes the benefit payment will be higher, but you may end up receiving less overall benefit payments if you die sooner than expected.

This is when you need to consider your personal factors, since a break-even analysis tells you nothing about these relevant and important facts. Important personal factors to consider include health, family life expectancy, marital status, immediate financial needs, and quality of life.

For example, if you have health ailments and suffer from medical conditions that may prohibit you from enjoying a lasting quality of life, take the benefits at an earlier age.

If you’re married and about to become eligible for benefits, then perhaps one should take the benefit first, with the second postponing benefits until an older age. The postponement of the second would yield a higher payment when benefits would begin.

Regardless of what your factors might be, careful review of all of your options from a financial and personal viewpoint are prudent in order to arrive at the best decision for you.

Sources: Social Security Administration, GAO

Here’s What The U.S. Buys The Most Of From China – Trade Overview

In the past twenty-plus years, China has evolved from a heavy equipment machinery exporter to a prominent leader in technology product exports. Large international conglomerates have established an enormous manufacturing presence throughout China, utilizing its cheap labor and quick turnaround times. China’s manufacturing plants are among the most modern in the world, producing large capacities almost entirely for export

As the world’s appetite for electronic devices has grown, so has China’s ability to manufacture and export these devices. As a product exporter, China is able to manufacture and export finished products worldwide. In addition, China is also an exporter of components, which may be used in the manufacture and assembly of products in other countries, such as the United States. By exporting components in addition to finished products, China is able to hedge against tariff issues and labor costs should they become a factor.

Sources: WTO, IMF, U.S. Dept. of Commerce

What The U.S. Imports From Mexico – Trade Overview

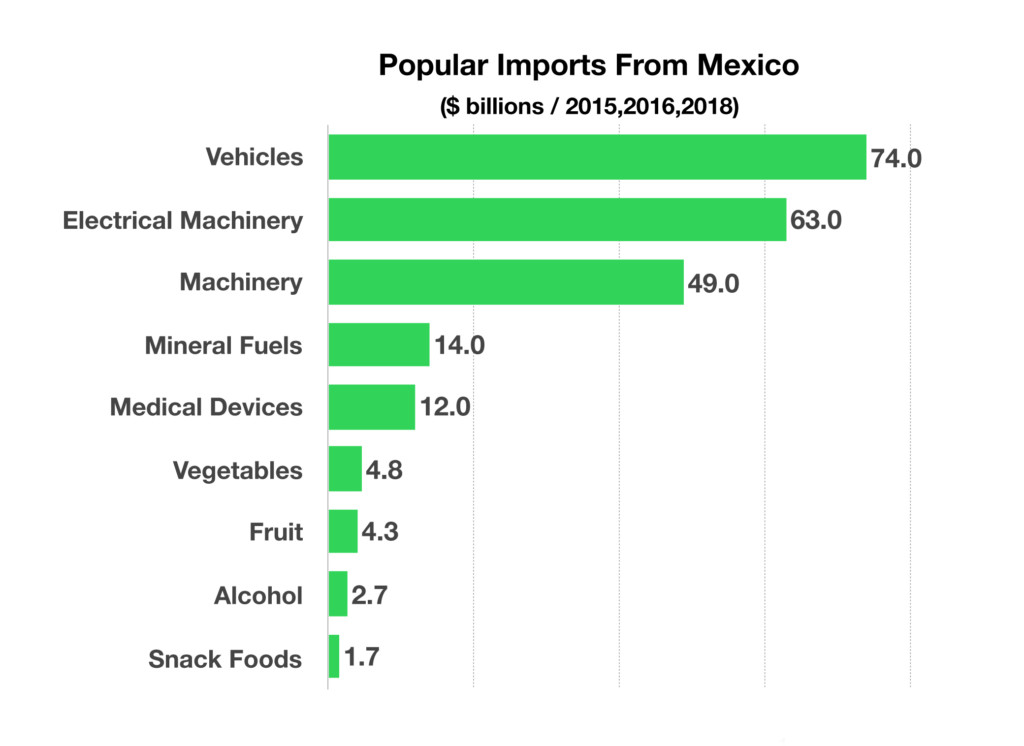

The administration has proposed tariffs up to 25% on imported products from Mexico in order to stem illegal immigration from the country. Some argue that imposing such a tariff would make certain imported products more expensive for American consumers

The U.S. imported $93 billion worth of vehicles from Mexico in 2018, with auto parts accounting for the single largest type of product imported from Mexico valued at over $51 billion in 2016, making the automotive industry an integral component of trade with Mexico. Interestingly enough, exports headed from the U.S. to Mexico are primarily for use in the automotive industry, with machinery, fuels, and plastics making up the largest portions.

Agricultural and food products imported from Mexico, such as vegetables, fruit, snack foods and alcohol, totaled over $17 billion in 2018. Mexico is currently the world’s largest exporter of beer, exporting $3.6 billion of the alcohol to the U.S. in 2018.

The administration announced that any proposed tariffs on Mexican imports would not take effect until June 10th in order to give Mexico ample time to respond or negotiate terms.

Sources: Dept. of Commerce, BLS

Proposed For 401k Plans & IRAs – Retirement Planning

This past month the House of Representatives passed the SECURE Act, which will introduce various changes to retirement plans including IRAs and 401k plans. The act was approved by the House in May and is expected to be approved by the Senate and become law relatively soon.

One of the most significant revisions to IRAs introduced by the legislation is repealing the prohibition on contributions to a traditional IRA by an individual who has attained age 70 1/2. The legislation doesn’t propose a revised maximum contribution age, yet states that more Americans continue working beyond traditional retirement age. So essentially, there will no longer be an age limit on IRA contributions.

A modification to 401k plans that will affect eligibility requirements for part-time workers is a major change. Longer term part-time employees will no longer be excluded from 401k plans, allowing part-time workers the ability to save and accumulate savings towards retirement.

Annuity payments will become an option for retirees when leaving their job and taking their retirement savings. In addition to opting for a rollover of retirement assets to an IRA or other qualified plan, retirees will be able to choose annuity payments as well.

The Required Minimum Distribution (RMD) age for IRAs will increase from age 70 1⁄2 to 72. This is beneficial for those retirees that don’t need the income from their IRAs or rollover IRAs until later, thus minimizing the tax liability on distributions that would have been required at age 70 1/2.

Safe Harbor provisions will be simplified for 401k employer plans in order to facilitate plan administration as well as allowing greater flexibility to employers and employees. Such changes will eventually increase participation in employer sponsored retirement plans, an objective of the SECURE Act.

Source: House Committee on Ways & Means; https://waysandmeans.house.gov

Equities Give Up Early Gains – Equity Market Update

In stark contrast to the strong performance during the first four months of 2019, U.S. equities faltered in May as continued trade disputes hindered economic growth expectations. All sectors of the S&P 500 Index fell in May, with the exception of Real Estate. Technology and financial stocks experienced the brunt of the pullback in May

May was the worst month since December 2018, when markets reacted to heightening trade fears and a possible rate hike by the Federal Reserve. Ironically, some analysts are expecting a reduction in rates by the Fed later this year in response to tariff reverberations and slowing economic global growth. A rate decrease by the Fed might lure equities higher as loan costs and capital remain inexpensive, thus buffering profit margins for U.S. companies.

Should a continued drop in rates persist, economists note that the U.S. dollar may weaken, thus boosting U.S. multi-national company earnings, which primarily operate internationally.

Global inflation expectations have eased considerably over the past month, prompting central banks in various countries to consider lowering rates, also known as growth stimulus efforts.

Sources: S&P, Bloomberg, Federal Reserve