Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

A resurgence of sporadic economic activity emerged in May as stay-at-home bans were eased and some businesses slowly reopened. Virus resurgence fears are still a concern as uncertainty lingers regarding the development of an effective vaccine.

Following April’s rebound for U.S. equities, the month of May continued to post recaptured gains for all major stock indices. Slow re-openings by states and cities enabled a gradual reactivation of economic activity that benefited nearly all sectors of the equity markets.

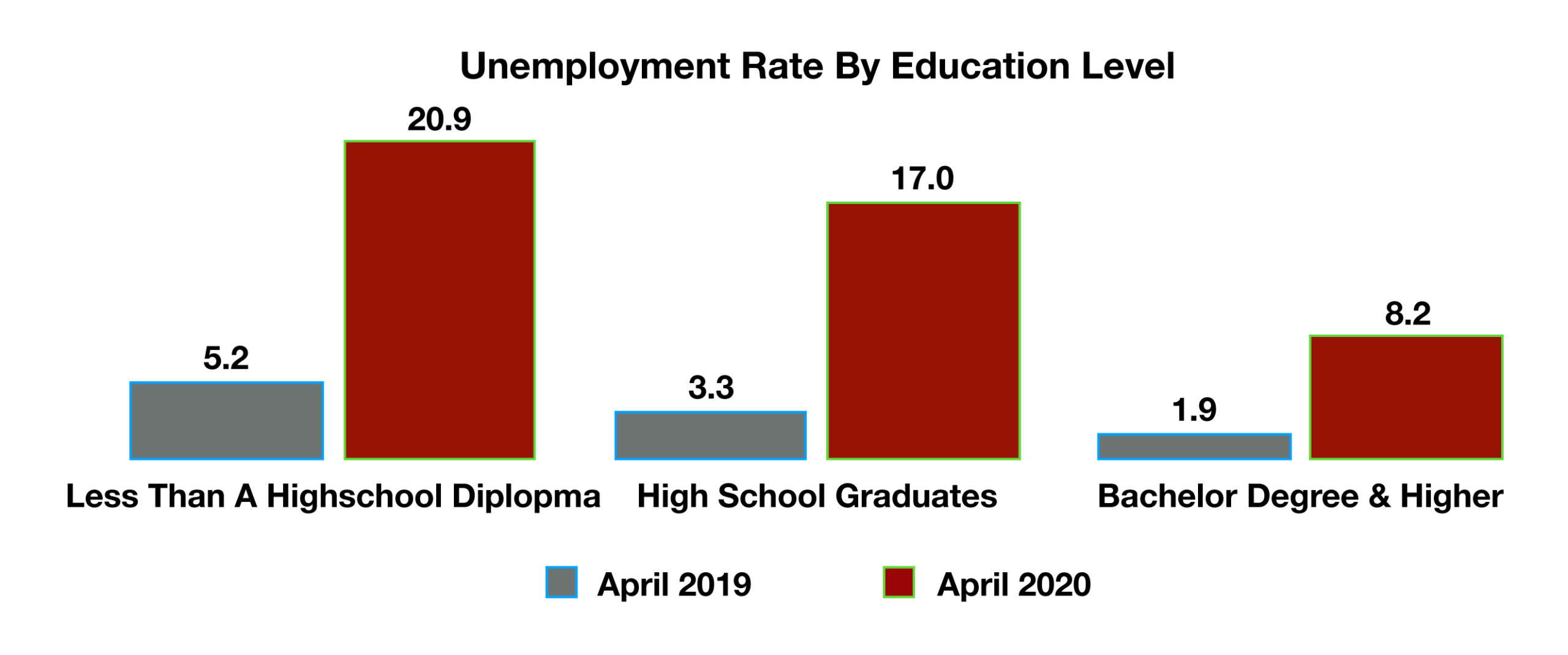

Unemployment reached 14.7%, the highest since the great depression era when unemployment was 25%. Individuals from all income and education levels were profoundly affected, with over 40 million applying for unemployment claims since the middle of March. The extent of the lockdown for businesses nationwide contributed to a surge of small business bankruptcies that may prohibit the re-hiring of millions of workers in numerous industries.

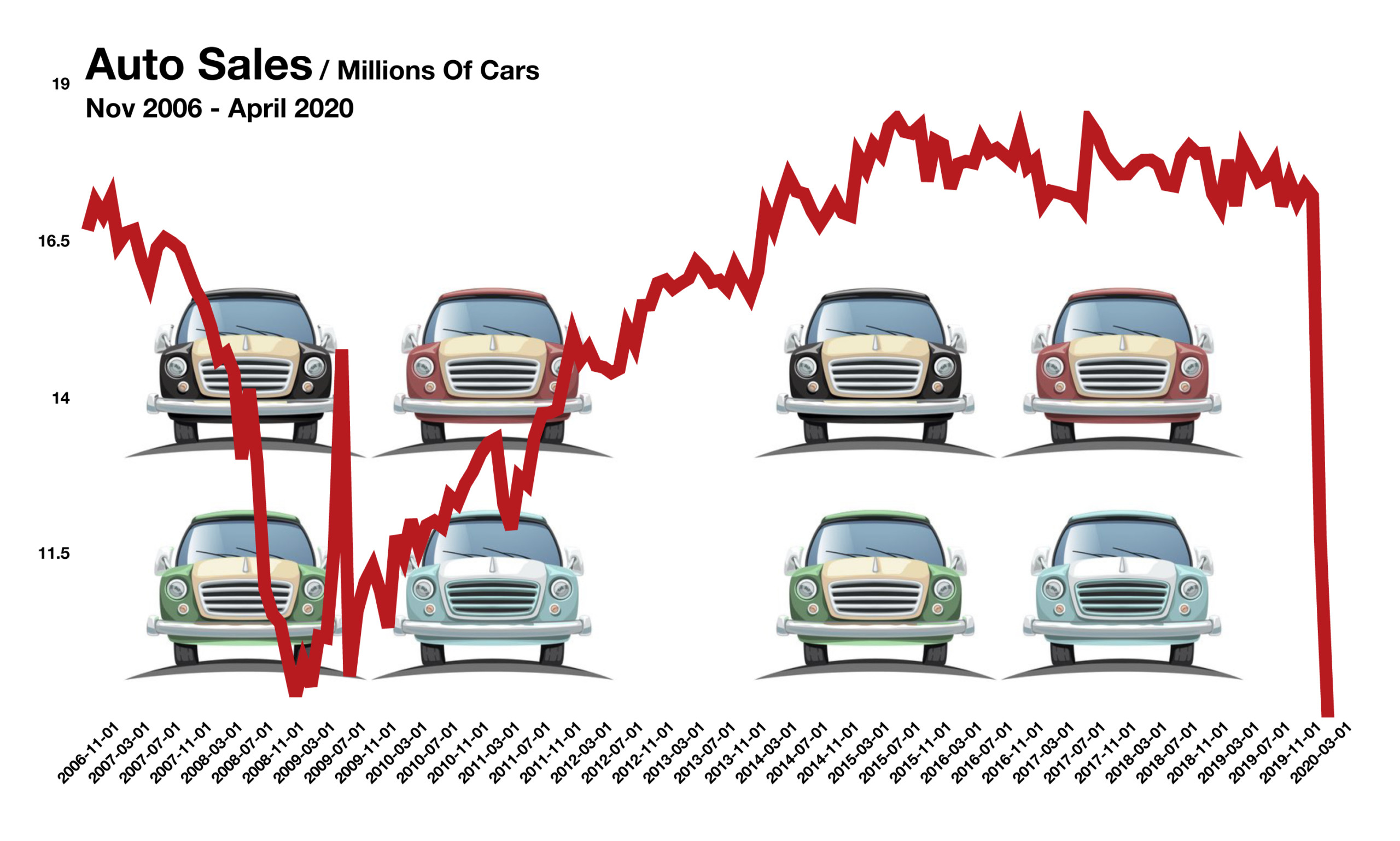

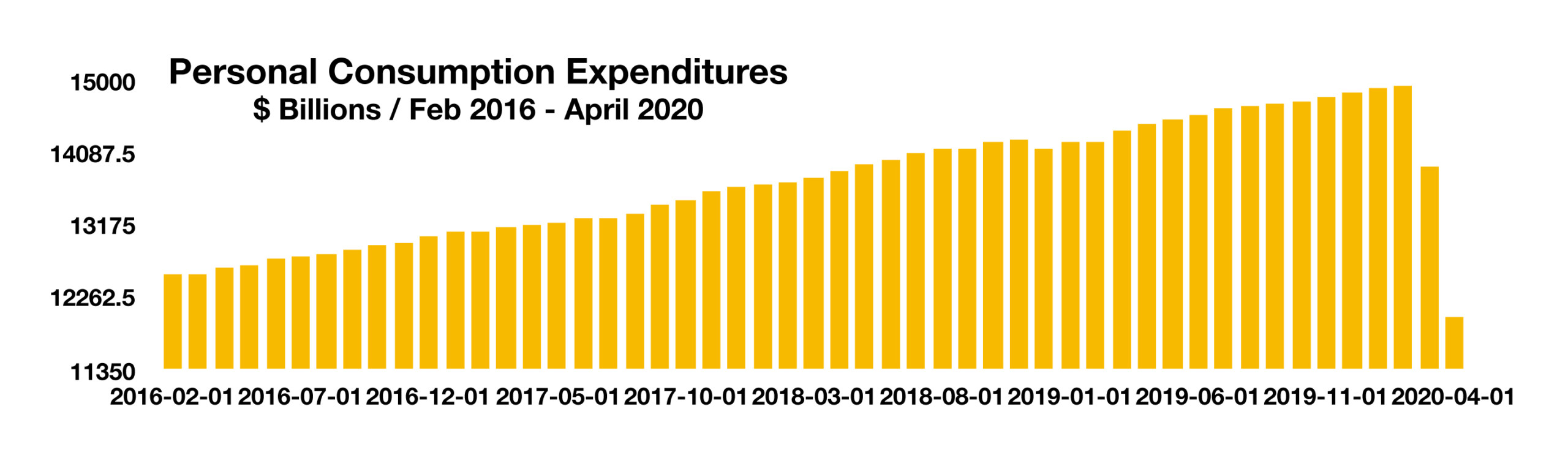

Retail sales in April saw their largest decline on record, the result of mandatory store closings and stay-at-home requirements. Industrial and manufacturing activity also fell in April, an indicator of a slower economic environment. Economic damage may not be fully recognized for months as lagging data tracked by various government agencies trickle into financial markets. Consumer confidence, as measured by the University of Michigan CS Index, improved in May as consumers were encouraged by the gradual easing of the virus quarantine. Inflation expectations also increased as scarce goods demanded higher prices across the country.

Economists and analysts are curious as to how the millions of unemployed workers will sustain themselves when their unemployment benefits expire. The $600 weekly unemployment benefit provided by the federal government expires on July 31st, unless extended by Congress. Individual state benefits vary greatly in terms of maximum weekly amounts, durations, and extension qualifications.

A study compiled by the Chicago Federal Reserve revealed that consumers spent nearly half of their federal stimulus checks within two weeks, then reverted to their prior spending habits. Economists expect that the economic effects of the one-time payments will be short-lived.

Congress is expected to extend the period of time allotted for small businesses to use funds provided by the Paycheck Protection Program (PPP) from 8 weeks to 24 weeks. The additional time allows businesses to use funds for approved expenses including payroll, rent, and utilities.

Federal unemployment benefits skyrocketed to $430 billion in April, the single largest monthly increase ever. Monthly unemployment benefits averaged $29.5 billion per month over the last five years, prior to March 2020 following the virus outbreak.

(Sources: Federal Reserve, Dept. of Labor, Dept. of Commerce, Bloomberg)

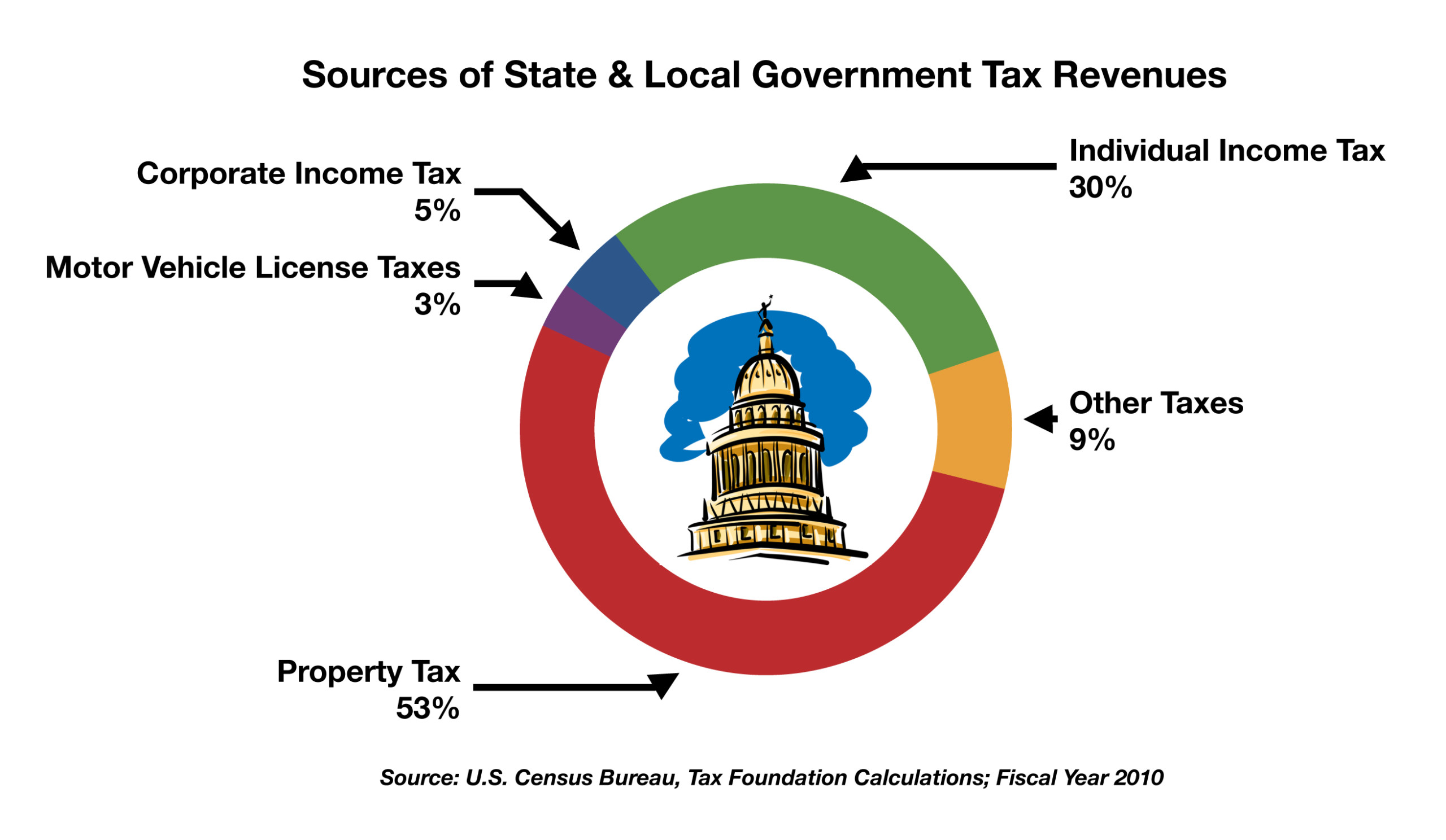

The dramatic loss of jobs led to unpaid mortgages and property taxes as homeowners struggled to meet ends. Data collected by the U.S. Census Bureau and the Tax Foundation estimate that over 50 percent of state and local government revenues came from property taxes over the past decade. Individual income taxes are also significant, representing 30% of tax revenues while corporate income taxes make up roughly 5%. That explains why the sharp increase in unemployment is decimating state and local tax revenue. (Sources: U.S. Census Bureau, The Tax Foundation)

The dramatic loss of jobs led to unpaid mortgages and property taxes as homeowners struggled to meet ends. Data collected by the U.S. Census Bureau and the Tax Foundation estimate that over 50 percent of state and local government revenues came from property taxes over the past decade. Individual income taxes are also significant, representing 30% of tax revenues while corporate income taxes make up roughly 5%. That explains why the sharp increase in unemployment is decimating state and local tax revenue. (Sources: U.S. Census Bureau, The Tax Foundation)

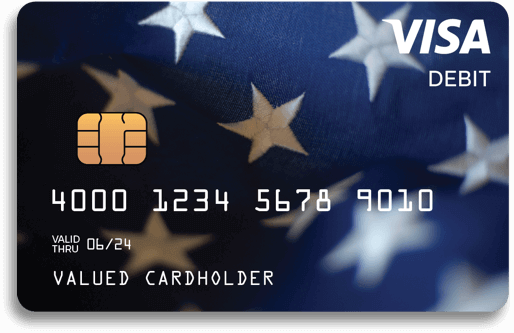

For those who have not yet received a stimulus check or direct deposit, a debt card may be on its way. The debit cards are being issued by MetaBank, which is the Treasury Department’s financial agent, and mailed in plain white envelopes from Money Network Cardholder Services. The card is known as an Economic Impact Payment Card (EIP). One potential problem is that the envelope and the card may appear illicit and fraudulent to recipients, who are justifiably wary about what they receive in the mail. The IRS notes that if you’ve received a card and are still not certain if it is a legitimate EIP card, you can visit EIPcard.com for confirmation. (Source: IRS.gov/corornavirus/economic-impact-payment)

For those who have not yet received a stimulus check or direct deposit, a debt card may be on its way. The debit cards are being issued by MetaBank, which is the Treasury Department’s financial agent, and mailed in plain white envelopes from Money Network Cardholder Services. The card is known as an Economic Impact Payment Card (EIP). One potential problem is that the envelope and the card may appear illicit and fraudulent to recipients, who are justifiably wary about what they receive in the mail. The IRS notes that if you’ve received a card and are still not certain if it is a legitimate EIP card, you can visit EIPcard.com for confirmation. (Source: IRS.gov/corornavirus/economic-impact-payment)