Wright Financial, LLC

395 Taylor Blvd., Suite 107

Pleasant Hill, CA 94523

925.246.7982

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

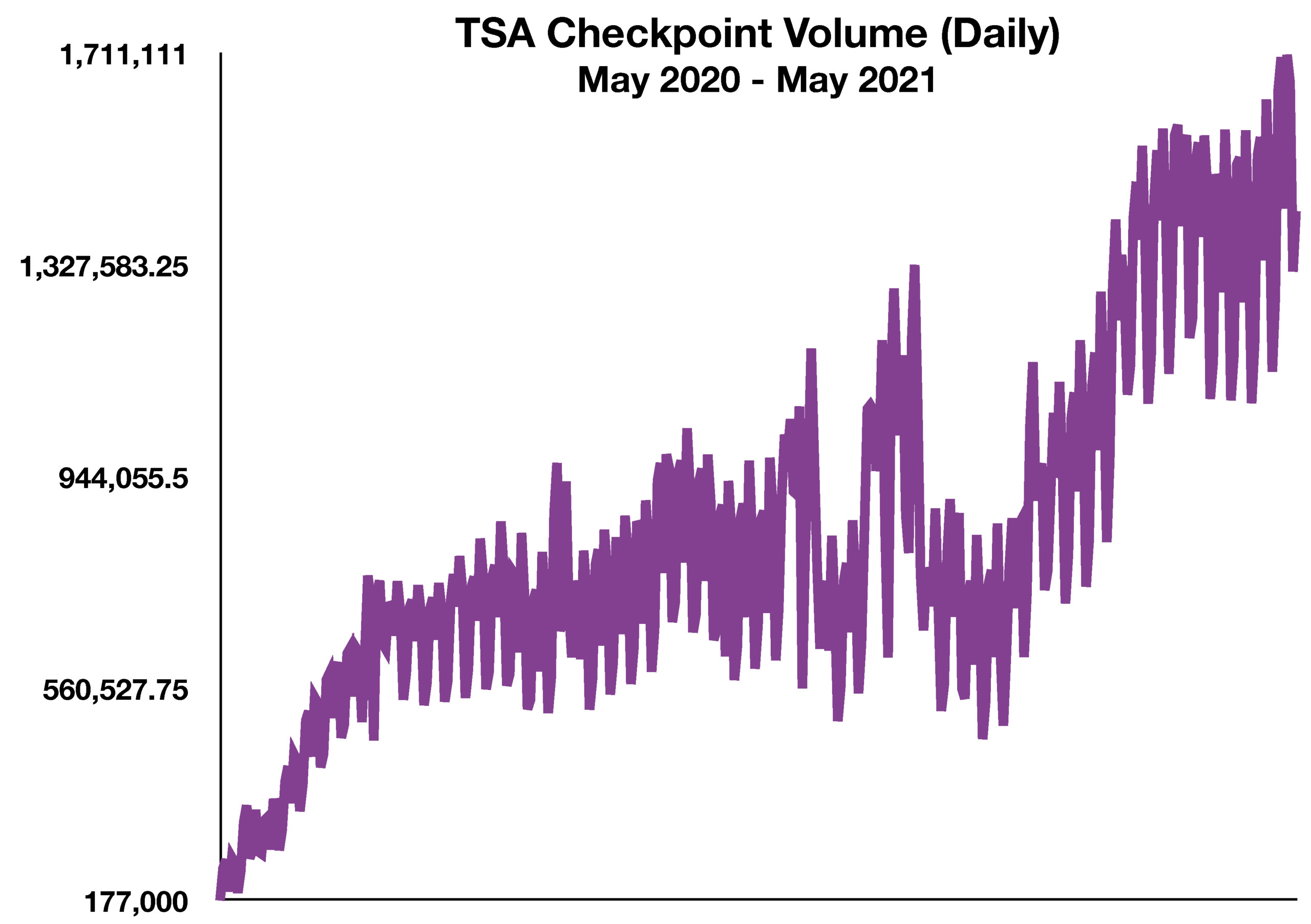

Financial global markets are drawing support from the effectiveness of ongoing vaccinations and improving economic indicators. Consumer sentiment is re-evolving, resulting in rising consumer demand as pandemic worries wane. Pent up demand from the past year is thought to be driving the bulk of economic activity.

Ransomware cyberattacks and internet crimes have been rising at an alarming rate according to the FBI, threatening companies, government entities and individuals. Digital currencies, such as bitcoin, are the primary form of payment utilized for ransom and extortion cases since payments can be made anonymously and are not traceable. The FBI encourages individuals, especially elders, to be aware of numerous online scams and phone calls by visiting its Common Scams & Crimes site https://www.fbi.gov/scams-and-safety/common-scams-and-crimes.

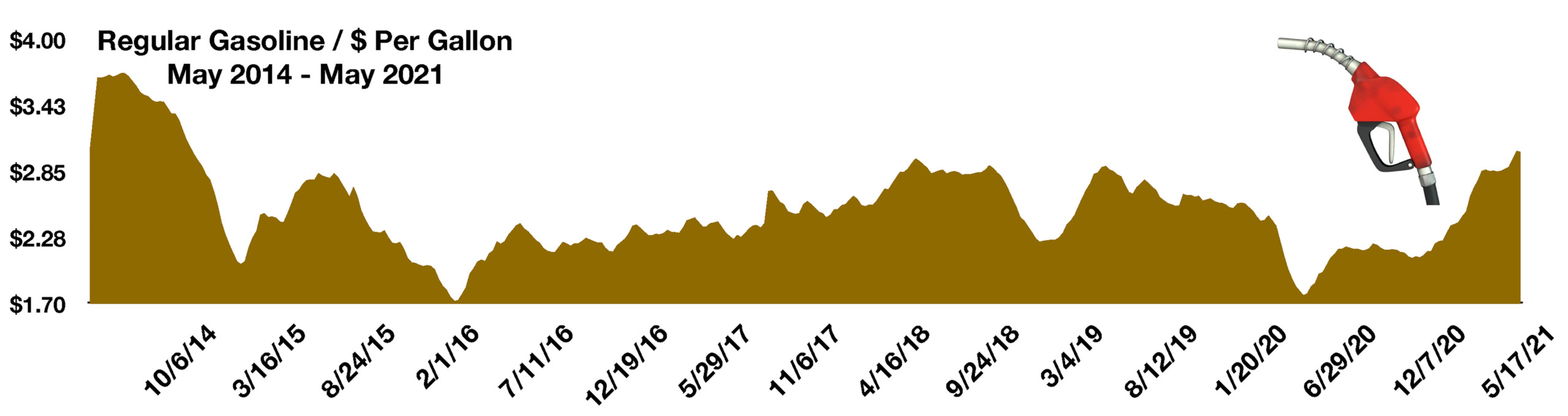

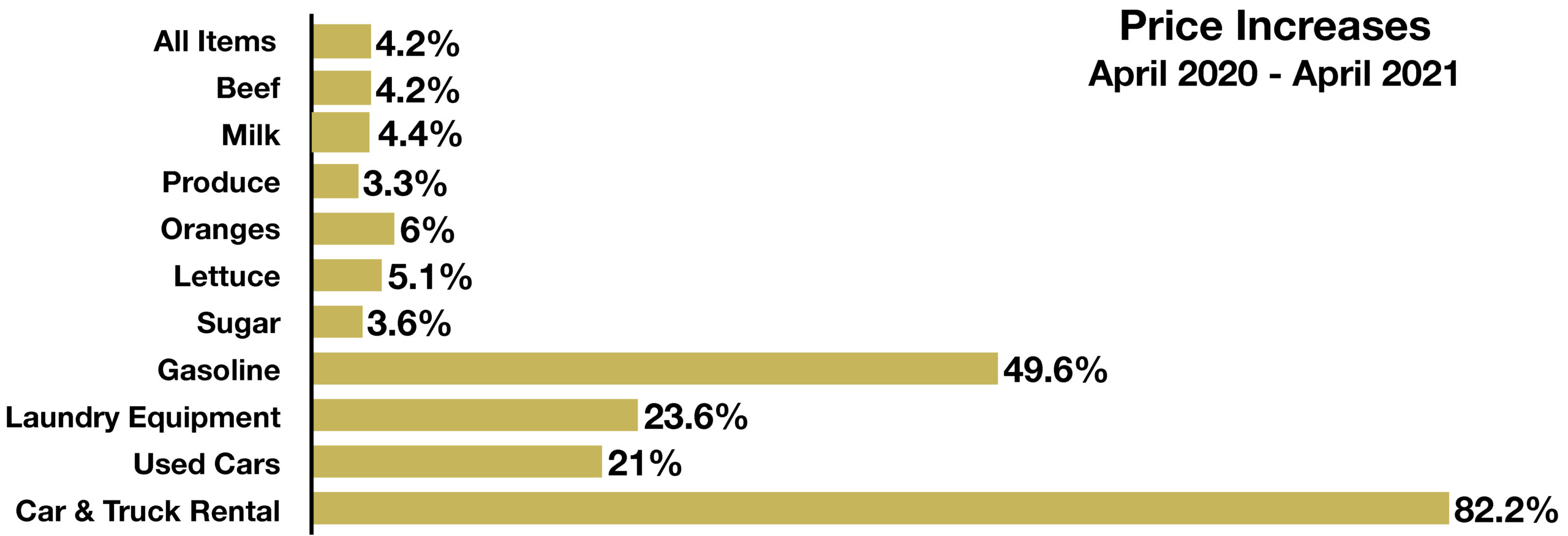

Escalating inflation concerns prompted Federal Reserve members to consider limiting purchases of Treasury and mortgage bonds, which is an indirect method of raising interest rates. The reduction in stimulus efforts, also known as tapering, last occurred in 2013.

The administration released a proposed $6 trillion federal budget for the upcoming fiscal year, expected to be funded by higher taxes for top earners and corporations. Analysts, as well as nonpartisan analysis, expect additional issuance of Treasury debt in order to help fund ongoing federal deficits.

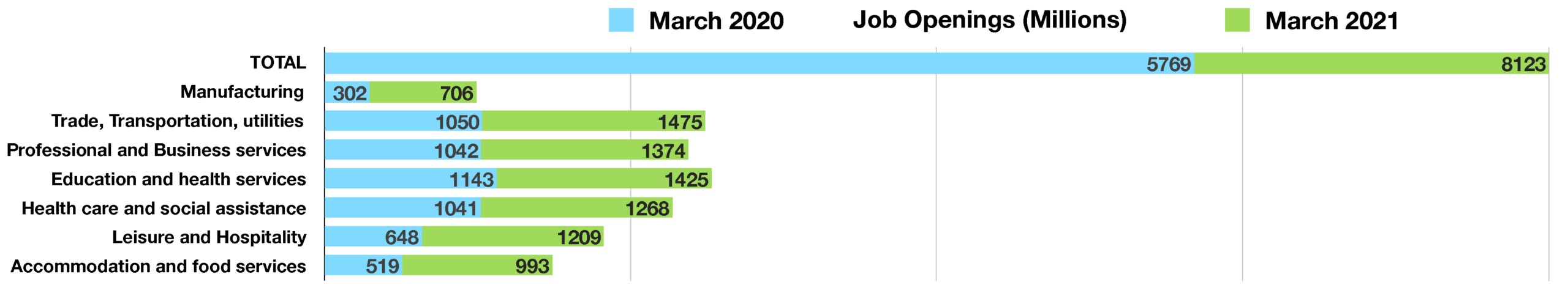

Various states are ending supplemental unemployment benefits which were instituted during the early months of the pandemic last year. It is estimated that 3.7 million unemployed recipients will be affected. Some states eliminating unemployment benefits are instead offering financial incentives for individuals to find a job. The Department of Labor’s most recent data reveal that there were over 8 million unfilled job openings at the end of March, the largest number of openings since November 2018.

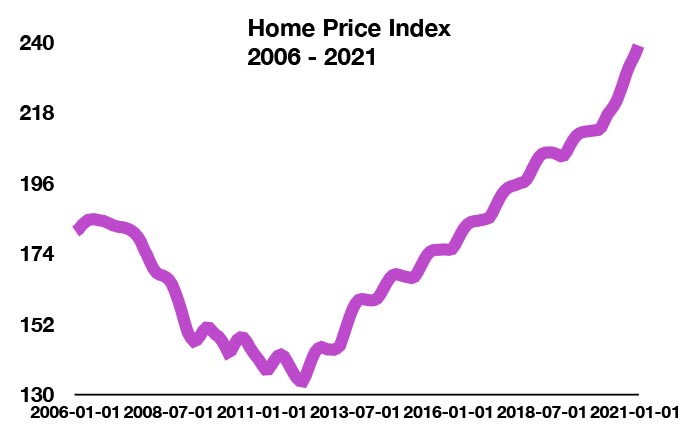

The upward trajectory of home prices has made it less affordable for many to purchase, forcing some would-be home buyers to rent instead. Rising home values have resulted in rising rent costs nationwide, as lacking home supplies have spurred demand for rentals.

(Source: Bureau of Economic Analysis)

(Source: Bureau of Economic Analysis)