Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

Consensus is growing among various economists and market analysts that inflation could, potentially, force consumers to cut back on spending to the extent that a recession materializes. Consumer expenditures have a significant impact on economic activity, comprising about 70% of Gross Domestic Product (GDP).

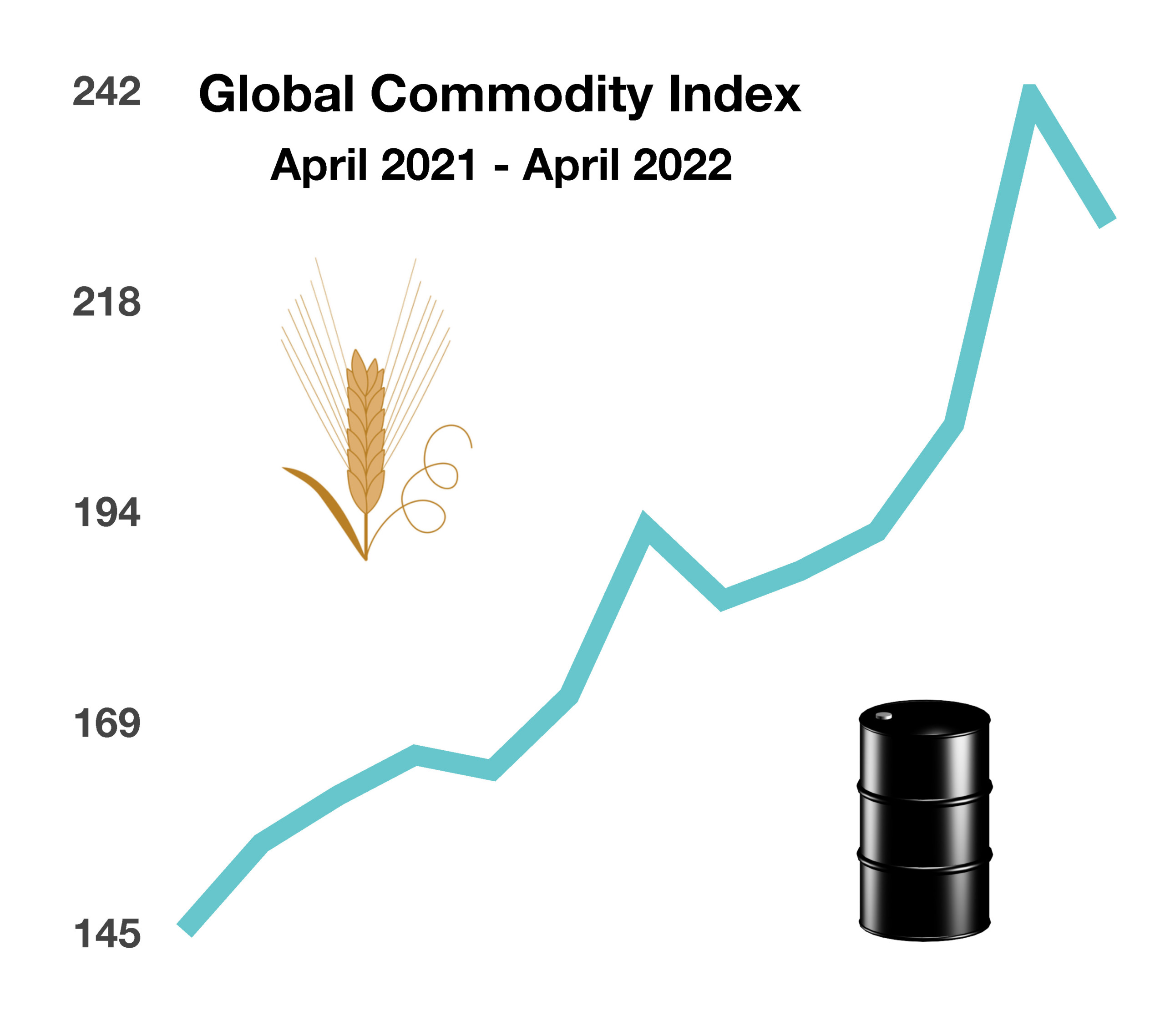

The Federal Reserve notes that rising interest rates can pose a risk to the U.S. economy. The Federal Reserve Bank of New York released a report in early May identifying specific concerns that members of the Fed have. Among the concerns are that elevated and persistent inflation, coupled with a sharp rise in interest rates could slow economic activity and cause an increase in delinquencies, bankruptcies and other forms of financial distress. The report also identified uncertainty regarding heightened commodity prices and geopolitical risks attributed to the ongoing Russian conflict.

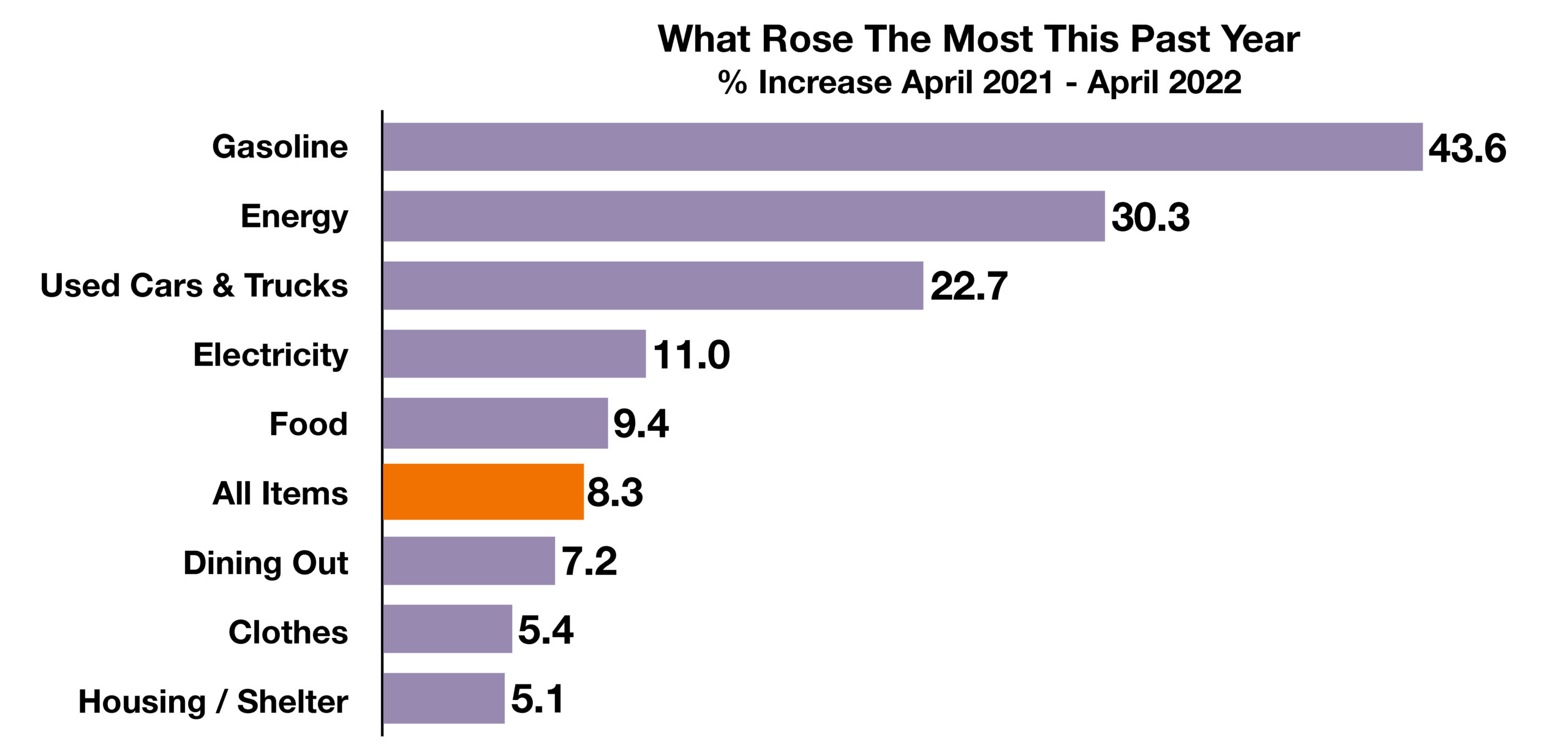

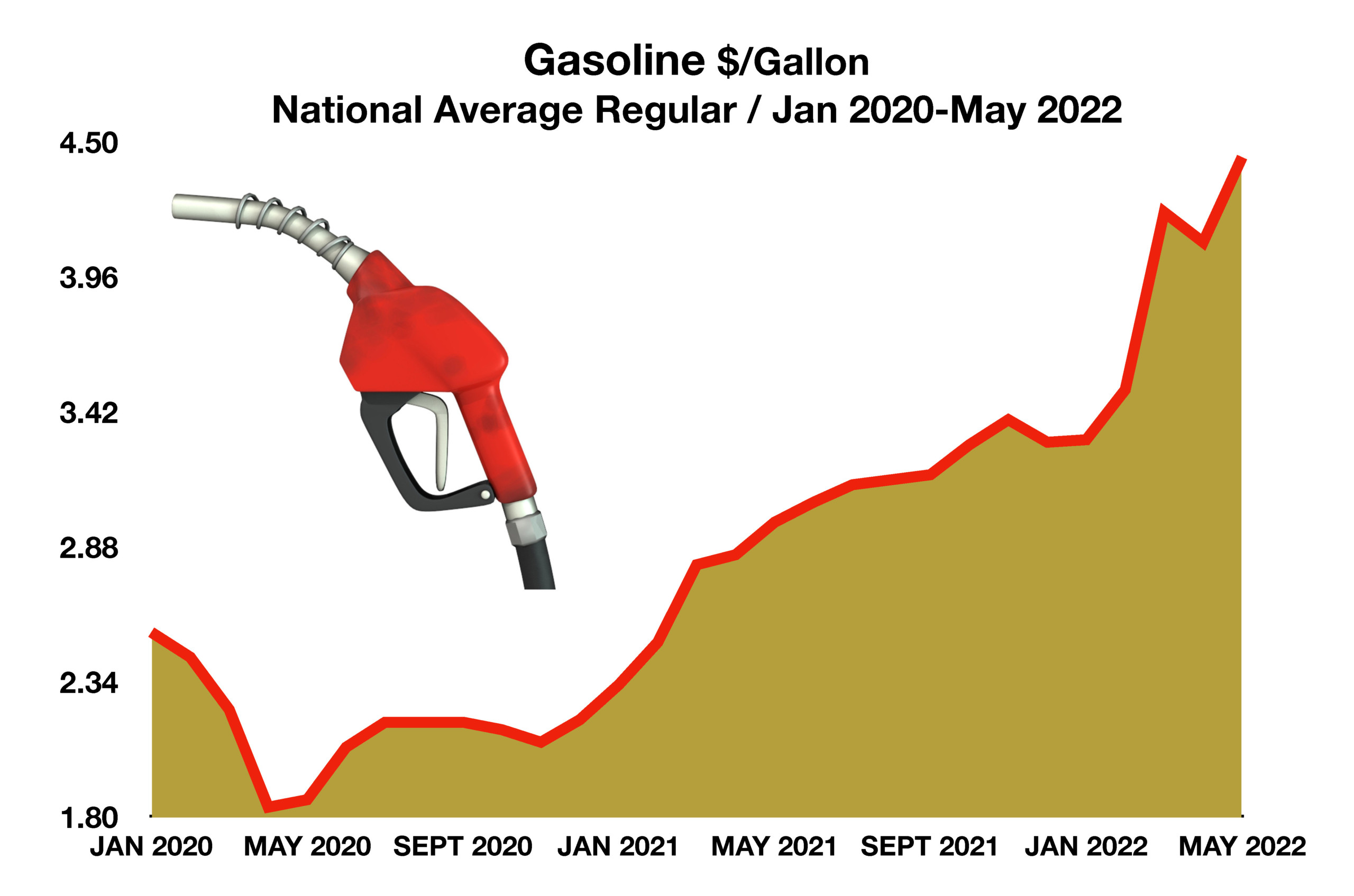

Inflation appeared to ease slightly in April, but underlying price pressures for gasoline and other energy costs are acute for consumers. Recent data showed an increase from 8.3% to 8.6% annualized inflation in May as reflected by the consumer price index (CPI). Fuel oil now stands at a 12-month price increase of 106.7%.

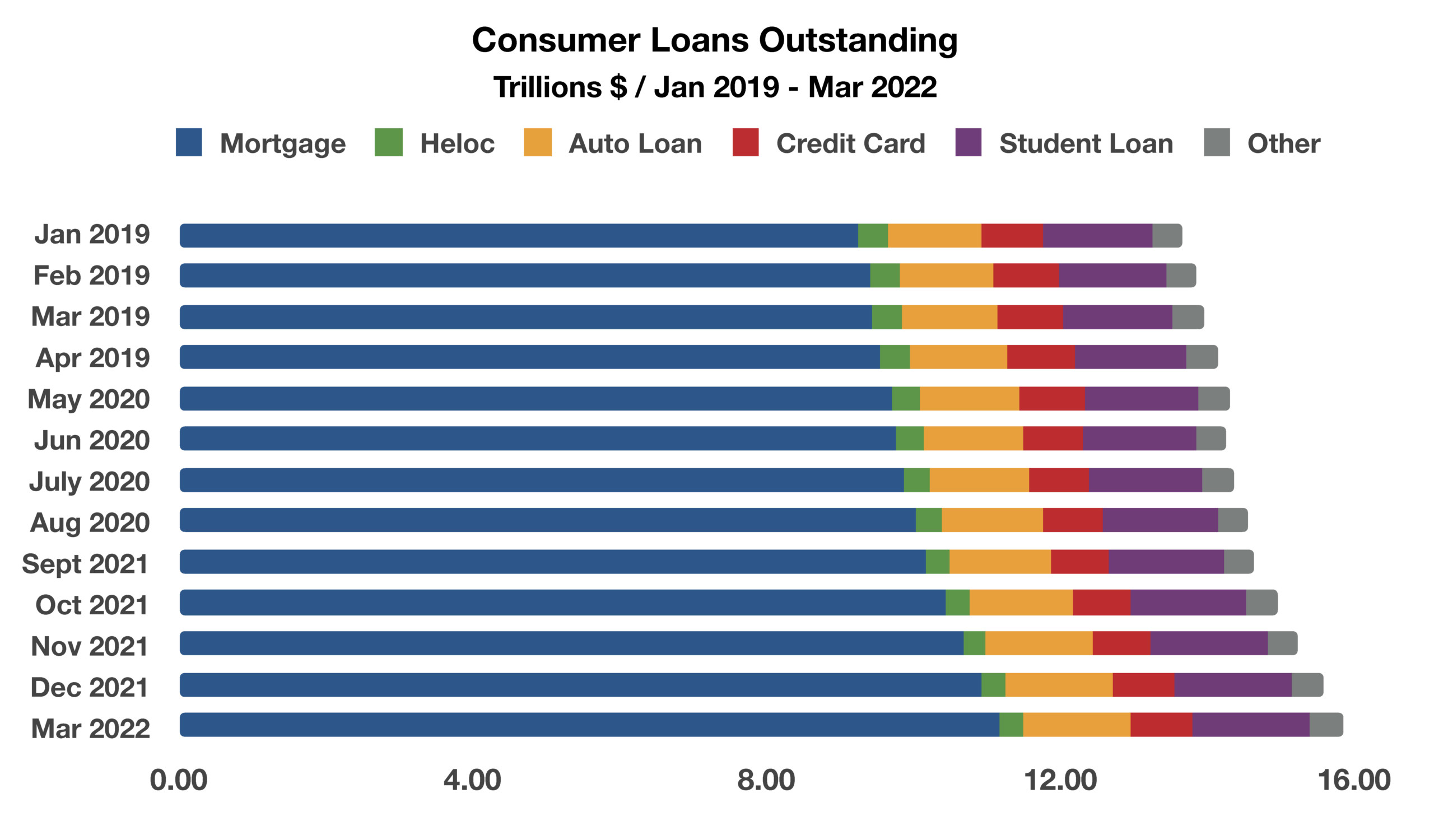

Federal Reserve data indicates a rise in revolving credit card usage and a decrease in the savings rate. Consumer credit outstanding has risen the most since November 2001, when the economy was in recession. The Federal Reserve calculates that the average household is spending an additional $300 per month due to inflation.

Soaring transportation costs translate into higher prices for companies and consumers. A gallon of diesel rose to over $5.50 in May from $3.17 a year ago. Diesel is the primary fuel used for transporting goods via trucks, trains, and shipping.

The Federal Reserve indicated that it plans to raise short term rates again in June and July, but potentially not as much as previously expected. Extensive inflationary pressures in conjunction with higher rates are likely prompting a slowdown in consumer activity, a welcome sign for the Federal Reserve.

According to the Federal Reserve, it now takes the average home buyer 10 years worth of wages to buy an average-priced single family home, double the historical norm of 5 years worth of wages.

Sources: BLS, Labor Department, Federal Reserve Bank of Atlanta; HOAM, EIA