OverRidge Wealth Advisors

6300 Ridglea Place, Suite 1020

Forth Worth, TX 76116

817.738.1451

ENOUGH ALREADY

The New Oxford American Dictionary sums up our title this way: “used as an intensive after a word or phrase to express impatience.” Words/phrases that come to mind are: elections, politics, stock market, volatility, Federal Reserve, oil, interest rates, economy, jobs, wages, investing, fear, uncertainty, and a few dozen others we could add with a five minute discussion. Times are uncertain for sure so we thought it time to “talk out” a few things as we wind down the final quarter of 2016. Let’s start with a comment or two about the elections, much as we hate to enter the political fray.

The current season has brought on its own life cycle of recrimination and tension. Extracting the polemics, financial markets always have a problem with political change because of the uncertainty. You will no doubt see this inquietude for the remainder of the election cycle and into the early part of the new administration. We have seen this before and should not be surprised. Just know that our goal is to extract the facts and not the suppositions when it comes to politics. That said, let’s move on.

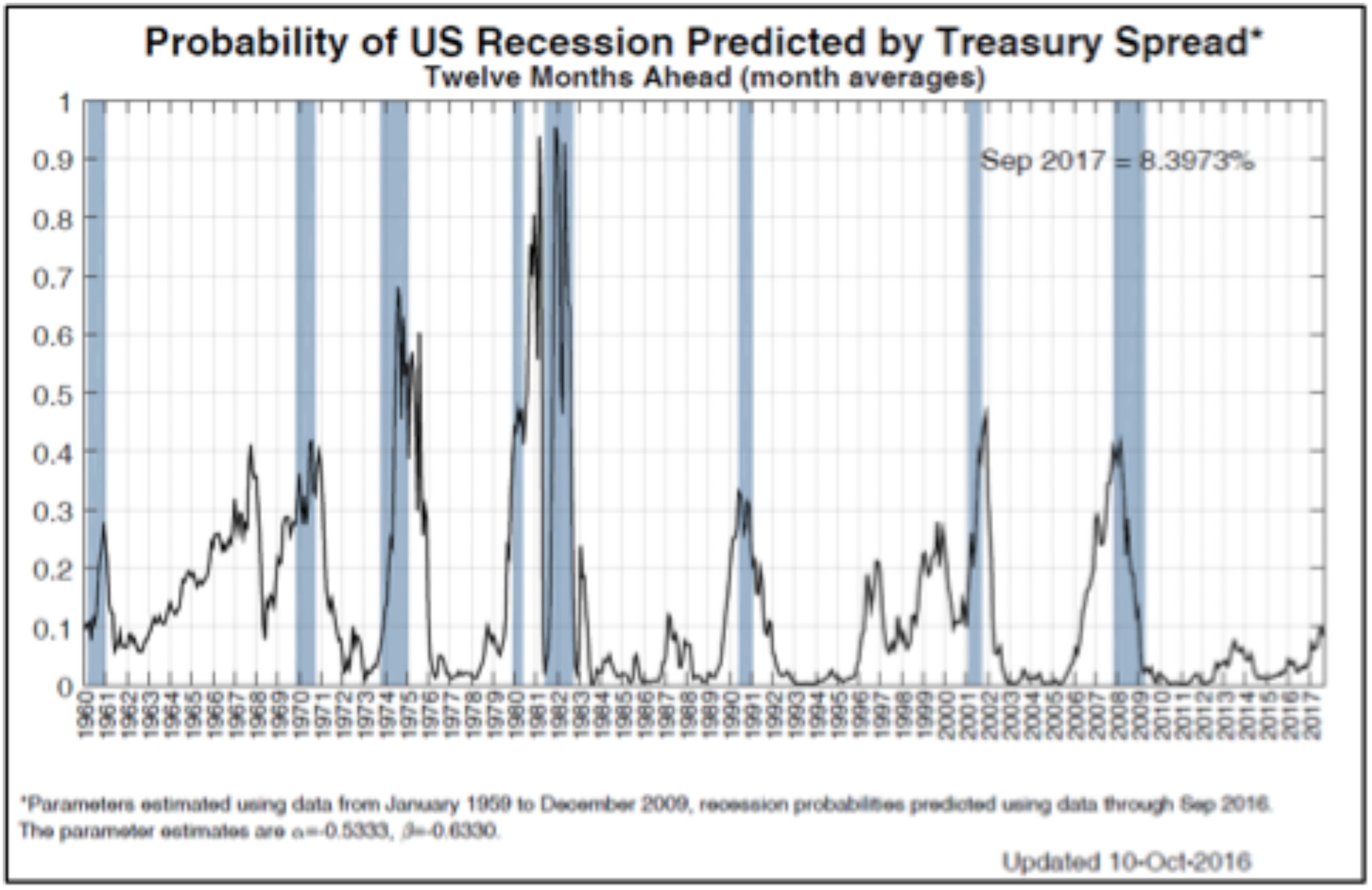

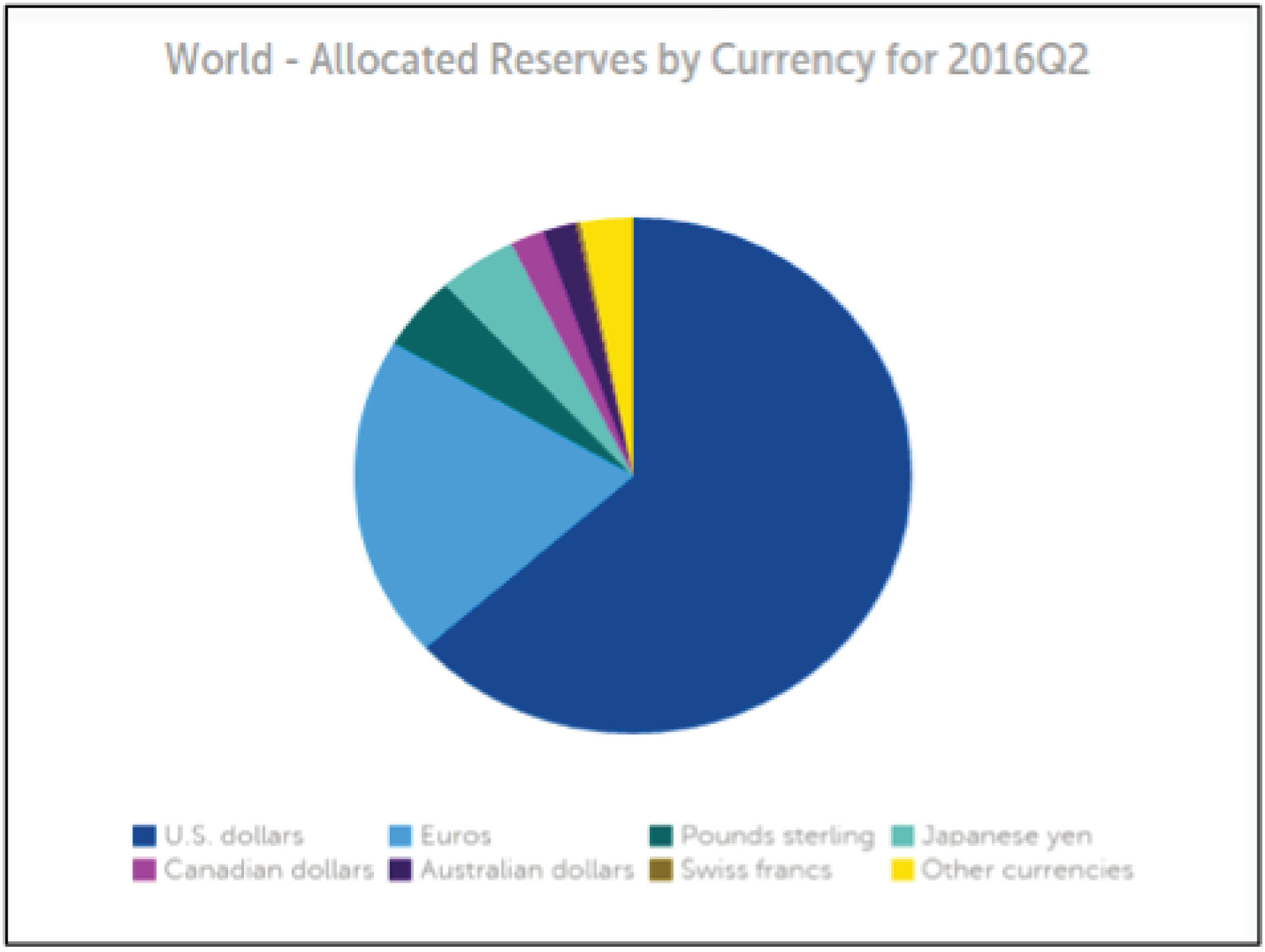

First let’s revisit our macro-indicators. You may recall, from our last letter, we presented three areas of focus that give us actionable signals about the markets and the economy. The goal here is to read specific markers that tell us when to reduce your investment exposure. Each one is very specific to a certain aspect of the market and triggers a one-third reduction in your holdings. This allows us to methodically balance your holdings rather than react to short-term market whims. The first indicator is based on market trend – using two longer-term moving averages to assess market symptoms. The second indicator is an assessment of the macro-economic picture using 14 key metrics. This is a longer-term measurement that gives us a better picture of the economy as a whole. Our third and final indicator is an assessment of financial stress. Using publications from two Federal Reserve Districts, we create a weighted value that indicates dislocations in the credit/bond markets. As you can see we don’t base our decisions on any one factor or data set. The idea to conflate the myriad of information into direct signals that give us clearer readings concerning the broad and overarching factors affecting investors.

CURRENT MACRO INDICATORS