Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Fund Overview

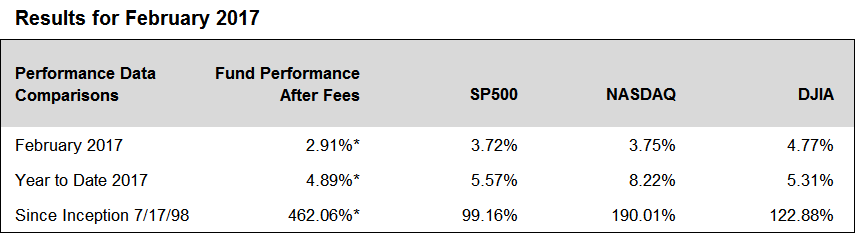

Equities maintained their uptrend in February, with the major indices and the Ocean Park funds again posting solid gains. A rebound in producer durables and health care stocks enhanced our results.

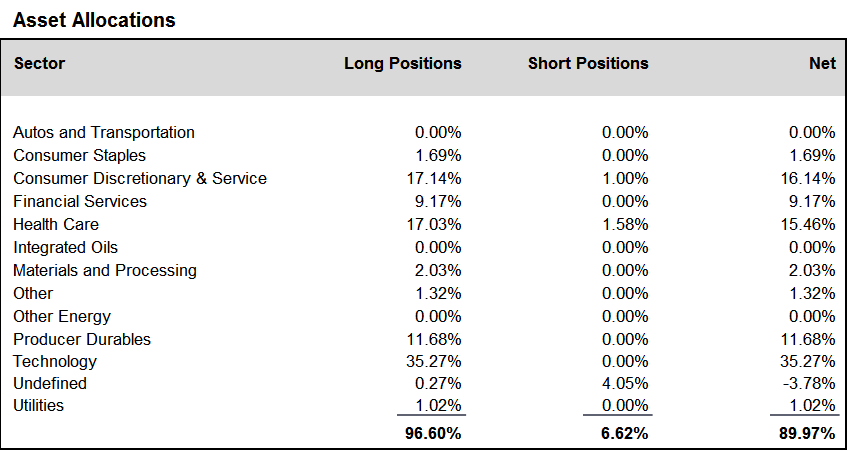

During the month of February, we reduced positions in the consumer discretionary and service and the materials and processing sectors. To maintain balance in the portfolio, we also reduced our short position in SPYs and QQQs (which has the effect of increasing our net long exposure). We finished the month at about 90% net long, up modestly from about 88% at the end of January.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4.

Past performance does not guarantee future results.