Kim Nordmo

Artience Capital Management, LLC

PO Box 777 Genoa, NV 89411

415-354-5574

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

U.S. equities continued to defy negative sentiment and sanguine market readings as tepid economic data advanced stocks higher in February. Equities posted their best first two months of the year since 1991, rebounding from the volatile fourth quarter of 2018. Gross domestic product (GDP), the primary measure of U.S. economic growth, expanded at a 2.6% annualized pace for the fourth quarter of 2018. Despite negative sentiment and market turmoil towards the end of the year, consumer spending and business investment continued to gradually expand.

GDP as well as other economic indicators that were not released during the government shutdown were posted in early February, a month past its scheduled release. It is expected that additional lingering data will continue to be released throughout March, helping to shed light on the economy’s current stance.

According to Federal Reserve data, declines in stock values, as which occurred in late 2018, have a far greater impact on middle and upper income earners now relative to 30 years ago. Middle America now has many of the same investment opportunities that only the very wealthy had decades ago.

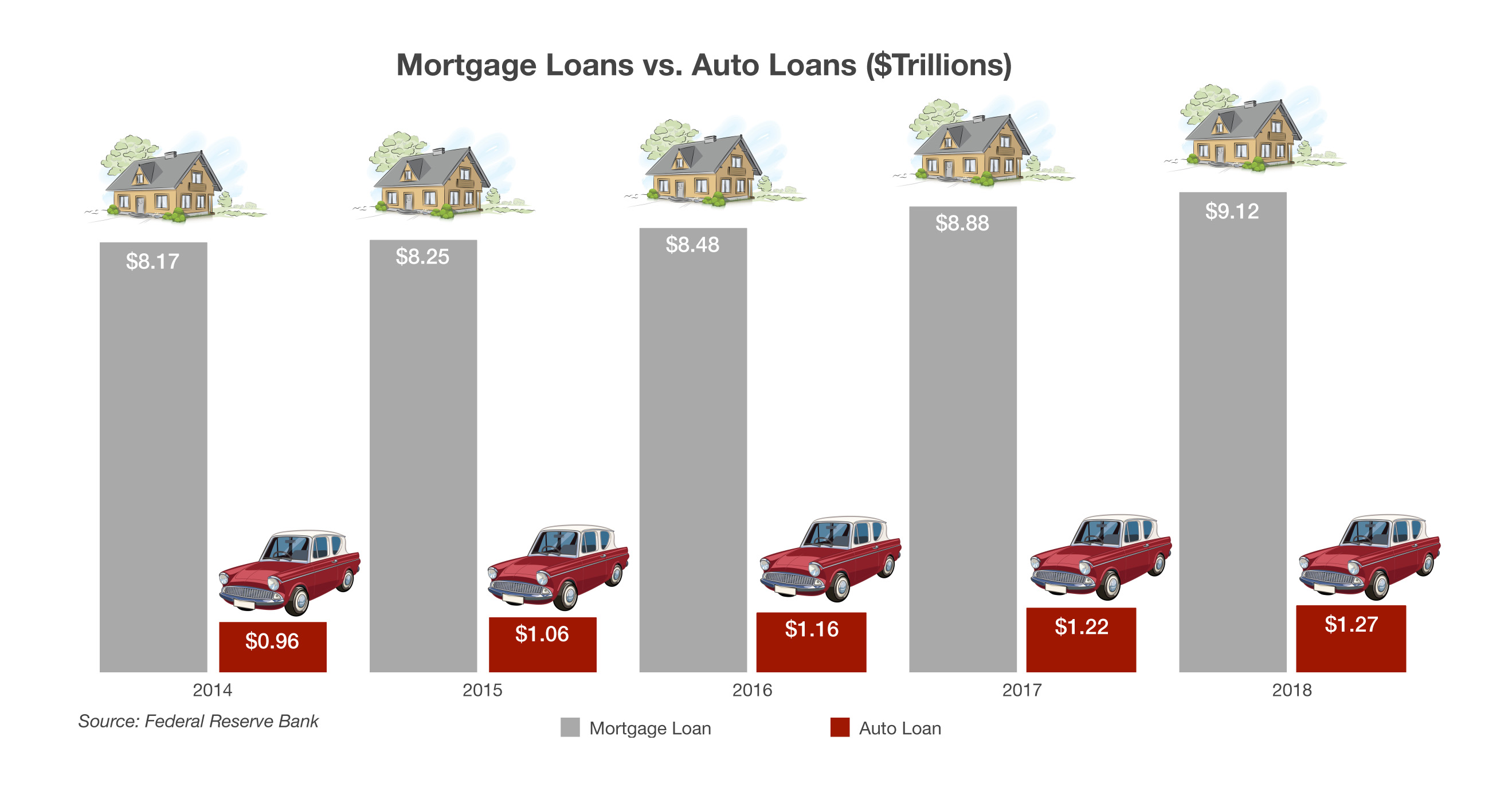

A key housing report, which was delayed due to the government shutdown, revealed that new housing starts in December 2018 fell to the lowest monthly level since September 2016. Economists believe that the slowdown may have been in response to the market pullback in December as well as continued weakness in the housing sector.

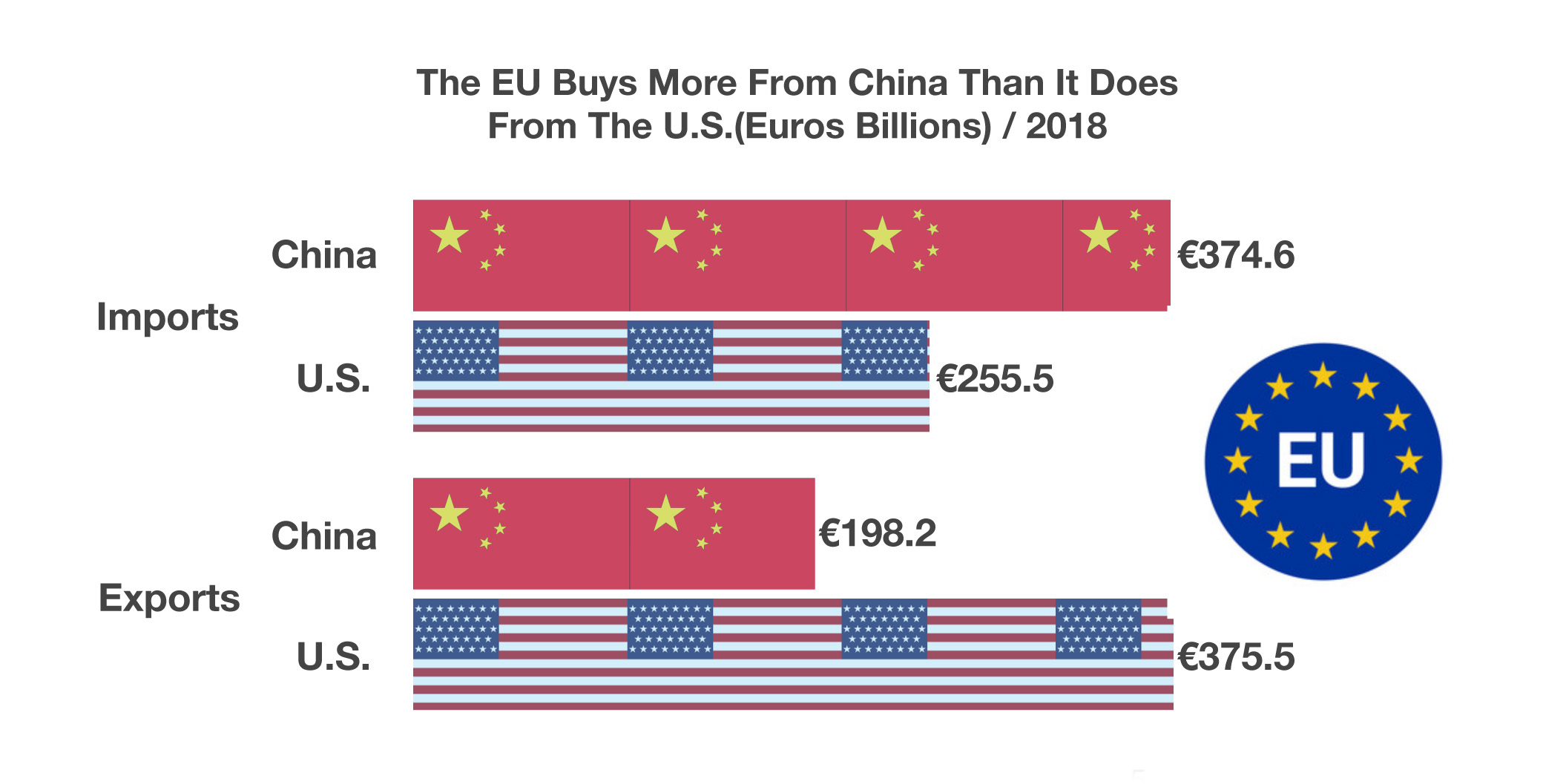

Trade tensions with China eased as a March 1st deadline was extended by the President, with discussions between U.S. and Chinese negotiators continuing into March. Another notable deadline looms in Europe as the exit of Britain from the EU, known as Brexit, approaches on March 29th.

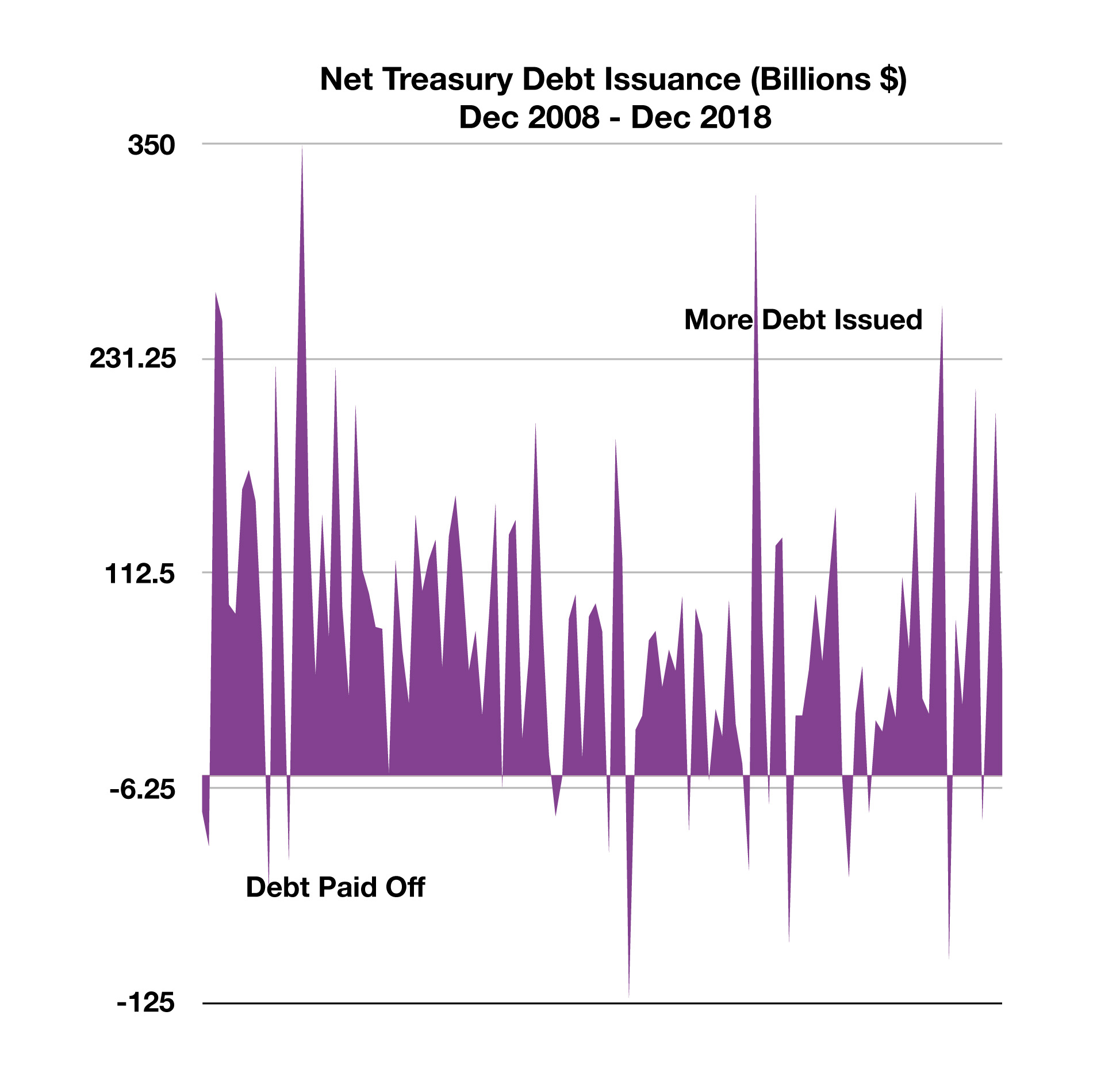

Comments by the Fed Chair, Jerome Powell, hinted that the Federal Reserve has become increasingly concerned with stock prices and market volatility. Some economists believe that the Fed slowed its pace of rate increases in order to alleviate further market turmoil following December’s rout.

Federal government offices and agencies avoided a second shutdown following a Congressional compromise on border security. The prior shutdown at the beginning of the year lasted 45 days, which hindered businesses reliant on governmental permits and authorizations.

The IRS reported that for 2018 tax returns filed as of February 22, 2019, the average federal tax refund was $3,143, slightly above the average refund of $3,013 for the same period last year. This tax season is the first year where the 2017 tax cuts have become fully effective, including revisions to withholdings and standard deduction levels. According to data from the IRS and the Tax Foundation, American taxpayers had $140 billion less withheld from their paychecks in 2018.

Sources: Fed, BLS, IRS, EuroStat, Bloomberg