Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview – March 2020

Fear has been permeating capital markets worldwide as the impact of the (COVID-19) coronavirus continues to evolve. Global economic forecasts have been revised downward by the International Monetary Fund (IMF) and the World Bank as factory closures, quarantines, and travel bans continue to hinder numerous industries.

The Federal Reserve helped alleviate markets with a rate reduction announcement as a result of a rare emergency meeting. The rate cut was made in order to maintain liquidity and structure in an already stressed environment caused by the virus outbreak. Fed Chairman Jerome Powell said that “the fundamentals of the U.S. economy remain strong,” yet the coronavirus may pose evolving risks for the economy.

Transparency and liquidity are becoming critical as investors worldwide sought safe haven instruments such as U.S. Treasury bonds. Yields on Treasuries fell to historical lows as funds migrated from equities to bonds, driving bond prices up.

U.S. equities registered their largest weekly losses since 2008, with $3.6 trillion worth of stock values erased within the last week of February. The rapid decline was among the swiftest in market history, creating havoc in all sectors and industries. Global equity markets also saw similar losses as large capitalized international stocks and emerging market equities gave up gains. Global equity valuations retreated due to uncertainty surrounding the extent of the outbreak and its effects on the global economy. Analysts are closely following companies with supply chains tied to China, which has become a widespread concern.

The virus outbreak has affected financial markets differently relative to other more traditional disruptions. Supply chains tethered to China are creating a shortage of supplies and products, while demand had not been an issue until the virus outbreak. Should a vaccine emerge making the coronavirus outbreak a shorter term incident, then pent up demand could propel economic activity higher.

Many analysts are expecting a gradual reduction in inventory levels affecting various consumer products, including electronics and apparel, since both rely heavily on supply chains and manufacturing sourced out of China.

The National Center for Biotechnology Information reports that advancements in medical technology over the years has allowed the development and creation of new vaccines to combat viruses at a faster pace than decades ago.

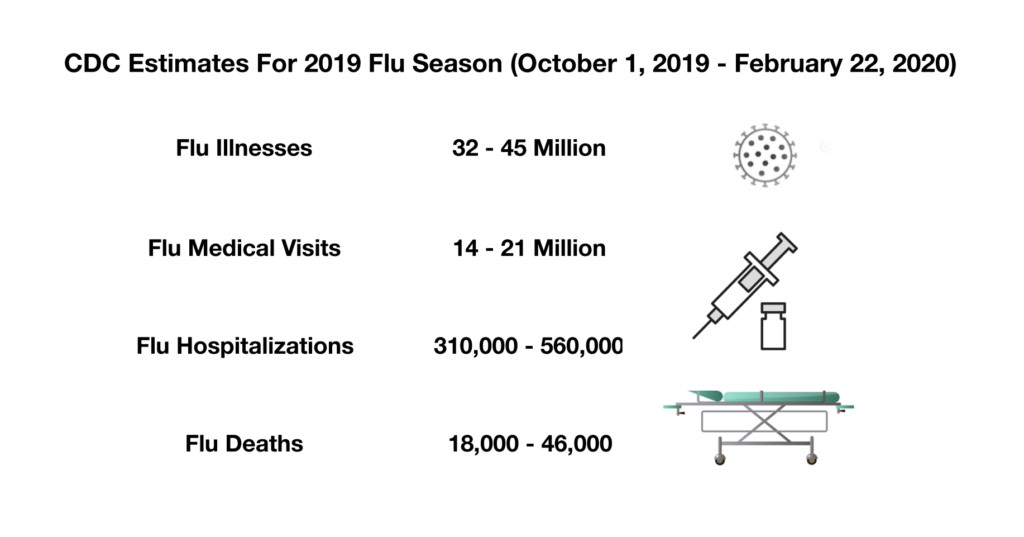

The extent of the coronavirus can be put into perspective as related to influenza, also known as the flu, which currently affects over 32 million Americans. Flu-related deaths in the United States are estimated to reach between 18,000 and 46,000 this flu season alone, as reported by the Centers for Disease Control. The center also estimates that as many as 45 million Americans will suffer flu-related symptoms and illnesses during this year’s season.

Sources: IMF, World Bank, Fed, U.S. Treasury, NCBI, CDC

February saw stock valuations retreat to where they were in July and August 2019. Analysts believe that the pullback has helped identify several overvalued stocks. Valuations are considered to be more in line with historical standards relative to where they were at the beginning of the year.

The final week of February saw all equity indices fall substantially. The S&P 500 Index slumped 11.49%, the Dow Jones Industrial Index fell 13.6%, and the tech-heavy Nasdaq Index gave up 10.54%.

The pullback among all major equity indices has been one of the fiercest in market history, yet reigning in valuations that were considered lofty by many analysts. Fortunately, the stellar performance of the equity markets in 2019 is serving as a buffer for the dramatic pullback.

U.S. corporate earnings for a host of companies in various sectors are estimated to be revised downward following the review of sales and inventory figures.

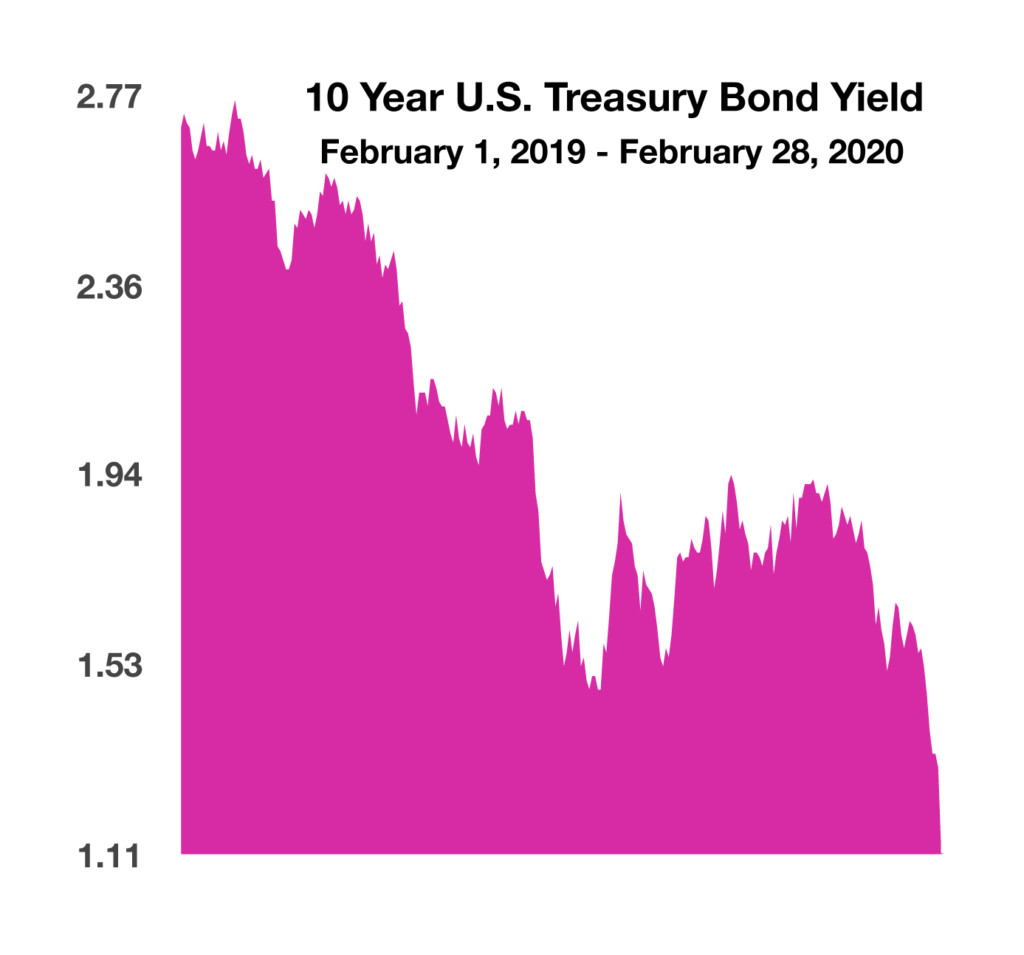

When U.S. equity markets fell 14% over two months in 2003 during the SARS outbreak, rates were much higher, with the 10-year Treasury yielding over 3.5%. The yield on the 10-year Treasury on Feb 28th at 1.13% is lower than the current S&P 500 Index yield for stock dividends at 1.97% on Feb 28th. Analysts view the yield difference as a benefit for stocks for yield seeking investors.

Sources: S&P, Dow Jones, Nasdaq, Bloomberg, U.S. Treasury

Treasury Bond Yields Drop To Historic Lows – Fixed Income Update

Treasury bond yields traded at record low levels, driven by global investors seeking safe haven assets. All Treasury maturities yielded well below 2% at the end of February, lower than the Fed’s inflation target of 2%. The dramatic drop in yields brought the 10-year Treasury bond yield to 1.13 % at the end of February, the lowest yield for the 10-year Treasury on record.

An insatiable demand for global bonds brought yields lower across all bond sectors, elevating positive returns for bonds in nearly every sector thus far this year.

The Federal Reserve reduced the Fed Funds rate, a key monetary tool rate, following a rare emergency meeting. The rate reduction was made with hopes of stemming market uncertainty and shoring up liquidity for extended periods of volatility. The announcement triggered a drop in bond yields across various bond sectors.

Sources: U.S. Treasury

Past Pandemics & What Came Of Them – Health Overview

Over the decades, pandemics have evolved and lasted for varying periods of time, yet always culminating with the containment and/or elimination of a virus. Should history repeat itself, a vaccine will eventually emerge to combat the COVID-19 virus, thus alleviating the threat of further immediate contamination.

Even though scientists have not identified how to stop a virus outbreak before it starts, advancements in medical technology over the past 17 years have drastically reduced the time it takes to develop and implement a vaccine after a new virus emerges.

The current coronavirus outbreak has been preceded by two similar outbreaks since 2003, Severe Acute Respiratory Syndrome (SARS) and Middle East Respiratory Syndrome (MERS). SARs originated out of China in 2002, spread worldwide and was contained within a few months. The World Health Organization (WHO) tracks deaths related to pandemics globally. The organization found that the SARs virus resulted in 774 deaths in 17 countries. MERs, also known as the camel flu, resulted in 862 deaths.

Joint efforts among international governments and nonprofit research entities have allowed extended research on emerging infectious diseases worldwide. Several groups and scientists from various countries are already underway trying to develop a vaccine for COVID-19.

Sources: The National Center for Biotechnology Information, WHO

Consumer Debt Surpasses $14 Trillion – Consumer Dynamics

As the economy has grown, so has household debt. Data tracked by the Federal Reserve shows that debt held by U.S. households rose to over $14 trillion in the fourth quarter of 2019, the highest level ever. Mortgage debt rose as a continued low-rate environment fostered refinances and new loans at near-record low interest rates.

According to data from the Federal Reserve Bank of New York, total household debt at $14 trillion now surpasses debt levels Americans had in 2008, when total consumer debt reached a record high of $12.68 trillion.

The Fed tracks household debt by categories such as mortgage, student, credit cards, home equity loans, and auto loans. Over the decades, the most consistent and significant amount of household debt has been mortgages. Home equity loans, or HELOCs, actually fell in 2019.

The recent increase in total overall debt is primarily attributable to a steady rise in both student and auto loans. Recent Federal Reserve data shows that these two loan types are primarily held by younger consumers. The concern is that the difficulty of obtaining mortgage loans has led younger consumers to take out student and auto loans instead.

Sources: Federal Reserve Bank of New York

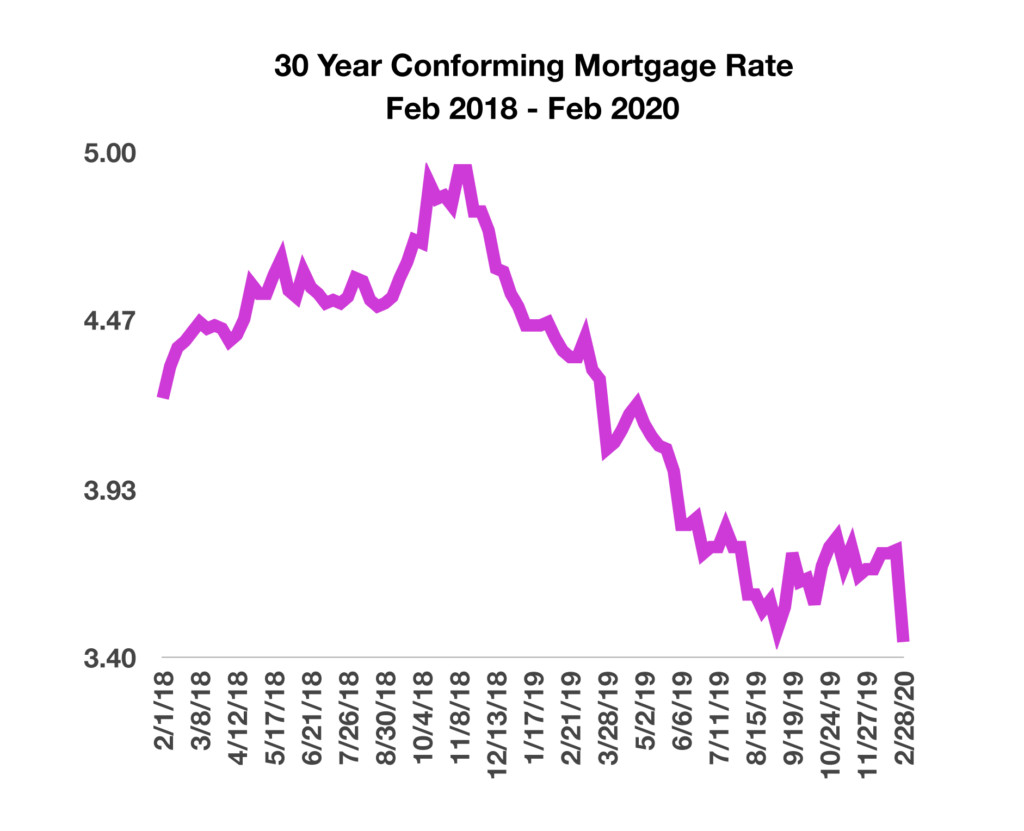

Sudden Drop In Mortgage Rates Spurs Housing Buffer – Housing Market Update

The abrupt drop in interest rates has brought about a boost to the housing market in the form of lower mortgage rates. The rate for a conforming 30-year loan fell to 3.45% at the end of February, nearly a full percentage point from a year earlier.

Falling interest rates have prompted an increase in mortgage activity as the cost to borrow for homebuyers has become less expensive. Mortgage rates fell in late February approaching the lows last seen in 2012, when the rate for a conforming 30-year loan was 3.37% in October 2012.

The challenge for many homebuyers has been rising home prices and affordability throughout the country. Slow rising wages and stagnant incomes have, for the most part, not kept up with rising home prices. Even though mortgage rates have dropped, housing prices are still elevated to the levels that force many to wait or rent until housing prices drop.

Data tracked by the Federal Reserve Bank of St. Louis and Freddie Mac reveal that even as mortgage rates fell since the beginning of the year, affordability still declined. Affordability is the ability of a homebuyer to purchase a home and pay for all related expenses with an existing income.

Mortgages accounted for two-thirds of the $14 trillion in U.S. household debt in the last quarter of 2019. Because they are typically paid off over decades, mortgage rates tend to be correlated with 10-year Treasury bond yields rather than with the short-term rates controlled by the Federal Reserve.

Sources: Federal Reserve Bank of St. Louis, Freddie Mac