Derek J. Sinani

Founder/Managing Partner

derek@ironwoodwealth.com

7047 E. Greenway Parkway, Ste. 250

Scottsdale, AZ 85254

480.473.3455

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Fear has been permeating capital markets worldwide as the potential impact of the (COVID-19) Coronavirus continues to evolve. Appropriately, global economic forecasts have been revised downward by the International Monetary Fund (IMF) and the World Bank as factory closures, quarantines, and travel bans continue to hinder numerous industries. The Federal Reserve helped alleviate markets with a rate reduction announcement as a result of the increased uncertainty. Fed Chairman Jerome Powell said that “the fundamentals of the U.S. economy remain strong,” yet the Coronavirus may pose evolving risks for the economy, and the rate cut was designed to help reduce those uncertainties.

As you know, U.S. equities experienced tremendous volatility throughout the week – yet, remarkably the SP500 finished the week with a slight gain. The rapid decline was among the swiftest in recent history, creating havoc in all sectors and industries. Global equity markets also saw similar swings as large capitalized international stocks and emerging market equities gave up gains. Global equity valuations retreated due to uncertainty surrounding the extent of the outbreak and its effects on the global economy. Analysts are closely following companies with supply chains tied to China, which has become a widespread concern.

The virus outbreak has affected financial markets differently relative to other more traditional disruptions. Supply chains tethered to China are creating a shortage of supplies and products – everything from pharmaceuticals to children’s toys. Heaven forbid you try to find hand-sanitizer. With that said, should an effective treatment quickly emerge, or seasonally warmer weather slows transmission – pent up demand could actually propel economic activity higher. After yoga this Saturday morning, my wife and I had lunch – and the world from the perspective of central Arizona appeared to be business as usual.

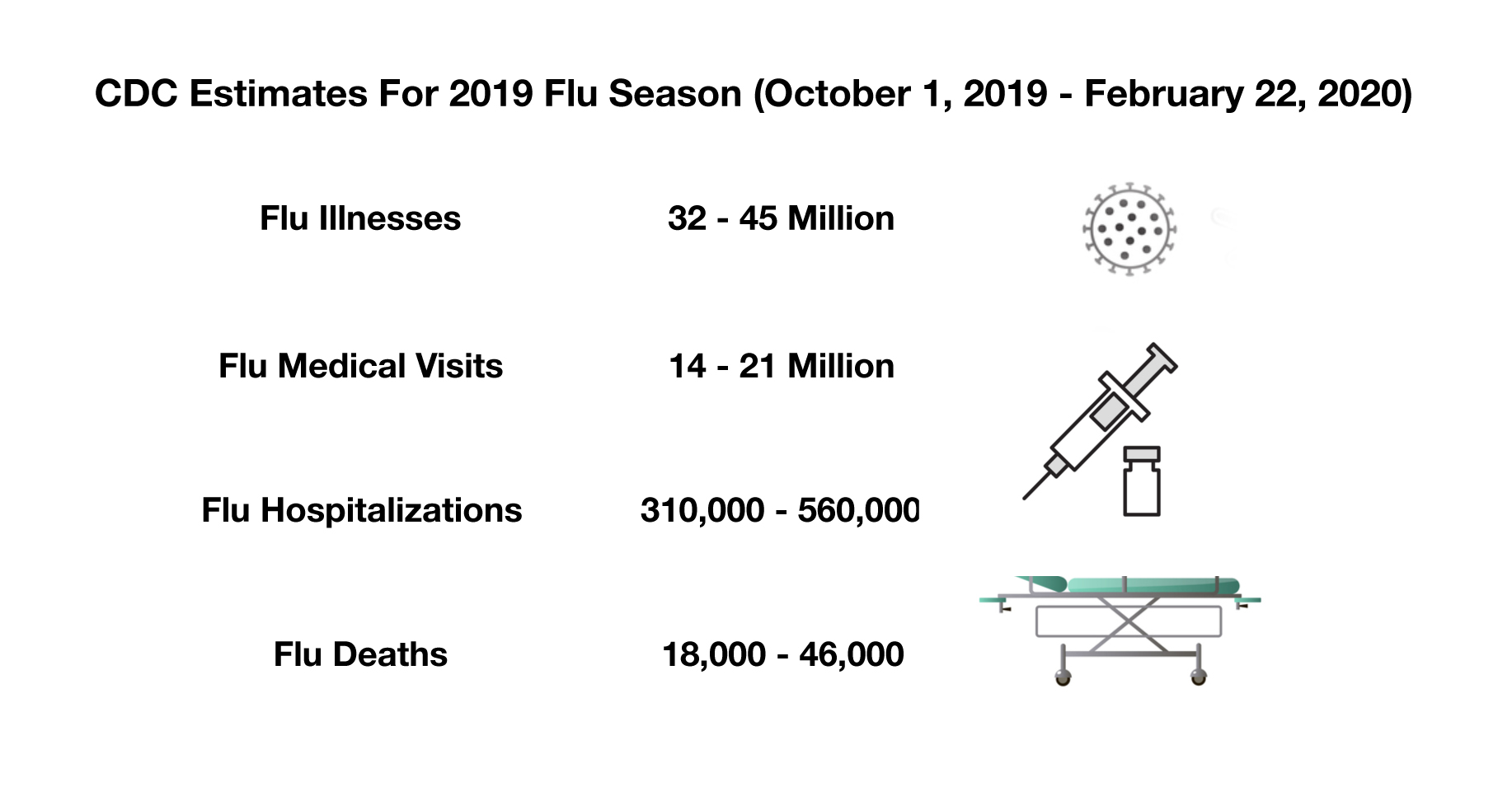

The extent of the Coronavirus can be put into perspective as related to influenza, the common and seasonal “flu”, which is estimated to affect over 32 million Americans annually. Flu-related deaths in the United States are estimated to reach between 18,000 and 46,000 this flu season alone, as reported by the Centers for Disease Control. The center also estimates that as many as 45 million Americans will suffer flu-related symptoms and illnesses during this year’s season.

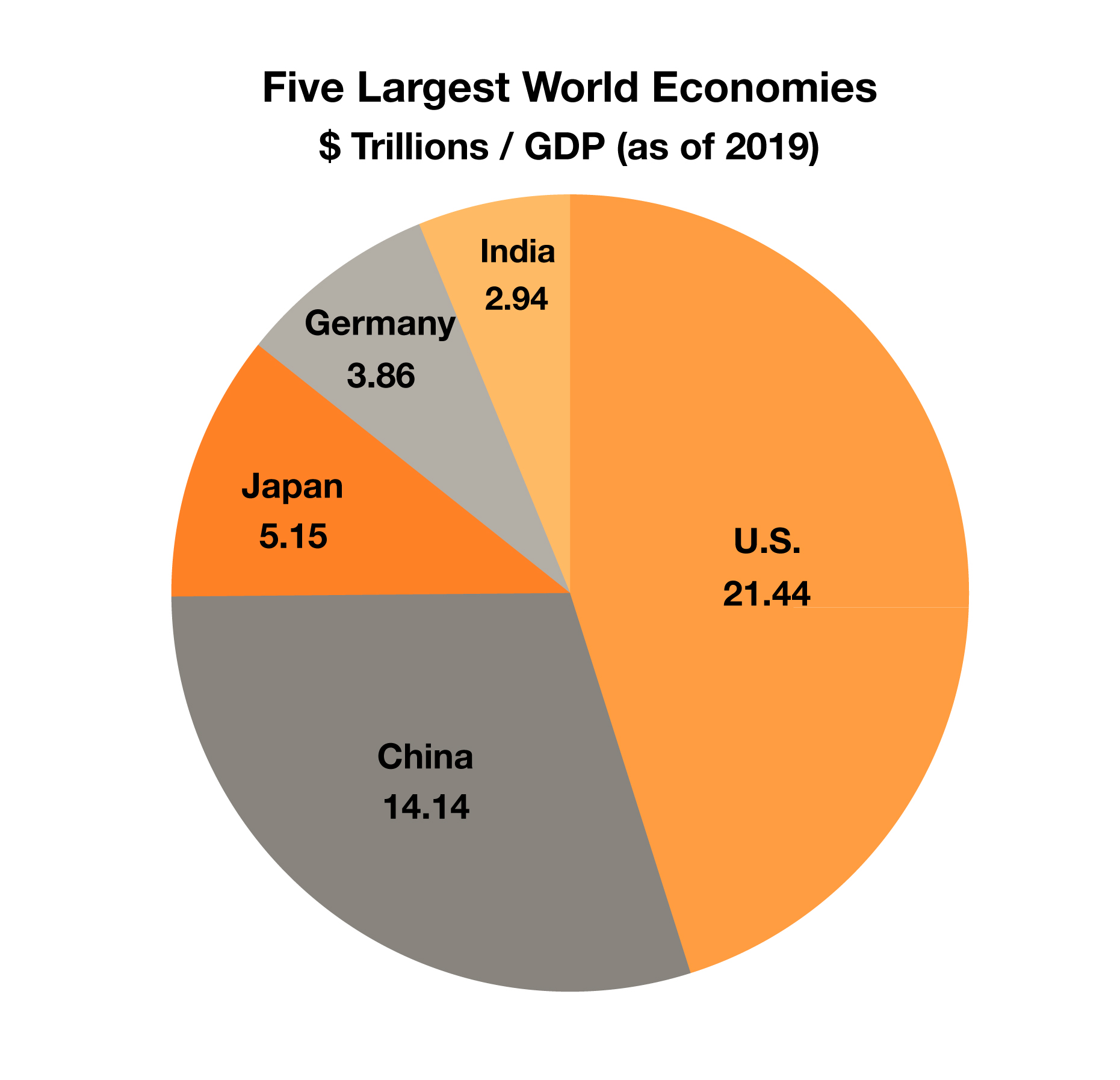

China is referred to as “the world’s factory,”producing a broad range of items from shoes and socks to hammers and computers. The country’s enormous manufacturing base allows it to export massive volumes of goods globally, meeting demand from nearly every consumer in the world. China has experienced exponential growth over the past few decades, from a GDP of $305 billion in 1980, to over $14 trillion this past year, making it the second largest economy after the United States. The difference in GDP between the two nations’ economies has been shrinking over the years, as Chinese economic growth has consistently outpaced that of the United States. (Source: World Bank)

China is referred to as “the world’s factory,”producing a broad range of items from shoes and socks to hammers and computers. The country’s enormous manufacturing base allows it to export massive volumes of goods globally, meeting demand from nearly every consumer in the world. China has experienced exponential growth over the past few decades, from a GDP of $305 billion in 1980, to over $14 trillion this past year, making it the second largest economy after the United States. The difference in GDP between the two nations’ economies has been shrinking over the years, as Chinese economic growth has consistently outpaced that of the United States. (Source: World Bank)