Michael J. Berger & Co., CPA’s LLP

3425 Veterans Memorial Hwy

Ronkonkoma, NY 11779

631.471.3400

www.bergercpa.com

cpa@bergercpa.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Fear has been permeating capital markets worldwide as the impact of the (COVID-19) coronavirus continues to evolve. Global economic forecasts have been revised downward by the International Monetary Fund (IMF) and the World Bank as factory closures, quarantines, and travel bans continue to hinder numerous industries.

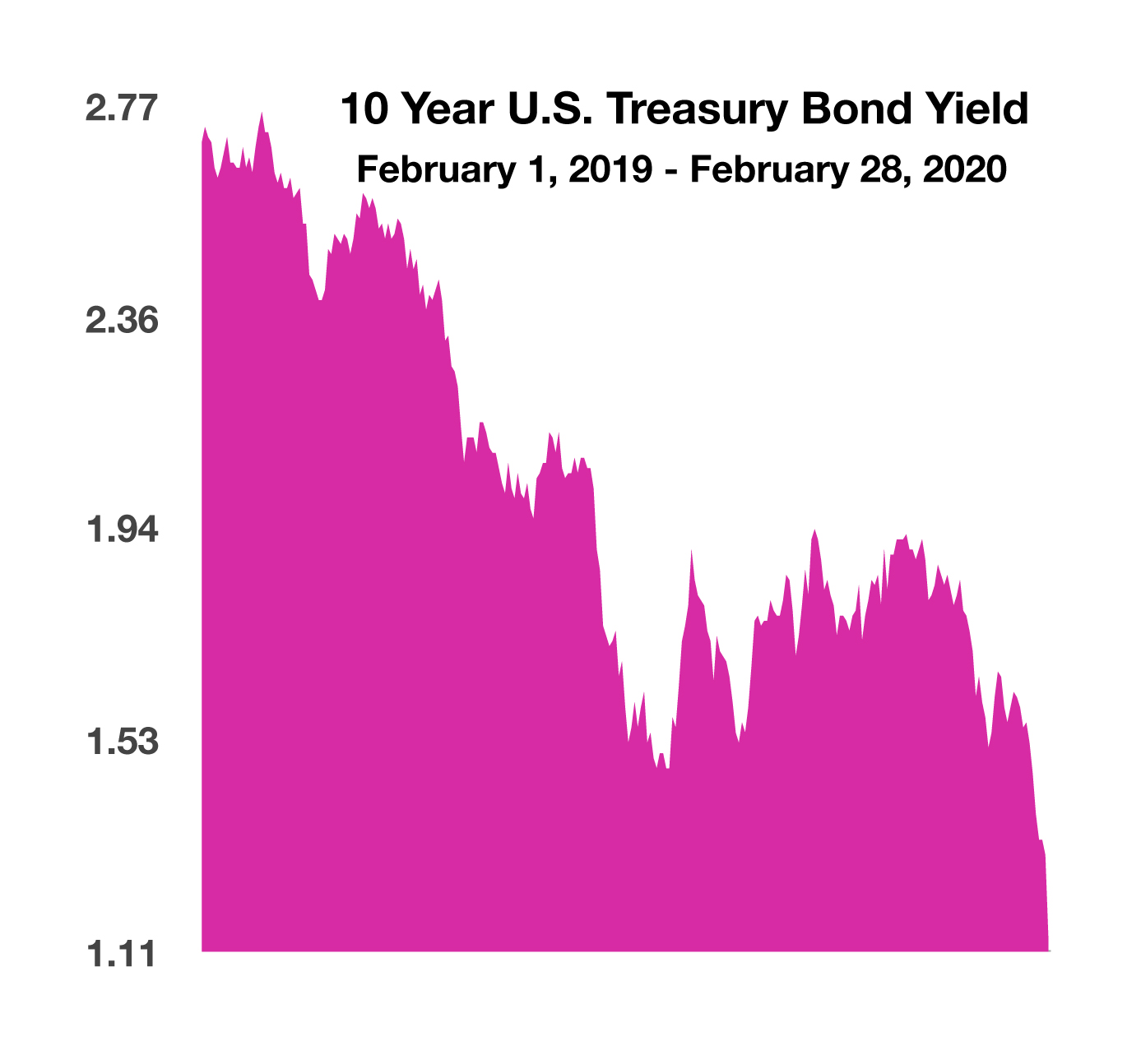

The Federal Reserve helped alleviate markets with a rate reduction announcement as a result of a rare emergency meeting. The rate cut was made in order to maintain liquidity and structure in an already stressed environment caused by the virus outbreak. Fed Chairman Jerome Powell said that “the fundamentals of the U.S. economy remain strong,” yet the coronavirus may pose evolving risks for the economy. Yields on Treasuries fell to historical lows as funds migrated from equities to bonds, driving bond prices up.

U.S. equities registered their largest weekly losses since 2008, with $3.6 trillion worth of stock values erased within the last week of February. The rapid decline was among the swiftest in market history, creating havoc in all sectors and industries. Global equity markets also saw similar losses as large capitalized international stocks and emerging market equities gave up gains. Global equity valuations retreated due to uncertainty surrounding the extent of the outbreak and its effects on the global economy. Analysts are closely following companies with supply chains tied to China, which has become a widespread concern.

The virus outbreak has affected financial markets differently relative to other more traditional disruptions. Supply chains tethered to China are creating a shortage of supplies and products, while demand had not been an issue until the virus outbreak. Should a vaccine emerge making the coronavirus outbreak a shorter term incident, then pent up demand could propel economic activity higher.

The National Center for Biotechnology Information reports that advancements in medical technology over the years has allowed the development and creation of new vaccines to combat viruses at a faster pace than decades ago.

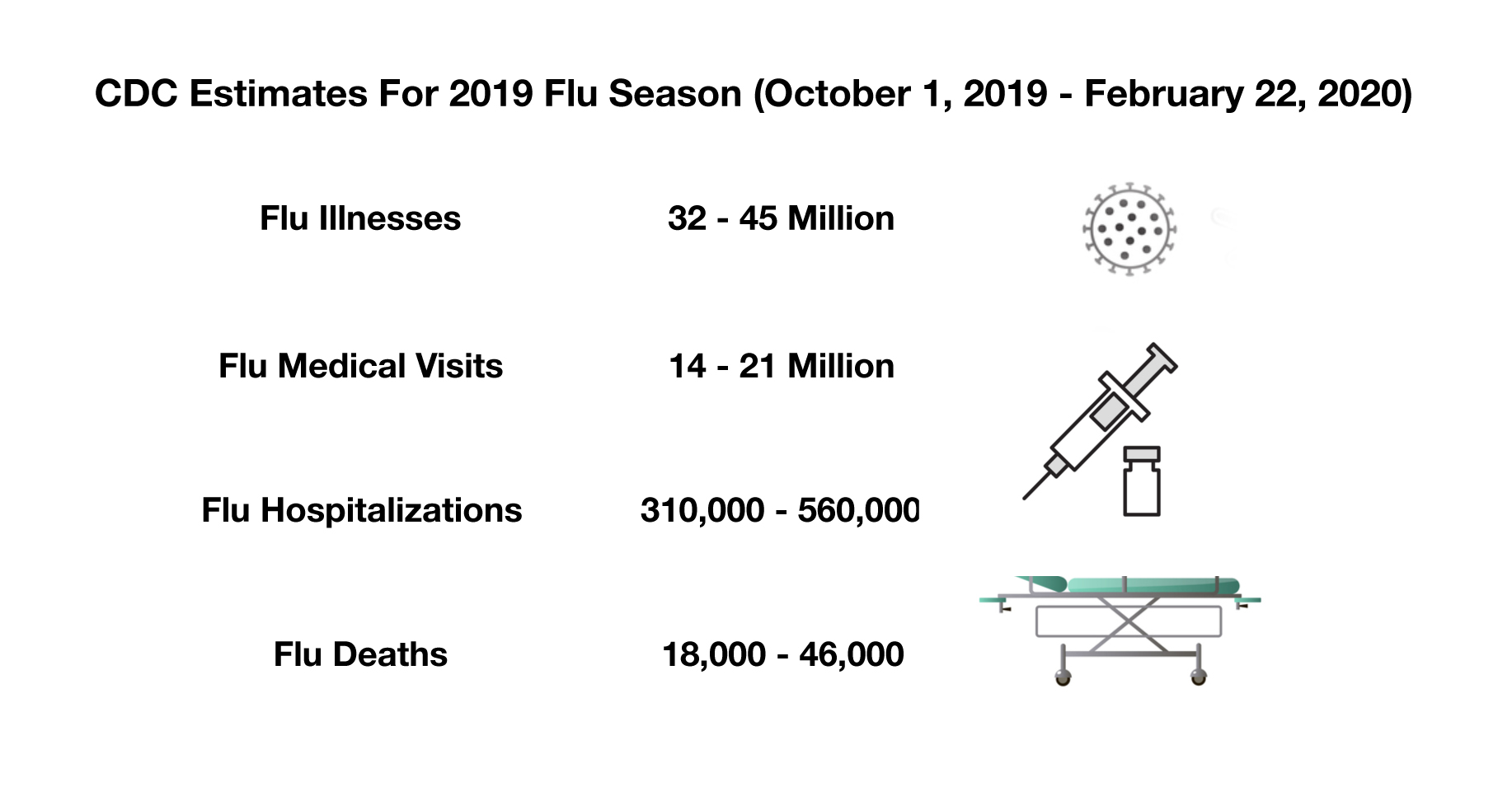

The extent of the coronavirus can be put into perspective as related to influenza, also known as the flu, which currently affects over 32 million Americans. Flu-related deaths in the United States are estimated to reach between 18,000 and 46,000 this flu season alone, as reported by the Centers for Disease Control. The center also estimates that as many as 45 million Americans will suffer flu-related symptoms and illnesses during this year’s season. (Sources: IMF, World Bank, Fed, U.S. Treasury, NCBI, CDC)

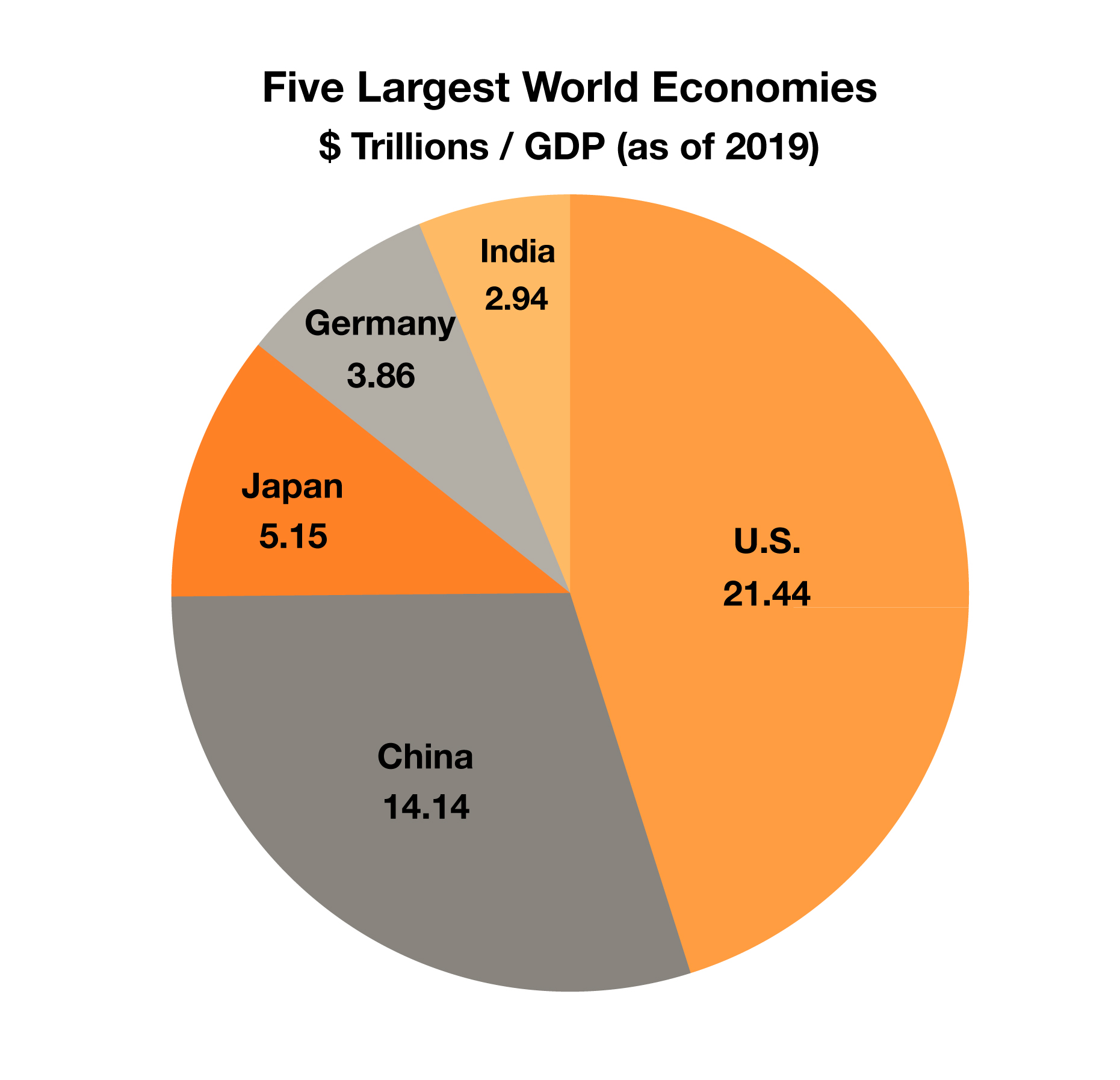

China is referred to as “the world’s factory,”producing a broad range of items from shoes and socks to hammers and computers. The country’s enormous manufacturing base allows it to export massive volumes of goods globally, meeting demand from nearly every consumer in the world. China has experienced exponential growth over the past few decades, from a GDP of $305 billion in 1980, to over $14 trillion this past year, making it the second largest economy after the United States. The difference in GDP between the two nations’ economies has been shrinking over the years, as Chinese economic growth has consistently outpaced that of the United States. (Source: World Bank)

China is referred to as “the world’s factory,”producing a broad range of items from shoes and socks to hammers and computers. The country’s enormous manufacturing base allows it to export massive volumes of goods globally, meeting demand from nearly every consumer in the world. China has experienced exponential growth over the past few decades, from a GDP of $305 billion in 1980, to over $14 trillion this past year, making it the second largest economy after the United States. The difference in GDP between the two nations’ economies has been shrinking over the years, as Chinese economic growth has consistently outpaced that of the United States. (Source: World Bank)