Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Fund Overview

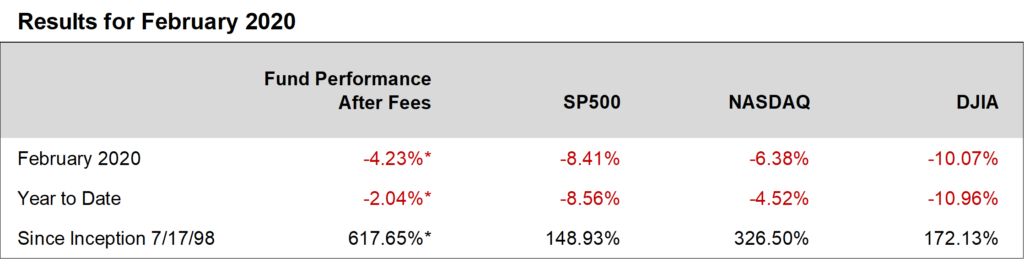

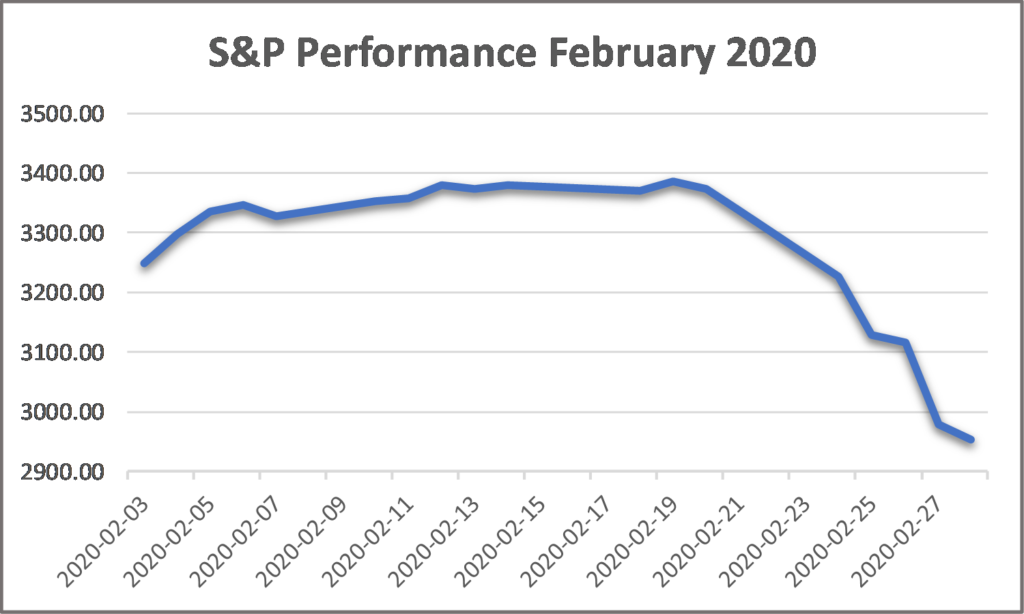

Equities declined significantly in February as the market began to absorb the worldwide impact of the coronavirus. The Ocean Park funds also lost ground, but outperformed the major indices and remained well ahead of them for the year to date.

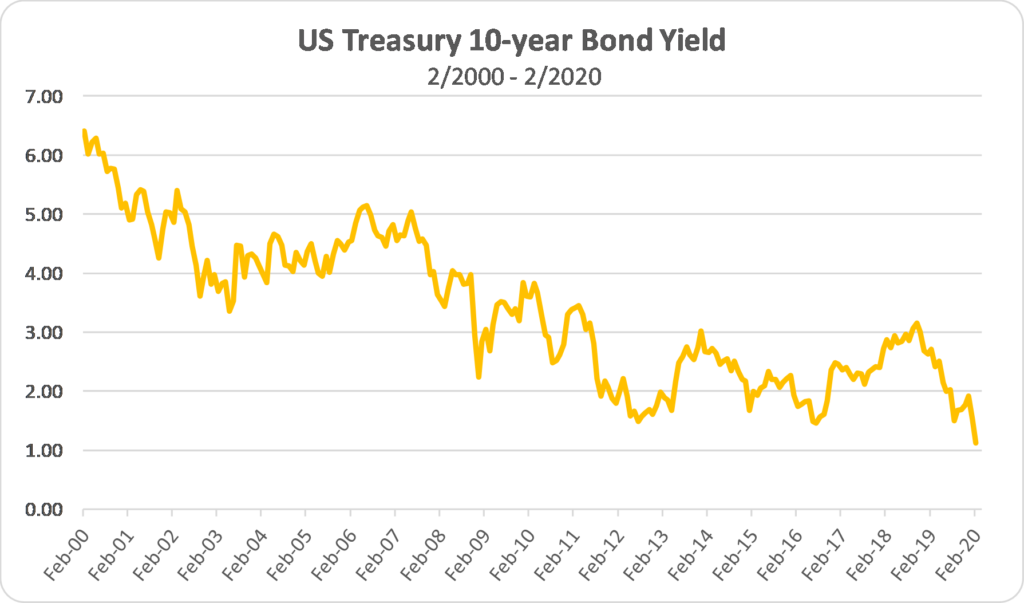

Over the life span of the Ocean Park funds—almost 22 years—there have been several periods when stocks incurred dramatic losses: the Long Term Capital Management crisis in 1998, the dot-com bubble in 2000-2001, and the financial crisis of 2008, to name a few. At such times there is often a powerful impulse to flee. But as the late Jack Bogle, founder of Vanguard Investments put it: “If someone tells you to get out of the market, before you do, remind them to tell you when to get back in.” Put another way, timing the market has proved impossible in the long run. Thus, we have always resisted the temptation to time the market, relying instead on the view that, over time, stocks have an upward bias. We believe that our results since inception validate that approach.

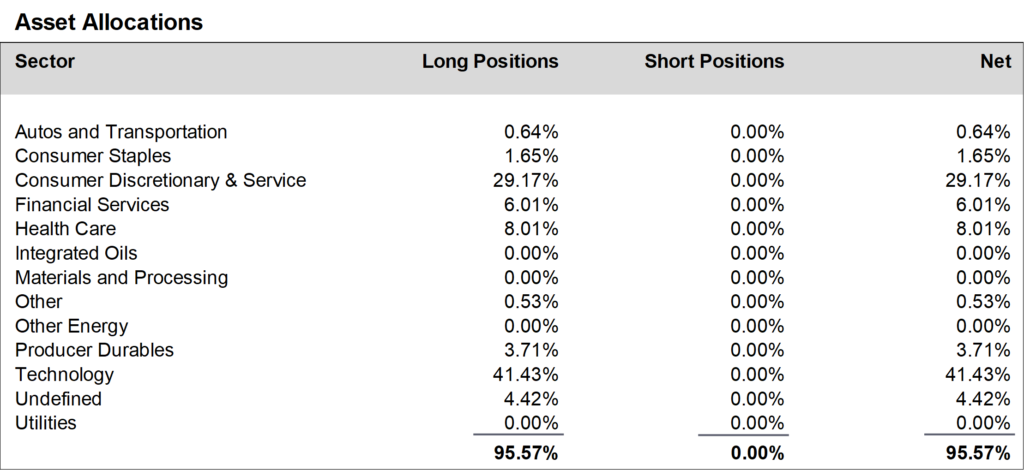

During February, we added to positions in the technology sector, and reduced positions in the consumer discretionary and service and health care sectors. We ended the month at about 96% net long, down from about 98% net long in January.

Daily updates on our activity are available on our Results Line, at 310-281-8577, and current information is also maintained on our website at www.oceanparkcapital.com. To gain access

to the site enter password opcap.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4. Past performance does not guarantee future results.